|

市場調查報告書

商品編碼

1636603

歐洲生物分解性杯:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Europe Biodegradable Cups - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

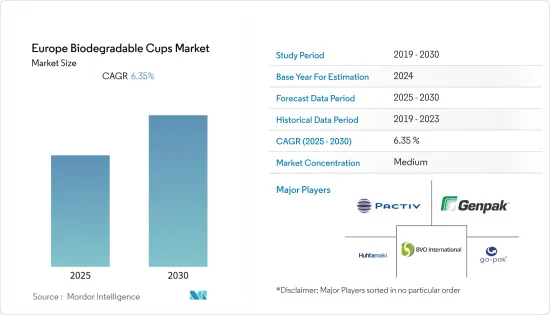

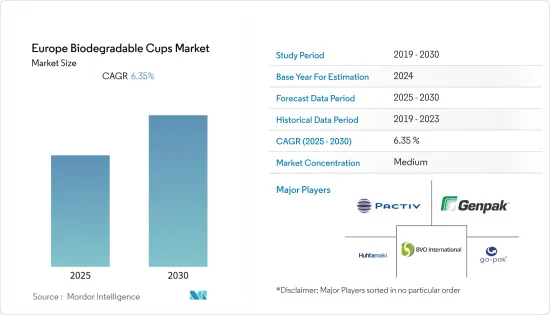

預計預測期內歐洲生物分解性杯子市場的複合年成長率將達到 6.35%。

新冠疫情的爆發已導致許多企業開始放棄無塑膠永續性目標。一些研究表明,病毒可以透過紙板和塑膠傳播,導致超級市場使用一次性材料包裝產品的情況增加。

主要亮點

- 要真正發揮生物分解性杯包裝的潛力,需要有足夠的堆肥和回收基礎設施來支持其使用。目前,世界上很少有城市擁有這樣的基礎建設。然而,隨著人們認知的提高、投資的增加以及對一次性塑膠的禁令,這一趨勢可能會愈演愈烈,為現有和新的市場參與者創造充足的機會。進行此類活動的合作可以為在該市場營運的供應商創造策略機會。

- 目前,歐洲在市場中處於領先地位,因為掩埋成本(以掩埋稅和垃圾掩埋場門禁費的總和計算)明顯較高,加之態度轉變和塑膠禁令。由於生物分解性塑膠包裝的優異性能和優勢,歐洲地區新進業者的範圍正在迅速擴大。

- 據歐洲生質塑膠稱,生物分解性塑膠(包括 PLA、PHA、澱粉混合物等)佔全球生質塑膠產能的 55.5% 以上(超過 100 萬噸)。預計到 2024 年,生物分解性塑膠產量將增加到 133 萬噸,這主要得益於顯著的成長率,尤其是 PHA 的成長率。

- 該地區還迎來了新參與企業,他們將高度生物分解性的杯子帶入市場。例如,2020 年 1 月,Lavazza Professional 推出了一款可回收和生物分解,名為 KLIX 環保杯,該產品採用來自永續管理森林的紙張製造。該產品自 2020 年 2 月起與製造商 Kotkamills 合作在 KLIX 自動販賣機上銷售,並供應給一系列熱飲品牌,並計劃全年供應。新型 KLIX 環保杯的獨特之處在於,由於採用了專利的特殊水基分散阻隔板,它可以與辦公用紙等普通廢紙一起回收。預計此類技術創新加上日益增多的夥伴關係關係將在預測期內推動市場成長。

歐洲生物分解性杯子市場的趨勢

食品預計佔很大佔有率

- 根據應用,食品和飲料最終用戶預計最能適應生物分解性包裝。例如,2021 年 5 月,丹麥研究人員想出了一種方法,以草纖維取代食品配送中使用的塑膠,他們稱這種塑膠「100%生物分解性」。

- 新冠疫情讓消費者意識到做好準備和把健康放在第一位的重要性,從而增加了整個全部區域對包裝食品的需求。同樣,許多品牌也調整了其產品包裝以吸引消費者。因此,包裝現在被視為消費者和品牌之間的重要橋樑,可以有效傳達衛生習慣的維護和消費者安全被優先考慮的訊息。

- 然而,大多數政府都在推動在本國禁止使用一次性塑膠,這減緩了塑膠的流通,並阻礙了各企業採用生物分解性的包裝。例如,在英國,環境、食品和農村事務部已將塑膠吸管、攪拌棒和棉籤的禁令延長至2020年10月。

- 食品業也正在重新考慮使用可回收和環保材料的方法,因為這可能會增加傳播的威脅。例如,甚至在實施封鎖之前,一些咖啡業的公司就已經恢復使用一次性杯子了。這也許是暫時的趨勢,但並不代表環保包裝在未來不會受到更多的關注。

- 為了滿足日益成長的需求,該地區的新興企業也在不斷成長。 2021年4月,Picup在波蘭推出了植物性紙杯。這家位於波茲南的新興企業的 100%生物分解的茶杯和咖啡杯在過濾器底部有一顆種子,喝完後可以長成一棵樹。

- Picup 為咖啡連鎖店和其他行動式企業提供了一種即時、方便和實用的替代方案,對地球沒有任何影響,因為客戶不一定需要自備可重複使用的杯子。客製化他們的杯子上的標誌。

英國:預計大幅成長

- 隨著外帶和街頭小吃店的興起,在英國,隨時隨地吃東西已經成為新常態。英國最近訂定了要求加強包裝回收的法規。

- 英國GM Packaging Ltd 等公司推出了使用甘蔗渣和竹纖維製造的產品,這使得他們能夠生產可堆肥的餐具,如刀、叉、湯匙和杯子。配備這使得這些產品價格實惠、安全且環保。

- 這種成長背後的另一個因素是消費者意識。先前,大多數消費者都知道,標準紙杯很難回收,通常會因為其聚乙烯 (PE)內襯而被送往垃圾掩埋場,而且包括英國在內的歐洲很少有回收設施可以處理它們。

- 為了滿足日益成長的需求,現有市場和新參與企業都在推出新產品,以搶佔該地區的市場佔有率。例如2020年12月,英國推出了一款完全無塑膠、可回收的無蓋外帶杯。新推出的無蓋蝴蝶杯在英國各地的野生禽鳥和濕地信託中心展出。這些杯子可以與紙板和普通紙張一起在普通紙質垃圾箱中回收,並且可以自然生物分解和堆肥。

歐洲生物分解性杯子產業概況

歐洲生物分解性杯子市場規模中等,擁有 Genpak LLC、Pactiv LLC、BVO International GmbH 和 Huhtamaki Group 等知名企業。透過設計、技術和應用的創新可以獲得永續的競爭優勢。據觀察,市場現有企業採取溫和的競爭策略,進行夥伴關係活動,重視研發和創新活動。然而,該地區正在經歷大量新參與企業,這可能會在整個預測期內分化市場。

- 2021 年 3 月 - 總部位於盧森堡的 Capsul'in Pro 推出了一款零影響咖啡機,該咖啡機 100% 以生物基為基礎,可在家中堆肥,並且具有高氧氣阻隔性,可保護咖啡的風味和香氣。零影響膠囊 100%植物來源,不含任何石化燃料衍生材料。使用後,膠囊可以放入家庭堆肥箱或與有機廢物一起收集。

- 2020 年 11 月 -酵母約克郡印刷和行銷公司 Just Peel 計劃在匯豐銀行英國分行的資助下,為飲料行業推出一系列標準化一次性品脫和半品脫紙杯。該公司利用六位數的銀行融資方案購買了專用機器,以生產完全可品牌化、不含 PE 和 PLA 塑膠、帶有 CE 標誌的品脫和半品脫紙杯。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 飲料業對永續產品的需求不斷增加

- 嚴格的政府監管導致人們關注基於材料的創新。

- 市場挑戰

- 生態系分析

- 產業吸引力-波特五力分析

- COVID-19 對生物分解性杯子行業的影響(對餐飲業產生負面影響,而餐飲業是市場成長的主要貢獻者之一)| 由於感染風險較低,對一次性產品的關注度增加| 供應鏈挑戰(涵蓋以下主題)

第5章 市場區隔

- 依材料類型

- 生質塑膠(PLA、PBS 等)

- 紙

- 按應用

- 飲料(冷飲和熱飲 | 冰淇淋)

- 食品(糖果零食、醬料、調味品)

- 按最終用戶

- 食品服務(咖啡廳、飯店)

- 設施(商場和其他商業設施)

- 其他(一般家庭等)

- 按國家

- 英國

- 德國

- 義大利

- 法國

- 其他歐洲國家(西班牙、北歐、比荷盧三國等)

第6章 競爭格局

- 公司簡介

- Genpak LLC

- Pactiv LLC

- BVO International GmbH

- Huhtamaki Group

- Go-Pak Limited

- Scyphus Limited

- Bio Futura Group

- Vegware

- The Cup Folk

第7章 市場展望

The Europe Biodegradable Cups Market is expected to register a CAGR of 6.35% during the forecast period.

With an outbreak of COVID-19, many companies have begun shifting away from the sustainability goal of banning plastic. Some studies suggested that the virus can be passed on through cardboard and plastic, which has resulted in increased usage of single-use materials across the supermarkets to wrap products.

Key Highlights

- To truly capture the potential for biodegradable cup packaging, the region needs to have an adequate composting and collection infrastructure to support the use. Currently, very few municipalities across the world have such infrastructure. However, with the increasing awareness, investment, and ban on single-use plastic, this is likely to ascend, creating an ample amount of opportunities for the existing and new market players. Partnering for such activities can create strategic opportunities for vendors operating in the market space.

- Currently, Europe leads the market, owing to substantially higher landfill disposal costs (calculated by adding together landfill taxes plus landfill gate fees), coupled with awareness and plastic bans. Owing to the exceptional characteristics and benefits of biodegradable plastic packaging, the scope for new entrants is rapidly increasing in the European region.

- According to the European bioplastics, the biodegradable plastics altogether, including PLA, PHA, starch blends, and others, account for over 55.5% (over one million tonnes) of global bioplastics production capacities. The production of biodegradable plastics is anticipated to increase to 1.33 million in the year 2024, especially due to PHA's significant growth rates.

- The region is also witnessing entry of new players that are introducing highly biodegradable cups in the market. For instance, in January 2020, Lavazza Professional introduced a new recyclable and biodegradable product known as KLIX Eco Cup that is manufactured using paper sourced from sustainably managed forests. The product is created in partnership with manufacturer Kotkamills, was made available in KLIX vending machines from February 2020, serving a wide range of hot drinks brands, with more to come throughout the year.The new KLIX Eco Cup is unique due to a special patented water-based dispersion barrier board that enables the cups to be recycled with normal paper waste, just like office paper. Such innovations combined with increasing partnerships is expected to spur the market growth during the forecast period.

Europe Biodegradable Cups Market Trends

Food is Expected to Gain Significant Share

- By application, food, beverage end users are expected to adapt to biodegradable packaging the most. For instance, in May 2021, researchers in Denmark have created a way to replace plastic used in delivering food with grass fibers, which they say is '100 % biodegradable.'

- The novel coronavirus has aided consumers to realize the importance of always being prepared and putting health first and increased the demand for packaged food across the region. Similarly, many brands had also tweaked the packaging of the products in order to appeal to the consumers. Therefore, the packaging is now being seen as a vital bridge between consumers and brands to effectively communicate that hygiene practices are maintained, consumer safety is prioritized.

- However, most of the government has pushed the banning on single-use plastic in their countries, which has gained some time for the plastic cycle and hindered the adoption of biodegradable packaging by various companies. For instance, in the United Kingdom, The Department for Environment, Food & Rural Affairs postponed the ban on plastic straws, stirrers, and cotton buds to October 2020.

- Also, the food sector is also reconsidering its approach to using recyclable or eco-friendly materials that might augment transmission threats. For instance, even before the enforcement of lockdown, some players involved in the coffee business had resumed using disposable cups. Even though this might be a momentary trend, it does not mean that the environment-friendly packaging options will not be reconsidered in the future.

- Owing to the growing needs, the region is also witnessing growth of startups. In April 2021, Picup launched its plantable paper cups in Poland. The Poznan-based startup's 100% biodegradable cups of tea or coffee contain seeds at the bottom of the filter, allowing a tree to grow after the drink is consumed.

- For businesses that provide on-the-go services, such as coffee chains where customers may not always bring their own reusable cups, Picup provides an instant, convenient, practical alternative that leaves behind a lighter footprint on the planet and can work with brands to customise cups with their brand logos.

United Kingdom is Expected to Grow Significantly

- With the rise of takeaway and street food outlets, grabbing food on the go is the new norm in the United Kingdom. The United Kingdom has recently introduced regulations that require increased recycled content for packaging.

- Companies, like GM Packaging Ltd, in the United Kingdom have launched products that are manufactured using sugarcane (Bagasse) and bamboo fiber, which allows them to meet the consumer's needs through reliable and stable products with compostable utensils, such as knives, forks, spoons, and cups. This makes these products affordable, safe, and eco-friendly.

- The growth is also attributed to consumer awareness. Earlier most consumers were unaware that standard paper cups are difficult to recycle and are usually sent to landfills due to a Polyethylene (PE) lining that very few recycling facilities across Europe can process including the United Kingdom.

- Owing to the increasing demand, new as well as established players in the market are launching new products to gain market share in the region. For instance, in December 2020, Britain's fully plastic-free and recyclable lid-free takeaway cup was launched in the United Kingdom. The newly launched ButterflyCup which needs no separate lid was showcased at WWT (Wildfowl & Wetlands Trust) centres across the United Kingdom. The cup can be recycled in the regular paper bin along with cardboard and ordinary paper, biodegrades naturally and can be composted.

Europe Biodegradable Cups Industry Overview

The European biodegradable cups market is moderate, with market incumbents, such as Genpak LLC, Pactiv LLC, BVO International GmbH, Huhtamaki Group, among others, operating in the market. Sustainable competitive advantage can be gained through innovation in design, technology, and application. The market incumbents have been identified to adopt moderate competitive strategies, by partnerships activities, emphasis on R&D, and innovative activities. However, there are many new players that are expanding in the region and might make the market fragmented through the forecast period.

- March 2021 - Luxembourg-based company Capsul'in Pro launched its Zero Impact Nespresso-compatible coffee capsule, that is 100% biobased, certified home compostable and with a high oxygen barrier that protects the flavour and aroma of the coffee. The Zero Impact capsule is completely plant-based and does not contain materials derived from fossil fuels. After use, the capsule can be put in a home compost bin or collected with organic waste.

- November 2020 - East Yorkshire printing and marketing business Just Peel announced that it is planning to launch a range of disposable pint and half pint standardised paper cups for the drinks industry supported by funding from HSBC UK. The company used a six-figure funding package from the bank to purchase specialist machinery to produce fully brandable, PE and PLA plastic free, CE-marked pint and half-pint paper cups.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for Sustainable Products specifically in the beverage industry

- 4.2.2 Stringent government regulations has led to higher emphasis on material-based innovations

- 4.3 Market Challenges

- 4.4 Industry Ecosystem Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6 Impact of COVID-19 on the Biodegradable Cups Industry (Key themes covered include adverse impact on the foodservice industry which is one of the foremost contributors to market growth| Higher focus on Single-use products owing to lower risk of transmission| Supply-chain challenges)

5 MARKET SEGMENTATION

- 5.1 By Material Type

- 5.1.1 Bio-Plastics (PLA, PBS & others)

- 5.1.2 Paper

- 5.2 By Application

- 5.2.1 Beverage (Cold & Hot Beverages| Ice-Cream)

- 5.2.2 Food (Confectionaries, Spreads & Dressings)

- 5.3 By End User

- 5.3.1 Food Service Outlets (Cafe & Hotels)

- 5.3.2 Institutional (Malls & other commercial establishments)

- 5.3.3 Others (Households, etc.)

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 Italy

- 5.4.4 France

- 5.4.5 Rest of Europe (Spain, Nordics, Benelux, etc.)

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Genpak LLC

- 6.1.2 Pactiv LLC

- 6.1.3 BVO International GmbH

- 6.1.4 Huhtamaki Group

- 6.1.5 Go-Pak Limited

- 6.1.6 Scyphus Limited

- 6.1.7 Bio Futura Group

- 6.1.8 Vegware

- 6.1.9 The Cup Folk