|

市場調查報告書

商品編碼

1636609

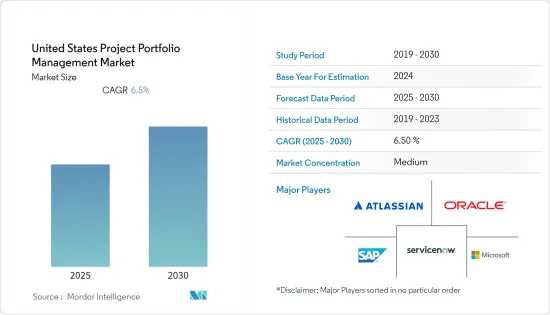

美國計劃合管理:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United States Project Portfolio Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計預測期內美國計劃合管理市場複合年成長率將達到 6.5%。

主要亮點

- 實施計劃合管理解決方案能為公司帶來多種好處。使計劃與組織目標保持一致;促進有關計劃衝突的決策;消除計劃規劃中的個人偏見;強調關注長期觀點的重要性;確保計劃管理辦公室是一個企業,這可以包括幫助計劃與優先事項不一致,並有助於建立計劃管理中的管治和監督。

- 計劃合管理是一個不斷成長的市場,仍具有巨大的成長潛力。與 2020 年相比,2021 年計劃合管理解決方案的採用有所增加。例如,根據《2022 年 PMO 展望報告》,2021 年有 30% 的受訪者使用電子表格或其他免費工具,但到 2022 年這一比例下降到 21%。 2021 年計劃合管理解決方案的廣泛採用在很大程度上抵消了這一下降趨勢。根據報告,計劃合管理軟體的採用率從 2020 年的 22% 增加到 2021 年的 28%。對於希望從策略工具中獲取即時洞察的組織來說,這種轉變凸顯了集中資料的重要性。

- 投資組合管理解決方案市場正處於轉型期,用戶向現有市場參與者施壓,要求他們提供動態的業務運作。為了擴展 PPM 解決方案的產品功能,最終用戶可以安裝可選的內容插件並配置整合。例如,PPM 平台 Clarity 提供了處理來自多個來源的資料的整合選項。用戶可以根據業務需求靈活地整合合適的插件或模組。

- 工業4.0是長期的演進過程,計劃合管理可以指導工業4.0計劃的實施,成為企業策略的工具。在工業領域,高階管理支援、計劃發起人、指導委員會和大型團隊被視為工業 4.0計劃的關鍵成功因素。計劃專業人員可以透過傳統或敏捷方法進行合作,以補充他們的能力並實現計劃目標。計劃合管理旨在促進計劃的成功交付,從而提供結構性能力,引導各行業實現工業 4.0 的策略目標。

- 過去幾十年來,遠距辦公的趨勢一直持續成長。然而,COVID-19 的影響在很短的時間內顯著加速了這一趨勢,迫使各種規模的企業在全國範圍內迅速適應政府建議的自我隔離措施。由於新冠疫情導致更多人需要遠端工作,計劃合管理軟體對於企業來說至關重要,因為它可以幫助企業管理遠端工作環境並有效地交付計劃。

美國計劃合管理市場趨勢

雲端基礎計劃管理部門將在預測期內實現顯著成長

- 雲端PPM是雲端與PPM的結合,支援協同調度、規劃和快速有效的決策。中小企業大量採用雲端分析來提高業務效率是推動該市場成長的決定性因素之一。

- 對大規模計劃管理的需求不斷增加是推動雲端基礎的PPM 市場發展的主要成長要素之一。根據 PMI 的一項調查,大約 87% 的高階主管認為他們的組織了解計劃管理的價值。根據 Wellingtone Limited 2020 年的一項調查,89% 的受訪者表示其組織擁有多個 PMO,其中 50% 的受訪者擁有兩個。

- 雲端基礎的部署預計比傳統的內部託管容易得多。公司可以為部分員工購買一個月的訂閱(或免費測試)來測試軟體。例如,微軟提供 Microsoft Project & Portfolio Management - Project Online Premium,每位用戶每月收費 55 美元。

- 此外,員工擴大採用 BYOD(自帶設備),從而增加了筆記型電腦、智慧型手機和平板電腦等個人設備的使用。這對 IT 部門提出了挑戰,要求他們跨不同平台和行動裝置向多個地點的高階主管和團隊成員提供現代化應用程式和安全存取。

- 此外,易於存取、企業移動性以及地理分佈的業務部門之間的即時協作等多種因素正在推動 BYOD 趨勢的成長。因此,它被認為是推動各行業採用雲端基礎的PPM 解決方案的因素之一。

預計預測期內,IT 產業將佔據最大的市場佔有率。

- 隨著 IT 與業務的連結越來越緊密,從而帶來寶貴實務的相互影響,IT 產業對計劃合管理的需求也日益增加。

- 各種規模的組織都使用計劃合管理來簡化計劃選擇和編排,最佳化所需資源的分配和利用,並創建高效的價值和風險管理模型。

- 現今的 PMO 中的軟體開發和IT基礎設施計劃需要高標準的管治,但最具創新性和競爭力的 IT計劃通常必須使用敏捷計劃管理方法來交付。透過內建管治和與敏捷 PPM 工具的整合,PMO 可以自上而下控制 IT計劃,為業務計劃帶來一致、協作和策略性的力量。

- 一些公司正在利用 IT PPM 工具來集中和轉移複雜的計劃、財務和ALM 流程(透過工作流程支援和供應商流程內容),以實施敏捷、迭代和混合敏捷方法。方法包含了大量

- 透過這種方式,IT PPM 自動化可以有效地用作計劃、規劃和投資組合決策和自適應執行流程的一部分,從而使 IT PPM 實施變得有用且成功。

美國計劃合管理產業概況

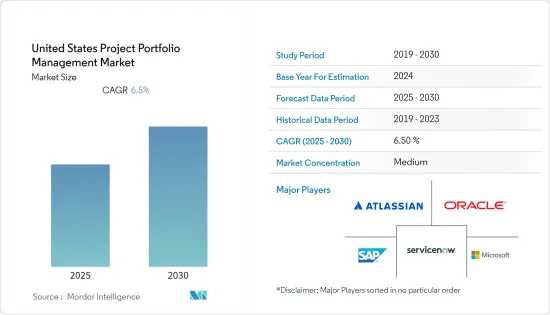

美國計劃合管理市場競爭適中,由幾家大公司組成,其中包括: Oracle Corporation、ServiceNow Inc.、Microsoft Corporation、Atlassian Corporation PLC、Asana Inc.、SAP SE、Monday.com 等。技術進步,許多公司正在透過有機和無機成長策略擴大其市場佔有率並開拓新市場。

- 2022年4月,Proggio獲得由美國2.0 Ventures主導的700萬美元A輪資金籌措。經營團隊和現有投資者 Mangrove Capital Partners 參與了 A 輪資金籌措,以加速公司在美國擴張和營運。

- 2022 年 2 月,總部位於愛達荷州博伊西的私募股權公司 Teleo Capital Management 收購了加拿大計劃合管理軟體顧問公司 Western Principles。 Western Principles 與公共和私部門客戶合作實施 Microsoft 的 PPM 解決方案,包括 UMT360 策略性投資組合管理軟體。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 市場動態

- 市場促進因素

- 市場挑戰

- COVID-19 對市場的影響

第5章 市場區隔

- 按類型

- 解決方案

- 服務

- 按部署

- 本地

- 雲

- 按最終用戶

- 資訊科技/通訊

- 醫療保健和生命科學

- 工程和建築

- 製造業

- 能源、公共產業和水處理

- 教育

- 其他最終用戶

第6章 競爭格局

- 供應商排名(基於多項基礎指標)

- 公司簡介

- Oracle Corporation

- ServiceNow Inc.

- Microsoft Corporation

- Atlassian Corporation PLC

- Asana Inc.

- SAP SE

- Monday.com

- Planview Inc.(Changepoint)

- Smartsheet Inc.

- Upland Software, Inc.

- Workday Inc.

- Wrike(Citrix Systems Inc.)

- Micro Focus

- Sopheon Corporation

第7章:未來展望

第 8 章:關於發布者

The United States Project Portfolio Management Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- Implementing project portfolio management solutions offer several benefits to businesses. It caters to alignment between organization objectives and projects; makes decision-making easier around project conflicts; takes the personal bias out of project planning; emphasizes the importance of focusing on the long-term view; helps the project management office turn down projects which are not aligned with business priorities; supports to create governance and oversight into the management of projects.

- Project portfolio management is still a growing market with tremendous growth potential. The year 2021 witnessed increasing adoption of project portfolio management solutions compared to 2020. For instance, according to the PMO Outlook Report 2022, in 2021, 30% of respondents were using spreadsheets and other free tools, while in 2022, that decreased to 21%. This downward trend was mostly countered by adopting more project portfolio management solutions in 2021. The report indicated that the project portfolio management software adoption rate increased from 22% in 2020 to 28% in 2021. This shift is evident in highlighting the importance of the centralized data in organizations that are aimed to gain from real-time insights available in a strategic tool.

- The market for portfolio management solutions is in transition as users pressure established market players to offer dynamic business operations. To extend the product functionalities of PPM solutions, end-users can install optional content add-ins and configure integrations. For instance, Clarity, a PPM platform, offers integration options to work with data from multiple sources. Users have the flexibility to integrate the right set of add-ins and modules as per the business requirement.

- As industry 4.0 is a long-term evolutionary process, project portfolio management can guide the implementation of industry 4.0 projects to become an instrument of company strategy. In the industry, top management support, project sponsors, steering committee, and multiskilled teams are seen as primary success factors for industry 4.0 projects. Project professionals can collaborate through traditional or agile approaches to supplement their abilities and deliver the project's objectives. Project portfolio management is set to enable structural capability leading various industries towards industry 4.0 strategic goals as it contributes to successful project implementation.

- The trend toward remote work has been continuously growing for the past decades. However, the effect of COVID-19 has significantly accelerated this trend in an extremely short time, forcing companies, irrespective of their size, to adapt quickly to the self-isolation measures recommended by governments across the country. With the COVID-19 pandemic requiring more people to work remotely, the project portfolio management software has become an essential tool for the companies as it can help manage the remote working environment and deliver projects efficiently.

US Project Portfolio Management Market Trends

Cloud-based Project Portfolio Management Segment to Register Substantial Growth During the Forecast Period

- Cloud PPM is emerging at an accelerated pace, which is the combination of cloud and PPM and supports collaborative scheduling, planning, and faster and effective decision-making. The significant adoption of cloud analytics enhanced business effectiveness for SMEs are some of the determinants boosting the growth of this market.

- The rising requirement for large-scale project management is one of the major growth factors for the cloud-based PPM market. According to a PMI survey, around 87% of senior executives believed their organization understood project management's value. A survey by Wellingtone Limited as of 2020 indicates that 89% of respondents said that they have one or more PMOs, organizations have one or more PMOs, with 50% have more than one.

- Implementing cloud-based is expected to be much easier compared to traditional on-premise hosting. The company can purchase a month's subscription (or test it for free) for some of its workforce to test the software. For instance, Microsoft Corporation offers its Microsoft Project & Portfolio Management - Project Online Premium at USD 55/User/Month.

- Furthermore, the rising usage of Bring Your Own Device (BYOD) in the workforce has augmented the usage of personal devices such as laptops, smartphones, and tablets. This, in turn, has created a challenge for IT to provide novel applications and secure access to distinct platforms and mobile handsets utilized by the managers and the team members across various locations.

- In addition, several factors such as easy accessibility, enterprise mobility, and real-time cooperation of geographically distributed business units have fortified the growth of the BYOD trend. Therefore, it is considered one of the factors driving the adoption of cloud-based PPM solutions across diverse industries.

IT Industry is Expected to hold Largest Market Share During the Forecast Period

- The demand for project portfolio management in the IT industry increasing with the growing proximity of IT and the business leads to the cross-fertilization of valuable practices, the IT business adapting the PPM tools and approaches within IT to improve the work efficiency.

- Organizations of all sizes use project portfolio management to rationalize project selection and orchestration, optimize the allocation and utilization of essential resources and build highly efficient value and risk management models.

- Software development and IT infrastructure projects in today's PMO require high governance standards, yet most innovative, competitive IT projects often must be delivered using agile project management methods. A PMO with top-down IT project control using built-in governance and integrations with agile PPM tools lends consistent, collaborative, strategic power to business initiatives.

- Several companies have leveraged the IT PPM tool to help concentrate and shift complex project, financial, and ALM processes (through workflow support and vendor process content) to supplement their existing methodologies with considerable uptake of agile, iterative, and hybrid agile methods.

- Thus, IT PPM automation is used effectively as a part of the project, program, portfolio decision-making, and adaptive execution process for any IT PPM implementation to be helpful and successful.

US Project Portfolio Management Industry Overview

The United States Project Portfolio Management Market is moderately competitive and consists of several major players such as Oracle Corporation, ServiceNow Inc., Microsoft Corporation, Atlassian Corporation PLC, Asana Inc., SAP SE, Monday.com, etc. In terms of market share, few major players currently dominate the market. However, with innovations and technological advancements, many companies are increasing their market presence through organic and inorganic growth strategies and tapping new markets. Some of the recent developments in the market are:

- April 2022, Proggio received an investment of USD 7 million in series A funding led by a US-based 2.0 Ventures. Management and its existing investor Mangrove Capital Partners participated in the series A funding to help the company accelerate its expansion and operation in the United States.

- February 2022, Teleo Capital Management, a Boise , Idhao based private equity firm, acquired Western Principles, a canada based project portfolio management software consultancy. Western Principles work with public and private sector client for the implementation of Microsft's PPM solution and also implementes UMT360 strategic portfolio managment software.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.2 Market Challenges

- 4.3 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Solution

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By End User

- 5.3.1 IT and Telecom

- 5.3.2 Healthcare and Lifescience

- 5.3.3 Engineering and Construction

- 5.3.4 Manufacturing

- 5.3.5 Energy, Utilities and Water Treatment

- 5.3.6 Education

- 5.3.7 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Ranking (Based on several base indicators)

- 6.2 Company Profiles

- 6.2.1 Oracle Corporation

- 6.2.2 ServiceNow Inc.

- 6.2.3 Microsoft Corporation

- 6.2.4 Atlassian Corporation PLC

- 6.2.5 Asana Inc.

- 6.2.6 SAP SE

- 6.2.7 Monday.com

- 6.2.8 Planview Inc. (Changepoint)

- 6.2.9 Smartsheet Inc.

- 6.2.10 Upland Software, Inc.

- 6.2.11 Workday Inc.

- 6.2.12 Wrike (Citrix Systems Inc.)

- 6.2.13 Micro Focus

- 6.2.14 Sopheon Corporation