|

市場調查報告書

商品編碼

1637719

己內醯胺 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Caprolactam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

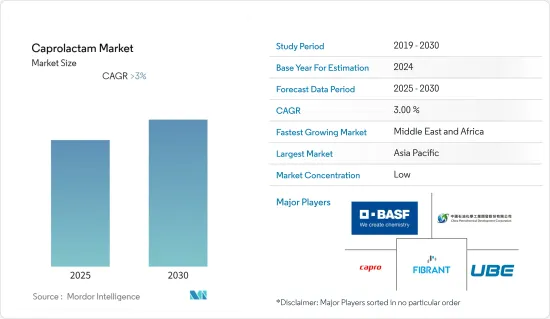

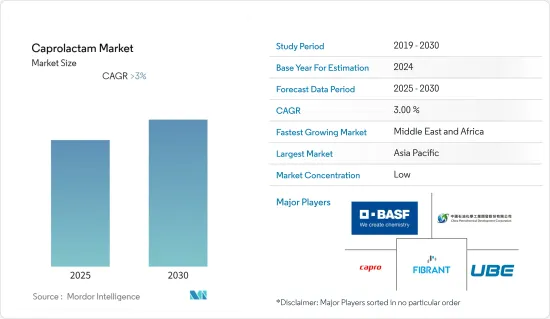

預計己內醯胺市場在預測期內複合年成長率將超過 3%。

由於COVID-19的爆發,己內醯胺市場受到了負面影響。世界各地的封鎖限制了供應鏈,並嚴重阻礙了工業擴張。然而,市場去年有所復甦,預計未來幾年將大幅成長。

主要亮點

- 短期來看,尼龍6產能擴張是推動市場成長的關鍵因素。

- 另一方面,己內醯胺的毒性和尼龍6替代品的存在可能會阻礙市場成長。

- 在整個預測期內,擴大關注己內醯胺回收可能是一個機會。

- 亞太地區主導全球市場,其中中國、印度和韓國等國的消費量最高。

己內醯胺市場趨勢

對紡織品和地毯的需求增加

- 己內醯胺是製造尼龍 6 合成纖維的單體,尼龍 6 廣泛用於紡織工業製造不織布。

- 由尼龍 6 製成的布料色彩鮮豔、重量輕、堅固耐用。在常壓下很容易染色,顏色鮮豔、深邃。雪紡、歐根紗等織物的光澤和透明度歸功於尼龍6。

- 由尼龍 6 樹脂製成的地毯纖維耐用、有彈性且不褪色。尼龍 6 為地毯製造商提供了廣泛的顏色和設計選擇。此外,由尼龍 6 製成的地毯具有耐磨損、耐擠壓和耐消光的特性,同時賦予最終產品持久的性能。尼龍 6 是地毯製造中使用的最耐用、用途最廣泛的纖維。

- 在全球紡織業中,化纖佔2021年紡織品總產量的77%以上,佔較大比例。

- 根據德國化纖工業協會Industrievereinigung Chemiefaser統計,2021年全球合成纖維總產量為8,820萬噸,較2020年成長約9%。

- 此外,2021年全球合成化學纖維(尼龍6、聚醯胺等)產量增加9.2%,達8,090萬噸。

- 德國、西班牙、法國、義大利和葡萄牙等歐洲國家的紡織業約佔世界紡織業的五分之一,價值約1,600億美元。

- 由於其特性,紡織和地毯行業對尼龍6的需求不斷增加,這將有利於預測期內的市場研究。

亞太地區主導市場

- 亞太地區在全球市場佔據主導地位,佔約70%的高佔有率。由於中國和印度等國家紡織工業的成長,該地區己內醯胺的消費量正在增加。

- 中國是全球最大的尼龍6生產國。中國最大的六家尼龍生產商包括廣東新會美達尼龍、BASF(中國)和力恆(長樂)聚醯胺科技。以GDP計算,中國是世界第二大經濟體。

- 根據中國工業與資訊化部統計,2022年1月至10月中國紡織品出口1,257億美元,較去年同期成長6.9%。此外,2022年1月至10月,中國主要紡織企業營業收入總合達4.28兆元人民幣(約6,116.5億美元),較去年同期成長1.6%。

- 根據世界貿易組織(WTO)的數據,印度是第三大紡織品製造國。 IBEF預計,到2029年,印度紡織品市場規模預計將達到2,090億美元,紡織業的市場需求可望進一步增加。

- 越南、台灣和孟加拉等其他國家在紡織業中佔有很大佔有率,預計己內醯胺需求在預測期內將快速成長。

- 除紡織業外,主要用於汽車工業的工業紗線、樹脂和薄膜對己內醯胺的需求也很大。

- 根據國際汽車製造組織(OICA)的數據,亞太地區汽車工業成長了6%,達到46,732,784輛。

己內醯胺產業概況

全球己內醯胺市場細分,五家主要企業約佔35%的佔有率(基於產能)。該市場的主要參與企業包括(排名不分先後)中國石化開發公司、Fibrant、 BASF SE、Capro Co 和 UBE Corporation。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 擴大尼龍6產能

- 抑制因素

- 己內醯胺毒性

- 尼龍 6 替代品的存在

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 原料

- 苯酚

- 環己烷

- 最終產品

- 尼龍6樹脂

- 尼龍6纖維

- 其他最終產品

- 目的

- 工程樹脂/薄膜

- 工業絲

- 紡織品/地毯

- 其他

- 最終用戶產業

- 車

- 地毯

- 紡織品

- 其他

- 地區

- 亞太地區

- 中國

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率分析

- 主要企業策略

- 公司簡介

- AdvanSix Inc.

- Alpek SAB de CV

- BASF SE

- Capro Co.

- China Petrochemical Development Corporation

- China Petroleum & Chemical Corporation(Sinopec)

- Domo Chemicals

- Fertilisers And Chemicals Travancore Limited(FACT)

- Fibrant

- Fujian Jinjiang Petrochemical

- Juhua Group Corporation

- Lanxess

- PJSC Kuibyshevazot

- Shandong Haili Chemical Industry Co. Ltd

- Sumitomo Chemical Co. Ltd

- Toray Industries Inc.

- UBE Corporation

- Xuyang Group

第7章 市場機會及未來趨勢

- 越來越關注己內醯胺回收

- 其他機會

The Caprolactam Market is expected to register a CAGR of greater than 3% during the forecast period.

Due to the outbreak of COVID-19, the caprolactam market was negatively impacted. Owing to the lockdown in various countries across the world, there were supply chain constraints that significantly obstructed the expansion of the industry. However, the market recovered last year, and it is expected to grow at a significant rate in the coming years.

Key Highlights

- Over the short term, the growing production capacity of Nylon 6 is the major driving factor favoring the market's growth.

- On the flip side, the toxicity of caprolactam and the presence of substitute products for Nylon-6 will likely hinder the market growth.

- Increasing focus on recycling caprolactam will likely act as an opportunity over the forecast period.

- Asia-Pacific dominated the market across the world, with the largest consumption from countries, such as China, India and South Korea.

Caprolactam Market Trends

Increasing Demand for Textile and Carpets

- Caprolactam is the monomer for the production of a chemical fiber called Nylon 6, which is extensively used in the textile industry to produce non-woven fabrics.

- Fabric made from nylon 6 is colorful and lightweight, and strong and durable. It can be easily dyed at normal atmospheric pressure and produces bright and deep shades. Fabrics, such as chiffon and organza, owe their luster and translucent appeal to nylon 6.

- Carpet fiber made from nylon 6 resin is durable, resilient, and colorfast. Nylon 6 offers a great range of colors and design options to carpet manufacturers. Furthermore, carpets made from nylon 6 are resistant to abrasion, wear and tear, and crushing and matting while granting long-lasting performance to the end product. Nylon 6 is the most durable and versatile fiber used to manufacture carpets.

- In the global textile industry, chemical fiber accounts for the major share accounting for more than 77% of the total production volume of textile fiber in the year 2021.

- As per the Industrievereinigung Chemiefaser (German Chemical Fiber Industry Association) in the year 2021, the total global production volume for chemical fibres was 88.2 million metric tons, registering an increase of around 9% as compared to the year 2020.

- Furthermore, the global production of synthetic chemical fibers (nylon 6, polyamide, etc) increased by 9.2% in the year 2021 and reached 80.9 million metric tons.

- The textile industries of European countries such as Germany, Spain, France, Italy, and Portugal are valued at around one-fifth of the global textile industry registering a value of around USD 160 billion.

- Owing to its properties the demand for nylon 6 from the textile and carpet industry is observing a continuous increase and is likely to favour the market studied over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global market with the highest share of almost 70%. With the growing textile industry in countries like China and India, the consumption of caprolactam is increasing in the region.

- China is the largest producer of nylon 6 worldwide. Some of the largest manufacturers of nylon 6 in China are Guangdong Xinhui Meida Nylon Co Ltd, BASF (China) Co. Ltd, Liheng (Changle) Polyamide Technology Co. Ltd, etc. In terms of GDP, China is the second-largest economy in the world.

- As per the Chinese Ministry of Industry and Information Technology, China's textile exports from January to October 2022 grew 6.9 % year on year (YoY) and reached USD 125.7 billion. Moreover, the combined operating revenue of the major Chinese textile enterprises increased by 1.6 % YoY to CNY 4.28 trillion (~ USD 611.65 billion) during the January-October 2022 period.

- According to the WTO (World Trade Organization), India is the third-largest textile manufacturing industry. In India, the production of fabric from the decentralized sector of the country was recorded as 74.27 billion sq. m. in 2020 and the overall production was registered at more than 76.29 billion sq. m. According to IBEF, the Indian textiles market is expected to reach USD 209 billion by 2029, which will further boost the demand for the market from textile sector.

- Other countries such as Vietnam, Taiwan, and Bangladesh enjoy a prominent share in the textile industry and are expected to upsurge the demand for caprolactam at a high pace over the forecast period.

- Along with textile industry, caprolactam also has significant demand from industrial yarn, and resin and films which are majorly used in the automotive industry.

- As per the Organisation Internationale des Constructeurs d'Automobiles (OICA) the automotive industry in the Asia-Pacific increased by 6% and reached to 46,732,784 vehicles.

Caprolactam Industry Overview

The global caprolactam market is fragmented, and the top five players account for around 35% share (in terms of production capacity) in the global market. Key players in the market include (not in any particular order) China Petrochemical Development Corporation, Fibrant, BASF SE, Capro Co., and UBE Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Production Capacity of Nylon 6

- 4.2 Restraints

- 4.2.1 Toxicity of caprolactam

- 4.2.2 Presence of substitute products for Nylon-6

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume )

- 5.1 Raw Material

- 5.1.1 Phenol

- 5.1.2 Cyclohexane

- 5.2 End Product

- 5.2.1 Nylon 6 Resins

- 5.2.2 Nylon 6 Fibers

- 5.2.3 Other End Products

- 5.3 Application

- 5.3.1 Engineering Resins and Films

- 5.3.2 Industrial Yarns

- 5.3.3 Textiles and Carpets

- 5.3.4 Other Applications

- 5.4 End-user Industry

- 5.4.1 Automotive

- 5.4.2 Carpet

- 5.4.3 Textile

- 5.4.4 Other End-user Industries

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 South Korea

- 5.5.1.4 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AdvanSix Inc.

- 6.4.2 Alpek S.A.B. de CV

- 6.4.3 BASF SE

- 6.4.4 Capro Co.

- 6.4.5 China Petrochemical Development Corporation

- 6.4.6 China Petroleum & Chemical Corporation (Sinopec)

- 6.4.7 Domo Chemicals

- 6.4.8 Fertilisers And Chemicals Travancore Limited (FACT)

- 6.4.9 Fibrant

- 6.4.10 Fujian Jinjiang Petrochemical

- 6.4.11 Juhua Group Corporation

- 6.4.12 Lanxess

- 6.4.13 PJSC Kuibyshevazot

- 6.4.14 Shandong Haili Chemical Industry Co. Ltd

- 6.4.15 Sumitomo Chemical Co. Ltd

- 6.4.16 Toray Industries Inc.

- 6.4.17 UBE Corporation

- 6.4.18 Xuyang Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Focus on Recycling Caprolactam

- 7.2 Other Opportunities