|

市場調查報告書

商品編碼

1637721

金融雲:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Finance Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

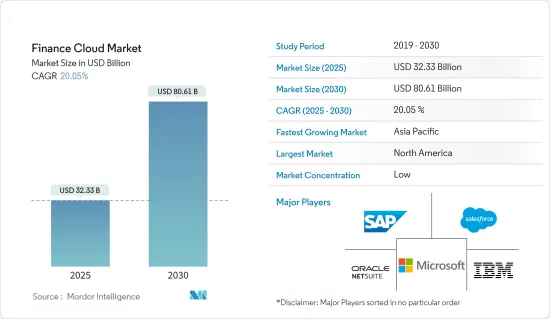

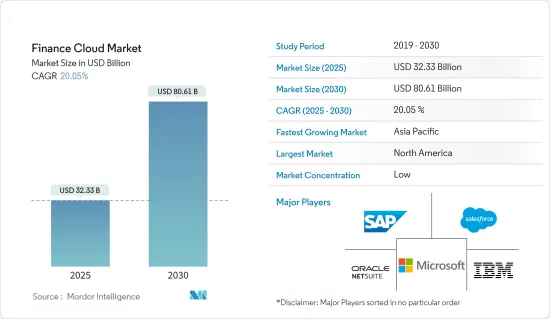

2025 年金融雲市場規模預估為 323.3 億美元,預計到 2030 年將達到 806.1 億美元,預測期內(2025-2030 年)的複合年成長率為 20.05%。

隨著收益的增加,雲端還可以產生更多的潛在客戶並提供更好的定價。

主要亮點

- 銀行服務、金融和保險公司正在選擇數位應用程式來快速回應持續的客戶查詢,同時也考慮長期利益並實現競爭優勢。例如,Ess Kay Fincorp 選擇了雲端基礎的借貸平台來數位化其整個借貸業務,並將貸款核准時間縮短了 33%。

- 業務效率的提升也是推動金融雲市場成長的因素之一。 Roha Housing Finance 希望在兩小時內發放貸款,而不是傳統的三天。透過利用雲端基礎的技術的靈活性和成本效益來實現「客戶至上」的理念,該公司現在能夠在七天內完成端到端的貸款處理,比住宅行業基準快 50%。

- 在印度、中國、巴西、非洲等新興國家和地區,金融雲端處理服務市場仍有很大的拓展空間。例如,監控和分析軟體供應商 ITRS Group Ltd. 預測今年亞太地區 86% 的金融服務業將使用公有雲。透過利用雲端基礎的應用程式,公司可以顯著降低購買、維護和升級 IT 系統和設備的成本。

- 然而,資料安全保護問題、過高的投入和維護成本限制了金融雲端產業的發展。資料遺失通常會危及雲端儲存的安全。資訊完全可能受到電腦病毒、駭客攻擊和系統故障的影響,而不是被竊取或共用。

金融雲市場趨勢

財富管理佔市場主導地位

- 隨著全球財富的增加,財富管理產業也不斷發展。根據瑞信的最新財富報告,去年財富成長強勁,以目前外匯計算,截至年終全球財富總合463.6 兆美元,成長 9.8%。

- 事實上,根據加拿大皇家銀行財富管理公司的數據,去年這些人最大的集中地是北美,共有 790 萬高淨值人士居住在那裡。去年亞太地區報告的高淨值人士數為720萬人。資產超過100萬美元的個人是淨資產最高的個人。

- 報告稱,未來五年全球財富預計將成長約26%,隔年達到399兆美元。中階的成長將成為財富的主要推動力,未來五年億萬富翁的數量將飆升,達到創紀錄的 5,500 萬人。

- 事實上,高淨值人士的需求很大。他們的業務競爭比以往更加激烈。因此,企業必須不斷創新,利用金融雲等最尖端科技來搶佔不斷成長的市場的更大佔有率。

- 人工智慧的使用日益廣泛是市場的新趨勢之一。財富管理是金融服務領域中最早大量使用人工智慧技術的領域之一。人工智慧應用需要使用雲端網路,因為人工智慧運算會產生龐大的財務資料。因此,由於人工智慧在金融領域的應用不斷擴大,預計金融雲市場也將在研究期間興起。

亞太地區將經歷最高成長

- 亞太地區各地的金融機構正在開始數位轉型。這使金融機構能夠實現成本效率。例如,在印度,印度政府正透過金融科技等舉措,致力於數位化付款系統並提高金融包容性,即 Jan Dhan Yojana、Aadhaar 和 UPI 統一支付介面。

- 去年四月,中國央行表示將加速發展國內金融科技基礎設施,以跟上日益受到資料、人工智慧和大型科技影響的金融業。其中包括升級連接資料中心和所有央行辦公室和分店的網路,以及去年建立「央行雲端」。

- 由於 BFSI 領域的不斷變化,印度的小型金融銀行 (SFB) 正處於發展的早期階段。這些金融機構希望制定可行的產業計畫,滿足社會弱勢族群的需求。許多現代銀行正在採用雲端運算和人工智慧/機器學習來為客戶做出更快、更明智的決策並更快地進行風險評估。

- 在公共部門舉措、中小企業以及銀行、金融服務和保險 (BFSI) 行業數位轉型的幫助下,科技巨頭Oracle在印度 (SMEs) 的雲端業務方面取得了重大進展。借助Oracle Cloud,銀行可以減少對資料中心基礎設施的依賴、僅按實際使用量付費以及根據業務需求調整容量,從而實現價值最大化。 Oracle聲稱,與使用其他雲端供應商的銀行相比,使用其雲端的銀行可節省高達 50% 的費用。

金融雲業概覽

金融雲市場競爭激烈,由幾個主要企業組成。為了在市場上站穩腳跟,參與者正在採取產品創新、合作夥伴關係和併購等策略。

- 2023 年 2 月-軟體投資公司 Thoma Bravo 宣布已完成 Coupa Software 的收購,雲端基礎的業務支出管理平台,整合了供應鏈、採購和財務職能中的流程,收購價格約為80億美元。

- 2022 年 1 月-軟體即服務 (SaaS) 和業務流程即服務 (BPaaS) 供應商 Avaloq 持續加強與加拿大皇家銀行旗下公司 RBC Wealth Management 在亞洲的長期夥伴關係關係。它還將幫助 RBC 財富管理推進其雲端基礎的SaaS 模型,並引入更為複雜的解決方案來實現其財富管理平台的現代化。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素與限制因素簡介

- 市場促進因素

- 需要改進客戶關係管理

- 金融業對業務效率的需求

- 市場限制

- 雲端基礎的網路威脅的崛起

第6章 市場細分

- 按解決方案/服務

- 財務預測

- 財務報告與分析

- 風險與合規

- 託管服務

- 按部署

- 公共雲端

- 私有雲端

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Oracle Corporation(and Netsuite)

- IBM Corporation

- Microsoft Corporation

- Salesforce.com Inc.

- SAP SE

- Sage Intacct Inc.

- Workday, Inc.

- Unit4(and FinancialForce)

- Acumatica Inc.

- Huawei Technologies Co. Ltd

第8章投資分析

第9章 市場機會與未來趨勢

簡介目錄

Product Code: 46324

The Finance Cloud Market size is estimated at USD 32.33 billion in 2025, and is expected to reach USD 80.61 billion by 2030, at a CAGR of 20.05% during the forecast period (2025-2030).

Along with increased revenue, the cloud increases the number of leads generated and offers better pricing.

Key Highlights

- Banking services and financial and insurance companies are opting for digital applications to quickly address customers' ongoing queries, along with keeping into consideration the long-term benefits and achieving a competitive advantage. For instance, Ess Kay Fincorp chose a cloud-based lending platform to digitize its entire lending business and decrease its loan approval time by 33%.

- Operational efficiency is another factor driving the growth of the finance cloud market. Roha Housing Finance wanted to issue loans within two hours instead of three days. After adopting the agility and cost efficiency of cloud-based technology to offer a "customer-first" approach, it was able to provide end-to-end loan processing in seven days, which is 50% faster than the benchmark for the housing finance industry.

- In developing nations and areas like India, China, Brazil, and Africa, the market for financial cloud computing services has a lot of room to expand. For instance, the ITRS Group Ltd., a monitoring and analytics software provider, predicted that 86% of the Asia Pacific financial services industry would use the public cloud this year. By utilizing cloud-based applications, businesses can significantly reduce the cost of purchasing, maintaining, and upgrading IT systems and equipment.

- However, problems with data security and protection and expensive investment and maintenance expenses limit the expansion of the finance cloud industry. Data loss routinely puts cloud storage's security in jeopardy. Information can be affected entirely by a computer virus, hacking, or a broken system instead of being stolen and shared.

Finance Cloud Market Trends

Wealth Management sector to Dominate the Market

- As global wealth increases, there is a rise in wealth management professionals. As per the Credit Suisse Wealth Report of the current year, wealth grew at a strong pace last year, and by year's end, global wealth at prevailing exchange rates totaled USD 463.6 trillion, a gain of 9.8%.

- In fact, according to RBC Wealth Management, North America accounted for the most significant concentration of these people last year with 7.9 million HNWIs living there. The number of HNWIs reported in the Asia Pacific region was 7.2 million last year. The individuals with a fortune of over USD 1 million are the highest Networth Individuals.

- The same report indicates that global wealth is projected to increase by about 26% over the next five years, reaching USD 399 trillion by the following year. Growth in the middle class will be the main driver of wealth, but over the next five years, there will be a sharp rise in the number of millionaires, who will reach a new all-time high of 55 million.

- In fact, there's a lot of demand for wealthy individuals with HNWIs. And the competition is even more fiercethan ever in terms of their business. Consequently, businesses must continue to innovate and gain a bigger share for the growing market by staying on top of cutting edge technologies such as Finance Cloud.

- The growing use of AI is one of the market's emerging trends. Wealth management is one of the first sectors in the financial services sector to utilize AI-based technology in a substantial way. The production of huge financial datasets by AI computation makes the use of cloud networks necessary for AI applications. As a result, the Financial Cloud Market will also emerge over the research period as a result of the growing use of AI in the finance sector.

Asia-Pacific to Witness the Highest Growth

- Financial institutions across the Asia-Pacific region are embracing digital transformations. This allows them to be more cost-efficient. For instance, in India, through fintech initiatives like the The Indian Government is working towards digitisation of payment systems and increasing financial inclusion, i.e. Jan Dhan Yojana, Aadhaar & UPI Unified Payments Interface.

- In April last year, in an effort to keep up with a financial sector that is increasingly being shaped by data, artificial intelligence, and Big Tech, China's central bank announced that it was accelerating infrastructure development for its own financial technology. This includes updating its data centers and the network connecting all central bank offices and branches, as well as establishing a "central bank cloud" last year.

- Small Finance Banks (SFBs) in India have reached a nascent stage of evolution due to the constantly changing BFSI sector. These financial institutions want to create a workable business plan that will meet the demands of the underprivileged groups in society. Many of these modern banks employ the cloud and AI/ML to make quicker and more informed decisions for their customers, along with quick risk assessments.

- With the help of public sector initiatives, small and medium-sized businesses, and digital innovation in the banking, financial services, and insurance (BFSI) industries, technology giant Oracle Corp. is experiencing substantial development in its cloud business in India (SMBs). Banks can lessen their dependency on data center infrastructure, pay only for what they use, and maximize value by aligning capacity with business demand with Oracle Cloud. Oracle says that banks that use their cloud can cut costs by up to 50% compared to banks that use other cloud providers.

Finance Cloud Industry Overview

The Finance Cloud market is competitive and consists of several major players. In order to gain a better foothold in the market, players are adopting strategies such as product innovation, partnerships and mergers and acquisitions

- February 2023 - Thoma Bravo, a software investment firm, announced that it had completed its acquisition of Coupa Software, a provider of cloud based business spend management platform that unifies processes across the supply chain, procurement, and finance functions, for approximately $8.0 billion.

- January 2022 - Avaloq, a provider of software as a service (SaaS) and business process as a service (BPaaS) and ), In Asia, they will continue to strengthen their longstanding partnership with RBC Wealth Management, an operation of the Royal Bank of Canada. It will also help RBC Wealth Management to move forward with a cloud based SaaS model and modernise the wealth management platform by implementing more sophisticated solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Need for Improved Customer Relationship Management

- 5.2.2 Demand for Operational Efficiency in Financial Sector

- 5.3 Market Restraints

- 5.3.1 Rise of Cloud-based Cyber Threats

6 MARKET SEGMENTATION

- 6.1 By Solution and Service

- 6.1.1 Financial Forecasting

- 6.1.2 Financial Reporting and Analysis

- 6.1.3 Risk and Compliance

- 6.1.4 Managed Service

- 6.2 By Deployment

- 6.2.1 Public Cloud

- 6.2.2 Private Cloud

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation(and Netsuite)

- 7.1.2 IBM Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 Salesforce.com Inc.

- 7.1.5 SAP SE

- 7.1.6 Sage Intacct Inc.

- 7.1.7 Workday, Inc.

- 7.1.8 Unit4(and FinancialForce)

- 7.1.9 Acumatica Inc.

- 7.1.10 Huawei Technologies Co. Ltd

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219