|

市場調查報告書

商品編碼

1637733

貨運運輸管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Freight Transport Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

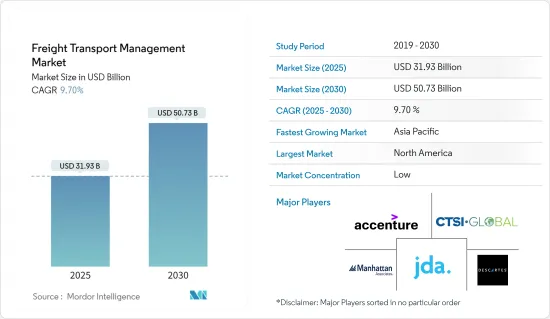

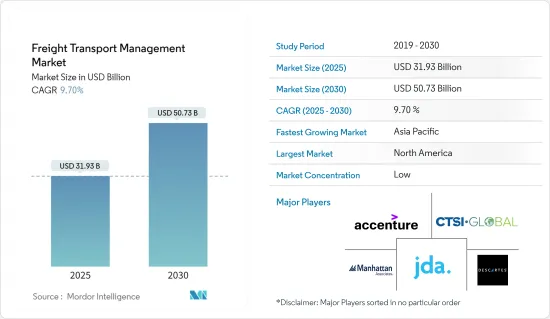

貨運運輸管理市場規模預計在 2025 年為 319.3 億美元,預計到 2030 年將達到 507.3 億美元,預測期內(2025-2030 年)的複合年成長率為 9.7%。

主要亮點

- 市場對貨物管理解決方案的需求不斷成長,這是由多種因素推動的,例如貨物管理提供的高利潤水平,以及全球化程度的提高導致的航運量增加。

- 每個國家的經濟都依賴更好的貨運業務效率。隨著人口的成長和全球化的進程,對商品和服務的需求也隨之增加。為了解決業務運作中的各種環境和安全問題,許多航運公司都選擇了貨物運輸管理解決方案。

- 科技的進步使得我們能夠以新穎的方式設想流程,從而創造新的效率。預計貨運市場的成長將受到資訊網路的出現所推動,這些資訊網路可以使新興領域的連接更快、交易時間更長、運輸更安全。

- 在印度等新興國家,終端用戶和製造商面臨的物流問題可以透過各種貨物管理解決方案來解決,如車輛追蹤和維護、安全監控系統、倉庫管理系統、第三方物流服務等。必要的管理結構來實現這一點。這一因素正在支持整個目標市場的成長。

- 海運的高度複雜性和低效率以及必要的成本控制對貨運市場的成長提出了挑戰。此外,預計跨境運輸相關的風險將阻礙貨運市場的發展。儘管如此,運輸管理系統的開發正在進行中,以滿足物流行業的需求並考慮到存在的問題。

貨物運輸管理市場趨勢

鐵路貨運對貨運管理解決方案的需求很大

- 鐵路貨運使用鐵路作為陸上運輸貨物的手段。鐵路運輸用於運輸多種不同類型的貨物,包括化學品、建築材料、農產品、汽車、能量成分、石油、風力發電機和林業產品。

- 此外,鐵路運輸是最常用的運輸方式之一,在全球範圍內擁有龐大的基礎設施。隨著鐵路在運輸上的使用增加,管理鐵路貨運的貨運管理也隨之成長。

- 鐵路貨運在環境、土地利用、能源消耗、安全性能等方面較其他運輸方式具有競爭優勢。因此,鐵路物流環境變得複雜且充滿挑戰,偏好越來越依賴鐵路貨運經驗和 IT 系統。

- 這就導致了各種各樣的鐵路貨運管理解決方案的出現。這些解決方案針對的是輕型貨運列車、多式聯運鐵路和私營鐵路,這些鐵路面臨日益增加的營運複雜性和日益成長的流程簡化需求。因此,DXC Technology 和 Goal Systems 等公司開發的產品系列都專注於這些需求。

- 此外,該市場的主要成長要素是對鐵路貨運服務的需求不斷成長,尤其是在經濟合作暨發展組織(OECD) 國家。考慮到這一點,預計鐵路貨運管理解決方案在預測期內將大幅成長。

預計北美將佔據很大市場佔有率

- 預計美國將在該地區發揮重要作用。這一佔有率是由於越來越多的公司向網路管道擴張而導致的零售額成長所致。由於 IT 和雲端處理領域的技術進步,美國貨運運輸業持續成長。

- 由於數位化全球化日益增強以及物聯網在各個領域的應用不斷增加,北美貨運運輸管理解決方案市場發展勢頭強勁,尤其是在美國。北美公路貨運市場是世界上最成熟的市場之一。

- 網路銷售的快速成長促使企業提高供應鏈效率,減少運輸時間,並儘快將產品送到客戶手中。結果,國內公路運輸量增加,調動了大量卡車。道路技術的不斷發展正在推動全球各個地區的貨運運輸管理市場的發展。

- 根據美國運輸部統計,卡車運輸占美國貨運量的近70%。預計未來幾十年內貨運量將成長45%,需要建造更多的高速公路、鐵路、港口、管道和改善多式聯運連接,以高效運輸貨物。卡車運輸需求的增加,特別是由於該國電子商務的蓬勃發展,預計將導致該地區對貨物運輸管理解決方案的需求增加。

貨運運輸管理產業概況

貨運運輸管理產業的特點是分散性明顯,競爭對手和本地參與者眾多。該行業也正在經歷向資訊和通訊領域的轉變,尤其是雲端處理。多式聯運經營者採取橫向和縱向整合等商業實踐,是為了降低營運成本、提高利潤率,進而加劇市場競爭。該行業的一些知名企業包括 JDA Software、Accenture PLC、DSV A/S、Manhattan Associates 和 Ceva Logistics。

曼哈頓公司宣布將於 2023 年 5 月推出其新的曼哈頓主動庭院管理解決方案。此舉符合公司實現統一供應鏈的更廣泛願景。新的堆場管理解決方案旨在與曼哈頓公司領先的倉庫和運輸管理解決方案無縫整合,所有解決方案都在單一的雲端原生平台上運行。

2023 年 2 月,IBS Software 完成對埃森哲貨運和物流軟體 (AFLS) 的收購。透過此次策略收購,IBS Software 進一步鞏固了其作為航空貨運業知名技術供應商的地位。此次收購將使 IBS Software 能夠透過整合更多解決方案並共用創新和經營模式轉型的通用願景,增強其在貨運和物流領域的產品服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 由於國際貿易增加,貨運量增加

- 資訊科技的成長趨勢

- 市場限制

- 由於引進新技術,資本投入較高

- 貿易路線上的風險與擁擠

第6章 市場細分

- 按解決方案(僅定性分析解決方案提供的主要服務、關鍵市場趨勢、主要企業、產品等)

- 貨運成本管理

- 貨物安全與監控系統

- 貨物運輸解決方案

- 倉庫管理系統

- 貨運第三方物流解決方案

- 其他解決方案

- 按部署

- 雲

- 本地

- 按運輸方式

- 鐵路貨運

- 公路貨運

- 水上貨物

- 航空貨運

- 按最終用戶

- 航太和國防

- 車

- 石油和天然氣

- 消費品和零售

- 能源和電力

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- JDA Software

- Manhattan Associates

- CTSI-Global

- Accenture PLC

- Descartes Systems Group Inc.

- DSV A/S

- HighJump

- CEVA Logistics

- DB Schenker

- Geodis

第8章投資分析

第9章 市場機會與未來趨勢

The Freight Transport Management Market size is estimated at USD 31.93 billion in 2025, and is expected to reach USD 50.73 billion by 2030, at a CAGR of 9.7% during the forecast period (2025-2030).

Key Highlights

- The growing demand for freight management solutions in the market is being driven by the high levels of benefits that freight management offers, as well as a combination of factors such as increased globalization contributing to rising transport volumes.

- The economy of all countries depends on better operational efficiency in freight transport. With the growth of population and globalization, there is an increase in demand for goods and services. In order to address the different environmental and safety concerns of their operations, a number of shipping undertakings are choosing freight transport management solutions.

- Technological progress has made it possible to conceive the process in novel ways and generate new efficiencies. The freight transport market growth is foreseen to be driven by the emergence of information networks with rapid contacts, transaction times, and more secure shipments within emerging sectors.

- In emerging countries, e.g., India, end users, and manufacturers do not have the controls necessary to solve logistics problems that can be solved through a range of freight management solutions like fleet tracking& maintenance, safety and security monitoring systems, warehouse management systems, or third-party logistics services. This factor is underpinning the growth of the entire target market.

- The high complexity and inefficiency of maritime transport, as well as the cost control required, are a challenge for market growth in freight transport. In addition, it is expected that the development of the freight market will be hindered by the risk associated with cross-border transport. Nevertheless, in order to be able to meet the needs of the logistics sector and take into account existing problems, transport management systems are being developed.

Freight Transport Management Market Trends

Rail Freight to Account for a Significant Demand for Freight Management Solutions

- Freight railway transport uses railways as a means of shipping cargo on land. It is employed for the transportation of many types of cargo, e.g., chemicals, earth-building materials, agricultural products, automobiles, energy feedstocks, oils, and wind turbines, as well as forestry production.

- Furthermore, rail transport is one of the most frequent modes of transport and has a large infrastructure in place all over the world. The increasing use of railways for transportation increases the growth of freight transportation management for managing rail freight transportation.

- In terms of performance in the environment, land use, energy consumption, and safety, rail freight transport has a competitive edge over other modes. As a result, the railway logistics environment is complex and difficult to navigate due to an increased preference with companies having to rely on rail cargo experience and IT systems for their management.

- This has led to the emergence of a range of management solutions for rail freight traffic, which are geared towards small cargo trains, intermodal railroads, and private railway lines that have been confronted with an increased level of operating complexity and increasingly pressing demands for process simplification. As a result, the portfolio of products developed by companies like DXC Technology and Goal Systems is being concentrated on these needs.

- Furthermore, the main growth driver for this market will be a higher demand for rail freight services, particularly in Organization for Economic Co-operation and Development (OECD) countries. With that in mind, rail freight management solutions are expected to grow significantly over the forecast period.

North America is Expected to Hold a Major Share in Market

- It is estimated that the United States will play a major role in this region. As a result of the increasing number of companies moving into the Internet channel, this share is attributed to an increase in retailers' sales. The US has continued to grow its freight transport sector, thanks to technological progress in the IT and Cloud computing sectors.

- The North American market for freight transport management solutions picked up momentum, particularly in the US, because of globalization as a result of growing digitalization and increased use of the Internet of Things by various sectors. North America's road freight market is one of the most mature markets in the world.

- The rapid growth of the online sales sector has led to a need for companies to improve their supply chain's efficiency, decrease transit time, and provide the products at customers' disposal as soon as possible. This has resulted in the increased movement of domestic traffic via roads, with a high volume of trucks being mobilized to do so. The increasing development of road technology is driving the global freight transport management market in all regions.

- According to the US Department of Transport, truck traffic in the United States accounts for nearly 70% of freight movements. It is expected to rise by 45% over the coming decades, requiring more highways, railroads, ports, or pipelines, as well as improved intermodal connections that move cargo efficiently. The increased demand for trucking, especially due to the boom in e-commerce in the country, is expected to lead to an increased demand for freight transport management solutions in the region.

Freight Transport Management Industry Overview

The freight transport management industry is characterized by significant fragmentation, with numerous competitors and local players. This sector is also witnessing a shift towards the information communication domain, particularly in cloud computing. The adoption of business practices involving both horizontal and vertical integration by intermodal freight transport operators has been driven by the desire to reduce operational costs and enhance profit margins, resulting in intensified competition within the market. Prominent players in this industry include JDA Software, Accenture PLC, DSV A/S, Manhattan Associates, and Ceva Logistics.

In May 2023, Manhattan Associates announced the launch of its reimagined Manhattan Active Yard Management solution. This move is aligned with the company's broader vision of achieving a unified supply chain. The new yard management solution has been designed to seamlessly integrate with Manhattan Associates' leading warehouse and transportation management solutions, all operating on a single, cloud-native platform.

In February 2023, IBS Software completed the acquisition of Accenture Freight and Logistics Software (AFLS). This strategic acquisition further solidifies IBS Software's position as a prominent technology provider in the air freight industry. By incorporating additional solutions and sharing a common vision for innovation and business model transformation, this acquisition will enable IBS Software to enhance its offerings in the freight and logistics sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Freight Transportation due to Increasing International Trade

- 5.1.2 Inclination of Growth toward Information Technology

- 5.2 Market Restraints

- 5.2.1 High Capital Investment due to Implementation of New Technologies

- 5.2.2 Risk and Congestion Associated with Trade Routes

6 MARKET SEGMENTATION

- 6.1 By Solution (Qualitative Analysis only Major services offered by the solution, key trends in the market, major players and products etc.)

- 6.1.1 Freight Transportation Cost Management

- 6.1.2 Freight Security and Monitoring System

- 6.1.3 Freight Mobility Solution

- 6.1.4 Warehouse Management System

- 6.1.5 Freight 3PL Solutions

- 6.1.6 Other Solutions

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By Mode of Transport

- 6.3.1 Rail Freight

- 6.3.2 Road Freight

- 6.3.3 Waterborne Freight

- 6.3.4 Air Freight

- 6.4 By End User

- 6.4.1 Aerospace and Defense

- 6.4.2 Automotive

- 6.4.3 Oil and Gas

- 6.4.4 Consumer and Retail

- 6.4.5 Energy and Power

- 6.4.6 Other End Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JDA Software

- 7.1.2 Manhattan Associates

- 7.1.3 CTSI-Global

- 7.1.4 Accenture PLC

- 7.1.5 Descartes Systems Group Inc.

- 7.1.6 DSV A/S

- 7.1.7 HighJump

- 7.1.8 CEVA Logistics

- 7.1.9 DB Schenker

- 7.1.10 Geodis