|

市場調查報告書

商品編碼

1637752

機器人 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

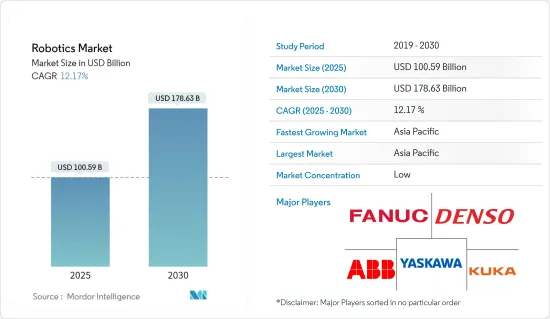

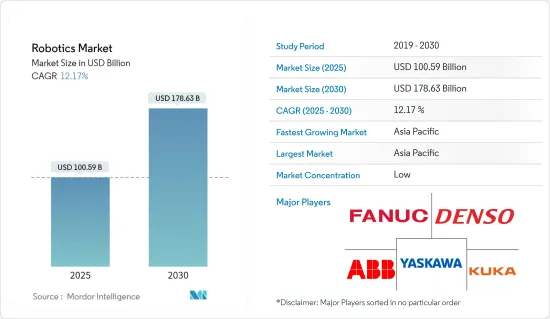

預計2025年機器人市場規模為1,005.9億美元,2030年將達1,786.3億美元,預測期間(2025-2030年)複合年成長率為12.17%。

機器人學結合了工程和技術來開發稱為機器人的智慧機器。無論是人工操作還是自主操作,這些機器人都可以娛樂或承擔繁瑣、複雜或涉及健康和安全風險的任務。機器人技術主要分為工業機器人和服務機器人,廣泛應用於各終端使用者產業。

工業機器人是用於製造和工業自動化應用的機器人系統。可程式設計和自動化,能夠在 3 個或更多軸上移動。這些機器人配備了感測器、控制器和致動器,使它們能夠在工業環境中執行各種功能和操作。工業機器人應用廣泛,包括焊接、噴漆、組裝、拆卸、拾取和放置、包裝和標籤、堆疊、物料輸送和運輸貨物。它們也用於採礦和建設業等重工業,以執行對人類來說太危險和困難的任務。

近年來,各行業擴大引入先進的機械和技術解決方案。這一趨勢背後有幾個因素。例如,世界各地的公司都面臨人事費用上升的問題,這往往導致生產力下降。人事費用上漲是由於政府監管、供需不平衡以及技術純熟勞工短缺所造成的。因此,許多公司正在轉向自動化解決方案作為更經濟的選擇。這一轉變將顯著推動工業 4.0 市場的發展,對於改善工業環境中的功能、控制和安全性至關重要。

隨著中小企業的不斷壯大,世界各國政府都在推動數位技術和先進工業技術的引進。這些措施旨在簡化和提高業務效率,並創造有利於市場成長的環境。在此背景下,截至2023年,美國將約有3,300萬家中小企業。截至2024年2月,印度註冊微企業3,932萬家(資料來源:IBEF,中小微型企業部),其中小型工業61萬家,中型企業6萬家。

整合先進技術的機器人成本比傳統機器人更高。機器人系統的成本與強大的硬體和高效的軟體有關。自動化設備採用先進的自動化技術,需要較高的資金投資。例如,設計、建造和安裝自動化系統可能花費數億美元。

這場大流行對世界各地的各行各業造成了嚴重破壞,從小型企業到大公司。政府為遏制病毒傳播而實施的封鎖措施加劇了這些挑戰,對一系列產業產生了負面影響。例如,OPEC指出,全球石油需求將從2019年的1.27億桶/日下降至2020年的9,119萬桶/日。然而,預計到2024年將增加至1.0446億桶/日。

機器人市場趨勢

服務機器人將在預測期內引領市場

- 商務用機器人主要用於製造設施以外的各種特殊情況。工業機器人專注於自動化製造任務,而商務用服務機器人則具有多種形式和功能,用於執行瑣碎、危險、耗時或重複性任務。這種自動化使人類工作者能夠從事更多的認知功能。

- 企業部署專業服務機器人時,安全是重中之重。這些機器人不是取代人類工人,而是管理危險的任務,使人類能夠專注於認知功能並保持安全。例如,在國防領域,專業服務機器人旨在保護士兵在戰鬥中免受危險。

- 技術的進步大大提高了安全機器人的功能。這些機器人透過複雜的分析來確定其行為,並可以放置在困難的場景中進行監控。透過整合各種感測器,專業機器人更加熟悉環境分析,可以獲得更可靠的資料。這種演變顯著增強了機器人在安全和巡邏方面的作用。

- 此外,現場機器人在農業和建築領域也越來越受歡迎。這些機器人被設計用來承擔對人類來說通常困難、危險和耗時的任務,例如砌磚、拆除和種植作物。

- 配備攝影機、雷射雷達和 GPS 等感測器的現場機器人可以自主導航並了解周圍環境。這些優勢正促使許多製造商開發現場機器人。

- 家用機器人,特別是輔助機器人、伴同性機器人、娛樂機器人的需求正在快速成長。需求的增加主要是由於人口老化和越來越多的人面臨流動性挑戰。

- 世界衛生組織 (WHO) 強調,作為全球趨勢,人們的壽命越來越長,許多人預計能活到 60 多歲或以上。這種趨勢是通用的,每個國家的老年人數量和比例都在增加。據預測,到 2030 年,世界上六分之一的人將超過 60 歲,這一人口將從 2020 年的 10 億增加到 14 億。到 2050 年,這一數字預計將增加一倍,達到 21 億,80 歲及以上的人口預計將增加兩倍,達到 4.26 億。

- 根據 IFR 的數據,家用機器人構成了最大的消費機器人群。吸塵器等家用掃地機器人是目前使用最多的應用。到2023年,家庭任務機器人出貨量預計將達到4,860萬台,娛樂機器人出貨量預計將達到670萬台。預計此類發展將成為未來市場發展的驅動力。

亞太地區預計將出現顯著成長

- 中國製造業引領世界,產生龐大的市場需求。越來越多的中國製造商正在採用工業4.0解決方案來提高效率,並推動市場進一步成長。

- 中國製造業正快速邁向工業4.0,成為數位革命的主要企業。中國利用其強大的工業基礎和技術知識專注於創新和競爭力。在「中國製造2025」等舉措下,中國政府旨在增強國家製造能力並培育高科技產業。這些措施可能會促進市場成長。

- 由於其強大的製造業和政府對創新的大力支持,韓國也處於工業自動化採用的前沿。憑藉其技術突破和工業實力,韓國有望主導該市場並顯著增強其經濟地位。

- 韓國蓬勃發展的汽車產業為擴大研究市場帶來了廣闊的前景。在全球對電動車日益成長的興趣以及政府對加強國內製造業的支持的推動下,包括起亞汽車和現代汽車在內的韓國汽車製造商正在提高產能並大力投資研發。

- 台灣汽車工業近年來經歷了顯著的成長。台灣專注於電動車和智慧運輸解決方案,已成為全球汽車產業的關鍵參與企業。此外,台灣的半導體製造專業知識使其能夠為 ADAS(高級駕駛輔助系統)和自動駕駛汽車提供關鍵組件。

- 此外,歷史上貢獻國內生產總值(GDP)89%以上的日本汽車產業正處於重大轉折點。日本雄心勃勃的目標是到 2050 年實現淨零排放,到 2030 年將排放量減少 46%,這推動了電動車 (EV) 越來越受歡迎。

- 為了進一步強調這一轉變,日本經濟產業省 (METI) 在其「綠色成長策略」下制定了更雄心勃勃的目標,即到 2035 年實現 100% 的電動車銷售佔有率。值得注意的是,混合動力電動車 (HEV) 已經佔據重要地位,佔日本汽車總銷量的近 30%。

機器人產業概況

在機器人市場上,全球和本土企業都在激烈地爭奪霸主地位。競爭取決於定價、產品供應、市場佔有率以及公司進入市場的動能等因素。主要企業透過研究、開發和整合工作發揮重大影響力。但市場滲透率高,細分程度高。

創新是確保在這種環境下持續競爭的關鍵。現有企業透過策略性地關注產品差異化和擴大市場範圍來維持自己的地位。收購、與市場參與企業建立夥伴關係以及開發新產品和服務是該市場供應商的主要競爭策略。

該市場的主要參與企業包括 ABB 有限公司、安川電機公司、電裝公司、發那科公司和庫卡公司。競爭取決於定價、產品供應、市場佔有率以及公司進入市場的動能等因素。主要企業透過研究、開發和整合工作發揮重大影響力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 和其他宏觀經濟趨勢的影響

- 工業生態系中協作機器人的演變

第5章市場動態

- 市場促進因素

- 工業4.0到來,推動自動化

- 日益重視安全

- 中小企業數位轉型舉措

- 市場限制因素

- 初始投資高,需熟練勞動力

第6章 市場細分

- 依技術類型

- 工業的

- 服務

- 按最終用戶

- 工業機器人終端用戶

- 車

- 飲食

- 電子產品

- 其他工業機器人終端用戶

- 服務機器人最終用戶

- 後勤

- 軍事/國防

- 醫療保健

- 服務機器人的其他終端用戶

- 工業機器人終端用戶

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Yaskawa Electric Corporation

- Denso Corporation

- Fanuc Corporation

- KUKA Aktiengesellschaft

- Kawasaki Heavy Industries Ltd

- Toshiba Corporation

- Panasonic Corporation

- StAubli International AG

- NACHI-FUJIKOSHI Corp.

- Yamaha Motor Co. Ltd

- Seiko Epson Corporation

- Comau SpA(Stellantis NV)

- Omron Adept Technologies Inc.

- Intuitive Surgical Inc.

- Stryker Corporation

- Irobot Corporation

- Softbank Robotics

第8章投資分析

第9章市場的未來

The Robotics Market size is estimated at USD 100.59 billion in 2025, and is expected to reach USD 178.63 billion by 2030, at a CAGR of 12.17% during the forecast period (2025-2030).

Robotics merges engineering and technology to develop intelligent machines known as robots. Whether human-controlled or autonomous, these robots can entertain or undertake tasks that may be tedious, complex, or pose health and safety risks. Robotics, categorized mainly into industrial and service types, finds extensive application across diverse end-user industries.

Industrial robots are robotic systems used for manufacturing and industrial automation applications. They are programmable, automated, and capable of movement on three or more axes. These robots have sensors, controllers, and actuators to perform various functions and operations in industrial environments. Industrial robots have many uses, like welding, painting, assembly, disassembly, picking and placing, packaging and labeling, palletizing, material handling, and transporting goods. They are also used in heavy industry, such as mining and construction, for tasks that are too dangerous or difficult for human workers.

In recent years, various industries have increasingly adopted advanced machinery and technological solutions. This trend is driven by several factors. For instance, businesses globally face rising labor costs, often resulting in reduced productivity. These escalating labor costs stem from government regulations, imbalances in supply and demand, and a dearth of skilled labor. As a result, many companies are turning to automated solutions as a more economical choice. This transition significantly boosts the Industry 4.0 market, which is crucial for improving functionality, controllability, and safety in industrial settings.

With the rising prominence of SMEs, governments worldwide are championing the adoption of digital and advanced industrial technologies. These efforts aim to streamline operations and boost efficiency, fostering a conducive environment for market growth. For context, in 2023, the United States boasted approximately 33 million SMEs. In India, as of February 2024, there were 39.32 million registered micro industries (Source: IBEF, Ministry of MSME), alongside 0.61 million small industries and 0.06 million medium industries.

Robots integrated with advanced technologies cost more than traditional robots. The costs of robotic systems are associated with robust hardware and efficient software. Automation equipment involves the usage of advanced automation technologies that require high capital investment. For instance, an automated system may cost millions of dollars for design, fabrication, and installation.

The pandemic has wreaked economic havoc on industries worldwide, from small enterprises to large corporations. Compounding these challenges, government-imposed lockdowns aimed at curbing the virus's spread have adversely affected various sectors. For example, OPEC noted a drop in global crude oil demand from 100.27 million barrels per day in 2019 to 91.19 million barrels per day in 2020. However, projections indicate a rise to 104.46 million barrels per day by 2024.

Robotics Market Trends

Service Robots to Lead the Market During the Forecast Period

- Professional robots are primarily utilized outside manufacturing facilities in various professional settings. While industrial robots focus on automating manufacturing tasks, professional service robots-diverse in both form and function-take on menial, dangerous, time-consuming, or repetitive tasks. This automation allows human workers to engage in more cognitive functions.

- When businesses deploy professional service robots, safety is paramount. Instead of replacing human workers, these robots manage hazardous tasks, enabling humans to concentrate on cognitive functions and stay safe. For instance, in the defense sector, professional service robots are designed to shield soldiers from harm during combat.

- Advancements in technology have largely enhanced the functionality of security robots. These robots can be deployed in challenging scenarios for surveillance, with actions determined by sophisticated analytics. By integrating various sensors, professional robots have become adept at environmental analysis, yielding more dependable data. This evolution has notably bolstered their roles in security and patrolling.

- In addition, field robots are gaining traction in agriculture and construction. These robots are engineered to undertake tasks that are often challenging, hazardous, and time-intensive for humans, including bricklaying, demolition, and crop planting.

- Field robots, equipped with sensors like cameras, lidar, and GPS, autonomously navigate and perceive their surroundings. These advantages have spurred numerous manufacturers to develop field robots.

- The demand for domestic robots, particularly assistance, companion, and entertainment robots, has surged. This uptick is largely attributed to an aging population and a growing number of individuals facing mobility challenges.

- The World Health Organization (WHO) highlights a global trend: people are living longer, with many expecting to reach their sixties and beyond. This trend is universal, with every nation witnessing an increase in the number and proportion of older individuals. Projections indicate that by 2030, one in six people worldwide will be aged 60 or even older, with this demographic swelling from 1 billion in 2020 to 1.4 billion. By 2050, this number is set to double to 2.1 billion, and those aged 80 and above are expected to triple, reaching 426 million.

- According to the IFR, robots for domestic tasks constituted the largest group of consumer robots. Vacuuming and other indoor domestic floor cleaning robots are currently the most used applications. In 2023, the shipments of robots for domestic tasks and entertainment robots were anticipated to reach 48.6 million and 6.7 million, respectively. Such developments are expected to drive the market's growth in the future.

Asia Pacific Expected to Witness Significant Growth

- China is leading the global manufacturing industry and creating significant market demand. More Chinese manufacturers are adopting Industry 4.0 solutions to improve efficiency, driving further market growth.

- China's manufacturing sector is quickly moving toward Industry 4.0, with the country being a key player in the digital revolution. China focuses on innovation and boosting competitiveness by leveraging its strong industrial base and technological knowledge. Under initiatives like "Made in China 2025," the Chinese government aims to bolster the nation's manufacturing prowess and foster high-tech industries. Such initiatives are likely to drive the growth of the market.

- In addition, South Korea, bolstered by a robust manufacturing sector and steadfast government support for tech innovation, stands at the forefront of adopting industrial automation. With its technological strides and industrial might, the country is poised to excel and significantly bolster its economic standing in this market.

- South Korea's thriving automotive sector presents promising prospects for expanding the market studied. South Korean car manufacturers, including Kia and Hyundai, are ramping up production capacities and significantly investing in R&D, buoyed by rising global interest in electric vehicles and government support for bolstering domestic manufacturing.

- The automotive industry in Taiwan has experienced significant growth in recent years. With a focus on electric vehicles and smart mobility solutions, Taiwan positioned itself as a key player in the global automotive industry. In addition, Taiwan's expertise in semiconductor manufacturing allowed it to supply critical components for advanced driver-assistance systems (ADAS) and autonomous vehicles.

- In addition, Japan's automotive sector, which historically contributes to over 89% of the nation's GDP, is undergoing a significant shift. Driven by Japan's ambitious targets of achieving net-zero emissions by 2050 and a 46% reduction by 2030, electric vehicles (EVs) are gaining traction.

- Further emphasizing this shift, Japan's Ministry of Economy, Trade, and Industry (METI) set an even more ambitious goal under the Green Growth Strategy: achieving a 100% sales share for EVs by 2035. Notably, hybrid electric vehicles (HEVs) are already a significant player, accounting for nearly 30% of total vehicle sales in Japan.

Robotics Industry Overview

In the robotics market, global and regional players vie for dominance in a fiercely competitive arena. Competition hinges on factors like pricing, product offerings, and market share, as well as the vigor with which firms engage in the market. Leading companies wield significant influence through their R&D and consolidation efforts. However, the market is marked by high penetration and growing fragmentation.

Innovation is key to securing a lasting competitive edge in this landscape. Established players strategically focus on product differentiation and expand their market reach to maintain their positions. Acquisitions, partnerships with industry participants, and new product/service rollouts have been key competitive strategies exhibited by vendors in the market.

Some of the major players in the market are ABB Ltd, Yaskawa Electric Corporation, Denso Corporation, Fanuc Corporation, and KUKA AG, among others. Competition hinges on factors like pricing, product offerings, and market share, as well as the vigor with which firms engage in the market. Leading companies wield significant influence through their R&D and consolidation efforts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 and Other Macroeconomic Trends

- 4.5 Evolution of Collaborative Robots in the Industrial Ecosystem

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advent of Industry 4.0 Driving Automation

- 5.1.2 Increasing Emphasis on Safety

- 5.1.3 Digital Transformation Initiatives Undertaken by SMES

- 5.2 Market Restraints

- 5.2.1 High Initial Investment and the Requirement of Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Technology Type

- 6.1.1 Industrial

- 6.1.2 Service

- 6.2 By End User

- 6.2.1 End Users of Industrial Robots

- 6.2.1.1 Automotive

- 6.2.1.2 Food & Beverage

- 6.2.1.3 Electronics

- 6.2.1.4 Other End Users of Industrial Robots

- 6.2.2 End Users of Service Robots

- 6.2.2.1 Logistics

- 6.2.2.2 Military and Defense

- 6.2.2.3 Medical and Healthcare

- 6.2.2.4 Other End Users of Service Robots

- 6.2.1 End Users of Industrial Robots

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Yaskawa Electric Corporation

- 7.1.3 Denso Corporation

- 7.1.4 Fanuc Corporation

- 7.1.5 KUKA Aktiengesellschaft

- 7.1.6 Kawasaki Heavy Industries Ltd

- 7.1.7 Toshiba Corporation

- 7.1.8 Panasonic Corporation

- 7.1.9 StAubli International AG

- 7.1.10 NACHI-FUJIKOSHI Corp.

- 7.1.11 Yamaha Motor Co. Ltd

- 7.1.12 Seiko Epson Corporation

- 7.1.13 Comau SpA (Stellantis NV)

- 7.1.14 Omron Adept Technologies Inc.

- 7.1.15 Intuitive Surgical Inc.

- 7.1.16 Stryker Corporation

- 7.1.17 Irobot Corporation

- 7.1.18 Softbank Robotics