|

市場調查報告書

商品編碼

1637780

工業物聯網 (IIoT):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Industrial Internet Of Things (IIoT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

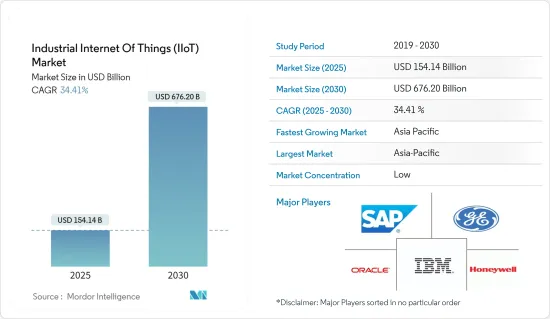

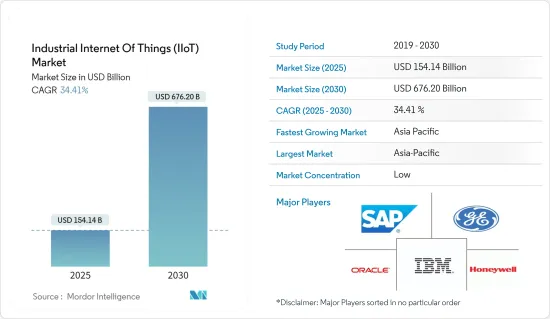

工業物聯網市場規模在 2025 年預計為 1,541.4 億美元,預計到 2030 年將達到 6,762 億美元,預測期內(2025-2030 年)的複合年成長率為 34.41%。

主要亮點

- 巨量資料和機器學習 (ML) 等技術擴大被用於利用連網裝置產生的資料來改善機器對機器 (M2M)通訊並簡化工作流程。此外,物聯網製造中的製造成本和感測器成本的下降也進一步推動了需求。

- 由於提高電源效率可帶來利潤率增加等顯著優勢,各公司正積極投資該市場。根據微軟的研究,物聯網對於製造業變得越來越重要。業界 87% 的物聯網決策者已經採用了物聯網,大多數人表示物聯網對其組織的成功至關重要,並且對這項技術感到滿意。

- 此外,由於其下一代功能,工業IoT中邊緣運算的利用率和需求正在迅速增加。例如,義大利高科技公司SECO今年宣布與高通技術國際有限公司建立策略夥伴關係。此次夥伴關係旨在推出與工業物聯網(IIoT)一致的創新邊緣運算產品和解決方案。根據協議,SECO 將被任命為 Qualcomm Technologies IIoT 設計中心合作夥伴,並負責為主要針對OEM客戶的即用型硬體解決方案創建特定的參考設計。

- Google、亞馬遜網路服務和微軟等市場現有企業正在尋求加強與邊緣運算公司的合作,為工業用戶提供一站式解決方案。此外,隨著全球安裝的工業機器人數量的增加,對低延遲和低抖動通訊的需求預計將大幅增加,從而極大地推動對 IIoT 解決方案的需求。

- AWS IoT TwinMeker 引入了三種新的實體建模功能,以簡化真實系統數位雙胞胎的建立、部署和擴充性:首先,現在支援元資料操作,包括匯入、匯出和更新。變得更容易來自外部來源或不同 AWS 帳戶的裝置模型和元資料。這簡化了大型實體模型的建立。其次,增加了AWS IoT TwinMaker的服務配額,以支援具有更多實體和組件的數位雙胞胎。第三,複合組件類型的引入為建構複雜組件提供了更大的靈活性和效率。

- 此外,元資料批次操作和複合組件現在可在 AWS IoT SiteWise 中訪問,從而可在 AWS IoT TwinMaker 普遍可用的所有地區實現行業採用(元資料批量操作除外,因為AWS GovCloud 中無法存取)。建模體驗我們的客戶。預計此類發展將影響未來和正在進行的 IIoT計劃,這些項目在可預見的未來可能會被視為不必要的,並可能被推遲或取消。

工業物聯網 (IIoT) 市場趨勢

製造業佔很大市場佔有率

在各個行業中,製造業在投資額和市場佔有率方面佔據主導地位,離散製造業和流程製造業都在積極投資物聯網應用。此外,人們也越來越重視物聯網在工業中的整合,尤其是隨著工業 4.0 的出現。物聯網提供了最佳化營運、減少停機時間、提高效率、促進資料主導決策的手段,最終有助於提高利潤率,同時降低收益。物聯網採用的投資報酬率)。

例如,Ubisense 的一項研究追蹤了物體的精確位置、運動和交互,研究結果清晰地展現了 2023 年製造業的狀況,其中 62% 的製造商組裝物聯網技術。納入採用率的大幅成長凸顯了人們越來越認知到物聯網在簡化業務和提高生產力方面具有巨大潛力。

未來幾年,公共產業、離散製造、流程製造和生命科學領域將對物聯網解決方案進行最多投資。許多使用案例預計將透過基於條件的設備追蹤和維護繼續增強資產追蹤、資產壽命和物理距離執行能力。

隨著決策者越來越傾向於採用物聯網解決方案,預計該行業的採用率將高於其他行業。根據通用電氣的一項調查,58%的製造商認為物聯網對於其工業業務的數位轉型是必不可少的。

Capgemini SA的研究也顯示,各垂直產業對高潛力用例的平均採用率僅次於通訊,製造業專注於製造資產維護、製造智慧和產品品質最佳化,高達33%。

此外,未來幾年工業機器人在製造業的應用預計將進一步增加。例如,根據 IFR 的預測,全球製造業對先進機器人的需求將會成長。由於這些發展,預計未來幾年製造業的其他各個方面,包括內部物流、庫存和倉庫管理也將自動化。

根據微軟的一項調查,87% 的製造業決策者支援採用,其中主要使用案例包括工業自動化、品質和合規性、生產計畫和調度、供應鏈和物流以及工廠安全和保障。

亞太地區佔有最大市場佔有率

預計工業IoT將比消費者物聯網佔據更大的市場佔有率。

隨著中美關係變得緊張,中國正在轉向日本的物聯網專業知識,以減少對美國的依賴。因此,中國已邀請IVC成員代表參加多場中國物聯網主題研討會。中國也請求IVC協助建立一個國際組織,專注於研究和實施職場更好的IIoT技術。

此外,政府在該地區實施 IIoT使用案例發揮關鍵作用。 「數位印度」和「印度製造」等政府舉措正在抑制製造業的發展。 「印度製造」宣傳活動從物聯網中受益匪淺,為製造組織的永續提供了創新途徑。

智慧先進製造和快速轉型中心 (SAMARTH) Udyog Bharat 4.0舉措旨在提高印度製造業對製造業 4.0 的認知,並使相關人員能夠應對與智慧製造相關的挑戰。

工業物聯網 (IIoT) 產業概覽

在當前的工業 4.0 時代,全球大多數製造公司都在使用物聯網,因此工業物聯網 (IIoT) 市場呈現分散化。這導致了激烈的市場競爭,現在每家公司都能夠使用物聯網提供服務。市場的一些關鍵發展包括:

2023 年 4 月 - 西門子推出西門子 Xcelerator,這是一個全球開放的數位業務平台,旨在更快、更廣泛地為加拿大客戶釋放數位化優勢。該平台將加速工業、建築、電網和行動等各領域的價值創造的數位轉型。西門子 Xcelerator 不斷擴大的市場促進了客戶、合作夥伴和開發商之間的無縫互動和交易。我們透過精心挑選的支援物聯網的硬體、軟體和數位服務組合來簡化數位轉型,並以服務形式提供,符合互通性、靈活性和開放性的設計原則。該平台正在與包括加拿大設施和營運管理公司 Dexterra Group 在內的關鍵參數合作。

2023 年 7 月-Honeywell宣布收購 SCADAfence,該公司專門提供監控廣泛的操作技術(OT) 物聯網 (IoT) 網路的網路安全解決方案。 SCADAfence 以其在資產發現、威脅偵測和安全管治的專業知識而聞名,這些都是工業和建築管理網路安全工作的重要組成部分。

此外,SCADAfence 產品線無縫配置為 Honeywell Connected Enterprise 內 Honeywell Forge Cybersecurity + 套件的一部分。這項策略舉措與Honeywell對數位化、永續性和 OT 網路安全 SaaS 解決方案的關注相一致。此次整合使Honeywell能夠提供全面的企業 OT 網路安全解決方案,為需要對情境察覺進行更高安全控制的一線經理、營運經理和 CISO 提供服務。此外,此次收購將增強Honeywell的網路安全能力,並增強其快速擴張的OT網路安全產品組合,提高客戶的營運安全性、可靠性和效率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 對 IIoT 市場的影響

- 法律規範

- 市場促進因素

- 數位化和工廠感測器的普及

- 對自動化和高效流程的需求不斷增加

- 市場限制

- 與資料安全和隱私、設備連接和互通性相關的問題

第5章 市場區隔

- 按類型

- 硬體

- 軟體

- 服務和連接

- 按最終用戶產業

- 製造業

- 運輸

- 石油和天然氣

- 公共產業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭格局

- 公司簡介

- Amazon Web Services Inc.

- Telefonaktiebolaget LM Ericsson

- Fujitsu Ltd

- Mitsubishi Electric Corporation

- SAP SE

- Siemens AG

- Honeywell International Inc.

- Emerson Electric Co.

- OMRON Corporation

- IBM Corporation

- Robert Bosch GmbH

- Oracle Corporation

- PTC Inc.

- Telit Communications Plc

- NXP Semiconductors NV

- Cisco Systems Inc.

- Cypress Semiconductor Corporation

- General Electric Company

第7章 供應商分類及主要供應商定位

第8章投資分析

第9章 市場機會與未來趨勢

The Industrial Internet Of Things Market size is estimated at USD 154.14 billion in 2025, and is expected to reach USD 676.20 billion by 2030, at a CAGR of 34.41% during the forecast period (2025-2030).

Key Highlights

- Technologies, such as big data and machine learning (ML), are being used increasingly to harness the data generated from connected devices to improve machine-to-machine (M2M) communication and streamline workflow. Also, declining manufacturing and sensor costs in producing IoTs further drive the demand.

- Significant advantages, such as large-scale profit margins through improvements in power efficiency, attract companies to invest in the market aggressively. According to a study by Microsoft, IoT is increasingly becoming indispensable to the manufacturing industry. 87% of IoT decision-makers in the industry have adopted IoT, and the vast majority say IoT is critical to the success of their company and that they are satisfied with the technology.

- Furthermore, the utilization and demand for edge computing in Industrial IoT are rapidly increasing due to its next-generation capabilities. For instance, in the current year, SECO, an Italian high-tech company, has announced a strategic partnership with Qualcomm Technologies International, Ltd-the goal of introducing innovative edge computing products and solutions tailored for the industrial Internet of Things (IIoT). Under the agreement, SECO is appointed Qualcomm Technologies IIoT design center partner, responsible for creating specific reference designs for readily available hardware solutions, primarily targeting OEM customers.

- Market incumbents like Google, Amazon Web Services, and Microsoft aim to establish more collaborative partnerships with edge-computing companies to provide one-stop solutions to industrial users. Further, the growing number of industrial robot installations globally is expected to create considerable demand for low latency and jitter communications, significantly improving the need for IIoT solutions.

- AWS IoT TwinMeker introduces three new entity modeling features to streamline the creation, deployment, and scalability of digital twins for real-world systems: Firstly, customers can now perform metadata bulk operations, including import, export, and update, facilitating the seamless migration of equipment models and metadata for external sources or different AWS accounts. This simplifies the creation of entity models at scale. Secondly, AWS IoT TwinMaker service quotas have been increased to support digital twins with higher entity and component counts. Third, introducing composite component types enhances flexibility and efficiency in constructing complex components.

- Moreover, metadata bulk operations and composite components are accessible in AWS IoT SiteWise, ensuring a consistent modeling experience for industrial customers across all regions where AWS IoT TwinMaker is generally available, except for metadata bulk operations, which are inaccessible in AWS GovCloud. Such developments were expected to influence future and current ongoing IIoT projects as they might be deemed non-essential and either postponed or canceled for the foreseeable future.

Industrial Internet of Things (IIoT) Market Trends

Manufacturing to Hold Major Market Share

Amongst the industries, the manufacturing industry holds a significant share of investment and market share, with both discrete and process manufacturing intensely investing in IoT adoption. Furthermore, there is a strong emphasis on integrating IoT within the industry, especially with the emergence of Industry 4.0. IoT is making significant strides in discrete and process manufacturing by providing avenues for operational optimization, downtime reduction, enhanced efficiency, facilitating data-driven decision-making, and ultimately contributing to increasing profit margins while minimizing costs, thus ensuring a swift return on investment (ROI) in IoT adoption.

For instance, according to the survey of Ubisense, a precise location, movement, and interaction of things tracker, the survey provides a clear snapshot of the 2023 manufacturing landscape, indicating that 62% of manufacturers have incorporated IoT technologies into their manufacturing or assembly processes. This significant increase in adoption highlights are growing acknowledgement of IoT's substantial potential to streamline operations and boost productivity.

In the upcoming years, utilities, discrete manufacturing, process manufacturing, and life sciences sectors will spend the most on IoT solutions. Most use cases are anticipated to continue enhancing asset tracking, asset life, and the ability to enforce physical distance through condition-based equipment tracking and maintenance.

The adoption rates from the industry are expected to be higher than any other industry due to the increased propensity of decision-makers to adopt IoT solutions. According to a study by General Electric, 58% of manufacturers mentioned IoT is required to transform industrial operations digitally.

In addition, a study by Capgemini found that industrial manufacturing held the second-highest average implementation percentage of high potential use cases by industries after telecom, which stood at 33%, focusing on production asset maintenance, manufacturing intelligence, and product quality optimization.

In addition, the adoption of industrial robots in manufacturing industries is expected to increase further over the coming years. For instance, according to IFR, the global demand for advanced robots in manufacturing is expected to grow; owing to such developments, various other aspects of the manufacturing industry, such as in-house logistics, inventory, and warehouse management etc., are also expected to be automated over the coming years.

According to a study by Microsoft, 87% of the manufacturing industry's decision-makers favored adoption, with industrial automation, quality & compliance, production planning & scheduling, supply chain and logistics, and plant safety & security being the primary use cases.

Asia Pacific To Hold Maximum Market Share

Industrial IoT is expected to represent a larger market share than consumer IoT.

Due to the straining US-China relationship, China is turning to Japanese IoT expertise to reduce dependency on the US. Thus, China has invited IVC member representatives to several Chinese symposiums addressing the IoT topic. China has also asked the IVC to help form an international organization focusing on researching and implementing better IIoT technology in the workplace.

Furthermore, the government plays a significant role in implementing the use cases of IIot in the region. Government initiatives like Digital India and Make in India are impeding the manufacturing industry. The make in India campaign immensely benefited from IoT for providing innovative ways for the sustainable development of manufacturing organizations.

The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aims to enhance awareness about manufacturing 4.0 within the Indian manufacturing industry and help stakeholders address the challenges related to smart manufacturing.

Industrial Internet of Things (IIoT) Industry Overview

The industrial internet of things market is fragmented as the majority of manufacturing companies across the world are using IoT after the current evolution of industry 4.0. This makes the market highly competitive and allows companies to provide services in IoT. Some of the key developments in the market are:

April 2023 - Siemens has introduced its global open digital business platform Siemens Xcelerator, aiming to rapidly and broadly unlock digitalisation benefits for its Canadian customers. This platform expedites digital transformation in value generation across various sectors such as industry, buildings, grids, and mobility. Siemens Xcelerator's expanding marketplace facilitates seamless interactions and transactions among customers, partners, and developers. It simplifies digital transformation by providing a curated portfolio of IoT-enabled hardware, software, and digital services adhering to design principles like interoperability, flexibility, and openness as a service. The platform collaborates with critical parameters, including Dexterra Group, are Canadian facilities and operations management company.

July 2023 - Honeywell has announced its acquisition of SCADAfence, which specializes in cyber security solutions for monitoring extensive operational technology (OT) Internet of Things (IoT) networks. SCADAfence is known for its expertise in asset discovery, threat detection, and security governance, crucial elements for cyber security initiatives in industrial and building management.

Moreover, the SCADAfence product lineup is set to seamlessly become part of the Honeywell Forge Cybersecurity+ suite within Honeywell Connected Enterprise. This strategic move aligns with Honeywell's emphasis on digitalization, sustainability, and OT cyber security SaaS solutions. The integration empowers Honeywell to deliver a comprehensive enterprise OT cyber security solution, catering to site managers, operations management, and CISOs in their quest for enhanced security management in situational awareness. Furthermore, this acquisition reinforces Honeywell's cyber security prowess and enhances its rapidly expanding OT cyber security portfolio, improving operational security, reliability, and customer efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 COVID-19 Impact on the IIoT market

- 4.5 Regulatory Framework

- 4.6 Market Drivers

- 4.6.1 Proliferation of digitization and adoption of sensors in plants

- 4.6.2 Growing demand for automated and efficient process

- 4.7 Market Restraints

- 4.7.1 Issues Related to Security and Privacy of Data and Connectivity of Devices and Interoperability

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services & Connectivity

- 5.2 End-user Vertical

- 5.2.1 Manufacturing

- 5.2.2 Transportation

- 5.2.3 Oil and Gas

- 5.2.4 Utility

- 5.2.5 Other End-user Verticals

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amazon Web Services Inc.

- 6.1.2 Telefonaktiebolaget LM Ericsson

- 6.1.3 Fujitsu Ltd

- 6.1.4 Mitsubishi Electric Corporation

- 6.1.5 SAP SE

- 6.1.6 Siemens AG

- 6.1.7 Honeywell International Inc.

- 6.1.8 Emerson Electric Co.

- 6.1.9 OMRON Corporation

- 6.1.10 IBM Corporation

- 6.1.11 Robert Bosch GmbH

- 6.1.12 Oracle Corporation

- 6.1.13 PTC Inc.

- 6.1.14 Telit Communications Plc

- 6.1.15 NXP Semiconductors NV

- 6.1.16 Cisco Systems Inc.

- 6.1.17 Cypress Semiconductor Corporation

- 6.1.18 General Electric Company