|

市場調查報告書

商品編碼

1637782

歐洲紙包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

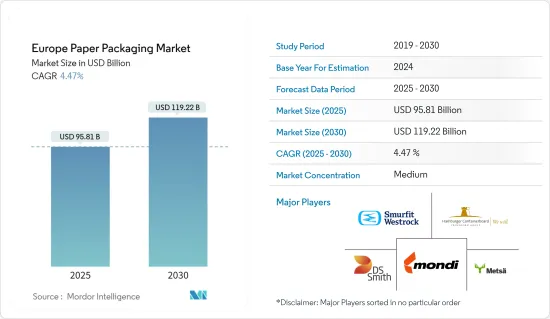

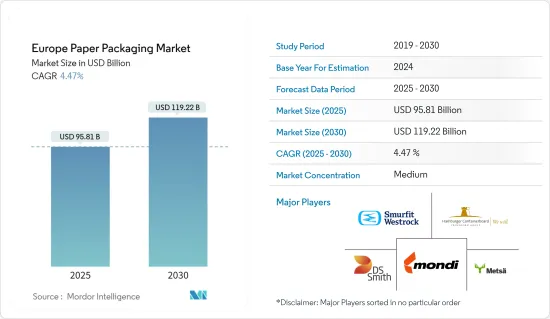

歐洲紙包裝市場規模預估至2025年為958.1億美元,預估至2030年將達1,192.2億美元,預測期間(2025-2030年)複合年成長率為4.47%。

主要亮點

- 紙包裝是保護、儲存和運輸各種產品的一種低成本且通用的方式。它還可以進行客製化以滿足消費者需求和產品特定要求。紙包裝的生物分解性、重量輕和可回收性等特性使其成為包裝的重要組成部分。由於這些因素,食品和飲料行業對此類包裝的需求不斷增加。

- 隨著重點轉向永續性,紙和紙板包裝預計將在醫療保健、食品和飲料、零售和電子商務等各種最終用戶行業中獲得吸引力,預計紙包裝產品將取代塑膠包裝。電子商務行業對紙包裝的需求激增預計將支持市場成長。

- 由於歐洲都市化不斷提高,食品包裝越來越注重永續性和便利性。消費者對便利性日益成長的需求是推動市場的關鍵因素之一。食品服務包裝產業認知到客戶的需求不斷變化,並正在對這些不斷變化的偏好做出反應。生產商正在考慮如何在使用後處理包裝,從而生產出可隨時處理的包裝商品。

- 亞馬遜在歐洲各地的電子商務中用紙質氣枕取代了塑膠空氣枕。這種紙被稱為墊材,專門設計用於防止產品在包裝內移動,防止損壞。此包裝適用於亞馬遜上銷售的所有產品,包括使用亞馬遜履約服務的產品。對亞馬遜來說,擺脫塑膠是朝著正確方向邁出的一步。亞馬遜的最新舉措是減少一次性塑膠包裝,用紙袋和紙板信封取代一次性塑膠袋,用於亞馬遜在歐洲各地的履約。

- 人們擔心紙包裝對環境的影響。如果不以永續的方式進行管理,紙張原料(特別是木漿)的採購可能會導致森林砍伐。森林砍伐會對生態系、生物多樣性和氣候變遷產生負面影響。此外,當紙張透過某些製程(主要是漂白)生產時,會排放戴奧辛,這是一種有害污染物。這些污染物會對環境和人類健康產生負面影響。

歐洲紙包裝市場趨勢

飲料領域預計將佔據主要市場佔有率

- 紙包裝解決方案用於果汁、酒精飲料和代餐奶昔等飲料。飲料品質受到 pH 值、儲存溫度、壓力和污染物存在的影響。含量的變化會改變飲料的成分。越來越多的公司正在採用具有阻隔性(熱、濕氣、細菌)的生物分解性包裝產品,以消除氧化的可能性。例如,英國的 When in Rome 為 Ocado 推出了紙酒瓶。該瓶子是與永續包裝公司 Frugalpac 合作開發的。由 94% 的再生紙製成,比一次性玻璃瓶的碳排放減少 84%。

- 使用輕質包裝材料的日益成長的趨勢以及降低生產、運輸和處理成本的願望正在推動飲料軟紙包裝的發展。強調視覺包裝趨勢的電子商務公司的崛起推動了需求。

- 在非酒精飲料的推動下,液體包裝/利樂包裝是成長最快的包裝形式之一。該公司選擇這種包裝類型是因為它比液態奶的塑膠袋或果汁和其他飲料的寶特瓶更現代、更有吸引力。

- 在中歐和東歐,飲料紙盒回收率正在根據歐盟包裝廢棄物法規不斷提高。這凸顯了該產業對循環社會的奉獻。歐洲的紙箱回收已吸引了總計約 2 億歐元(2.16 億美元)的投資,預計到 2027 年將進一步吸引 1.2 億歐元(1.296 億美元)的投資。

- 2023 年 6 月,利樂和斯道拉恩索聯合投資 2,900 萬歐元(3,130 萬美元),在波蘭(特別是奧斯特羅萊卡)推出了新的回收生產線。該計劃旨在將波蘭飲料紙盒的年回收能力大幅提高至三倍。此生產線的主要重點是從飲料紙盒中分離材料,特別是從聚合物和鋁中分離纖維,並將其回收成瓦楞材料。

- 該計劃不僅旨在加強回收過程,而且還最大限度地減少對原生纖維的需求。新生產線預計年產能為5萬噸,將使波蘭每年的飲料紙盒回收量從2.5萬噸增加到7.5萬噸。此外,該計劃旨在容納來自捷克共和國、匈牙利、斯洛伐克、拉脫維亞、愛沙尼亞和立陶宛等國家不斷增加的飲料量。

德國可望佔據較大市場佔有率

- 隨著技術環境的快速變化,包裝行業正在採用各種技術並改進產品,以增強和提高生產力。由於針對過度塑膠污染的立法收緊,綠色包裝材料在整個預測期內的使用量可能會增加。由於這些限制,紙包裝預計將在商業上有很高的需求,因為它可以用作塑膠的替代品。

- 出於永續性因素,該地區的公司正致力於擴大紙質包裝的產能。 2024 年 3 月,領先的永續包裝供應商 Protega World 在德國 Nunbrecht 開設了新的配銷中心,加強了其歐洲供應鏈。 2023 年 5 月杜塞爾多夫 Interpack 展會後,Protega 轉向北歐市場,標誌著擴大策略的關鍵時刻。

- Protega 推出創新的 Hexcel 保鮮膜。這種可回收的紙質保護包裝被定位為傳統塑膠氣泡包裝的環保替代品。 Hexcel 產品系列,包括空隙填充和紙緩衝,僅在英國製造。這款多功能產品為從化妝品、餐具到杜松子酒和珠寶飾品等各種物品提供出色的保護。透過採用 FSC 認證的紙張和卡片包裝,公司可以大幅減少碳排放。

- 在政府有關永續包裝的各種法規以及消費者對其購買選擇對環境影響的認知不斷提高的推動下,預計在預測期內,紙張和紙板包裝的需求將會增加。根據德國聯邦統計局的數據,2023 年德國紙包裝市場的營業額約為 144 億歐元(157 億美元)。

歐洲紙包裝產業概況

歐洲紙包裝市場正在變得半固體,有幾個有影響力的參與企業。其中一些重要的參與企業目前在市場佔有率方面處於市場領先地位。這些擁有巨大市場佔有率的領先參與企業正專注於擴大海外基本客群。主要參與企業包括 Smurfit Westrock、DS Smith PLC、Mondi Group、Hamburger Containerboard GmbH 和 Metsa Board Oyj。

- 2024年7月,Smurfit Kappa完成了對WestRock的收購,創建了全球領先的包裝公司Smurfit WestRock。該公司的全球總部仍將設在 Smurfit Kappa 的故鄉都柏林,其北美和南美業務將集中在 WestRock 的故鄉亞特蘭大。合併後,Smurfit Kappa 股東將持有更名後營業單位50.4% 的持有權。合併後的 Smurfit WestRock 將擁有覆蓋 40 個國家和六大洲的 500 多家工廠和 63 家造紙廠的廣泛網路。

- 2024 年 7 月英國DS Smith 在過去三年中投資超過 5,000 萬歐元(5,400 萬美元),以加強其在葡萄牙的包裝設施。這些投資主要集中在技術進步和可再生能源解決方案的整合。作為該計劃的關鍵要素,DS Smith 在其位於波爾圖和萊裡亞的工廠安裝了兩台新的瓦楞機。此外,里斯本包裝工廠還透過升級瓦楞機並增加 2,800 毫米寬的干端來進行擴建。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 食品和飲料領域的需求增加

- 由於電子商務的成長,對各種紙和紙板包裝的需求增加

- 市場限制因素

- 森林砍伐對紙包裝的影響

第6章 市場細分

- 依產品類型

- 折疊式紙盒

- 瓦楞紙箱

- 其他

- 按最終用戶產業

- 食物

- 飲料

- 醫療保健

- 個人護理

- 電子商務

- 菸草

- 其他

- 按國家/地區

- 英國

- 法國

- 德國

- 義大利

- 西班牙

第7章 競爭格局

- 公司簡介

- Smurfit Westrock

- DS Smith PLC

- Mondi Group

- Hamburger Containerboard GmbH(Prinzhorn Group)

- Papierfabrik Palm GmbH & Co. KG

- Metsa Board Oyj

- Progroup AG

- Emin Leydier SA

- Svenska Cellulosa Aktiebolaget-SCA

- Stora Enso Oyj

- International Paper Company

第8章投資分析

第9章市場的未來

The Europe Paper Packaging Market size is estimated at USD 95.81 billion in 2025, and is expected to reach USD 119.22 billion by 2030, at a CAGR of 4.47% during the forecast period (2025-2030).

Key Highlights

- Paper packaging is a low-cost and versatile way to protect, store, and transport various products. It can also be customized to satisfy the needs of consumers or product-specific requirements. Attributes like biodegradability, lightweight, and recyclability of paper packaging make it an essential component for packaging. Due to such factors, the demand for such packaging has increased in the food and beverage industry.

- With the focus shifting toward sustainability, paper and paperboard packaging are expected to gain traction, with the country pushing for paper packaging products over plastic packaging for various end-user industries, including healthcare, food and beverages, retail, and e-commerce. The surging demand for paper packaging in the e-commerce industry will support market growth.

- The growth in the rate of urbanization across Europe has resulted in a higher focus on sustainability and convenience in food packaging. The increased need for consumer convenience is one of the primary factors driving the market. The foodservice packaging industry has recognized customers' evolving demands and is catering to these changing preferences. Producers are considering how the packaging will be disposed of after usage, resulting in packaging items that can be discarded quickly.

- Amazon replaced plastic air pillows with paper for e-commerce across Europe. This paper, called dunnage, is specially designed to keep the product from moving inside the package, preventing damage. This packaging applies to all products sold through Amazon, including those that use Amazon's fulfillment services. Getting rid of plastic is a step in the right direction for Amazon. Amazon's latest step was to reduce single-use plastic packaging after switching from single-use plastic bags for Amazon-fulfilled shipping to paper bags and cardboard envelopes across Europe.

- The environmental impact of paper packaging is a concern. Procuring raw materials for paper production, particularly wood pulp, can contribute to deforestation if not managed sustainably. Deforestation can adversely affect ecosystems, biodiversity, and climate change. Furthermore, producing paper, mainly through specific processes like bleaching, can discharge dioxins, which are hazardous pollutants. These pollutants can have detrimental effects on the environment and human health.

Europe Paper Packaging Market Trends

The Beverage Segment is Expected to Hold a Significant Market Share

- Beverages such as fruit juices, alcoholic drinks, and meal replacement shakes use paper packaging solutions. The quality of beverages is affected by pH, storage temperature, pressure, and the presence of contaminants. Changes in the levels can alter the composition of the beverage. Companies are increasingly employing biodegradable packaging products with high barrier resistance (heat, moisture, and bacteria) to eliminate possible oxidation. For instance, When in Rome, a United Kingdom-based company, launched a paper wine bottle for Ocado. The bottle was developed in collaboration with sustainable packaging company Frugalpac. It is made from 94% recycled paper and has an 84% lower carbon footprint than a single-use glass bottle.

- The growing trend of using lightweight packaging material and the rising inclination toward reducing production, shipment, and handling costs are driving the flexible paper packaging of beverages. The demand is driven by the rise of e-commerce companies focusing on visually appealing packaging trends.

- Liquid cartons/tetra packs are one of the fastest-growing packaging types, driven by non-alcoholic beverages. Companies opt for this package type, as it is more modern and attractive than plastic pouches for liquid milk or PET bottles for juices and other beverages.

- Central and Eastern Europe have seen a rise in beverage carton recycling rates, aligning with the EU Packaging and Packaging Waste Regulation. This underscores the industry's dedication to circularity. European carton recycling has already attracted investments totaling around EUR 200 million (USD 216 million), with an additional EUR 120 million (USD 129.6 million) anticipated by 2027.

- In June 2023, Tetra Pak and Stora Enso, through a joint investment of EUR 29 million (USD 31.3 million), commenced a new recycling line in Poland, specifically in Ostroleka. This initiative aims to significantly boost Poland's annual recycling capacity for beverage cartons, with a goal to triple it. The primary focus of this line is the separation of materials from beverage cartons, specifically fibers from polymers and aluminum, which are then recycled into cardboard materials.

- The project aims to not only enhance the recycling process but also to minimize the need for virgin fibers. The anticipated annual capacity of this new line is 50,000 tonnes, which, if achieved, would elevate Poland's annual beverage carton recycling capacity from 25,000 to 75,000 tonnes. Additionally, the project is designed to cater to the increased beverage volumes from countries like Czechia, Hungary, Slovakia, Latvia, Estonia, and Lithuania.

Germany is Expected to Hold a Significant Market Share

- With the rapidly changing technological environment, the packaging industry is set to improve its products by adopting various technologies to enhance and improve productivity. Due to increased legislation against excessive levels of plastic pollution, green packaging materials have the potential to see a rise in utilization throughout the forecast period. As a result of these constraints, paper packaging is expected to be in high demand in the business, as it can be used as a plastic substitute.

- Owing to sustainability factors, players in the region are focusing on expanding the capacity of paper-based packaging. In March 2024, Protega Global, a prominent sustainable packaging supplier, bolstered its European supply chain by inaugurating a new distribution center in Numbrecht, Germany. After the Interpack event in Dusseldorf in May 2023, Protega pivoted toward the northern European market, marking a pivotal moment in its expansion strategy.

- Protega launched its innovative Hexcel wrap, which is a recyclable paper-based protective packaging positioned as an eco-conscious alternative to traditional plastic bubble wrap. The Hexcel line, including void fill and paper cushioning, is exclusively manufactured in the United Kingdom. This versatile product provides robust protection for a wide array of items, ranging from cosmetics and crockery to gin and jewelry. By transitioning to FSC-certified paper and card packaging, companies can significantly slash their carbon footprint.

- Driven by various government regulations regarding sustainable packaging and growing consumer awareness about the impact of their buying choices on the environment, the demand for paper and paperboard packaging is anticipated to rise during the forecast period. According to Statistisches Bundesamt, in 2023, the German paper packaging market saw a revenue of approximately EUR 14.4 billion (USD 15.70 billion).

Europe Paper Packaging Industry Overview

The European paper packaging market is semi-consolidated with several influential players. Some of these important players are currently leading the market in terms of market share. These influential players with significant market shares are focused on expanding their customer base abroad. Major players include Smurfit Westrock, DS Smith PLC, Mondi Group, Hamburger Containerboard GmbH, and Metsa Board Oyj.

- July 2024: Smurfit Kappa finalized the acquisition of WestRock, marking the birth of Smurfit WestRock, a global packaging giant. The company's global headquarters will remain in Dublin, the original base of Smurfit Kappa, while its North and South American operations will be centered in Atlanta, WestRock's former hub. Following the merger, Smurfit Kappa's shareholders will hold a controlling 50.4% stake in the rebranded entity. The combined entity, Smurfit WestRock, boasts an extensive network of over 500 facilities and 63 paper mills strategically spread across 40 nations and six continents.

- July 2024: Over the past three years, the British company DS Smith has channeled over EUR 50 million (USD 54 million) into enhancing its packaging facilities in Portugal. These investments primarily focus on technological advancements and the integration of renewable energy solutions. As a key component of this initiative, DS Smith introduced two new fluting machines at its Oporto and Leiria facilities. Additionally, the company bolstered its Lisbon packaging plant by upgrading its corrugator and adding a 2,800 mm wide dry end.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from the Food and Beverage Sector

- 5.1.2 Increasing Growth of E-commerce Creating Demand for Various Paper and Paperboard Packaging Types

- 5.2 Market Restraints

- 5.2.1 Effects of Deforestation on Paper Packaging

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Folding Cartons

- 6.1.2 Corrugated Boxes

- 6.1.3 Other Product Type

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care and Household Care

- 6.2.5 E-Commerce

- 6.2.6 Tobacco

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 France

- 6.3.3 Germany

- 6.3.4 Italy

- 6.3.5 Spain

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Smurfit Westrock

- 7.1.2 DS Smith PLC

- 7.1.3 Mondi Group

- 7.1.4 Hamburger Containerboard GmbH (Prinzhorn Group)

- 7.1.5 Papierfabrik Palm GmbH & Co. KG

- 7.1.6 Metsa Board Oyj

- 7.1.7 Progroup AG

- 7.1.8 Emin Leydier SA

- 7.1.9 Svenska Cellulosa Aktiebolaget - SCA

- 7.1.10 Stora Enso Oyj

- 7.1.11 International Paper Company