|

市場調查報告書

商品編碼

1637800

美國泡殼包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United States Blister Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

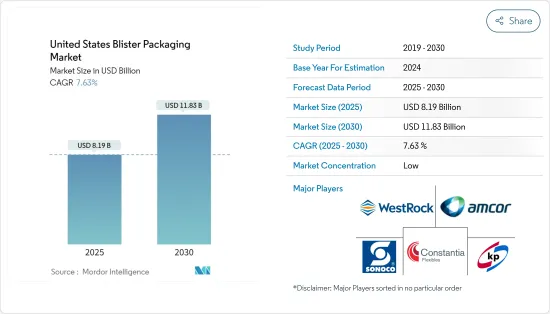

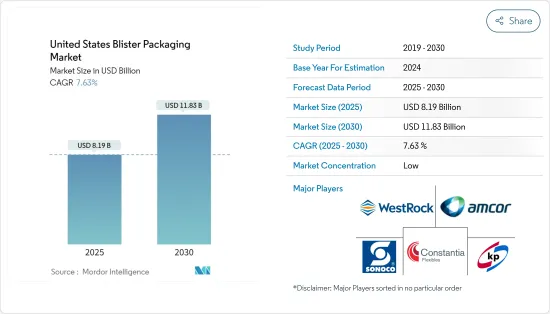

美國泡殼包裝市場規模預計在2025年為81.9億美元,預計到2030年將達到118.3億美元,預測期內(2025-2030年)的複合年成長率為7.63%。

泡殼包裝是用於各種消費品、食品和藥品的預成型塑膠包裝。這些包裝解決方案可保護您的產品免受潮濕和污染等外部因素的影響,確保長期保護。

在泡殼包裝中,產品放入預先形成的泡殼或腔體中,並用卡片或墊片固定到位。這種包裝方法廣泛用於各種消費品,尤其是製藥和工業產業。製藥業佔據泡殼包裝市場的主導地位,佔有相當大的佔有率。製藥公司更喜歡泡殼包裝,因為它提供了額外的產品保護、簡化的分銷、單位劑量的便利性和清晰的產品標誌。

根據美國商務部的數據,到 2050 年,美國85 歲及以上人口預計將增加兩倍。臨床醫生和公共衛生服務提供者正在為這一人群及其亞群體培養一種富有同情心的文化。隨著老化和肥胖人口的增加,骨關節炎、糖尿病和相關行動障礙的盛行率可能會持續上升。所有這些因素預計都將刺激對口服藥物的需求,從而推動對藥品泡殼包裝的需求。

根據美國疾病管制與預防中心 (CDC) 的數據,美國50 歲及以上美國預計將成長,在 2020 年至 2050 年間達到近 6,100 萬人。這意味著患有一種或多種慢性病的人數預計將增加近9,900萬人,從2020年的7,150萬人增加到2050年的1.42億多人。

隨著生活方式的演變,消費者越來越青睞攜帶式食品包裝,並注重便利性和易用性。為了滿足這種需求,糖果零食和烘焙製造商擴大使用泡殼包裝。隨著該地區烘焙產品零售額的不斷成長,泡殼包裝預計將在食品行業中實現顯著成長。

泡殼包裝引發了嚴重的環境問題。如果處理不當,它們會對環境造成危害。此外,由塑膠和鋁箔成的專用包裝也使回收過程變得複雜。藥品泡殼包裝是最大的固態廢棄物來源之一。包裝複雜、層次多,回收難度高。

美國泡殼包裝市場趨勢

製藥業可望強勁成長

- 泡殼包裝作為一種包裝形式變得越來越流行,以滿足注重安全的消費者和監管機構的需求。泡殼包裝允許追蹤和序列化通訊協定,有助於防止假冒。無論產品是非處方止痛藥或新型臨床試驗藥物,泡殼包裝仍是一種有效的包裝形式,可提高患者的依從性。

- 單位劑量包裝有助於減少治療期間的錯誤並防止錯過劑量。這也使得忙碌的人們能夠更準確、更方便地管理他們的用藥方案。在單位劑量包裝中,錠劑或膠囊可分為單位劑量泡殼包裝和穿孔包裝。

- 根據患者的需求,包裝可以客製化為每日或亞每日劑量。它們也可以印在包裝上,幫助患者記住何時服用哪種錠劑。單位劑量包裝還可以保護每片錠劑直至服用,從而保護產品的功效。它有望挽救因藥物過量攝取死亡的生命,並增加對泡殼包裝的需求。

- 根據歐洲製藥工業和協會聯合會(EFPIA)的資料,2017年至2022年美國新藥銷售佔有率為64.4%,2018年至2023年將增至67.1%。預計預測期內此類新藥在國內銷售的成長將進一步推動泡殼包裝的需求。

- 在市場上經營的各家公司都在推出新產品作為業務擴展的一部分。例如,2023 年 10 月,全球特種材料市場領導索爾維宣布推出一種具有超高水蒸氣阻隔性將減少藥品泡殼薄膜的碳足跡。作為一種水分散體,DiofanUltra 736 滿足直接藥物接觸的監管要求,並有助於設計更薄塗層設計中的永續薄膜。該公司投資這項具有挑戰性的計劃是為了進一步提高醫療保健產業的產品識別要求。

老齡人口增加和疾病流行

- 隨著國家人口的成長和疾病發病率的上升,製藥公司正在利用這一優勢擴大其固態劑量生產設施。根據美國人口普查局的數據,過去十年美國65 歲及以上人口增加了三分之一以上。

- 預計到 2060 年,美國人口將進入老化階段,約四分之一的美國年齡將超過 65 歲。其中,69%的老年人最終將需要長期照護。預計這些因素將推動市場成長。

- 隨著越來越多的消費者過著積極的生活方式,對按需便利的需求也隨之增加。對於力量和靈活性較差的老年人來說,撕開泡殼包裝底部的小標籤可能是一項挑戰。將產品從泡殼包裝的鋁箔(或沖孔)中推出,迫使產品從泡殼包裝的底部出來,使老年患者更容易在旅途中取用藥物。

- 老年人口正在增加,預計這一趨勢將在整個預測期內持續,從而增加對藥品的需求,從而推動市場成長。此外,癌症和感染疾病等慢性病的急劇增加,加上人口老化需要先進且方便用戶使用的包裝,可能會增強泡殼包裝市場。泡殼包裝以其便利性而聞名,尤其適用於固態口服藥物。

- 隨著人口老化,醫療保健系統面臨越來越多的慢性病和不斷上漲的處方箋費用。一般來說,老年患者對藥物的反應與年輕患者不同。根據美國人口普查局的數據,2016年至2060年間,美國100歲或以上人口數預計將增加。 2016年,美國100歲以上老人數量達82,000人。到2060年,百歲老人的數量預計將達到58.9萬人。預計所有這些因素都將支持美國泡殼包裝的成長。

美國泡殼包裝產業概況

美國泡殼包裝市場較為分散。該市場的供應商採用關鍵夥伴關係、合併和收購作為主要策略來生產滿足最終用戶需求的產品。包裝材料經過嚴格的品質測試,以確保其不會污染內容物或帶來任何健康風險。保持穩定的原料供應是夥伴關係的關鍵驅動力。美國泡殼包裝市場的主要參與者包括 Amcor Ltd、Westrock Company、Sonoco Products Company、Constantia Flexibles Group、Honeywell International Inc. 等。

2023 年 9 月,全球包裝領導者 Sonoco 決定收購 Graphic Packaging Corporation 的軟包裝部門。 Graphic Packaging 被位於科羅拉多戈爾登的 ACX Technologies Inc. 收購。 Sonoco 在軟包裝領域的立足點被公認為包裝行業中一個快速成長的領域。

2023 年 7 月 Constantia Flexibles 推出其在醫藥包裝領域的最新創新 REGULA CIRC。這種尖端的冷成型箔技術重新定義了泡殼包裝的永續性標準,使消費者和環境都受益。基於我們對循環社會的承諾,REGULA CIRC 旨在滿足即將訂定的法規並確保其符合永續包裝的基準標準。 REGULA CIRC 代表了設計的重大轉變,透過使用聚乙烯 (PE) 密封層代替傳統的 PVC,體現了循環經濟的原則。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 老齡人口增加和疾病流行

- 產品創新,例如尺寸較小、成本相對較低

- 市場限制

- 嚴格的政府法規

第6章 市場細分

- 按工藝

- 冷成型

- 熱成型

- 按材質

- 塑膠

- 紙和紙板

- 鋁

- 按最終用戶產業

- 消費品

- 藥品

- 工業

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Westrock Company

- Constantia Flexibles GmbH

- Sonoco Products Company

- Klockner Pentaplast Group

- Tekni-Plex Inc.

- Blisterpak Inc.

- Honeywell International Inc.

第8章投資分析

第9章:市場的未來

The United States Blister Packaging Market size is estimated at USD 8.19 billion in 2025, and is expected to reach USD 11.83 billion by 2030, at a CAGR of 7.63% during the forecast period (2025-2030).

Blister packs are pre-formed plastic packaging for various consumer goods, foods, and pharmaceuticals. These packaging solutions safeguard products from external factors like humidity and contamination, ensuring prolonged protection.

Blister packaging involves placing products in pre-formed blisters or cavities secured with cards or pads. This packaging method is widely used for various consumer goods, especially in the pharmaceutical and industrial industries. The pharmaceutical industry dominates the blister packaging market, holding a substantial share. Pharmaceutical companies prefer blister packaging because it offers enhanced product protection, streamlined distribution, unit dosage convenience, and clear product identification.

According to the United States Department of Commerce, the US population aged 85 and over is projected to triple by 2050. Clinicians and public health service providers cultivate a culture of compassion for this population and its subgroups. The prevalence of osteoarthritis and diabetes, as well as related mobility impairments, will continue to rise as people age and become more overweight. All such factors are anticipated to boost the demand for oral medication, thus propelling the demand for blister packaging in pharmaceuticals.

According to the Centers for Disease Control and Prevention (CDC), the number of people over 50 in the United States is expected to increase, reaching almost 61 million between 2020 and 2050. That means the number of people with one or more chronic diseases is expected to go up by nearly 99 million, from 71.5 million in 2020 to over 142 million in 2050.

As lifestyles evolve, consumers favor on-the-go packaging for food products, prioritizing convenience and ease of use. Confectionery and bakery manufacturers are increasingly using blister packaging to meet this demand. With the region experiencing a rise in retail sales of bakery goods, blister packaging is expected to see significant growth in the food industry.

Blister packaging raises significant environmental concerns. If not disposed of correctly, it poses risks to the environment. Additionally, specific packs that combine plastic and foil complicate the recycling process. Pharmaceutical blister packaging is one of the largest sources of solid waste. Recycling is difficult due to the complexity of these packages with multiple layers.

United States Blister Packaging Market Trends

The Pharmaceutical Segment is Expected to Witness Significant Growth

- The blister pack is becoming increasingly popular as a packaging format that meets the needs of security-conscious consumers and regulatory bodies. Blister packaging enables track-and-trace and serialization protocols and helps prevent counterfeiting. The blister pack remains an effective packaging format for enhancing patient compliance, regardless of whether the product is an OTC pain reliever or a novel clinical-trial medication.

- Unit dose packaging helps to reduce errors and prevent missed doses during therapy. It also makes it easier for busy individuals to manage their medication regimens correctly and conveniently. Unit dose packaging allows pills and capsules to be parcelled and perforated in unit dose blister packs.

- Depending on the patient's needs, the packaging can be customized to daily or time-of-day dosage. The packaging can also be printed to help patients remember which pills to take and when. The unit dose packaging also helps protect the product's efficacy by protecting every tablet until it is administered. It is expected to save lives from drug overdoses and boost the demand for blister packaging.

- According to data from the European Federation of Pharmaceutical Industries and Associations (EFPIA), the sales distribution of new drugs in the United States from 2017 to 2022 was 64.4%, and it increased to 67.1% from 2018 to 2023. Such a rise in the sales of new drugs in the country would further drive the demand for blister packs during the forecast period.

- Various companies operating in the market are launching new products as part of their business expansion. For instance, in October 2023, Solvay, one of the global market leaders in specialty materials, introduced DiofanUltra736, a new polyvinylidene chloride (PVDC) coating solution with an ultra-high water vapor barrier that allows carbon footprint decline for pharmaceutical blister films. As an aqueous dispersion, DiofanUltra736 fulfills regulatory needs for direct pharmaceutical contact and helps design sustainable films with thinner coating designs. The company invested in this challenging project to further improve product identification, a requirement in the healthcare industry.

Growing Geriatric Population and Prevalence of Diseases

- As the country's population grows and disease rates rise, pharmaceutical companies are taking advantage of this to expand their manufacturing facilities for solid doses. According to the United States Census Bureau, the number of people aged 65+ in the United States has increased by more than one-third over the past decade.

- The United States population is projected to gray out by 2060, with nearly one-quarter of Americans aged 65+. Of these, 69% of senior adults will need long-term care at some point. Such factors are anticipated to fuel market growth.

- As more and more consumers are engaged in active lifestyles, the demand for on-demand convenience increases. For seniors with reduced physical strength or agility, the small tabs on the bottoms of blister packs can be challenging to peel. Pushing the product through the foil (or punch-out) of a blister pack, which pushes the product out of the base of the blister, makes it easier for elderly patients to access their medications while on the go.

- The senior population is rising, a trend projected to persist throughout the forecast period, fueling a heightened demand for pharmaceuticals and driving market growth. Additionally, the surging prevalence of chronic ailments, including cancer and infectious diseases, coupled with an aging demographic that requires advanced, user-friendly packaging, is set to bolster the blister packaging market. Blister packaging, known for its convenience, is particularly beneficial for solid oral medications.

- As the population ages, the healthcare system faces many chronic diseases and increasing prescription costs. In general, elderly patients respond differently to medications compared to younger patients. According to the United States Census Bureau, the number of people over 100 in the United States is expected to increase between 2016 and 2060. In 2016, the United States had 82,000 people over 100. In 2060, the number of centenarians is expected to reach 589,000. All such factors are expected to support the growth of blister packaging in the United States.

United States Blister Packaging Industry Overview

The blister packaging market in the United States is fragmented. Vendors in the market have been using significant partnerships, mergers, and acquisitions as major strategies to produce products that meet the needs of end users. Packaging materials undergo rigorous quality testing to ensure that they do not contaminate the contents or affect health. Maintaining a steady supply of raw materials is a significant challenge that drives partnerships. Major players in the US blister packaging market include Amcor Ltd, Westrock Company, Sonoco Products Company, Constantia Flexibles Group, and Honeywell International Inc.

September 2023: Sonoco, a global leader in packaging, finalized its acquisition of Graphic Packaging Corporation's flexible packaging division. Graphic Packaging is a wholly owned subsidiary of ACX Technologies Inc., based in Golden, Colorado. In an all-cash deal, Sonoco invested around USD 105 million. Sonoco's foothold in flexible packaging is recognized as the packaging industry's rapidly expanding segment.

July 2023: Constantia Flexibles introduced REGULA CIRC, its latest innovation in pharmaceutical packaging. This state-of-the-art coldform foil technology redefines sustainability standards in blister packaging, benefiting both consumers and the environment. With a commitment to circularity, REGULA CIRC is engineered to align with upcoming regulations, ensuring it meets the standard of sustainable packaging benchmarks. REGULA CIRC introduces significant design changes by replacing traditional PVC with a polyethylene (PE) sealing layer, embracing circular economy principles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Geriatric Population and Prevalence of Diseases

- 5.1.2 Product Innovations Such as Downsizing Coupled with Relatively Low Costs

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations

6 MARKET SEGMENTATION

- 6.1 By Process

- 6.1.1 Coldforming

- 6.1.2 Thermoforming

- 6.2 By Material

- 6.2.1 Plastic

- 6.2.2 Paper and Paperboard

- 6.2.3 Aluminum

- 6.3 By End-user Industry

- 6.3.1 Consumer Goods

- 6.3.2 Pharmaceutical

- 6.3.3 Industrial

- 6.3.4 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Westrock Company

- 7.1.3 Constantia Flexibles GmbH

- 7.1.4 Sonoco Products Company

- 7.1.5 Klockner Pentaplast Group

- 7.1.6 Tekni-Plex Inc.

- 7.1.7 Blisterpak Inc.

- 7.1.8 Honeywell International Inc.