|

市場調查報告書

商品編碼

1637825

企業快閃記憶體:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Enterprise Flash Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

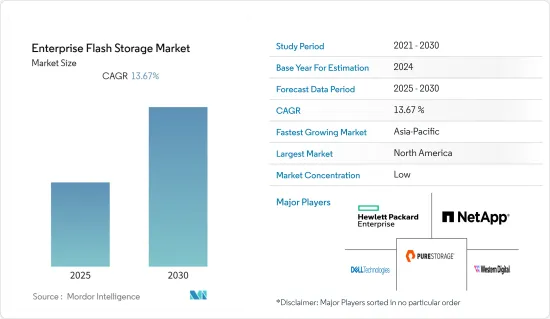

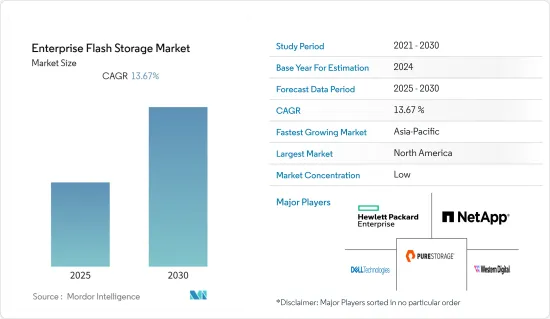

預測期內,企業快閃記憶體市場預計將實現 13.67% 的複合年成長率

主要亮點

- 雲端技術的日益普及加上企業產生的資料量的不斷增加預計將推動市場的發展。全球各地企業資料中心對快閃記憶體的需求日益成長。它在功耗、效能、擴充性和易於管理性方面具有優勢,從而提高了其採用率。

- 非揮發性記憶體標準(NVMe)等變化正在推動企業快閃儲存市場的成長。即時分析和要求苛刻的資料庫系統等關鍵任務應用程式可以輕鬆在快閃記憶體系統上運行。虛擬伺服器、金融系統、虛擬桌面平台和收集大量資料的資料分析應用程式也是如此。

- 在數位化需求的推動下,它有望為 BFSI 和 IT 服務等各種終端用戶產業帶來價值,從而增加全球對超級資料中心的需求。同時,新的企業儲存投資受到公共雲端資源和全球更新企業基礎設施的需求所推動。

- Flash 正在改變遊戲規則,提供支援本地、邊緣和公共雲端基礎架構消費的混合雲端環境。快閃記憶體的另一個優點是它的靈活性和比傳統可移動儲存更動態的環境中部署的能力,例如作為物聯網設備、攝影機和感測器的快取或持久緩衝區。快閃記憶體儲存正在推動大小型組織的 IT 轉型。

- 全球疫情大流行以及封鎖導致的資料消費激增,導致記憶體和儲存產品短缺且價格上漲,與資料中心營運的需求形成競爭。儘管已經恢復了有限的生產,但現有的庫存很快就被大型科技公司囤積起來。驅動器供應商預計,由於庫存低、等待時間長和生產問題,閃存驅動器的高價格將持續到明年。

企業快閃記憶體市場趨勢

IT和通訊業佔據較大的市場佔有率

- IT和通訊業是快閃記憶體市場中最大的細分市場,預計在預測期內將實現最高收益。由於技術進步,預計未來幾年客戶端和企業市場對快閃記憶體設備的需求將保持穩定。這些因素可能會增加以更低價格獲得更好技術的可能性。

- 儲存設備使用量的快速成長是由於企業產生和處理的資料量的不斷增加。 SSD 主要用於消費性設備或為伺服器和儲存陣列提供小幅效能提升。

- HDD尚未完全滲透市場並且仍然佔有相當大的佔有率。在雲端和線上驅動器發展之前,IT 產業高度依賴硬碟來儲存資料。快閃記憶體設備市場正在經歷顯著的成長率。這種轉變正在緩慢地發生,但它被認為是一種有效的實體儲存資料的解決方案,比任何其他專門用於儲存的線上資料庫都能提供更高的資料安全性。

- 隨著高密度快閃記憶體技術的發展,全快閃儲存解決方案可以在很小的資料中心空間內提供更快的效能和更高的容量。隨著 IT 世界中資料量的不斷成長,企業可以透過簡化管理並減少空間、電力和冷卻使用,從長遠來看節省大量成本。

- 資料正在成為各種規模企業的關鍵差異化因素,企業擴大使用數據透過更明智的決策來推動競爭優勢和收益。因此,越來越多的企業,無論大小,都開始轉向人工智慧和機器學習來增強多種功能。

- 人工智慧和機器學習應用依賴大量資料來運作。這些應用程式需要大量資料才能有效和準確。此外,必須即時處理資料並儲存以供以後在 ML 和深度學習 (DL) 中使用。儲存可能成為實用化人工智慧和機器學習應用的瓶頸。可以透過適當的存儲來緩解這一問題。快閃記憶體和硬碟的混合用於攝取和即時處理,其中硬碟可提供充足的資料儲存和擴充性。

- 企業也使用快閃記憶體來備份高效能應用程式需求。快閃記憶體(尤其是 NVMe 快閃記憶體)因其快速恢復而聞名。在發生網路攻擊、停電或其他中斷時,快速恢復上線至關重要,而快閃記憶體對於此類使用案例至關重要。企業分別使用快閃記憶體和 HDD 的組合來滿足其熱儲存和冷儲存需求。

- 通訊,隨著4K/8K視訊、VR/AR應用、智慧製造、遠端巡檢、5G等技術對智慧安防等企業服務的支持,人工智慧將成為IT領域的重要參與者。正在向服務創新平台轉變,資料儲存和處理量可望從T比特級提升至P比特級,進一步推動市場成長。

亞太地區成長強勁

- 資訊科技和電腦技術的蓬勃發展產生了傳輸和儲存大量資料的需求,從而推動了該地區的需求。由於印度企業數量的增加和國際儲存供應商進入市場,預計亞太地區的採用率將最高。

- 快閃記憶體正在推動各種規模的企業實現 IT 產業的轉型。全快閃儲存具有多種優勢,包括更低的延遲、每個驅動器更高的 IOPS、工作負載整合、更小的硬體佔用空間、最小化的功耗和降低的管理成本。該地區正在不斷增加雲端運算的採用,以滿足競爭激烈的市場中對業務創新、敏捷性和擴充性日益成長的需求。

- 目前,印度是亞太地區繼中國之後成長第二快的雲端服務市場。數位化顛覆預計將推動印度快閃記憶體儲存的發展,尤其是在計程車產業、政府、醫院、公共教育和製造業領域。此外,隨著物聯網越來越普及,所有感測器都會產生一定程度的資料,這些數據需要儲存在某個地方進行分析,預計這也將推動該國對快閃記憶體的採用。

- Pure Storage 是一家提供全球最先進資料儲存技術和服務的 IT 先驅,該公司於 2022 年 6 月在班加羅爾開設了新的印度研發中心。該中心致力於改變儲存和資料管理的創新。據該公司稱,這些是印度可以發揮全球作用的領域。

- 世界的數位轉型正在刺激資料的增加,尤其是影片、影像和音訊檔案等非結構化資料的增加。 Pure Storage 提供廣泛的資料管理解決方案,包括 FlashArray、FlashBlade、FlashStack、AIRI、Pure as-a-Service、Portworx、Pure1、Evergreen、Pure Cloud Block Store 和 Purity。我們位於印度的研發中心為大多數產品線的持續創新做出了貢獻。

企業快閃儲存產業概覽

企業快閃記憶體市場本質上競爭激烈。由於大大小小的參與者眾多,市場集中度很高。所有主要參與者都擁有相當大的市場佔有率,並致力於擴大全球消費群。該市場的主要參與者包括 Pure Storage, Inc.、StorCentric, Inc.、Oracle Corporation、Dell, Inc. 和 Hewlett-Packard Enterprise Development LP。公司正在建立多種夥伴關係並投資於新產品的推出,以增加市場佔有率並在預測期內獲得競爭優勢。

2022年5月,NetApp宣布與NVIDIA在人工智慧基礎設施解決方案方面展開多年合作。 NetApp 宣布 NetApp 全快閃 NVMe 儲存和平行檔案系統 BeeGFS 通過 NVIDIA DGX SuperPOD 認證。 NVIDIA DGX SuperPOD 是一個 AI資料中心基礎架構平台,作為承包解決方案交付給 IT 部門,以支援當今企業面臨的最複雜的 AI 工作負載。 DGX SuperPOD 簡化了部署和管理,同時提供了幾乎無限的效能和容量可擴展性。

2022年3月,西部數據與三星就下一代高速儲存技術展開合作。此次合作旨在標準化並廣泛採用下一代資料放置、處理和結構 (D2PF) 儲存技術。換句話說,這兩個品牌正在合作解決下一代 SSD 技術和分區儲存解決方案生態系統。三星和西部數據已致力於開發高速儲存解決方案,兩家公司都專注於企業、雲端應用和分區儲存生態系統。分區儲存是一類儲存設備,其中主機和儲存設備協作以提供低延遲的高容量儲存。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 對企業快閃記憶體市場的影響

第5章 市場動態

- 市場促進因素

- 混合快閃記憶體陣列的演變和全Flash陣列銷售的崛起

- 儲存容量增加和價格下降使 HDD 更偏好

- 市場挑戰

- 相容性和最佳儲存效能問題

第6章 市場細分

- 按類型

- 全Flash陣列

- 混合快閃記憶體陣列

- 按最終用戶產業

- 資訊科技/通訊

- 車

- BFSI

- 衛生保健

- 防禦

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Pure Storage, Inc.

- StorCentric, Inc.

- Oracle Corporation

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Nimbus Data

- Western Digital Corporation

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Hitachi Vantara LLC

- NetApp

第8章投資分析

第9章:市場的未來

The Enterprise Flash Storage Market is expected to register a CAGR of 13.67% during the forecast period.

Key Highlights

- The growing adoption of cloud technology, coupled with growth in the amount of data generated by enterprises, is expected to drive the market. The adoption of flash storage is in demand in enterprise data centres globally. There are advantages in terms of power consumption, performance, scalability, and ease of management that boost the adoption rate.

- Non-Volatile Memory Express (NVMe) and other changes have helped the market for enterprise flash storage grow. Mission-critical applications, including real-time analytics and demanding database systems, can be performed easily with flash storage systems. So can virtual servers, financial systems, virtual desktop platforms, and data analytics applications that gather vast amounts of data.

- Aided by the demand for digitization, it is expected to contribute value to different end-user industries, such as BFSI and IT services, and raise the global need for mega data centers. On the other hand, new enterprise storage investments were made because of the need for public cloud resources and a global enterprise infrastructure update.

- Flash is becoming the game changer in delivering hybrid-cloud environments to support on-premise, the edge, and public cloud infrastructure consumption. Another benefit of flash storage is its flexibility and ability to be deployed into more dynamic environments than traditional removable storage, such as a cache or persistent buffer for IoT devices, cameras, and sensors. Flash storage is enabling IT transformation in a variety of organizations of all sizes.

- The global pandemic, COVID-19, and the surge in data consumption due to the lockdown have led to a shortage and higher prices for memory and storage products to counter the demand for data center operations. Although limited production has resumed, the current supply is quickly being stockpiled by large technology companies. Drive vendors expect that the high price of flash drives will continue into next year because of low stock, long wait times, and problems with production.

Enterprise Flash Storage Market Trends

IT & Telecom Sector to Hold Significant Market Share

- The IT and telecom industry is the largest market value segment in the flash storage market and is expected to be the highest earner during the forecast period.The demand for flash devices will remain stable in the client and enterprise markets for the next few years, owing to technological advancements. These factors will likely increase the availability of better technology at lower prices.

- The rapid growth in the usage of storage devices is justified by the companies' increased amount of data generated and processed. SSDs were mostly used in consumer devices or to give a server or storage array a little boost in performance.

- HDDs are still not exhausted in the market and still hold a considerable share. The IT industry relied immensely on hard drives to store data before the evolution of the cloud and online drives. The growth rate of flash storage devices is significantly increasing in the market. This transformation is slowly underway but is considered an effective solution to store data physically, which enables data security more than any other online database used explicitly for storage.

- With the development of high-density flash technologies, all-flash storage solutions offer faster performance and higher capacity in a fraction of the data center footprint. As the amount of data in the IT field continues to grow, businesses can save a lot of money over time by making management easier and using less space, power, and cooling.

- Data is becoming an essential differentiator for businesses of all sizes, and they are increasingly leveraging it to accelerate competitiveness and revenue through better and more informed decision-making. As a result, more and more companies, big and small alike, are using artificial intelligence and machine learning to enhance their competence across several functions.

- Artificial intelligence and machine learning applications rely on large volumes of data to function. These applications need a large amount of data for effectiveness and accuracy. Moreover, the data must be processed in real-time and stored for later use in ML and deep learning (DL). Storage can become the bottleneck for the practical usage of artificial intelligence and machine learning applications. This can be mitigated using the right storage: a mix of flash and hard drives-flash-based for ingesting and real-time processing, and a hard disk for ample data storage and scalability.

- Enterprises are also using flash for backup of high-performance application requirements. Flash storage (especially NVMe flash) has become famous for fast restores. In the wake of a cyberattack, power outage, or any other disruption, it is crucial to be back online quickly, and flash storage can become indispensable in such use cases. Enterprises use a mix of flash and HDD for hot and cold storage requirements, respectively.

- Additionally, with the advent of support for 4K/8K video, VR/AR applications, and enterprise services such as smart manufacturing, remote inspection, and intelligent security protection leveraging technologies such as 5G, AI is transforming the traditional support tools within the IT and telecom sectors into service innovation platforms where data storage and processing volumes are expected to grow from T-bit level to P-bit level, further leveraging the growth of the market.

Asia-Pacific to Witness Significant Growth

- The global boom in IT and computer technology has triggered the need for the transfer and Storage of vast amounts of data, subsequently pushing up the demand in the region. Owing to a growing number of enterprises In India and international storage vendors entering the market, Asia-Pacific is expected to witness the highest adoption rate.

- Flash storage is enabling IT industries' transformation for organizations of all sizes. All-flash Storage offers a variety of benefits, from lowering latency and increasing IOPS per drive to consolidating workloads, shrinking hardware footprints, minimizing power consumption, and reducing the cost of management. The region is seeking cloud adoption to leverage the increasing need for business innovation and agility and the ability to scale in the competitive market, followed by government initiatives toward digital India.

- Currently, India is immediately after China as the fastest-growing cloud services market across the Asia Pacific. Digital disruption is expected to drive flash storage in India, especially in taxi industries, government, hospitals, public education, and manufacturing. Furthermore, IoT, where every sensor produces some amount of data that needs to be stored somewhere to do analytics, is also expected to drive flash storage adoption in the country as IoT penetration increases.

- Pure Storage, an IT pioneer that delivers the world's most advanced data storage technology and services, inaugurated its new India Research and Development Center in Bangalore in June 2022. The center's prime focus is on innovations transforming Storage and data management. According to the company, these are the areas where India can play a global role.

- The global digital transformation is fueling data growth, specifically unstructured data such as video, picture, and audio files. Pure Storage has a broad portfolio of data management solutions, including FlashArray, FlashBlade, FlashStack, AIRI, Pure as-a-Service, Portworx, Pure1, Evergreen, and Pure Cloud Block Store and Purity. The India research and development center will contribute to the continued innovation in most of these product lines.

Enterprise Flash Storage Industry Overview

The Enterprise Flash Storage Market is very competitive by nature. The market is highly concentrated due to the presence of various small and large players. All the major players account for a large share of the market and are focusing on expanding their consumer base across the world. Some of the significant players in the market are Pure Storage, Inc.; StorCentric, Inc.; Oracle Corporation; Dell, Inc.; Hewlett-Packard Enterprise Development LP; and many more. The companies are increasing their market share by forming multiple partnerships and investing in introducing new products, thus earning a competitive edge during the forecast period.

In May 2022, NetApp collaborated with NVIDIA on artificial intelligence infrastructure solutions for many years. NetApp announced the certification of NetApp all-flash NVMe storage and the BeeGFS parallel file system with the NVIDIA DGX SuperPOD. The NVIDIA DGX SuperPOD is an AI data center infrastructure platform delivered as a turnkey solution for IT to support the most complex AI workloads facing today's enterprises. DGX SuperPOD simplifies deployment and management while providing virtually limitless scalability for performance and capacity.

In March 2022, Western Digital Corporation and Samsung collaborated on next-generation fast storage technologies. The collaboration aims to standardize and drive broad adoption of next-generation data placement, processing, and fabric (D2PF) storage technologies. In other words, the two brands are collaborating to work on next-gen SSD technology and an ecosystem for zoned storage solutions. Samsung and Western Digital have already indulged in developing high-speed storage solutions, and the companies are focusing on enterprise, cloud applications, and the Zoned Storage ecosystem. Zoned storage is a category of storage devices that allows hosts and storage devices to cooperate to deliver high-capacity storage with low latencies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Enterprise Flash Storage Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of Hybrid Flash Arrays and Increased Sales of All Flash Arrays

- 5.1.2 Increased Storage Capacity and Price Reduction Leading to Preference Over HDDs

- 5.2 Market Challenges

- 5.2.1 Compatibility and Optimum Storage Performance Issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 All-Flash Array

- 6.1.2 Hybrid Flash Array

- 6.2 By End-user Industry

- 6.2.1 IT & Telecom

- 6.2.2 Automotive

- 6.2.3 BFSI

- 6.2.4 Healthcare

- 6.2.5 Defense

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pure Storage, Inc.

- 7.1.2 StorCentric, Inc.

- 7.1.3 Oracle Corporation

- 7.1.4 Dell Inc.

- 7.1.5 Hewlett Packard Enterprise Development LP

- 7.1.6 Nimbus Data

- 7.1.7 Western Digital Corporation

- 7.1.8 IBM Corporation

- 7.1.9 Huawei Technologies Co., Ltd.

- 7.1.10 Hitachi Vantara LLC

- 7.1.11 NetApp