|

市場調查報告書

商品編碼

1637837

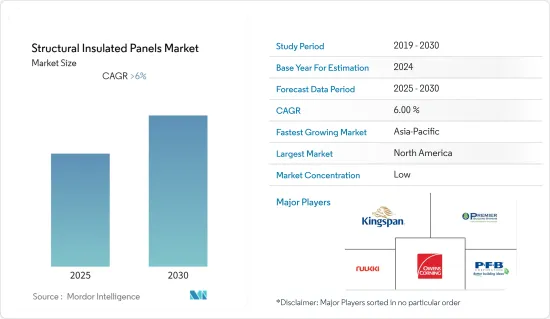

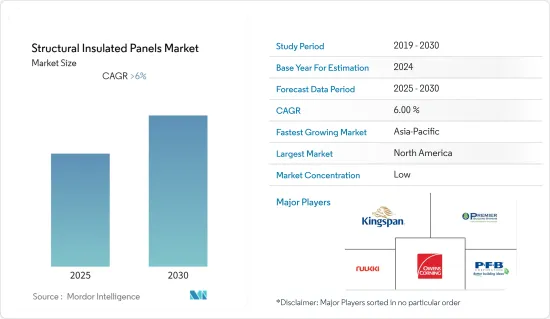

結構絕緣板:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Structural Insulated Panels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

結構保溫板市場預計在預測期內複合年成長率將超過 6%

建築業是受COVID-19疫情影響較大的產業之一。由於缺乏資金、勞動力短缺和封鎖規定,許多計劃在 2020 年陷入停滯。然而,建築業正在迅速復甦,預計未來幾年將繼續成長。

主要亮點

- 未來五到十年,預計建築業需求的增加和冷庫用途的擴大將推動市場。

- 另一方面,模組化建築等建築技術的改進可能會減緩市場成長。

- 然而,對綠色建築的需求正在增加,這可能代表著市場成長的機會。

- 北美佔據大部分市場,主要是由於加拿大和墨西哥建設計劃較多。

結構保溫板市場趨勢

建築牆體的需求增加

- 結構隔熱板通常以 4-1/2 英吋和 6-1/2 英吋的厚度出售。儘管可以創建彎曲的牆板,但對於非正交配置,通常最好使用螺柱框架。

- 用作結構隔熱牆板的面板的總體積遠大於用作結構隔熱屋頂板的體積。

- 定向纖維板在住宅中也是一種經濟高效的選擇。根據美國認證驗住宅師協會 (NACHI) 的數據,對於典型的 2,400 平方英尺住宅,定向塑合板的成本比木材低 700 美元。

- 目前,一些新興經濟體的建築業正在蓬勃發展。 2025年,中國計劃投資1.43兆美元大型建設計劃。據國家發改委稱,上海計劃投資387億美元,廣州已簽署16個新基礎建設計劃,投資80.9億美元。

- 2021 年,美國私部門新建住宅產量超過 7,760 億美元,高於 2020 年的 6,289 億美元。

- 隨著2025年大阪世博會的舉辦,日本建築業可望蓬勃發展。八重洲再開發計劃將於2023年完工,一棟高390m、地上61層的辦公大樓將於2027年完工。

- 2022年,德國宣布耗資30.8億美元的德國與英國之間的NeuConnect互聯計劃,預計於2028年完工。歐洲投資銀行將為該計劃出資4.065億美元。

- 因此,預計未來幾年對建築牆體的需求將會增加。

北美市場佔據主導地位

- 北美地區主導了全球市場佔有率。近年來,美國建築業的私人建築支出增加。

- 根據美國人口普查局的數據,2021 年 11 月美國建築業總產值預計為 16,258.8 億美元。此外,美國住宅預計為8,205.38億美元,比去年同期成長3.4%。

- 2023年1月,美國運輸部宣布將投資總計50億美元用於全美9個大型建設計劃。國家基礎設施計劃支持(大型)酌情津貼計劃宣布,已為這九個大型企劃的建設提供 12 億美元。

- 此外,加拿大的建築業在多倫多、蒙特婁和溫哥華等幾個主要城市都在成長。在這些城市,開發商取得了良好的投資收益,主要集中在高密度住宅計劃。建設業最重要的地點是多倫多和蒙特婁,約佔總收入的 25%。

- 根據 StatCan 的數據,加拿大建築投資在 2021 年 10 月成長 1.6% 至 178 億美元後,2021 年 11 月成長 1.2% 至 180 億美元。這刺激了建築工作並增加了對結構絕緣板的需求。

- 這些因素正在推動該地區結構隔熱板的消費。

結構保溫板產業概況

結構保溫板市場高度細分,沒有主要參與者佔據較大佔有率。許多市場領導者都是生產結構隔熱板並提供安裝和維護服務的向前整合公司。主要參與企業(排名不分先後)包括 Kingspan Group、Rautaruukki Corporation、Premier Building Systems Inc. Premier SIPS、Owens Corning 和 PFB Corporation。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 建築業的需求增加

- 冷庫應用程式增加

- 抑制因素

- 模組化建築技術等建築技術的進步

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 產品

- EPS(發泡聚苯乙烯)面板

- 硬質聚氨酯 (PUR) 和硬質聚異氰酸酯(PIR) 面板

- 玻璃絨板

- 其他產品(押出成型聚苯乙烯泡沫)

- 皮膚材質

- 定向纖維板(OSB)

- 合板

- 其他蒙皮材質(水泥板)

- 目的

- 建築牆

- 屋頂

- 冷藏庫倉庫

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Alubel SpA

- ArcelorMittal

- Balex-Metal

- Cornerstone Building Brands

- DANA Group of Companies

- ITALPANNELLI SRL

- Jiangsu Jingxue Insulation Technology Co. Ltd.

- Kingspan Group

- Manni Group SpA

- METECNO

- Multicolor Steels (India) Pvt. Ltd.

- Nucor Building Systems

- Owens Corning

- Premium Building Systems

- PFB Corporation(Riverside)

- Rautaruukki Corporation

- Tata Steel

- Zamil Industrial Pre-Engineered Buildings Co. Ltd.

第7章 市場機會及未來趨勢

- 綠建築需求增加

The Structural Insulated Panels Market is expected to register a CAGR of greater than 6% during the forecast period.

The construction industry is one of the industries that was badly impacted by the COVID-19 outbreak. Because of a lack of funds, labor shortages, and lockdown regulations, many projects were halted in 2020. But the construction industry is getting better quickly and will continue to grow over the next few years.

Key Highlights

- Over the next five to ten years, the market is likely to be driven by the growing demand from the construction industry and the growing number of uses in cold storage.

- On the other hand, improvements in building technologies, like modular construction, are likely to slow the growth of the market.

- But the demand for green buildings is growing, which could be a chance for the market to grow.

- North America had the most of the market, mostly because there were more building projects in Canada and Mexico.

Structural Insulated Panels Market Trends

Increasing Demand from Building Walls

- Structural insulated wall panels are generally available in thicknesses of 4-1/2 inches and 6-1/2 inches. It is possible to make curved wall panels, but for non-orthogonal shapes, it is often better to use stud framing instead.

- The total volume of the panels used as structural insulated wall panels is much higher than the volume used as structural insulated roof panels.

- Also, oriented strand boards are a cost-effective alternative for home construction. As per the National Association of Certified Home Inspectors (NACHI), OSB costs USD 700 less than wood for a typical 2400-square-foot home.

- The building and construction industry is currently thriving in several emerging economies. China has planned an investment of USD 1.43 trillion in major construction projects until 2025. According to the National Development and Reform Commission (NDRC), the Shanghai plan includes an investment of USD 38.7 billion, whereas Guangzhou signed 16 new infrastructure projects with an investment of USD 8.09 billion.

- In 2021, new home construction output in the U.S. private sector reached over USD 776 billion, which increased from USD 628.9 billion in 2020.

- The Japanese construction industry is expected to bloom as the country will host the 2025 World Expo in Osaka, Japan. In 2023 and 2027, respectively, the Yaesu redevelopment project and a 61-story, 390 meter-tall office tower will be finished.

- In 2022, Germany announced a USD 3.08 billion NeuConnect interconnector project connecting Germany with the United Kingdom, which is scheduled to be completed by 2028. The European Investment Bank will contribute USD 406.5 million to the project.

- So, these things are likely to increase the demand for building walls over the next few years.

North America to Dominate the Market

- The North American region dominated the global market share. The US construction industry has witnessed an increase in private construction spending over the years.

- According to the US Census Bureau, the total construction output in the United States was estimated at USD 1625.88 billion in November 2021. Also, non-residential construction in the US was estimated to be worth USD 820.538 billion, which is 3.4% more than it was during the same time last year.

- In January 2023, the U.S. Department of Transportation announced the investment of a total of USD 5 billion for nine mega-construction projects across the country. The National Infrastructure Project Assistance (Mega) discretionary grant program gave USD 1.2 billion to build these nine mega projects, which was announced by the government.

- Furthermore, the Canadian construction industry is witnessing growth in a few major cities, such as Toronto, Montreal, and Vancouver. In these cities, developers are registering good profits on investment, mainly with high-density residential projects. The most important places for construction are Toronto and Montreal, which bring in about 25% of the total revenue.

- StatCan says that investments in building construction in Canada went up by 1.2% to USD 18.0 billion in November 2021, after going up by 1.6% to USD 17.8 billion in October 2021. This drove construction work and increased demand for structural insulated panels.

- These factors are driving the consumption of structural insulated panels in the region.

Structural Insulated Panels Industry Overview

The structural insulated panels market is highly fragmented, with no major player accounting for a prominent share of the market. Most of the market leaders are forward-integrated, i.e., they produce structural insulated panels and provide installation and maintenance services. Some of the major players (not in any particular order) include Kingspan Group, Rautaruukki Corporation, Premier Building Systems Inc. (Premier SIPS), Owens Corning, and PFB Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Construction Sector

- 4.1.2 Increasing Cold Storage Applications

- 4.2 Restraints

- 4.2.1 Advancements in Building Technologies, such as Modular Construction Techniques

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Product

- 5.1.1 EPS (Expanded Polystyrene) Panel

- 5.1.2 Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panel

- 5.1.3 Glass Wool Panel

- 5.1.4 Other Products (Extruded Polystyrene Foam)

- 5.2 Skin Material

- 5.2.1 Oriented Strand Board (OSB)

- 5.2.2 Plywood

- 5.2.3 Other Skin Materials (Cement Board)

- 5.3 Application

- 5.3.1 Building Wall

- 5.3.2 Building Roof

- 5.3.3 Cold Storage

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.2.4 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alubel SpA

- 6.4.2 ArcelorMittal

- 6.4.3 Balex-Metal

- 6.4.4 Cornerstone Building Brands

- 6.4.5 DANA Group of Companies

- 6.4.6 ITALPANNELLI SRL

- 6.4.7 Jiangsu Jingxue Insulation Technology Co. Ltd.

- 6.4.8 Kingspan Group

- 6.4.9 Manni Group SpA

- 6.4.10 METECNO

- 6.4.11 Multicolor Steels (India) Pvt. Ltd.

- 6.4.12 Nucor Building Systems

- 6.4.13 Owens Corning

- 6.4.14 Premium Building Systems

- 6.4.15 PFB Corporation(Riverside)

- 6.4.16 Rautaruukki Corporation

- 6.4.17 Tata Steel

- 6.4.18 Zamil Industrial Pre-Engineered Buildings Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from Green Buildings