|

市場調查報告書

商品編碼

1639361

北美物聯網安全 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)North America IoT Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

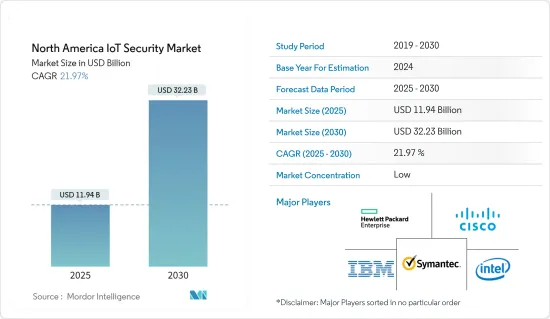

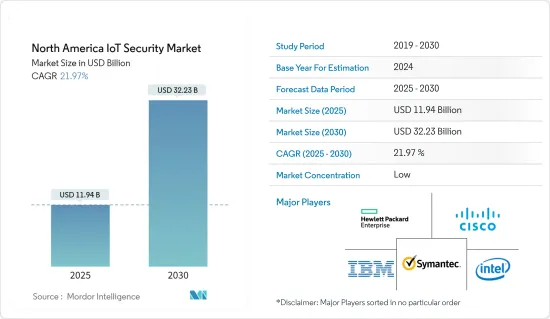

北美物聯網安全市場規模預計到 2025 年為 119.4 億美元,預計到 2030 年將達到 322.3 億美元,預測期內(2025-2030 年)複合年成長率為 21.97%。

主要亮點

- 新的經營模式和應用程式,加上設備成本的降低,正在推動物聯網的採用,從而導致連網型設備裝置、穿戴式裝置、汽車、儀表和家用電子電器產品的數量不斷增加。

- 針對消費者物聯網設備的攻擊非常普遍,而製造業和類似產業的潛在破壞使威脅更加嚴重。過去幾年,美國和加拿大的各個最終用戶產業都面臨嚴重的安全攻擊。物聯網安全正成為企業、消費者和監管機構關注的重點領域。由於這種關注的增加,世界各地提供基於物聯網的解決方案的公司正在對這些解決方案的安全方面進行大量投資。

- 例如,2022年10月,為雲端應用程式提供監控安全平台的Datadog, Inc.宣布全面推出雲端安全管理。該產品將雲端安全態勢管理 (CSPM)、雲端工作負載安全 (CWS)、警報、事件管理和彙報整合到單一平台中,以協助開發營運和安全團隊識別錯誤配置,以偵測威脅並保護雲端原生應用程式.

- 此外,對連網型設備的日益依賴連網型設備需要確保它們的安全。這一顯著成長預計將受到業界對部署互聯生態系統和 3GPP蜂巢式物聯網技術標準化的日益關注的推動。

- 隨著連接到網際網路的設備數量不斷增加,預計網路世界新威脅和攻擊的發生和出現將顯著增加。物聯網設備特別容易受到各種網路攻擊,包括資料竊取、假冒、網路釣魚攻擊和 DDoS(拒絕服務)攻擊。這些可能導致各種與網路安全相關的威脅,例如勒索軟體攻擊和其他嚴重的資料洩露,使企業付出巨大的成本和努力來恢復。

- 然而,設備間的複雜性加上缺乏普及性可能是一個主要問題,可能會限制整個預測期內的整體市場成長。

- 自 COVID-19 爆發以來,物聯網攻擊有所增加,因此世界各國實施了多項預防措施。隨著社區被告知待在家裡、學校關閉,多個組織找到了允許員工在家工作的方法。因此,視訊通訊平台的採用有所增加。此外,預計市場將在後 COVID-19 時期見證重大成長機會,特別是隨著主要市場參與企業推出各種經濟高效的雲端基礎的混合解決方案。

北美物聯網安全市場趨勢

資料外洩數量的增加預計將推動市場發展

- 隨著連接到網際網路的設備數量的增加,預計網路世界將會出現新的威脅和攻擊。過去幾年北美各個最終用戶產業的資料外洩事件的增加就證明了這一點。此類攻擊直接針對業務系統或個人,可能導致重大的財務和個人損失。這增加了對容易遭受資料外洩的消費性設備的物聯網安全性的需求。

- 此外,醫療保健、製造、BFSI 和汽車等各個最終用戶行業的資料外洩數量不斷增加,推動了對物聯網安全解決方案的需求,以保護互聯設備免受網路攻擊。例如,根據身分盜竊資源中心發布的 ITRC 2022 年度資料外洩報告,2022 年美國發生了 1,802 起資料外洩事件。美國的資料外洩事件數量已從 2005 年的 157 起大幅增加到 2022 年的 1,802 起。

- 此外,由於物聯網需求,雲端服務的採用率也很高。隨著雲端系統在各行業的使用不斷增加,這些系統的資料外洩漏洞也越來越大。許多提供者提供多種解決方案,增加了對統一安全平台的需求。物聯網安全可以部署在設備和通訊、資料儲存和生命週期解決方案中。

- 此外,由於政府加強保護企業免受網路攻擊,預計該市場將進一步成長。例如,2023 年 7 月,拜登政府啟動了物聯網 (IoT) 網路安全指示計劃,以保護美國免受與網路連線裝置相關的無數安全風險。該計畫名為“美國網路信任標誌”,旨在確保美國購買包含針對網路攻擊的強大網路安全保護的連網設備。

預計美國將主導市場

- 美國物聯網安全市場成長的關鍵因素是先進技術的高採用率、網路攻擊數量的增加以及該國聯網設備數量的增加。該國是物聯網部署的主要地區之一。其他因素包括該地區數位化和物聯網安全支出的增加。

- 此外,該地區也是賽門鐵克公司、IBM公司、FireEye公司和Palo Alto Networks公司等重要物聯網安全供應商的所在地。供應商正在透過增加產品創新來增加產品系列和市場佔有率。例如,2022 年 3 月,網路防火牆供應商 Palo Alto Networks 宣布與 Amazon Web Services 合作推出適用於 AWS 的新 Palo Alto Networks Cloud NGFW。

- 同樣在 2022 年 5 月,為電子應用各領域的客戶提供服務的全球半導體供應商意法半導體透露了其與意法半導體認證合作夥伴微軟的合作細節。其目的是增強新興物聯網應用的安全性。 ST 將其超低功耗 STM32U5 微控制器與 Microsoft Azure RTOS 和 IoT 中間件以及經認證的安全實作 Arm Trusted Firmware-M (TF-M) 安全服務(專門針對嵌入式系統)結合。

- 此外,美國的網路威脅呈上升趨勢。根據身分盜竊資源中心的數據,該國的平均違規數量在過去幾年中略有增加。 2022 年 10 月,拜登-哈里斯政府將重點放在改善美國網路防禦上,建立全面的方法來採取積極行動來加強和保護國家的網路安全。

- 根據GSMA行動智庫預測,到2025年終,北美工業和消費性物聯網連接總數預計將成長至約54億個。 2019年,北美地區物聯網連接總數達28億個。該地區工業和消費物聯網連接總數的顯著增加預計將顯著推動整個市場的成長機會。

北美洲物聯網安全產業概況

由於該全部區域存在大量區域參與企業,北美物聯網安全市場的競爭格局呈現細分的特性。這些市場參與企業擴大推出針對各行業的創新解決方案。此外,旨在提高市場佔有率的聯盟和收購顯著增加。

2022 年 12 月,網路安全解決方案供應商 Check Point Software Technologies Ltd. 宣布推出 Check Point Quantum Titan,這是其 Check Point Quantum 網路安全平台的增強版。 Quantum Titan 包含三個軟體刀片,利用深度學習和人工智慧 (AI) 的力量,針對高級域名系統漏洞 (DNS) 和網路釣魚攻擊以及自主的物聯網安全提供高級威脅防護。 Check Point 的 Quantum Titan 提供物聯網設備發現和自動應用零信任威脅保護設定檔來保護物聯網設備。

2022 年 12 月,Palo Alto Networks 宣布推出醫療物聯網安全,這是一款專為醫療設備設計的全面零信任安全解決方案。該解決方案使醫療保健組織能夠安全、快速地部署和管理新的互聯技術。網路安全的零信任方法著重於持續檢驗所有使用者和設備,從而消除組織安全框架內的隱式信任。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 資料外洩增加

- 智慧城市的出現

- 市場限制因素

- 設備間的複雜性和缺乏普遍的立法

第6章 市場細分

- 安全類型

- 網路安全

- 端點安全

- 解決方案

- 軟體

- 服務

- 最終用戶產業

- 車

- 醫療保健

- 政府機構

- 製造業

- 能源/電力

- 零售業

- BFSI

- 其他

- 地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Symantec Corporation

- IBM Corporation

- Check Point Software Technologies Ltd.

- Intel Corporation

- Hewlett Packard Enterprise Company

- Cisco Systems Inc.

- Fortinet Inc.

- Trustwave Holdings

- AT&T Inc.

- Palo Alto Networks Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The North America IoT Security Market size is estimated at USD 11.94 billion in 2025, and is expected to reach USD 32.23 billion by 2030, at a CAGR of 21.97% during the forecast period (2025-2030).

Key Highlights

- The emerging business models and applications, coupled with the reducing device costs, have been instrumental in driving the adoption of IoT, consequently, the number of connected devices, such as connected machines, wearables, cars, meters, and consumer electronics.

- Attacks on consumer IoT devices are prevalent, and the overall possibility of disruption in manufacturing and similar industries makes the threat more serious. Various end-user industries in the United States and Canada have faced considerable security attacks in various industries in the past few years. IoT security is becoming a significant focus area for businesses, consumers, and regulators. Following such increasing prominence, enterprises that are offering IoT-based solutions worldwide are investing heavily in the security aspect of these solutions.

- For instance, in October 2022, Datadog, Inc., the monitoring and security platform for cloud applications, declared the general availability of Cloud Security Management. This product brings together capabilities from Cloud Security Posture Management (CSPM), Cloud Workload Security (CWS), alerting, incident management, and reporting in a single platform to enable DevOps and Security teams to identify misconfigurations, detect threats, and secure cloud-native applications.

- Moreover, the increasing dependency on connected devices is creating the need to keep the connected devices secure. This significant growth is anticipated to be driven by the growing industry focus on deploying a connected ecosystem as well as the standardization of 3GPP cellular IoT technologies.

- With the growing number of devices connected to the Internet, the cyber world is anticipated to witness a significant rise in the occurrence and emergence of new threats and attacks. IoT devices are particularly vulnerable to various network attacks, such as data theft, spoofing, phishing attacks, and DDoS attacks (denial of service attacks). These can lead to various cybersecurity-related threats like ransomware attacks and other serious data breaches that can take businesses a lot of money and effort to recover from.

- However, the growing complexity among devices, coupled with the lack of ubiquitous legislation, could be a major matter of concern that can limit the overall market's growth throughout the forecast period.

- Since the beginning of COVID-19, there has been an increase in IoT attacks, and hence, countries worldwide have implemented several preventive measures. With communities being asked to stay at home and schools being closed, multiple organizations have found a way to allow their employees to work from their homes. This has resulted in a rise in the adoption of video communication platforms. Moreover, during the post-COVID-19 period, the market is expected to witness significant growth opportunities, especially due to the introduction of various cost-effective cloud-based and hybrid solutions by the leading major market participants.

North America IoT Security Market Trends

Increasing Number of Data Breaches is Anticipated to Drive the Market

- With the increase in the number of devices connected to the Internet, the cyber world is expected to witness a rise in the occurrence and emergence of new threats and attacks. This is evident by the growth in data breaches across the North America region in various end-user verticals over the past few years. These attacks, which directly target business systems and individuals, may potentially lead to enormous financial and personal losses. Thus fueling the need for IoT security for consumer devices that are highly susceptible to data breaches.

- Moreover, the growth in data breaches across the region in various end-user industries, such as healthcare, manufacturing, BFSI, automotive, etc., is driving the need for IoT security solutions to protect their connected devices from cyberattacks. For instance, according to the ITRC 2022 Annual Data Breach Report by Identity Theft Resource Center, the number of data compromises in the United States was 1802 cases in 2022. The number of data compromises in the United States significantly increased from 157 cases in 2005 to 1802 cases in 2022.

- Further, cloud services are experiencing high adoption rates owing to the demand for IoT. This increasing use of cloud systems across various verticals has increased the vulnerabilities of these systems to data breaches. With many providers offering multiple solutions, the need for a uniform security platform is rising. IoT security can be deployed for devices and communication, data storage, and lifecycle solutions.

- Additionally, the market is further expected to grow due to the increasing government initiatives to protect businesses from cyberattacks. For instance, in July 2023, The Biden administration launched an Internet of Things (IoT) cybersecurity labeling program to protect Americans against the myriad security risks associated with internet-connected devices. The program, "U.S. Cyber Trust Mark," aims to help Americans ensure they are buying internet-connected devices that include strong cybersecurity protections against cyberattacks.

United States is Expected to Dominate the Market

- The major crucial factors for the growth of the IoT security market in the United States are the high adoption of advanced technologies, increasing cyberattacks, and a growing number of connected devices in the country. The country is one of the dominant regions for IoT deployment. Other factors include the growth in digitalization and IoT security spending in the region.

- Moreover, the region houses significant IoT Security vendors, including Symantec Corporation, IBM Corporation, FireEye Inc., and Palo Alto Networks Inc., among others. The vendors are strengthening their product portfolio and market presence by boosting their product innovation. For instance, in March 2022, Palo Alto Networks, a provider of network firewalls, declared that it has teamed up with Amazon Web Services to unveil the new Palo Alto Networks Cloud NGFW for AWS, a managed Next-Generation Firewall (NGFW) service designed to simplify securing AWS deployments, allowing organizations to speed their pace of innovation while remaining highly secure.

- Also, in May 2022, STMicroelectronics, a global semiconductor provider serving customers across the spectrum of electronics applications, revealed the details of its collaboration with Microsoft, an ST-authorized partner. The aim was to strengthen the security of emerging Internet-of-things applications. ST is combining its ultra-low-power STM32U5 microcontrollers with Microsoft Azure RTOS & IoT Middleware as well as a certified secure implementation of the Arm Trusted Firmware -M (TF-M) secure services, especially for embedded systems.

- Moreover, the United States is experiencing an increasing number of cyber threats. According to the Identity Theft Resource Center, the average number of breaches in the country has increased marginally over the past few years. In October 2022, The Biden-Harris Administration brought a significant focus to improving the United States' cyber defenses, building a comprehensive approach to take aggressive action to strengthen and safeguard the nation's cybersecurity.

- As per GSMA Intelligence, the total number of industrial and consumer Internet of Things connections in North America is forecast to grow to around 5.4 billion by the end of the year 2025. In 2019, the total number of IoT connections in North America amounted to 2.8 billion connections. Such a significant rise in the overall count of the industrial and consumer Internet of Things connections within the region is expected to propel the market's overall growth opportunities significantly.

North America IoT Security Industry Overview

The competitive landscape of the North American IoT Security Market is characterized by fragmentation due to the presence of numerous regional players across the region. These market participants are increasingly introducing innovative solutions to cater to various industries. Furthermore, the market is experiencing a notable increase in collaborations and acquisitions aimed at enhancing its market presence.

In December 2022, Check Point Software Technologies Ltd., a cybersecurity solutions provider, unveiled Check Point Quantum Titan, an enhancement to the Check Point Quantum cyber security platform. The Quantum Titan release incorporates three software blades that harness the power of deep learning and artificial intelligence (AI) to offer advanced threat prevention against sophisticated domain name system exploits (DNS) and phishing attacks, as well as autonomous IoT security. With Check Point Quantum Titan, the platform now includes IoT device discovery and the automatic application of zero-trust threat prevention profiles to safeguard IoT devices.

In December 2022, Palo Alto Networks introduced Medical IoT Security, a comprehensive Zero Trust security solution designed for medical devices. This solution enables healthcare organizations to securely and rapidly deploy and manage new connected technologies. The zero-trust approach to cybersecurity focuses on continuously verifying every user and device, thereby eliminating implicit trust within the organization's security framework.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Data Breaches

- 5.1.2 Emergence of Smart Cities

- 5.2 Market Restraints

- 5.2.1 Growing Complexity among Devices, coupled with the Lack of Ubiquitous Legislation

6 MARKET SEGMENTATION

- 6.1 Type of Security

- 6.1.1 Network Security

- 6.1.2 End-point Security

- 6.2 Solution

- 6.2.1 Software

- 6.2.2 Services

- 6.3 End-user Industry

- 6.3.1 Automotive

- 6.3.2 Healthcare

- 6.3.3 Government

- 6.3.4 Manufacturing

- 6.3.5 Energy and Power

- 6.3.6 Retail

- 6.3.7 BFSI

- 6.3.8 Others End-user Industries

- 6.4 Geography

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Symantec Corporation

- 7.1.2 IBM Corporation

- 7.1.3 Check Point Software Technologies Ltd.

- 7.1.4 Intel Corporation

- 7.1.5 Hewlett Packard Enterprise Company

- 7.1.6 Cisco Systems Inc.

- 7.1.7 Fortinet Inc.

- 7.1.8 Trustwave Holdings

- 7.1.9 AT&T Inc.

- 7.1.10 Palo Alto Networks Inc.