|

市場調查報告書

商品編碼

1639373

環氧乙烷:市場佔有率分析、產業趨勢、成長預測(2025-2030)Ethylene Oxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

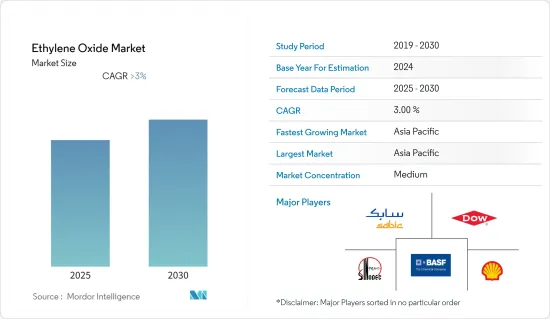

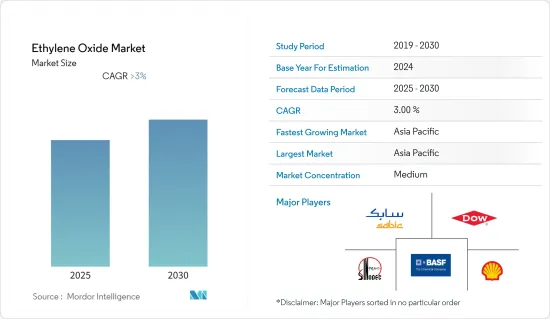

預計環氧乙烷市場在預測期內將維持3%以上的複合年成長率。

2020 年市場受到 COVID-19 的負面影響。全球美容和個人護理行業受到 COVID-19 大流行的嚴重影響。儘管業界重組從事乾洗手劑和清洗產品的生產,但銷量下降幅度較大。預計該行業需求將在2021年復甦,並在未來幾年保持適度成長。

主要亮點

- 短期來看,PET在食品和飲料行業的使用不斷增加,新興國家對家庭和個人保健產品的需求不斷增加,以及防凍劑的需求不斷成長是推動市場的關鍵因素。

- 然而,高暴露對健康和環境的影響可能會阻礙市場成長。

- 在生產中使用生物基乙烯而不是石油基乙烯可能是所研究市場的一個機會。

- 預計亞太地區在預測期內將擁有最高的市場佔有率和最快的成長速度。

環氧乙烷市場趨勢

紡織業需求增加

- 紡織業是環氧乙烷的主要最終用戶產業,其衍生物用作某些化合物的前體,這些化合物提供耐久壓榨、氨綸纖維的光穩定性、羊毛的防縮、抗靜電、驅蟲性能等。

- 印度、中國、美國是世界主要紡織品製造國。由於需求增加、投資擴大和基礎設施改善,該領域的需求在預測期內可能會增加。

- 2022 年 5 月,印度在德里 NIFT 啟動了 CoEK(卡迪布卓越中心),生產創新布料和服裝。其目標是透過引進新設計和採用國際標準來滿足國內外消費者的需求。

- 中國是世界領先的紡織品生產國和出口國之一。 2022年10月,我國紡織品產量31.8億公尺。

- 2022年1月至2022年10月,美國向歐盟出口紡織服飾產品18,0393萬美元,向東東南亞國協出口5,0,986萬美元。

- 因此,預計所有上述因素都將對預測期內的市場成長產生重大影響。

亞太地區主導市場

- 亞太地區目前主導全球環氧乙烷市場。亞太地區環氧乙烷及其衍生物的主要消費國為中國。

- 亞太地區也是最大的界面活性劑消費國和生產國。產量已達到高水平,成為向美國等已開發國家出口化妝品和個人保健產品的主要基地。

- 中國紡織業是其主要產業之一,也是世界上最大的服飾出口國。 2022年上半年,紡織品服飾出口額與前一年同期比較增加10%。

- 我國是PET樹脂生產大國,中油集團和江蘇桑芳祥是全球產量最大的生產商,產能超過200萬噸。因此,終端用戶產業對 PET 的需求不斷成長正在推動環氧乙烷需求。

- 該地區也是全球最大的汽車製造地,佔據全球近60%的市場。根據OICA統計,2021年汽車產量為2,608萬輛,與前一年同期比較成長3%。

- 為了鼓勵印度曼尼普爾邦織工的發展,亞馬遜印度公司於 2022 年 6 月與曼尼普爾手織機和手工藝品發展公司簽署了合作備忘錄。

- 因此,由於上述因素,亞太地區很可能在預測期內確認最高的市場佔有率。

環氧乙烷產業概況

環氧乙烷市場部分整合。該市場的主要企業包括(排名不分先後)殼牌公司、中國石化集團公司、陶氏化學公司、沙烏地阿拉伯基礎工業公司和BASF。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 擴大 PET 在食品和飲料行業的使用

- 新興國家對家庭和個人保健產品的需求增加

- 抑制因素

- 高暴露對健康和環境的影響

- 價值鏈分析

- 波特五力

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 衍生性商品

- 乙二醇

- 單乙二醇 (MEG)

- 二伸乙甘醇(DEG)

- 三甘醇 (TEG)

- 乙氧基化物

- 乙醇胺

- 乙二醇醚

- 聚乙二醇

- 其他衍生性商品

- 乙二醇

- 最終用戶產業

- 車

- 農藥

- 飲食

- 纖維

- 個人護理

- 藥品

- 清潔劑

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- China Petrochemical Corporation

- Clariant

- Dow

- India Glycols Limited.

- INEOS

- LOTTE Chemical Corporation

- LyondellBasell Industries Holdings BV

- NIPPON SHOKUBAI CO., LTD.

- Reliance Industries Limited.

- Shell plc

- SABIC

- Sasol

第7章市場機會與未來趨勢

- 生物基乙烯與石油基乙烯在生產上的利用

The Ethylene Oxide Market is expected to register a CAGR of greater than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. The global beauty and personal care industry has been significantly affected by the COVID-19 pandemic. Though the industry has restructured itself to engage in the production of hand sanitizers and cleaning agents, however, the drop in sales has been significant. The demand from the industry has recovered in 2021 and is likely to grow at a moderate rate in the coming years.

Key Highlights

- Over the short term, the major factors driving the market are the growing usage of PET in the food and beverage industry, increasing demand for household and personal care products in developing countries, and growing demand for antifreeze agents.

- However, the health and environmental effects of high exposure can hinder market growth.

- Using bio-derived ethylene over petro-based ethylene for production can act as an opportunity for the market studied.

- The Asia-Pacific region is expected to witness the highest market share and fastest growth during the forecast period.

Ethylene Oxide Market Trends

Increasing Demand from the Textile Industry

- The textile industry is a major end-user industry for ethylene oxide as the derivatives are used for the treatment of a wide variety of natural and synthetic fibers, as precursors for certain compounds providing durable press, light stabilization of spandex fibers, shrink-proofing wool, static prevention, and mothproofing, among others.

- India, China, and United States represent major textile manufacturing countries in the world. With rising demand, growing investments, and improved infrastructure facilities, the demand from the sector is likely to increase in the forecast period.

- In May 2022, the Center of Excellence for Khadi (CoEK) at NIFT in Delhi was inaugurated in India to produce innovative fabrics and apparel. The aim is to meet the needs of both domestic and foreign consumers by introducing new designs and adopting international standards.

- China is one of the largest producers and exporters of textiles in the world. In October 2022, textile production in China was 3.18 billion meters.

- The United States exported USD 1,803.93 Million worth of textiles and apparel to the European Union while the exports to the ASEAN countries were worth USD 509.86 million from January 2022 to October 2022.

- Thus, all the above-mentioned factors are expected to show a significant impact on the market growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global ethylene oxide market currently. China accounts for the major consumption of ethylene oxide and its derivatives in the Asia-Pacific region.

- Asia-Pacific has also become the largest consumer and producer of surfactants. The production has reached very high levels, becoming a major hub for the exporting of cosmetics and personal care products to developed nations, such as the United States.

- China's textile industry is one of the major industries, and the country is the largest clothing exporter across the world. In the first half of 2022, the export value of textiles and apparel increased by 10% compared to the previous year.

- China is a major producer of PET resins with the PetroChina Group and Jiangsu Sangfangxiang among the largest global manufacturers in terms of volume, with capacities of more than 2 million tons. Thus, the rising demand for PET from end-user industries is driving the demand for ethylene oxide.

- Also, the region is the largest automotive manufacturing hub, registering almost 60% share of the world. According to OICA, in the year 2021, the total production of vehicles stood at 26.08 million units registering an increase of 3% compared to the previous year.

- To encourage the development of weavers and artisans in Manipur, India, Amazon India signed an MoU with Manipur Handloom and Handicrafts Development Corporation Limited in June 2022.

- Hence, owing to the above-mentioned factors, Asia-Pacific is likely to witness the highest market share during the forecast period.

Ethylene Oxide Industry Overview

The ethylene oxide market is partially consolidated in nature. Some of the key players in the market include Shell plc, China Petrochemical Corporation, Dow, SABIC, and BASF SE (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage of PET in the Food and Beverage Industry

- 4.1.2 Increasing Demand for Household and Personal Care Products in the Developing Countries

- 4.2 Restraints

- 4.2.1 Health and Environmental Effects over High Exposure

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Derivative

- 5.1.1 Ethylene Glycols

- 5.1.1.1 Monoethylene Glycol (MEG)

- 5.1.1.2 Diethylene Glycol (DEG)

- 5.1.1.3 Triethylene Glycol (TEG)

- 5.1.2 Ethoxylates

- 5.1.3 Ethanolamines

- 5.1.4 Glycol Ethers

- 5.1.5 Polyethylene Glycol

- 5.1.6 Other Derivatives

- 5.1.1 Ethylene Glycols

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Agrochemicals

- 5.2.3 Food and Beverage

- 5.2.4 Textile

- 5.2.5 Personal Care

- 5.2.6 Pharmaceuticals

- 5.2.7 Detergents

- 5.2.8 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 China Petrochemical Corporation

- 6.4.3 Clariant

- 6.4.4 Dow

- 6.4.5 India Glycols Limited.

- 6.4.6 INEOS

- 6.4.7 LOTTE Chemical Corporation.

- 6.4.8 LyondellBasell Industries Holdings B.V.

- 6.4.9 NIPPON SHOKUBAI CO., LTD.

- 6.4.10 Reliance Industries Limited.

- 6.4.11 Shell plc

- 6.4.12 SABIC

- 6.4.13 Sasol

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Usage of Bio-derived Ethylene over Petro-based Ethylene for Production