|

市場調查報告書

商品編碼

1639375

模組化 UPS -市場佔有率分析、行業趨勢/統計、成長預測 (2025-2030)Modular UPS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

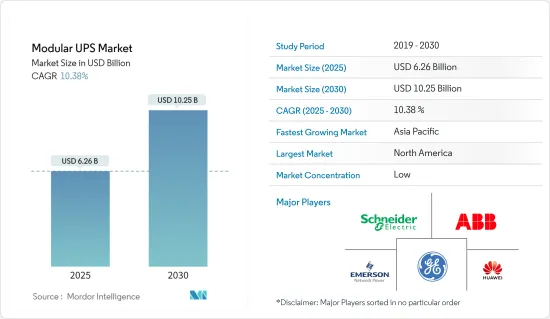

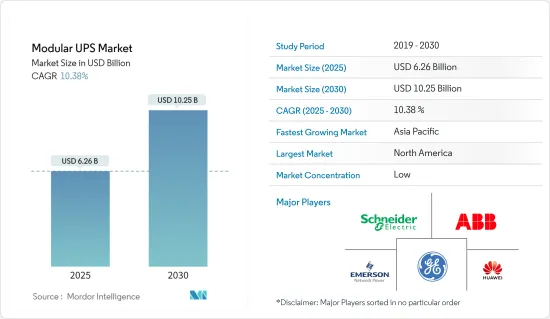

模組化UPS市場規模預計到2025年為62.6億美元,預計到2030年將達到102.5億美元,預測期內(2025-2030年)複合年成長率為10.38%。

在通常需要 100% 可用性的資料中心中,電源故障可能會導致資料遺失、關鍵服務缺失、硬體風險和重大財務損失。因此,資料中心對UPS的需求量很大,以確保持續供電並降低系統故障的風險。由於大規模應用程式和對雲端服務依賴的增加,主機託管服務的需求不斷增加,為模組化UPS產業提供了新的前景。

主要亮點

- 模組化不斷電系統(UPS) 是一種彈性且適應性強的電源保護系統,可調整 UPS 的效能。這些模組可熱插拔,並在連接時自動識別。該產品的零功耗停機時間、可靠和穩健的實施預計將提高其採用率。模組化 UPS 系統在需要為重要基礎設施提供可靠電力的企業中越來越受歡迎。

- 對新技術進步的需求不斷增加,包括雲端運算採用、資料儲存需求、數位服務、監管要求、不斷成長的用戶群以及跨區域業務可擴展性。

- 模組化不斷電系統(UPS) 系統的主要優點是可擴充性和降低維護成本。超大規模資料中心和託管供應商正在採用模組化 UPS 技術並採用各種架構來最大限度地降低營運成本並保持冗餘容量。由於與多個並聯 UPS 系統相比,N+1 設計提供了經濟高效的冗餘、卓越的負載和效率,因此許多組織選擇支援 10 kV-A 至 50kVA Select 的較小模組。同時,2N設計保證了精確的負載匹配。

- 模組化系統描述了一種簡化且更易於管理的維護方法。這些模組設計為可熱插拔,允許在系統保持運作的情況下無縫拆卸、更換和測試。模組化UPS系統的功率容量為10-100kVA、100-250kVA、215kVA及500kVA以上。這些系統廣泛應用於不同領域,包括資料中心、工業、通訊、商業、工業、政府和其他垂直領域。

- 然而,模組化 UPS 系統的初始安裝成本通常超過傳統集中式 UPS 解決方案。儘管模組化方法提供了可擴展性和適應性,但對於注重預算的客戶來說,初始資本投資可能會令人望而卻步,尤其是財務資源有限的中小型企業和組織。

- 模組化不斷電系統UPS 市場受到了 COVID-19 大流行的負面影響。模組化UPS市場的發展受到大規模政府、能源和工業企業倒閉的顯著影響。

模組化UPS市場趨勢

BFSI 部門確認成長

- 對於投資公司、銀行和保險公司等金融機構來說,關鍵應用至關重要,因為不能容忍因斷電造成的中斷和資料遺失。三相模組化不斷電系統用於保護敏感的金融和銀行系統免受電源故障的影響。

- 由於各個行業,特別是金融服務、銀行和保險行業的快速現代化和網際網路的廣泛使用,以及需要各種資料處理和服務系統來提供最高水平的客戶服務,對模組化UPS系統的需求不斷增加它是透過與商業銀行的聯繫來推動的。

- 此外,市場成長的關鍵驅動力之一是金融業需要保持在技術和業務的前沿,否則就有被競爭對手超越的風險。為了減少非法交易並增加全球電子貨幣、技術和網路資料安全的使用,各國政府正在計劃在網路銀行的使用方面進行創新。

- 截至2023年6月,中國約有9.43億人使用行動付款。由於COVID-19的爆發,自2017年以來新用戶的成長率開始下降。

- 上述應用的存在以及政府對發展無現金經濟國家的支持相信將為市場成長提供充足的機會。

北美佔據模組化 UPS 市場最大佔有率

- 由於 IT/通訊和醫療製造領域的高需求,預計北美將佔據模組化 UPS 市場的最大佔有率。這些組織擁有龐大的營運基地,對資料中心和託管服務的需求不斷成長,混合 UPS 解決方案的需求也不斷成長。

- 此外,由於 IT 的發展以及對電子商務和數位付款的興趣增加,美國各地對持續供電的資料中心的需求不斷增加,推動了模組化 UPS 的普及。此外,由於對資料和資產被盜的擔憂日益增加,當局正在進行定期檢查,這有助於市場成長。

- 近年來,拉丁美洲越來越受歡迎。在該地區,樂透、巨量資料、人工智慧等尖端技術正變得越來越普及。該領域的雲端使用也在加速。

- 除了建立微電網和本地發電外,營運商還購買冗餘電力基礎設施(例如 UPS 系統)為其設施供電,為系統製造商創造收入並推動市場向前發展。

模組化UPS產業概況

模組化 UPS 市場高度細分,參與者眾多,包括 ABB Ltd、艾默生網路能源、Delta Power Solutions、華為技術、施耐德電氣、通用電氣和 Gamatronic Electronic Industries Ltd。這表示市場集中度較低。

- 2023 年 7 月 - ABB Ltd. 在印度推出 MegaFlex DPA(分散式並行架構)UPS 解決方案。 ABB的MegaFlex UPS產品線面向UL和IEC市場,功率範圍為1.6 MW和1.5 MW。 MegaFlex 解決方案提供卓越的可用性和可靠性,同時提供市場上最小的佔地面積,IEC 版本比具有相同額定功率的競爭產品小多達 45%。

- 2023 年 7 月 - 施耐德電機推出 Easy UPS 三相模組化。這款堅固耐用的不斷電系統(UPS) 旨在保護關鍵負載,並具有經過第三方檢驗的即時插拔功能。 Easy UPS 三相模組的容量為 50 至 250kW,採用 N+1 可擴展配置,並支援用於遠端監控服務的 EcoStruxureTM 架構。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 託管和雲端服務高速成長

- 低擁有成本和營運成本

- 市場限制因素

- 對資料中心以外的用途缺乏認知

第6章 市場細分

- 按電源容量

- 0~50kVA

- 51~100kVA

- 101~300kVA

- 301kVA以上

- 按最終用戶

- 資料中心

- 工業的

- 通訊

- 商業的

- BFSI

- 政府/基礎設施

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Emerson Network Power

- Huawei Technologies Co. Ltd

- Schneider Electric SE

- General Electric

- Delta Electronics Inc.

- AEG Power Solutions

- Riello Elettronica Group

- Eaton Corporation

第8章投資分析

第9章 市場機會及未來趨勢

The Modular UPS Market size is estimated at USD 6.26 billion in 2025, and is expected to reach USD 10.25 billion by 2030, at a CAGR of 10.38% during the forecast period (2025-2030).

Data losses, lack of key services, hardware risks and significant financial loss may result from power disturbances in data centers that typically require 100% availability. Therefore, in order to ensure continuous power supply and reduce the risk of system failure, there is a high demand for UPSs in data centers. As a result of the growing reliance on large-scale applications and cloud services, demand for colocation services has increased, offering new prospects for the modular UPS industry.

Key Highlights

- The modular uninterruptible power supply (UPS) is a resilient and adaptable power protection system that regulates UPS performance. The modules are hot-swappable and automatically recognized when connected. The product's adoption is expected to be strengthened by its robust implementation of zero and dependable power downtime. Modular UPS systems are becoming more prevalent among companies that require a dependable power source for their essential infrastructure.

- There has been a growing demand for new technology advancements, such as cloud computing adoption, data storage needs,digital services, regulatory requirements, expanding user base, and business scalability across regions.

- The primary benefits of a modular uninterruptible power supply (UPS) system lie in its capacity for scalable expansion and decreased maintenance expenses. Hyperscale data centers and colocation providers employ modular UPS technology, employing various architectures to minimize operational costs and maintain redundant capacity. Many organizations opt for smaller modules supporting 10-kilovolt amperes to 50 kVA, as N+1 designs offer cost-effective redundancy, superior loading, and efficiency compared to multiple parallel UPS systems. Meanwhile, 2N designs ensure precise load matching.

- Modular systems offer a simplified and more manageable approach to maintenance. The modules are designed to be hot-swappable, allowing for seamless removal, replacement, and testing while the system remains operational. Modular UPS systems have power capacities ranging from 10-100 kVA, 100-250 kVA, 215 kVA, and 500 kVA and above. These systems are widely utilized in diverse sectors, including data centers, industries, telecommunications, commercial, BFSI, government, and other verticals.

- Moroever, the initial installation expenses associated with modular UPS systems typically exceed those of conventional centralized UPS solutions. Although the modular approach provides scalability and adaptability, the upfront capital investment may dissuade budget-conscious clients, particularly those in smaller enterprises or organizations with limited financial resources.

- The modular uninterruptible power supplyUPS market has been negatively affected by the COVID 19 pandemic. The development of the modular UPS market has been greatly influenced by the closure of large government, energy and industrial undertakings.

Modular UPS Market Trends

BFSI Segment to Witness the Growth

- Critical applications that can't be interrupted or data lost due to power failures are critical for financial institutions as investment firms, banks and insurance companies. In order to protect sensitive financial and banking systems from power disturbances, three phases of modular uninterruptible power supplies are used.

- The demand for modular UPS systems has been driven by rapid modernisation and the widespread use of the internet in various sectors, especially in the financial services, banking, and insurance sector, as different data processing and service systems are connected to commercial banks to provide the highest level of customer service.

- Moreover, The one of the main driver for the growth of the market is also the need for the financial sector to remain at the forefront of technology and business or risk being outpaced by its competitors. In order to reduce illegal transactions and to increase the use of electronic cash, technology and internet data security across the world and governments are planning innovation in the use of internet banking.

- As of June 2023, around 943 million people used mobile payments in China as of usage of electronic cash. . The outbreak of COVID-19 has led to an increase in the number of new users, as growth rates for new users have begun to decline after 2017.

- The presence of these above-mentioned applications and government support to develop cashless economy will provide ample opportunities for the growth of the market.

North America Holds the Largest Share in Modular UPS Market

- The market for modular UPS is estimated to be dominated by North America, due to high demand from the IT and telecommunications sectors, as well as health care and manufacturing. These organisations have significant operational bases, increasing the demand for data centres and colocation services as well as an increased need for hybrid UPS solutions.

- Moreover, The demand for data centers, which must be constantly supplied with power, is increased by the development of IT and a rising interest in e Commerce and digital payments across America, making modular UPS more popular. Moreover, regular checks which contribute to market growth are being carried out by the authorities in view of an increasing concern for data and asset theft.

- Latin America has grown in popularity in recent years. Advanced technologies such as lot, big data, and AI are becoming more popular in the region. Cloud use is also accelerating in this sector.

- In addition to establishing microgrids and local power generation, operators purchase redundant power infrastructure, such as UPS systems, to power their facilities, generating income for system makers and propelling the market forward.

Modular UPS Industry Overview

The Modular UPS market is highly fragmented, with a large number of players that includes ABB Ltd, Emerson Network Power, Delta Power Solutions, Huawei Technologies Co. Ltd, Schneider Electric SE, General Electric, Gamatronic Electronic Industries Ltd, and others. This implies that the market concentration is low.

- July 2023 - ABB Ltd announced the launch of MegaFlex DPA (Decentralized Parallel Architecture) UPS solutions in India. ABB's MegaFlex UPS line is aimed at the UL and IEC markets, with a power range of 1.6 and 1.5 MW. The MegaFlex solution provides exceptional availability and dependability while having the smallest footprint on the market, with the IEC version being up to 45 percent less than competitor products of the same power rating.

- July 2023 - Schneider Electric has introduced Easy UPS 3-Phase Modular. This robust uninterruptible power supply (UPS) is designed to protect critical loads while offering third-party verified Live Swap functionality. Easy UPS 3-Phase Modular available in 50-250 kW capacity with N+1 scalable configuration and supports the EcoStruxureTM architecture, which offers remote monitoring services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High growth in Colocation and Cloud Services

- 5.1.2 Low Cost of Ownership and Operations

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness Amongst Non-data Center Applications

6 MARKET SEGMENTATION

- 6.1 By Power Capacities

- 6.1.1 0 - 50 kVA

- 6.1.2 51 - 100 kVA

- 6.1.3 101 - 300 kVA

- 6.1.4 301- Above kVA

- 6.2 By End User

- 6.2.1 Data Centers

- 6.2.2 Industrial

- 6.2.3 Telecommunication

- 6.2.4 Commercial

- 6.2.5 BFSI

- 6.2.6 Government/Infrastructure

- 6.2.7 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 France

- 6.3.2.3 Germany

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Emerson Network Power

- 7.1.3 Huawei Technologies Co. Ltd

- 7.1.4 Schneider Electric SE

- 7.1.5 General Electric

- 7.1.6 Delta Electronics Inc.

- 7.1.7 AEG Power Solutions

- 7.1.8 Riello Elettronica Group

- 7.1.9 Eaton Corporation