|

市場調查報告書

商品編碼

1639380

管包裝:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Tube Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

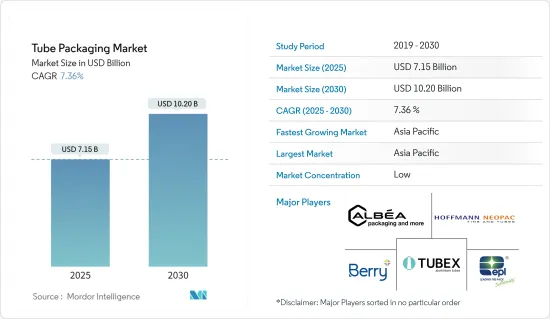

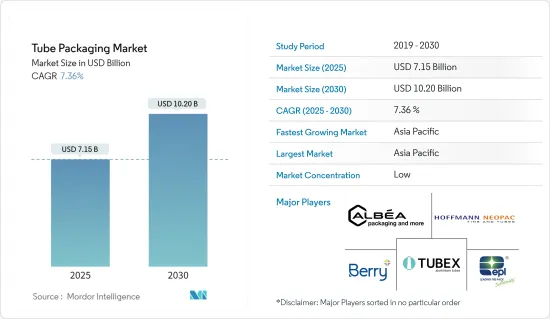

管包裝市場規模預計在 2025 年為 71.5 億美元,預計到 2030 年將達到 102 億美元,預測期內(2025-2030 年)的複合年成長率為 7.36%。

主要亮點

- 管包裝因其方便用戶使用的設計、便攜性以及產品存儲和分配的多功能性而成為化妝品和個人護理領域的熱門包裝選擇。受都市化、千禧世代人口激增和可支配收入增加的推動,軟管包裝市場呈現上升趨勢。隨著都市區的發展,人們對化妝品的認知和可及性正在提高。城市發展加上可支配收入的增加為市場參與者提供了有利可圖的機會,大大增加了對管包裝的需求。

- 目前,具有先進多層阻隔結構的積層軟管佔據市場主導地位。其優異的阻擋性能不僅延長了產品的保存期限,還能阻擋氧氣、光線和細菌,推動了日益成長的需求。

- 全球軟管包裝領域的需求正在快速成長,尤其是口腔清潔用品領域。隨著大眾對口腔衛生重要性的認知不斷提高,牙科護理的費用也上升。這些日益成長的擔憂以及不斷變化的生活方式正在推動全球管包裝市場的成長,並刺激對專業口腔護理產品的需求。

- 此外,化妝品包裝行業正在經歷技術復興,並專注於改善用戶體驗。整合刷子、海綿頭、帶泵的管子和其他新穎的施用器等創新正在推動這一需求。

- 然而,軟管包裝市場受到嚴格法規的困擾。雖然這些法規優先考慮產品安全和環境永續性,但它們也會影響製造流程、材料選擇和市場的整體成長軌跡。遵守這些法規通常需要在研發方面進行大量投資,這會增加管包裝製造商的生產成本。

軟管包裝市場趨勢

塑膠管正在徹底改變各行各業的現代包裝

- 塑膠管用於各種行業,包括化妝品、個人護理、食品和製藥。減少運輸成本和能源浪費,確保產品安全並延長保存期限。此外,它每次擠壓後都能恢復原狀的能力以及其奢華的外觀進一步刺激了市場需求。

- 積層軟管包裝正成為塑膠包裝的主流趨勢。該管由多層層壓箔製成,其外層和內層之間有一個整合的塑膠屏障。它們迅速走紅的主要原因是其具有保濕等功能,從而保護了產品的完整性。這使得它成為化妝品包裝的主要成分,尤其是護膚品。

- 亞洲國家,尤其是中國和印度對積層軟管的需求日益增加。這些管子用於包裝各種產品,從藥品和口腔保健用品到食品、化學品和化妝品。在印度,都市化、可支配收入的增加和有組織的零售業的擴張正在推動化妝品消費的激增,進一步推動了對永續管包裝的需求。

- 口腔衛生對整體健康至關重要,良好的習慣可以預防許多牙齒問題。人們對牙齒健康的認知不斷提高、牙齒問題日益增多以及口腔護理治療的重要性不斷提高,推動了口腔護理管市場的發展。

- 為了追求環境的永續性,口腔護理品牌優先使用再生和可再生塑膠。高露潔棕欖邁出了重要一步,已將其全球約 60% 的牙膏 SKU 轉換為可回收管。高露潔牙膏銷量佔據全球牙膏市場的 41% 的絕對佔有率,將對管包裝市場產生影響。根據該公司的年度報告,口腔、個人和家庭護理部門的銷售額預計將從 2022 年的 38.2 億美元增加到 2023 年的 39.3 億美元。

- 此外,印度領先的草藥和阿育吠陀品牌(如 Ayurveda、Dabur、Himalaya 和 Patanjali)正在透過 Babool 和 Dant Kranti 等熱門產品線來多樣化其產品線,從而進一步推動了對積層軟管的需求。如此。

亞洲化妝品市場不斷成長,推動創新軟管包裝解決方案的需求

- 隨著亞洲人民生活方式和生活水準的提高,健康和衛生意識的增強,對化妝品和藥品的需求顯著增加。

- 在該國,軟管包裝的需求主要來自化妝品和個人護理領域。管包裝的多功能性和便利性使其成為從乳霜、乳液到凝膠等各種產品的理想選擇。軟管不僅可以確保準確分配並保護產品免受污染,還可以增強貨架吸引力,使其成為許多化妝品品牌的首選。

- 此外,獨立經營美容產業對環保包裝解決方案的需求日益成長。這一趨勢很大程度上是由具有環保意識的消費者積極尋求永續的替代品所推動的。因此,許多獨立美容品牌開始轉向生物分解性、可回收或可再填充的管狀產品,力求滿足消費者的偏好並減輕對環境的影響。

- 除了其他優點之外,由於節省成本和卓越的阻隔保護作用,積層軟管正在國內化妝品和醫藥行業逐漸取代塑膠和鋁。同時,鋁管的阻隔性加上增強的功能性正在推動製藥和個人護理領域的需求。

- 根據中國國家統計局的資料,預計2023年中國化妝品零售額將達到約585.4億美元,高於2022年的556.3億美元。

- 化妝品收益的增加可能會刺激公司投資先進的包裝解決方案。這些投資可能會帶來管包裝材料的進步、創新設計和增強的功能,從而提高化妝品行業的整體包裝品質。

軟管包裝產業概況

軟管包裝市場較為分散,眾多參與者爭奪主導地位。隨著新進入者即將進入市場,競爭預計將進一步加劇。作為回應,現有參與者擴大轉向強力的競爭策略,強調技術創新、策略收購和高度重視研發。其他主要企業包括 Berry Global Inc.、EPL Limited (Essel Propack Limited)、Hoffmann Neopac AG、Albea SA、Tubex Aluminium Tubes、CTLpack group slu 和 Amcor plc。

- 2024 年 10 月 Hoffmann Neopac AG 在米蘭 CPHI 上展示了其最新創新:Polyfoil® 單材料阻隔 (MMB) 迷你管。新型 Polyfoil® MMB Mini 管為需要強阻隔性的產品(包括精選藥品、牙科和眼科製劑)提供了無鋁包裝替代品。這種緊湊型管不僅擴展了 Neopac 的高阻隔單一材料解決方案組合,也代表了永續高阻隔包裝技術領域的重大飛躍。

- 2024 年 1 月,高階護膚和化妝品公司 Groupe Clarins 與化妝品管供應商 Albea Tubes 合作,推出了一種名為 EcoLittle Top 的新型環保樣品包裝解決方案。嬌韻詩集團旨在透過推出 EcoLittle Top 來升級其樣品管,這是 Alvear 樣品管 EcoTop 系列的最新成員。這種尖端設計消除了一個部件,使整個管的重量減少了 47%。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 生態系分析

- 行業標準和法規

- 技術展望

- 進出口分析

- 原料分析

第5章 市場動態

- 市場促進因素

- 軟包裝趨勢推動軟管包裝市場成長

- 方便包裝需求不斷成長

- 市場挑戰

- 包裝業監管

第6章 市場細分

- 依封裝類型

- 擠

- 捻

- 其他封裝類型

- 按材質

- 塑膠

- 紙板

- 鋁

- 按應用

- 化妝品和洗護用品

- 醫療保健和製藥

- 食物

- 居家護理

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 北美洲

第7章 競爭格局

- 公司簡介

- Amcor plc

- Berry Global Inc.

- EPL Limited(Essel Propack Limited)

- Hoffmann Neopac AG

- CCL Industries Inc.

- Precision Concepts International

- Albea SA

- HCT Group

- Tubex Aluminium Tubes

- E2Global Inc.

- Global Tube spa

- CTLpack group slu

第8章投資分析

第9章 市場機會與未來趨勢

The Tube Packaging Market size is estimated at USD 7.15 billion in 2025, and is expected to reach USD 10.20 billion by 2030, at a CAGR of 7.36% during the forecast period (2025-2030).

Key Highlights

- Tubes have become a prevalent packaging choice in the cosmetics and personal care sector, due to their user-friendly design, portability, and versatility in storing and dispensing products. The tube packaging market is on an upward trajectory, fueled by urbanization, a burgeoning millennial demographic, and rising disposable incomes. As urban areas evolve, there is heightened awareness and accessibility to cosmetic products. Coupled with increased disposable income, this urban development presents lucrative opportunities for market players, significantly amplifying the demand for tube packaging.

- Laminated tubes, with their advanced multi-layered barrier structure, currently dominate the market. Their superior barrier properties not only extend product shelf-life but also shield against oxygen, light, and bacteria, driving their heightened demand.

- The global tube packaging sector is witnessing a surge in demand, particularly from the oral care segment. As public awareness of oral hygiene's significance rises, so do dental care costs. These heightened concerns, alongside evolving lifestyles, are propelling the tube packaging market's global growth and spurring demand for specialized oral care products.

- Furthermore, the cosmetic packaging sector is undergoing a technological renaissance, with a pronounced focus on elevating user experience. Innovations like integrated brushes, sponge heads, pump-equipped tubes, and other novel applicators are fueling this demand.

- However, the tube packaging market grapples with stringent regulations. While these regulations prioritize product safety and environmental sustainability, they also influence manufacturing processes, material choices, and the market's overall growth trajectory. Adhering to these regulations often necessitates hefty investments in research and development, which can escalate production costs for tube packaging producers.

Tube Packaging Market Trends

Plastic Tubes are Revolutionizing Modern Packaging across Various Industries

- Plastic tubes are used in diverse industries, including cosmetics, personal care, food, and pharmaceuticals. They reduce transportation costs and energy waste, ensure product safety, and extend shelf life. Additionally, their ability to return to shape after each squeeze and a premium appearance further fuel their market demand.

- Laminated tube packaging is emerging as a dominant trend in plastic packaging. Manufactured from multi-layer laminate foil, these tubes boast integrated plastic barriers between the outer and inner layers. Their surge in popularity is mainly due to features like moisture retention, which safeguard product integrity. This makes them a staple in cosmetic packaging, especially for skincare items.

- Asian nations, particularly China and India, are witnessing a rising demand for laminated tubes. These tubes are being utilized for packaging a spectrum of products, from pharmaceuticals and oral care items to food, chemicals, and cosmetics. In India, urbanization, increasing disposable incomes, and the expansion of organized retail drive a surge in cosmetic consumption, further amplifying the demand for sustainable tube packaging.

- Oral hygiene is paramount for overall health, with good practices preventing numerous dental issues. The oral care tube market is witnessing a boost, driven by heightened awareness of dental health, rising dental problems, and the importance of oral care therapies.

- In a bid for environmental sustainability, oral care brands prioritise using recycled or renewable plastics. Taking a significant step, Colgate-Palmolive Company has transitioned about 60% of its global toothpaste SKUs to recyclable tubes. Holding a dominant 41% share of the worldwide toothpaste market, Colgate's rising sales in toothpaste are poised to influence the tube packaging market. Their annual report shows that their oral, personal, and home care segment saw a revenue uptick from USD 3.82 billion in 2022 to USD 3.93 billion in 2023.

- Additionally, leading Herbal and Ayurvedic brands in India, such as Ayurveda, Dabur, Himalaya, and Patanjali, are diversifying their product lines with popular variants like Babool and Dant Kranti, further driving the demand for laminated tubes.

Asia's Rising Cosmetic Market Fuels Demand for Innovative Tube Packaging Solutions

- As the Asian population elevates its lifestyle and living standards, there's a notable surge in the demand for cosmetic and pharmaceutical products, driven by heightened awareness of health and hygiene.

- In the country, the demand for tube packaging is predominantly driven by the cosmetics and personal care sector. The versatility and convenience of tube packaging make it ideal for a variety of products, from creams and lotions to gels. Tubes not only ensure precise dispensing and protect products from contamination but also enhance shelf appeal, solidifying their status as a favored choice among numerous cosmetic brands.

- Furthermore, the independently owned and operated company (indie) beauty segment is witnessing a growing demand for eco-friendly packaging solutions. This trend is largely attributed to environmentally conscious consumers actively seeking sustainable alternatives. Consequently, many indie beauty brands are turning to biodegradable, recyclable, or refillable tube options, aiming to resonate with these consumer preferences and mitigate their environmental footprint.

- Additionally, while the personal care industry holds a significant share of the end-use market for laminated tubes, there's a notable trend: laminate tubes, prized for their cost-saving benefits and superior barrier protection, are poised to gradually supplant plastic and aluminum in the country's cosmetics and pharmaceutical sectors. Meanwhile, the high barrier properties of aluminum tubes, coupled with enhancements, are boosting demand in both the pharma and personal care segments.

- Data from the National Bureau of Statistics of China reveals that in 2023, China's retail sales of cosmetics reached approximately USD 58.54 billion, marking an uptick from USD 55.63 billion in 2022.

- This uptick in cosmetics revenue could spur companies to channel investments into pioneering packaging solutions. Such investments might lead to advancements in tube packaging materials, innovative designs, and enhanced functionalities, thereby elevating the overall packaging quality in the cosmetics sector.

Tube Packaging Industry Overview

The tube packaging market is fragmented, with numerous players vying for dominance. The anticipated entry of new players is set to heighten this competition. In response, established players are increasingly turning to robust competitive strategies, emphasizing innovation, strategic acquisitions, and a pronounced focus on R&D. Notable players in this arena include Berry Global Inc., EPL Limited (Essel Propack Limited), Hoffmann Neopac AG, Albea S.A., Tubex Aluminium Tubes, CTLpack group s.l.u, Amcor plc, and others.

- October 2024: At CPHI Milan, Hoffmann Neopac AG launched its latest innovation: the Polyfoil(R) Mono-Material Barrier (MMB) Mini tubes. These new Polyfoil(R) MMB Mini tubes offer an aluminum-free packaging alternative, catering to products that demand robust barrier properties, including select pharmaceutical, dental, and ophthalmic formulations. These compact tubes not only broaden Neopac's esteemed portfolio of high-barrier mono-material solutions but also mark a notable leap forward in the realm of sustainable high-barrier packaging technology.

- January 2024: Groupe Clarins, a luxury skincare and cosmetics firm, has partnered with Albea Tubes, a supplier of cosmetic tubes, to introduce a new eco-friendly sample packaging solution called EcoLittle Top. Groupe Clarins aims to upgrade its sample tubes by incorporating the EcoLittle Top, the newest addition from Albea Tubes' EcoTop collection. This cutting-edge design eliminates one component, resulting in a 47% reduction in the tube's overall weight.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

- 4.4 Industry Standards & Regulations

- 4.5 Technology Outlook

- 4.6 Import-Export Analysis

- 4.7 Raw Material Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Flexible Packaging Trend Propels Tube Packaging Market Growth

- 5.1.2 Increasing Demand for Convenience Packaging

- 5.2 Market Challenges

- 5.2.1 Regulations in the Packaging Industry

6 MARKET SEGMENTATION

- 6.1 By Type of Package

- 6.1.1 Squeeze

- 6.1.2 Twist

- 6.1.3 Other Type of Package

- 6.2 By Material

- 6.2.1 Plastic

- 6.2.2 Paperboard

- 6.2.3 Aluminum

- 6.3 By Application

- 6.3.1 Cosmetics & Toiletries

- 6.3.2 Healthcare & Pharmaceutical

- 6.3.3 Food

- 6.3.4 Homecare

- 6.3.5 Other Application

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Argentina

- 6.4.5.3 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor plc

- 7.1.2 Berry Global Inc.

- 7.1.3 EPL Limited (Essel Propack Limited)

- 7.1.4 Hoffmann Neopac AG

- 7.1.5 CCL Industries Inc.

- 7.1.6 Precision Concepts International

- 7.1.7 Albea S.A.

- 7.1.8 HCT Group

- 7.1.9 Tubex Aluminium Tubes

- 7.1.10 E2Global Inc.

- 7.1.11 Global Tube s.p.a.

- 7.1.12 CTLpack group s.l.u