|

市場調查報告書

商品編碼

1639389

紡織化學品:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Textile Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

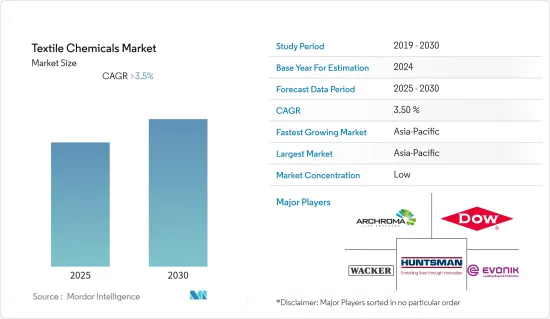

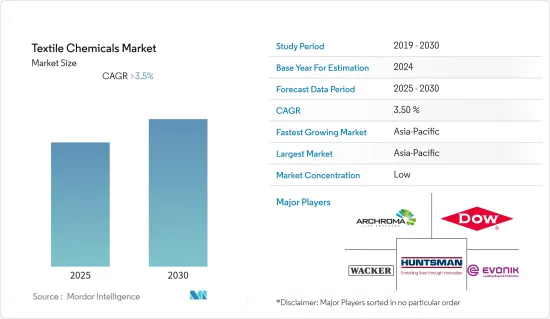

預測期內,紡織化學品市場預計將以超過 3.5% 的複合年成長率成長。

2020年和2021年上半年COVID-19疫情的零星爆發導致政府採取禁令和限制措施,嚴重抑制了紡織業活動,並限制了紡織化學品市場的成長。由於原料供應稀缺、工作時間/資金實力有限以及資金限制阻止了向下游紡織業的委託流動,紡織化學品行業陷入癱瘓。此外,由於人們被困在家中,對紡織品的需求急劇下降。然而,自2021年中疫情消退以來,各行各業已步入復甦軌道。 2022年,家居、工業和運動服裝紡織產品的需求預計將復甦,從而導致紡織品合約復甦和紡織化學品下游消費增加,從而重新激發市場相關人員的興趣。

主要亮點

- 從中期來看,新興經濟體紡織品產量的強勁成長以及對工業紡織品的需求不斷成長是推動該市場成長的關鍵因素。

- 另一方面,紡織染整產業的不利環境影響預計將在預測期內抑制該產業的成長。

- 然而,智慧紡織品的持續研發活動以及在紡織品製造中使用低 VOC 和生物分解性材料的日益成長的需求,在不久的將來為全球市場創造了豐厚的成長機會。

- 預計亞太地區將成為最大的紡織化學品市場,並預計在預測期內實現最高的複合年成長率。亞太地區佔據主導地位的原因是中國和印度等發展中經濟體對服裝、家居、工業和汽車紡織應用領域的紡織化學品需求旺盛。

紡織化學品市場趨勢

服裝應用佔市場主導地位

- 服飾是人類的基本需求之一。服裝部門包括經濟服飾、辦公服裝、商務服飾、運動服裝和奢侈品等各種產品。紡織化學品用於服裝生產的每個階段,從纖維製造、漂白、染色、在織物上印刷圖案等,並且在服裝領域非常受歡迎。

- 服裝生產中使用各種各樣的化學品,包括穩定劑、染料、黏合劑、柔軟劑、勻染劑、絲光劑等。整理化學品在服裝設計和開發中也具有很高的滲透率,以滿足特定的最終用途要求。例如,抗菌和防塵性能對於運動服來說非常重要。同樣,抗皺家居和商務服飾(透過與木糖醇檸檬酸鹽交聯實現)在高所得服飾中變得越來越普遍。

- 由於創新設計的不斷發展、獲得優選時尚選擇的機會不斷增多以及紡織行業參與者採用了卓越的行銷策略,當代服裝行業正呈現高速成長趨勢。網路和電子商務的普及使得消費者更加重視時尚,更容易接觸到高階品牌和限量版產品。服裝業的進化壓力正透過刺激消費使紡織化學品市場受益。

- 此外,服飾是一些國家的重要出口商品。根據國際勞工組織(ILO)的數據,全球服飾出口的60%以上來自新興國家,其中亞太地區佔32%。中國海關總署數據顯示,作為亞太地區最大的服飾市場,服飾出口成長17.35%,至1,893.5億美元。

- 同時,儘管人事費用和原料成本高昂,但美國的時尚和服飾仍然蓬勃發展。全國時裝設計師企業總數較去年同期成長了5%左右。此外,該國多年來一直在加強服飾貿易,2021 年出口額達 850.7 億美元(根據美國商務部和 OTEXA 報告),比 2020 年的服裝出口成長 21.07%。

- 服裝貿易的成長和時尚趨勢的上升是引發紡織化學品大量消費的關鍵因素,預計將在預測期內刺激研究市場的需求成長。

亞太地區可望主導市場

- 由於中國、印度、孟加拉和越南等國家擁有成熟的下游紡織製造業,亞太地區在全球紡織化學品市場中佔據主導地位。廉價勞動力和低生產成本支撐了這些國家紡織業的成長。

- 此外,消費者對價格實惠且舒適的服飾的看法發生變化,以及工業和汽車製造業的擴張,正在推動該地區對高價值和功能性布料的需求。

- 中國是世界上最大的紡織品生產國和出口國。中國工業與資訊化部資料顯示,2022年1-9月,中國紡織業持續保持平穩擴張態勢。中國主要紡織企業營業收入達3.86兆元(5,700億美元),比去年同期成長3.1%。

- 中國的人口結構支持了時尚、職業服裝和運動服裝的強勁銷售勢頭。該國的可支配收入一直在上升,導致過去歷史時期服飾平均支出激增。到2022年,約60%的中國消費者將從國內服飾品牌購買時尚服飾。

- 根據IBEF預測,到2025-2026年,印度紡織服裝產業規模將達到1,900億美元。印度佔全球紡織品和服裝貿易的佔有率為4%。印度22會計年度的紡織品和服裝出口額為444億美元,與前一年同期比較成長了41%,幅度驚人。

- 由於政府積極實施國家綜合紡織園區(SITP)和技能升級基金計劃等計劃,印度紡織業正經歷巨大的轉變。此外,預計到 2025 年,各種天然和合成纖維及紗線的供應將吸引 1,200 億美元的外國投資。

- 因此,紡織業的投資增加和進步預計將有利於紡織製造業,從而推動研究市場的成長。

紡織化學品產業概況

紡織化學品市場較為分散,既有國際參與者,也有國內參與者。市場的主要企業(不分先後順序)包括 Archroma、Huntsman International LLC、Dow、Wacker Chemie AG 和 Evonik Industries AG。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 新興經濟體紡織品產量強勁成長

- 技術紡織品需求不斷成長

- 限制因素

- 紡織印染加工業造成的環境污染

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 按類型

- 塗料和施膠化學品

- 著色劑和助劑

- 整理加工劑

- 退漿劑

- 其他類型(線潤滑劑、漂白水等)

- 按應用

- 服飾

- 家居佈置

- 汽車用紡織品

- 技術紡織品

- 其他用途(醫用紡織品、運動紡織品等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Achitex Minerva SpA

- Archroma

- Arkema Group

- Chemipol(Kothari Group Of Industries)

- CHT Group

- Covestro AG

- Croda International PLC

- Dow

- Evonik Industries AG

- Formosa Organic Chemical Industry Co. Ltd

- Giovanni Bozzetto SpA

- Huntsman International LLC

- Kemira Oyj

- K-tech(India)Limited

- LN Chemical Industries

- Kiri Industries Ltd

- Nouryon

- Rudolf GmbH

- Sarex

- Tanatex Chemicals BV

- The Lubrizol Corporation

- Wacker Chemie AG

第7章 市場機會與未來趨勢

- 在智慧紡織品領域持續研發

- 紡織品製造對低 VOC 和生物分解性材料的需求不斷增加

The Textile Chemicals Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The sporadic outbreak of the COVID-19 pandemic in 2020 and the first half of 2021 drastically curtailed textile industry activities due to imposed government bans and restrictions, thereby limiting the growth of the textile chemicals market. The textile chemical sector was paralyzed owing to scarce raw material supply, limited working hours/labor strength, and constrained financials, which halted the consignment flow to the downstream textile industry. Furthermore, the demand for textiles dropped drastically as people were confined to staying in their houses. However, the industries have been on track for recovery since the pandemic's retraction in mid-2021. The demand for home, industrial, and sportswear textiles rebounded in 2022, reinstating textile contracts which increased the downstream consumption of textile chemicals and revived the interests of market players.

Key Highlights

- Over the medium term, the robust growth in textile production in developing economies and the growing demand for industrial textiles are the major driving factors augmenting the growth of the market studied.

- On the flip side, the environmental harm caused by textile dyeing and finishing activities is anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the ongoing research and development activities in smart textiles and the growing urge to use low VOC and biodegradable materials for textile manufacturing will likely create lucrative growth opportunities for the global market soon.

- Asia-Pacific emerged as the largest market for textile chemicals and is expected to witness the highest CAGR during the forecast period. This dominance of Asia-Pacific is attributed to the bullish demand for textile chemicals in apparel, home furnishing, industrial, and automotive textile applications in growing economies like China and India.

Textile Chemicals Market Trends

Apparel Application to Dominate the Market

- Apparel is one of the fundamental needs of a human being. The apparel segment encompasses a diverse range of value clothing, office, and business clothing, sportswear, and statement luxury pieces. Textile chemicals are hugely popular in the apparel segment, where they are used at every stage of apparel production, starting from fiber manufacturing, bleaching, dyeing, and printing designs on fabrics.

- An extensive array of chemicals classified under stabilizers, dyes, binders, softeners, leveling agents, mercerizing agents, etc., are used in apparel production. Finishing chemicals are also finding high penetration in apparel design and development to address specific requirements of the intended end use. For instance, in sportswear, antibacterial and dust-repellent clothing are gaining high importance. Similarly, wrinkle-resistant home clothing and businesswear (obtained from crosslinking with citric acid xylitol) are becoming common among the upper-middle income population.

- The modern-day apparel industry is witnessing high growth trends owing to the development of innovative designs, growing accessibility to preferable fashion choices, and the adoption of good marketing strategies by textile industry players. The increased exposure to the internet and e-commerce among consumers has improved the fashion consciousness and availability of high-end brands and limited-edition products. The evolutionary pressure from the apparel segment benefits the textile chemical market by boosting their consumption.

- Furthermore, clothing is a crucial export commodity in several countries. According to the International Labour Organization, more than 60% of the world's clothing exports are manufactured in developing countries, with Asia-Pacific accounting for 32% of the share. China, the biggest apparel market in the Asia-Pacific region, registered a 17.35% hike in garment export shipments valued at USD 189.35 billion in the first seven months of 2022, as per the General Administration of Customs China.

- On the other hand, the United States boasts a thriving fashion and clothing industry despite costly labor and raw material. The country witnessed around a 5% y-o-y increase in the total number of fashion designer businesses. Furthermore, the country has strengthened its clothing trade over the years, closing the year 2021 with USD 85,007 million export value (revealed by the US Department of Commerce and OTEXA), up by 21.07% from the apparel export value obtained in 2020.

- The increase in apparel trade and growing fashion trends are significant factors that are expected to trigger large volume consumption of textile chemicals, thus fueling the growth in the demand for the studied market during the forecast period.

Asia-Pacific Region Expected to Dominate the Market

- The Asia-Pacific region dominates the global textile chemicals market owing to the presence of matured downstream textile manufacturing industries in countries like China, India, Bangladesh, and Vietnam. The availability of cheap labor and low production cost back the growth of the textile industry in these countries.

- Furthermore, the shift in consumer perception of affordable and comfortable clothing, as well as the expanding industrial and automotive manufacturing industries increase the demand for high-value and functional fabrics in the region.

- China owns the world's largest textile industry in terms of both production and export volumes. China's textile industry continued steady expansion in the first nine months of 2022, according to data from the country's Ministry of Industry and Information Technology. The combined operating revenue of major textile enterprises in China rose by 3.1% y-o-y reaching CNY 3.86 trillion (USD 570 billion) in that period.

- China's demographics support the attractive sales of fashion, professional and athletic apparel. The country's rising disposable income has resulted in a surge in average expenditure on clothes in the historical period. In 2022, around 60% of Chinese consumers purchased fashion apparel from domestic clothing brands.

- According to IBEF, the Indian textile and apparel industry is estimated to reach USD 190 billion by 2025-2026. India has a 4% share of the global trade in textiles and apparel. In FY 2022, India's textile and apparel exports amounted to USD 44.4 billion, registering a whopping 41% y-o-y increase.

- India's textile industry is undergoing a massive turnaround with the active enforcement of schemes such as Integrated Textile Parks (SITP) and the Technology Upgradation Fund Scheme by the government. Further, the country is expecting to attract USD 120 billion worth of foreign investments by 2025 supported by the availability of diverse natural and synthetic fibers and yarns.

- Thus, the rising investments and advancements in the textile industry are projected to benefit the textile manufacturing sector, thereby propelling the growth of the market studied.

Textile Chemicals Industry Overview

The textile chemicals market is fragmented, with both international and domestic companies. Some of the major players in the market (in no particular order) include Archroma, Huntsman International LLC, Dow, Wacker Chemie AG, and Evonik Industries AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Robust Growth in Textile Production in Developing Economies

- 4.1.2 Growing Demand for Industrial Textiles

- 4.2 Restraints

- 4.2.1 Environmental Pollution Caused by the Textile Dyeing and Finishing Industry

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Coating and Sizing Chemicals

- 5.1.2 Colorants and Auxiliaries

- 5.1.3 Finishing Agents

- 5.1.4 Desizing Agents

- 5.1.5 Other Types (Yarn Lubricant, Bleaching Agents, etc.)

- 5.2 Application

- 5.2.1 Apparel

- 5.2.2 Home Furnishing

- 5.2.3 Automotive Textile

- 5.2.4 Industrial Textile

- 5.2.5 Other Applications (Medical Textiles, Sports Textiles, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Achitex Minerva SpA

- 6.4.2 Archroma

- 6.4.3 Arkema Group

- 6.4.4 Chemipol (Kothari Group Of Industries)

- 6.4.5 CHT Group

- 6.4.6 Covestro AG

- 6.4.7 Croda International PLC

- 6.4.8 Dow

- 6.4.9 Evonik Industries AG

- 6.4.10 Formosa Organic Chemical Industry Co. Ltd

- 6.4.11 Giovanni Bozzetto SpA

- 6.4.12 Huntsman International LLC

- 6.4.13 Kemira Oyj

- 6.4.14 K-tech (India) Limited

- 6.4.15 L. N. Chemical Industries

- 6.4.16 Kiri Industries Ltd

- 6.4.17 Nouryon

- 6.4.18 Rudolf GmbH

- 6.4.19 Sarex

- 6.4.20 Tanatex Chemicals BV

- 6.4.21 The Lubrizol Corporation

- 6.4.22 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research and Development in the Field of Smart Textiles

- 7.2 Growth in Demand for Low VOC and Biodegradable Materials for Textile Manufacturing