|

市場調查報告書

商品編碼

1639403

充電電池:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Secondary Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

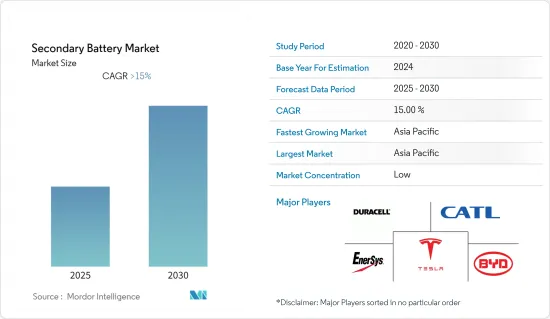

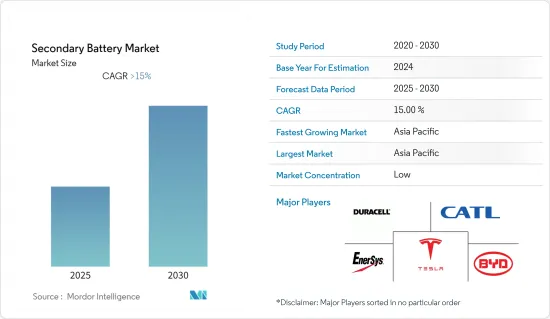

預計二次電池市場在預測期內複合年成長率將超過15%。

2020 年市場受到 COVID-19 的負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從中期來看,鋰離子電池價格的下降和電動車的普及將是推動市場的主要因素。

- 另一方面,原料供需之間的不匹配可能會阻礙市場成長。

- 新型先進電池化學材料的開發預計將為整個二次電池市場創造重大機會。

- 亞太地區預計將成為最大的市場,大部分需求來自中國、日本和印度。

二次電池市場趨勢

鋰離子電池技術主導市場

- 在各種類型的電池技術中,鋰離子電池(LIB)預計將在預測期下半年主導二次電池市場,這主要是由於其有利的容量重量比。此外,推動鋰離子電池採用的關鍵因素包括提高效能、提高能量密度和降低價格。

- 由於能量密度高,鋰離子電池的價格已從2013年的668美元/kWh大幅下降至2021年的123美元/kWh,成為所有電池中的熱門選擇。

- 鋰離子電池傳統上用於家用電子電器,例如行動電話、筆記型電腦和個人電腦。然而,由於電動車不排放任何二氧化碳或氮氧化物等溫室氣體,且對環境的影響較小,因此其設計經過修改,可用作混合動力汽車和全電動汽車(EV)的動力源。得越來越多。

- LIB 的製造工廠主要位於亞太地區、北美和歐洲。比亞迪有限公司和 LG 化學有限公司等主要市場參與企業計劃在亞太地區(主要是印度、中國和韓國)建立新的製造工廠。

- 因此,由於這些因素,鋰離子電池技術預計將在預測期內主導二次電池市場。

亞太地區主導市場

- 亞太地區擁有豐富的自然資源和人力資源,中國和印度將受益於政府對可再生能源和電動車的政策支持,以及不斷成長的中產階級人口的家用電子電器的創造。幾年二次電池企業的主要投資熱點。

- 在印度,隨著政府推廣電動車,當地電池生產正在迅速增加。印度政府的目標是到2030年將電動車的普及率提高30%,並正在製定實現這一目標的措施和方案。例如,政府將在2021年修訂目前正在實施的FAME-II(電動車快速採用和製造-II)計劃,旨在降低電動車的補貼率,以縮小汽油與電動車之間的差距。和電動車從120 印度盧比/千瓦時增加到180 印度盧比/千瓦時。

- 中國是最大的電動車市場,電動車銷量超過330萬輛,2021年約佔全球電動車銷量的16%。預計它將繼續成為全球最大的電動車市場。充電基礎設施的發展進一步支持了電動車在該國的普及。除了電動車之外,由於通訊服務的日益普及,對二次電池的需求也很高。

- 同樣,隨著 2020 年日本推出 5G 服務,隨著更多用戶可能在預測期內遷移到 5G,對 5G 塔和可充電電池的需求將激增。

- 因此,由於這些因素,亞太地區很可能在預測期內主導二次電池市場。

充電電池產業概況

二次電池市場高度細分。主要參與企業包括當代新能源科技有限公司、比亞迪、金霸王公司、EnerSys公司和特斯拉公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2027年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 2027 年按主要技術類型分類的電池/原料價格趨勢和預測(以美元/千瓦時或美元/噸為單位)

- 截至2020年國際貿易統計(進出口資料)(單位:百萬美元,依主要技術類型,依主要國家)

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 技術部分

- 鉛酸電池

- 鋰離子電池

- 其他技術(NiMh、NiCD 等)

- 目的

- 汽車電池(HEV、PHEV、EV)

- 工業電池(用於電源、固定電池(電信、UPS、能源儲存系統(ESS) 等)

- 可攜式電池(家用電子電器產品等)

- 其他用途(電動工具電池、SLI電池等)

- 地區

- 北美洲

- 亞太地區

- 歐洲

- 南美洲

- 中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Co. Ltd

- Contemporary Amperex Technology Co. Limited

- Duracell Inc.

- EnerSys

- GS Yuasa Corporation

- Clarios

- LG Chem Ltd

- Panasonic Corporation

- Saft Groupe SA

- Samsung SDI Co. Ltd

- Showa Denko KK

- Tesla Inc.

- TianJin Lishen Battery Joint-Stock Co. Ltd

第7章市場機會與未來趨勢

簡介目錄

Product Code: 49322

The Secondary Battery Market is expected to register a CAGR of greater than 15% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, declining lithium-ion battery prices and increasing adoption of electric vehicles are likely to be the major factors driving the market.

- On the other hand, the demand-supply mismatch of raw materials is likely to hinder the market's growth.

- Developing new and advanced battery chemistries will likely create immense opportunities for the overall secondary battery market.

- Asia-Pacific is expected to be the largest market, with the majority of the demand coming from China, Japan, and India.

Secondary Battery Market Trends

Lithium-ion Battery Technology to Dominate the Market

- Among different types of battery technologies, lithium-ion battery (LIB) is expected to dominate the secondary battery market in the latter part of the forecast period, majorly due to its favorable capacity-to-weight ratio. Also, other factors that play an important role in boosting the LIB adoption include better performance, higher energy density, and decreasing price.

- Due to its high energy density, the price of lithium-ion batteries decreased considerably from USD 668/kWh in 2013 to USD 123/kWh in 2021, making it a lucrative choice among all batteries.

- Lithium-ion batteries have traditionally been used in consumer electronic devices, such as mobile phones, notebooks, and PCs. However, they are increasingly being redesigned for use as the power source of choice in hybrid and the complete electric vehicle (EV) range, owing to factors such as low environmental impact, as EVs do not emit any CO2, nitrogen oxides, or any other greenhouse gases.

- LIB manufacturing facilities are majorly located in Asia-Pacific, North America, and Europe. Major market players, such as BYD Company Limited and LG Chem Ltd, have plans to set up new manufacturing facilities in the Asia-Pacific region, primarily in India, China, and South Korea.

- Therefore, based on such factors, lithium-ion battery technology is expected to dominate the secondary battery market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region has multiple growing economies with substantial natural and human resources, with China and India expected to be major investment hotspots for secondary battery companies in the coming years due to policy-level support from governments for both renewables and EVs and a growing middle-class population creating demand for consumer electronics.

- India has been witnessing a surge in manufacturing batteries locally due to the government's push toward e-mobility. The Indian government aims to achieve a 30% electric fleet by 2030 and has been formulating policies and programs to achieve the target. For example, in 2021, the government amended the ongoing FAME-II (Faster Adoption and Manufacturing of Electric Vehicles-II) scheme to increase the subsidy rate for electric vehicles from INR 120/kWh to INR 180/kWh to reduce the gap between petrol-powered two-wheelers and electric powered.

- China was the largest electric car market and sold more than 3.3 million electric vehicles, accounting for almost 16% of the global electric car sales in 2021. It is expected to remain the world's largest EV market in the future. The development of charging infrastructure is further propelling EV adoption in the country. Apart from EVs, the increasing penetration of telecommunication services indicates a high demand for secondary batteries.

- Similarly, in Japan, 5G services started in 2020, and an increasing number of subscribers are likely to switch to 5G during the forecast period, thus resulting in a surge in the demand for 5G towers and secondary batteries.

- Therefore, based on such factors, Asia-Pacific is likely to dominate the secondary battery market during the forecast period.

Secondary Battery Industry Overview

The secondary battery market is highly fragmented. Some of the major players include (in no particular order) Contemporary Amperex Technology Co. Limited, BYD Co. Ltd, Duracell Inc., EnerSys, and Tesla Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Battery/Raw Material Price Trends and Forecast (in USD per kWh or USD per metric ton), by Major Technology Type, till 2027

- 4.5 International Trade Statistics (Import/Export Data) in USD million, by Major Technology Type, by Major Countries, till 2020

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-acid Battery

- 5.1.2 Lithium-ion Battery

- 5.1.3 Other Technologies (NiMh, NiCD, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries (HEV, PHEV, and EV)

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications (Power Tools Batteries, SLI Batteries, etc.)

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Duracell Inc.

- 6.3.4 EnerSys

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Clarios

- 6.3.7 LG Chem Ltd

- 6.3.8 Panasonic Corporation

- 6.3.9 Saft Groupe SA

- 6.3.10 Samsung SDI Co. Ltd

- 6.3.11 Showa Denko KK

- 6.3.12 Tesla Inc.

- 6.3.13 TianJin Lishen Battery Joint-Stock Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219