|

市場調查報告書

商品編碼

1639409

MEMS 汽車感測器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)MEMS Automobile Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

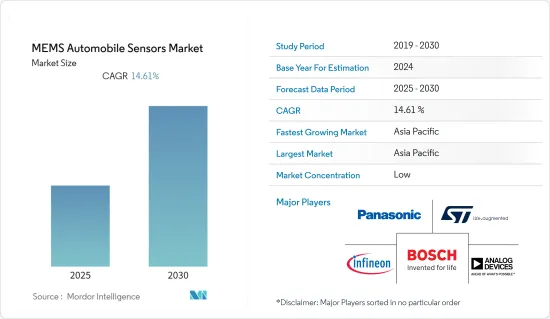

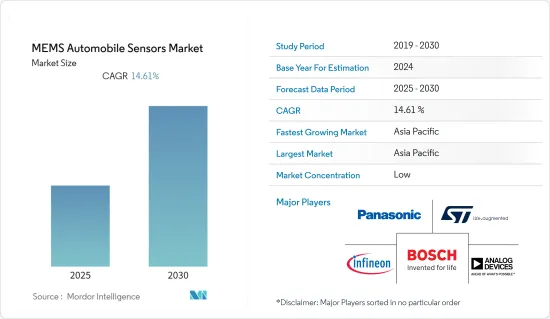

預計預測期內 MEMS 汽車感測器市場複合年成長率將達到 14.61%。

主要亮點

- MEMS感測器已成為汽車必不可少的零件。自從第一個版本作為加速計在汽車上使用以來,這種感測器技術已經取得了長足的發展,現在已成為汽車應用最突出的技術驅動力。在大多數先進的車輛中,這些靈敏的感測器不斷向汽車系統提供準確的資料,所連接的電子控制單元據此即時觸發必要的動作。

- 對車輛安全和保障的需求不斷增加是推動市場成長的主要因素之一。根據世界衛生組織 (WHO) 統計,每年有超過 150 萬人死於道路交通事故,約 5,000 萬人受傷。由於 MEMS 感測器在提高汽車安全性方面發揮關鍵作用,這些趨勢將成為市場成長的催化劑。

- 此外,電氣化和自動化是汽車產業的兩個重要趨勢。電動車(EV)在工業領域的出現極大地影響了壓力和磁感測器的需求和分佈。預計長期需求將進一步增加。電動車銷量的增加正在增加對感測器的需求。此外,汽車系統中各種定位和高價值感測模組(如雷達、LiDAR和影像處理)的整合度不斷提高,預計將在預測期內創造重大機會。

- 此外,嚴格的政府法規要求汽車製造商在主要汽車市場的新車中配備輪胎壓力監測系統 (TPMS) 和電子穩定控制 (ESC) 等安全系統,這使得 MEMS 成為安全系統使用案例背後的驅動力。感測器應用而興起。此外,各製造商正在進行多項產品創新,以抓住市場機會。例如,在 2021 年 CES 上,TDK 推出了汽車級 6 軸 ASIL-B MEMS IMU Smart Automotive IAM-20685。

- MEMS 設備的範圍從相對簡單的結構到具有由整合微電子控制的多個行動元件的極其複雜的結構。因此,該行業在複雜的製造過程中面臨各種挑戰。此外,這些感測器通常會受到高溫漂移的影響,這是一個進一步阻礙市場成長的挑戰。

- 此外,新冠疫情導致汽車需求放緩,影響了汽車零件供應鏈。從短期和中期來看,由於汽車製造商重新分配研發預算以滿足短期資本需求,疫情減緩了自動駕駛等尖端技術的發展。然而,預計預測期內,汽車產業的改善條件和成長動能將提供充足的成長機會。

MEMS 汽車感測器市場趨勢

安全氣囊展開感知器成長迅速

- MEMS 感測器在提高汽車安全性能方面發揮關鍵作用。隨著自動駕駛的進步,安全氣囊部署等安全應用對 MEMS 感測器的需求預計將翻倍。為了降低事故率,世界各國政府都在製定嚴格的法規,迫使汽車供應商在安全氣囊展開系統中採用最新的基於 MEMS 的感測器。

- 安全氣囊控制的碰撞感應是慣性 MEMS 感測器最大的汽車應用領域之一。在此應用中,加速計持續測量車輛的加速度。當預設參數超過閾值時,安全氣囊就會展開。因此,安全氣囊系統變得更加可靠和便宜,使得其幾乎普遍應用於汽車上。

- 考慮到道路交通事故發生率的不斷上升,世界各國政府都制定了嚴格的法規來鼓勵使用安全氣囊。在印度,一項要求車輛至少配備兩個安全氣囊的規定已經生效。政府提案汽車製造商在所有車型中標配六個安全氣囊,無論車身類型和型號如何。這些趨勢預計將為市場提供進一步的成長機會。

- 近年來,豪華車的銷售量大幅成長,尤其是在新興國家。由於這些汽車通常配備更多的安全氣囊,預計銷量的成長將對市場成長產生積極影響。例如,領先的豪華汽車品牌寶馬最近在全球銷售了252萬輛汽車。此外,對電動和混合動力汽車汽車的不斷成長的需求也有望對市場成長產生積極影響,因為這些汽車通常具有高水準的安全性和舒適性。

亞太地區成長速度最快

- 由於中國、印度和日本等經濟體汽車產業的快速成長,亞太地區預計將見證 MEMS 汽車感測器市場的最高成長率。例如,根據國際汽車製造商協會的數據,中國去年是世界最大汽車製造國,生產了約 2,600 萬輛汽車。以汽車年產量來看,緊接在中國之後的是美國、日本和印度。

- 中國自動駕駛和ADAS標準化進程正在加速推進。例如,去年中國政府發布了三項新的國家安全標準:《電動車安全要求》、《電動車牽引電池安全要求》和《電動公車安全要求》。這些強制性標準規定了電池組和車輛的安全要求,包括實施早期電池故障檢測機制。

- 亞太地區其他國家也正在呈現類似的趨勢。提案,今年 6 月,印度公路運輸和公路部 (MoRTH) 訂定了一套針對乘用車的規定,鼓勵汽車製造商提供先進的安全功能,提高該國生產的汽車的「出口價值」。引進名為「印度新車評估計畫(BNCAP)」的安全評估系統。

- 此外,日本和韓國等國家也迅速發展自動駕駛汽車。例如,韓國政府計劃推行完全自動駕駛,並希望在2035年,該國生產的汽車中有一半能夠實現完全自動駕駛。這些車輛需要極少的人工干預,因此感測器在其成功運作中發揮關鍵作用。因此,自動駕駛汽車產業的成長預計將進一步增加對 MEMS 感測器的需求。

MEMS 汽車感測器產業概況

MEMS 汽車感測器市場比較分散,由許多全球和區域參與者組成,例如意法半導體公司、松下公司、羅伯特博世有限公司、ADI 公司和英飛凌科技股份公司。這些參與者正致力於擴大全球基本客群。這些公司正專注於研發投資,推出新的解決方案、策略聯盟以及其他有機和無機成長策略,以在預測期內獲得競爭優勢。

2022年10月,NVIDIA與中國領先的汽車級MEMS LiDAR解決方案供應商Zvision簽署合作協議,Zvision作為該平台的關鍵LiDAR感測器合作夥伴之一加入了NVIDIA Jetson生態系統。透過協議,Zvision 計劃利用 NVIDIA 的全套軟體工具鍊和領先的 AI 晶片硬體來開發一系列基於固態 LiDAR 的自動駕駛感測器和系統。

2021年4月,義法半導體宣布推出適用於高性能汽車應用的下一代MEMS加速計-AIS2IH 3軸線性加速計。這些加速計為非安全汽車應用(例如遠端資訊處理、防盜、資訊娛樂、車輛導航和傾斜/傾角測量)帶來了更高的解析度、機械穩健性和溫度穩定性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 更加重視乘客安全以及法規和合規性

- 客戶喜歡提高自動化程度和性能

- 市場限制

- 介面設計考慮因素增加了 MEMS 感測器的實施成本

第6章 市場細分

- 按類型

- 輪胎壓力感知器

- 引擎機油感知器

- 燃燒感測器

- 燃油噴射/燃油幫浦感知器

- 安全氣囊展開感應器

- 陀螺儀

- 燃油導軌壓力感知器

- 其他類型

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 世界其他地區

- 北美洲

第7章 競爭格局

- 公司簡介

- Analog Devices Inc.

- Delphi Automotive PLC

- Denso Corporation

- General Electric Co.

- Freescale Semiconductors Ltd

- Infineon Technologies AG

- Sensata Technologies Inc.

- SiMicroelectronics NV

- Panasonic Corporation

- Liqid Inc.

- Robert Bosch GmbH

第8章投資分析

第9章 市場機會與未來趨勢

The MEMS Automobile Sensors Market is expected to register a CAGR of 14.61% during the forecast period.

Key Highlights

- MEMS sensors have become an indispensable part of vehicles. From the first versions used in motor vehicles, such as the accelerometer, this sensor technology has evolved significantly to become the most prominent technology driver for automotive applications. In most advanced vehicles, these delicate sensors continuously supply the automotive system with precise data, based on which the connected electric control units trigger necessary actions in real-time.

- The growing demand for safety and security in automobiles is one of the main factors that play a vital role in the market's growth. According to the World Health Organization, more than 1.5 million people are killed in road accidents yearly, and about 50 million people get injured. As MEMS sensors play a critical role in improving the safety features of vehicles, such trends act as catalysts for the growth of the market.

- Moreover, electrification and automation are two significant trends in the automotive industry. The emergence of electric vehicles (EVs) in the industry has dramatically impacted the demand for and distribution of pressure and magnetic sensors. It is expected to increase the demand in the long-term further. Increasing sales of electric cars are thereby increasing the demand for sensors. Furthermore, the increasing integration of various positioning and high-value sensing modules, such as RADAR, LIDAR, and imaging in automotive systems, is expected to create significant opportunities during the forecast period.

- In addition, strict government regulations encourage automotive manufacturers to include mandated safety systems, such as tire pressure monitoring systems (TPMS) and electronic stability control (ESC), in new vehicles in major automotive markets, creating new use cases for implementing MEMS sensors. Various manufacturers are also making several product innovations to grab the market's opportunities. For instance, at CES 2021, TDK announced Smart Automotive IAM-20685, an automotive grade 6-axis ASIL-B MEMS IMU.

- MEMS devices vary from a relatively simple structure to highly complex ones with multiple moving elements under the control of integrated microelectronics. Hence, the industry faces various challenges during the complex manufacturing process. Additionally, these sensors often have a more significant drift over temperature, which further challenges the growth of the market.

- Additionally, due to the COVID-19 pandemic, the demand for automotive slowed down, along with the effect on the supply chain of automotive parts. Over the short to medium term, the pandemic delayed the development of advanced technologies, such as autonomous driving, as automakers divert research budgets to fund immediate cash requirements. However, with the condition improving and the automotive sector gaining momentum, the industry is expected to offer ample growth opportunities during the forecast period.

Automobile MEMS Sensors Market Trends

Airbag Deployment Sensors to Witness a Significant Growth

- MEMS sensors play a vital role in improving the safety features of vehicles. With the evolution of autonomous driving, the demand for these sensors is expected to increase multiple-fold for safety-based applications, such as airbag deployment. To reduce accident levels, governments are framing stringent regulations, pushing automotive vendors to implement the latest MEMS-based sensors in airbag deployment systems, creating growth opportunities for the market.

- Crash sensing for airbag control is among the largest automotive application areas of inertial MEMS sensors. In this application, an accelerometer continuously measures the acceleration of the car. When the preset parameter goes beyond the threshold, the airbags are fired. The resulting increase in reliability and reduction in the price of the airbag system is further bringing about its near-universal inclusion in cars.

- Considering the growing rate of road accidents, governments across various countries are framing stringent regulations that promote the use of airbags. A minimum two airbag rule came into effect in India. The government proposed that automobile manufacturers include six airbags as standard across all variants, regardless of the body style or segment. Such trends are expected to create more growth opportunities in the market.

- The past years have witnessed significant growth in the sale of luxury vehicles, especially in developing countries. As these cars usually contain more airbags, the sales growth is expected to impact the growth of the market positively. For instance, recently, BMW, one of the leading luxury car brands, sold 2.52 million units of cars globally. Furthermore, the increasing demand for electric and hybrid vehicles is also expected to positively impact the growth of the market as these vehicles usually come with advanced safety and comfort features.

Asia-Pacific to Exhibit the Fastest Growth Rate

- Due to the rapidly growing automotive industry in economies such as China, India, and Japan, the Asia-Pacific is expected to exhibit the highest growth rate in the automotive MEMS sensors market. For instance, according to OICA, last year, China was the leading automobile manufacturer globally, with a production volume of about 26 million vehicles. China was followed by the United States, Japan, and India in annual vehicle production volume.

- The standardization of autonomous driving and ADAS is accelerating in China. For instance, last year, the Chinese government issued three new national safety standards (Electric Vehicle Safety Requirements, Electrical Vehicle Traction Battery Safety Requirements, and Electric Bus Safety Requirements). These mandatory standards put forward safety requirements for the battery pack and vehicle, including the implementation of early battery failure detection mechanisms.

- A similar trend is being adopted by other countries of the Asia-Pacific region, considering the growing number of road accident cases. For instance, to encourage automobile manufacturers to provide advanced safety features and boost the "export worthiness" of vehicles produced in the country, the Indian Ministry of Road Transport and Highways (MoRTH) proposed to introduce a safety rating system, Bharat New Car Assessment Program (BNCAP), for passenger cars, in June this year.

- Furthermore, countries such as Japan and South Korea are progressing fast to develop autonomous vehicles. For instance, the South Korean government plans to pursue full autonomy and wants half of its domestically-built cars to be fully autonomous by 2035. As these vehicles need minimal manual intervention, sensors play a crucial role in their successful operation. Hence, the growth of the autonomous vehicle industry is expected to drive the demand for MEMS sensors further.

Automobile MEMS Sensors Industry Overview

The MEMS automobile sensors market is fragmented in nature and consists of many global and regional players, such as, STMicroelectronics NV, Panasonic Corporation, Robert Bosch GmbH, Analog Devices Inc., and Infineon Technologies AG. These players focus on expanding their customer base across the globe. They focus on the research and development investment in introducing new solutions, strategic alliances, and other organic and inorganic growth strategies to earn a competitive edge over the forecast period.

In October 2022, Zvision, a leading provider of automotive-grade MEMS LiDAR solutions in China, and NVIDIA signed a collaborative agreement whereby Zvision joined the NVIDIA Jetson ecosystem as one of the platform's key LiDAR sensor partners. Through this agreement, Zvision plans to leverage NVIDIA's full-fledged software toolchains and lead AI chip hardware to develop a range of solid-state LiDAR-based autonomous driving sensors and systems.

In April 2021, STMicroelectronics unveiled AIS2IH three-axis linear accelerometer, a next-generation MEMS accelerometer for high-performance automotive applications. These accelerometers bring enhanced resolution, mechanical robustness, and temperature stability to non-safety automotive applications, including telematics, anti-theft, infotainment, vehicle navigation, and tilt/inclination measurement.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Passenger Safety and Security Regulations, and Increased Focus on Compliance

- 5.1.2 Increased Automation Features and Performance Improvements Preferred by Customers

- 5.2 Market Restraints

- 5.2.1 Increase in Overall Cost of MEMS Sensors Implementation due to Interface Design Considerations

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Tire Pressure Sensors

- 6.1.2 Engine Oil Sensors

- 6.1.3 Combustion Sensors

- 6.1.4 Fuel Injection and Fuel Pump Sensors

- 6.1.5 Air Bag Deployment Sensors

- 6.1.6 Gyroscopes

- 6.1.7 Fuel Rail Pressure Sensors

- 6.1.8 Other Types

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Rest of the World

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Analog Devices Inc.

- 7.1.2 Delphi Automotive PLC

- 7.1.3 Denso Corporation

- 7.1.4 General Electric Co.

- 7.1.5 Freescale Semiconductors Ltd

- 7.1.6 Infineon Technologies AG

- 7.1.7 Sensata Technologies Inc.

- 7.1.8 SiMicroelectronics NV

- 7.1.9 Panasonic Corporation

- 7.1.10 Liqid Inc.

- 7.1.11 Robert Bosch GmbH