|

市場調查報告書

商品編碼

1639418

高密度聚苯乙烯(HDPE) -市場佔有率分析、產業趨勢、成長預測 (2025-2030)High-density Polyethylene (HDPE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

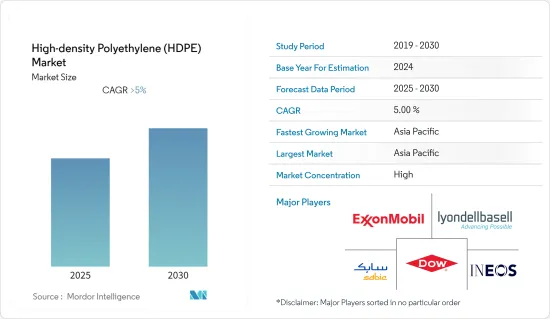

預計高密度聚苯乙烯(HDPE)市場在預測期內將維持5%以上的複合年成長率。

市場受到該地區 COVID-19 爆發的負面影響,包括需求和生產力下降、供應鏈中斷和地區停工。然而,該市場在2021年呈現顯著成長,並在2022年持續成長。

主要亮點

- 從中期來看,擴大使用塑膠管道作為替代品以及亞太地區建設活動的擴大是市場成長的關鍵驅動力。

- 另一方面,與 HDPE 生產和劣化相關的環境問題預計是預測期內抑制目標產業成長的主要因素。

- 超高聚合物 HDPE 正在蓄勢待發,並可能在不久的將來為市場創造利潤豐厚的成長機會。

- 亞太地區在市場上佔據主導地位,預計在預測期內仍將保持最高的複合年成長率。

HDPE市場趨勢

包裝產業需求不斷成長

- 高密度聚苯乙烯廣泛應用於包裝產業的軟包裝和硬包裝。這是因為它具有重量輕、強度高等特點。

- 高密度聚苯乙烯廣泛用於生產在儲存期間保護貨物的薄膜。包裝產業對包裝薄膜的需求不斷成長,導致HDPE薄膜應用廣泛成長。

- 購買力的增強、電子商務產業的快速成長、工業活動的活性化以及已調理食品需求的增加是推動全球包裝產業的關鍵因素。

- 隨著中國經濟的擴張,近年來中國包裝產業快速穩定成長。中國目前是全球最大的包裝市場之一,紙包裝、軟包裝、硬質塑膠包裝等細分市場成長迅速。

- 根據印度包裝工業協會統計,2019年印度包裝市場規模為505億美元。預計到2025年將成長至2,048.1億美元,2020年至2025年複合年成長率為26.7%。包裝是印度成長最快的行業之一,以每年 22-25% 的速度成長,使該國成為包裝產業的首選中心。

- 根據德國聯邦統計局公佈的資料,2021年德國包裝產業銷售額達295.9億歐元(350.1億美元),而2020年為262.6億歐元(299.8億美元)。

- 此外,根據英國包裝聯合會的數據,英國包裝製造業年營業額為110億英鎊(約151.3億美元)。它擁有超過 85,000 名員工,佔英國製造業的 3%。除了為國家 GDP 做出重大貢獻外,它還是更廣泛的包裝和供應鏈中的關鍵環節,推動了對 HDPE 的需求。

- 由於所有這些因素,預計高密度聚苯乙烯市場在預測期內將在全球範圍內成長。

亞太地區主導市場

- 由於中國和印度等國家的建築、電氣和電子以及包裝等最終用戶行業的需求不斷成長,預計亞太地區將主導市場。

- 亞太地區的建築業是世界上最大的建築業,由於人口成長、中等收入群體的成長和都市化,預計將產生重大影響。

- 中國已開啟建築業「十四五」規劃(2021-2025年)。該規劃預計2035年建築業全面實現工業化,建築品質顯著提升。

- 未來五年,印度建築業預計將快速成長。建築業預計將從2022年的2,500億美元發展到2027年的5,300億美元,複合年成長率為7.8%。預計2022年印度將成為世界第三大建築市場。

- 此外,亞太地區佔全球電子產品產量的70%以上,韓國、日本、中國等國家製造各種電氣元件,供應全球各產業。此外,預計2025年印度將成為全球第五大家用電子電器與電子產業。

- 印度的電氣和電子設備生產提供了諸如“印度製造”計劃等製造業承諾,以成長國內製造業、減少進口依賴、促進出口並使國家自力更生,預計由於“印度製造”等政府舉措,印度的電氣和電子設備生產將迅速成長。

- 預計這些積極因素將在預測期內推動亞太地區高密度聚苯乙烯市場的發展。

高密度聚苯乙烯行業概況

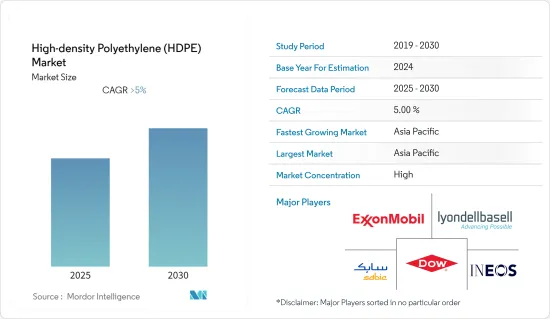

高密度聚苯乙烯市場具有綜合性。該市場的主要企業包括(排名不分先後)陶氏化學公司、埃克森美孚公司、ENEOS、SABIC 和 LyondellBasell Industries Holdings BV。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 增加使用塑膠管道作為替代品

- 擴大亞太地區的建設活動

- 抑制因素

- 與 HDPE 生產和劣化相關的環境問題

- 其他限制因素

- 產業價值鏈分析

- 波特五力

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 目的

- 管道和管子

- 硬質模壓製品

- 片狀薄膜

- 其他

- 最終用戶產業

- 包裝

- 運輸

- 電力/電子

- 建築/施工

- 農業

- 工業/機械

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Borealis AG

- Braskem

- Chevron Phillips Chemical Company LLC

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation, USA

- Indian Oil Corporation Ltd

- INEOS

- LG Chem

- LyondellBasell Industries Holdings BV

- SABIC

- TotalEnergies

第7章 市場機會及未來趨勢

- 超高聚合物HDPE發展勢頭強勁

The High-density Polyethylene Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in the region, including decreased demand and productivity, supply chain disruptions, and regional lockdowns. However, the market showed significant growth in 2021 and continued to grow in 2022.

Key Highlights

- Over the medium term, the major factors driving the market's growth are the increasing use of plastic pipes as substituents and growing construction activities in the Asia-Pacific region.

- On the flip side, environmental problems regarding the production and degradation of HDPE are the key factors anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, ultra-high molecular HDPE is gaining momentum and is likely to create lucrative growth opportunities for the market soon.

- The Asia-Pacific region is expected to dominate the market and will also witness the highest CAGR during the forecast period.

HDPE Market Trends

Growing Demand from the Packaging Industry

- High-density polyethylene is widely used in the packaging industry in both flexible and rigid packaging. Because of its properties of being lightweight, strong, etc.

- High-density polyethylene is widely used in the production of films used to protect goods in storage. Thin-film applications of HDPE are widely increasing due to the increasing demand for packaging films in the packaging industry.

- Increasing purchasing power, the rapid growth of the e-commerce sector, rising industrial activities, and increasing demand for ready-to-eat food are the key factors driving the packaging industry globally.

- Due to the country's expanding economy, China's packaging industry has grown rapidly and consistently in recent years. China is now one of the world's largest packaging markets, with fast-growing segments like paper packaging, flexible packaging, and rigid plastics packaging.

- According to the Packaging Industry Association of India, the India Packaging Market was valued at USD 50.5 billion in 2019. It is expected to grow to USD 204.81 billion by 2025, at a CAGR of 26.7% between 2020 and 2025. Packaging is one of India's fastest-growing industries, growing at a rate of 22-25% per year and transforming the country into a preferred hub for the packaging industry.

- As per the data published by Statistisches Bundesamt, the revenue of the packaging industry in Germany in 2021 accounted for EUR 29.59 billion (USD 35.01 billion) compared to EUR 26.26 billion (USD 29.98 billion) in 2020.

- Furthermore, according to the Packaging Federation of the United Kingdom, the UK packaging manufacturing industry has annual sales of GBP 11 billion (USD 15.13 billion). It employs more than 85,000 people, representing 3% of the United Kingdom's manufacturing workforce. It is a significant contributor to the country's GDP and a vital link in the broader packaging supply chain, likely enhancing the demand for HDPE.

- Owing to all these factors, the high-density polyethylene market is likely to grow across the world during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market due to increasing demand from end-user industries such as building and construction, electrical and electronics, and packaging from countries such as China and India.

- The construction sector in the Asia-Pacific region is the largest in the world and is expected to impact significantly, owing to the rising population, increase in middle-class income, and urbanization.

- China started its 14th Five-Year Plan period (2021-2025) for its construction industry. Looking to 2035, the plan anticipates that the construction sector will realize comprehensive industrialization, with great improvements to the quality of buildings.

- In the next five years, the Indian construction industry is predicted to rise at a rapid pace. The construction sector is predicted to develop at a compound annual growth rate of 7.8% from USD 250 billion in 2022 to USD 530 billion in 2027. Also, India is predicted to become the world's third-largest construction market by 2022.

- Further, Asia-Pacific accounts for more than 70% of global electronics production, with countries like South Korea, Japan, and China involved in manufacturing various electrical components and supplying them to various industries globally. Additionally, India is expected to become the fifth-largest consumer electronics and appliances industry in the world by 2025.

- Electrical and electronics production in India is expected to increase rapidly due to government initiatives with policies, such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect, which offer a commitment to growth in domestic manufacturing, lowering import dependence, energizing exports, and manufacturing, like the 'Make in India' program to make the country self-reliant.

- Such positive attributes are expected to drive the market for high-density polyethylene in Asia-Pacific region through the forecast period.

HDPE Industry Overview

The high-density polyethylene market is consolidated in nature. Some of the major players in the market (in no particular order) include Dow, Exxon Mobil Corporation, INEOS, SABIC, and LyondellBasell Industries Holdings BV, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use of Plastic Pipes as Substituents

- 4.1.2 Growing Construction Activities in the Asia-Pacific Region

- 4.2 Restraints

- 4.2.1 Environmental Problems Pertaining to The Production and Degradation of HDPE

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Pipes and Tubes

- 5.1.2 Rigid Articles

- 5.1.3 Sheets and Films

- 5.1.4 Other Applications

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Transportation

- 5.2.3 Electrical and Electronics

- 5.2.4 Building and Construction

- 5.2.5 Agriculture

- 5.2.6 Industry and Machinery

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Borealis AG

- 6.4.2 Braskem

- 6.4.3 Chevron Phillips Chemical Company LLC

- 6.4.4 Dow

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Formosa Plastics Corporation, U.S.A.

- 6.4.7 Indian Oil Corporation Ltd

- 6.4.8 INEOS

- 6.4.9 LG Chem

- 6.4.10 LyondellBasell Industries Holdings BV

- 6.4.11 SABIC

- 6.4.12 TotalEnergies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ultra-high Molecular HDPE Gaining Momentum