|

市場調查報告書

商品編碼

1851338

穿戴式運動感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Wearable Motion Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

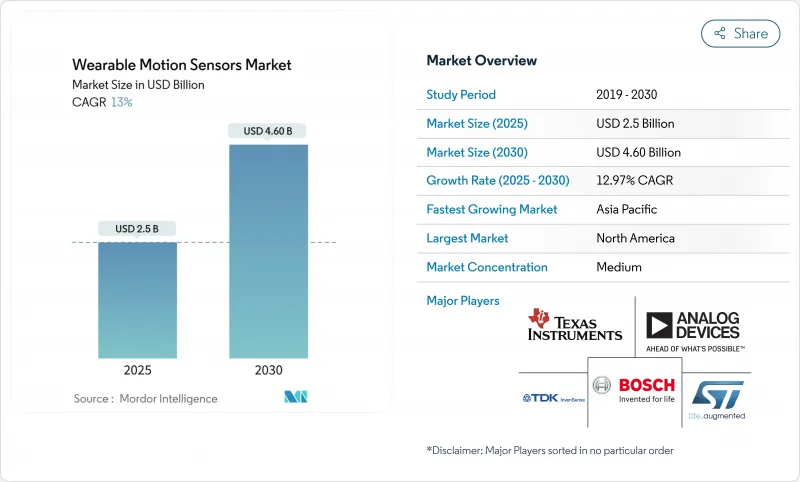

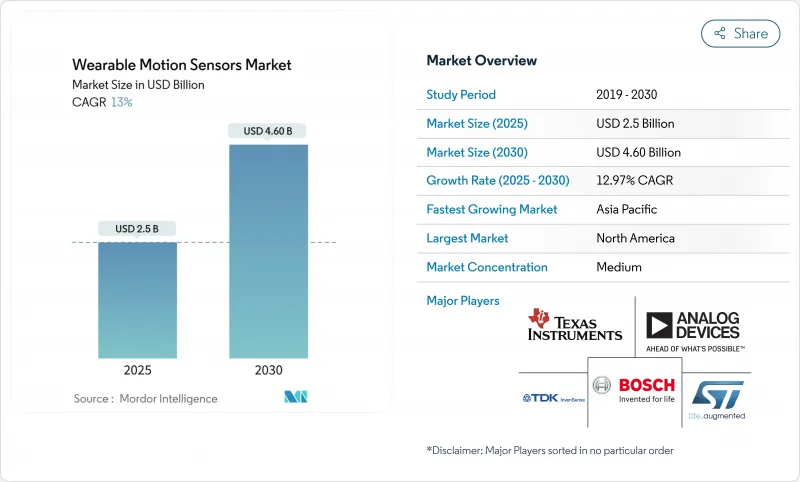

預計到 2025 年,穿戴式運動感測器市場規模將達到 25 億美元,到 2030 年將達到 46 億美元,在此期間的複合年成長率將達到 12.97%。

醫療保健、消費性電子、工業安全和國防等領域的應用不斷擴展,推動了這一發展趨勢。同時,微型化和設備端訊號處理技術的突破,將曾經分散的組件轉變為互聯產品的關鍵賦能者。遠端患者監護的監管支援、日益增強的健康意識以及對依賴精準即時運動數據的無縫人機互動介面的需求,都進一步刺激了市場需求。市場領導正致力於感測器融合、超低功耗設計和邊緣人工智慧等技術以實現差異化競爭,而新興企業則瞄準智慧紡織品和士兵現代化等細分市場。 MEMS製造的供應端限制以及與資料主權相關的合規成本不斷上升,是限制產能及時滿足的最主要瓶頸。

全球穿戴式運動感測器市場趨勢與洞察

人工智慧賦能的感測器融合技術驅動醫療穿戴設備

將感測器端人工智慧與多軸慣性數據結合,正將消費級設備轉變為臨床級監視器,能夠可靠地檢測與帕金森氏症和其他神經運動障礙相關的細微步態和震顫變化。研究表明,在區分早期帕金森自發性震顫方面,準確率高達 84%,這有助於擴展居家持續照護模式,並減少對間歇性臨床評估的依賴。支付方對演算法輔助診斷的接受度不斷提高,加速了醫院的採用,同時消費品牌也在為其生態系統添加醫療功能,以留住用戶。

日本和韓國的亞毫瓦級微機電系統(MEMS)用於老年護理

功耗低於1毫瓦的感測器無需充電即可運行數週,這對於可能忘記維護設備的年長用戶來說至關重要。此類感測器能夠自動發出跌倒警報並記錄日常活動,已在日本全國長期照護系統中使住院率降低了23%。韓國一項公私合作試點計畫也取得了類似的成效,這鼓勵了區域醫療保健網路推廣應用,並刺激了中國對居家養老解決方案的本地需求。

震顫鑑別診斷中的演算法局限性

目前無監督模型在震顫嚴重程度的多類別分類中準確率僅 57.1%,遠低於臨床閾值,限制了神經穿戴裝置的醫療保險報銷。資料集規模小、多樣性低以及真實世界環境噪音大等因素阻礙了研究進展,儘管研究原型前景可觀,但臨床應用仍進展緩慢。

細分市場分析

在穿戴式運動感測器市場,加速計到2024年將維持32.4%的市場佔有率,用於支援活動追蹤器、手勢操作介面和基本的跌倒偵測。這一主導地位反映了其成熟的成本曲線和微安培的睡眠電流。相較之下,MEMS組合感測器將加速計、陀螺儀和地磁感測器的功能整合到單一ASIC晶片中,降低了電路板級整合度,並實現了14.66%的複合年成長率。例如,意法半導體(STMicroelectronics)的LSM6DSV16BX整合了一個六軸慣性測量單元(IMU)和一個音訊加速計,用於穿戴式音訊裝置中的骨傳導指令。組合感測器在降低功耗的同時,縮小了與獨立IMU的性能差距,使其成為小型戒指和醫療貼片的理想選擇。

陀螺儀支援AR/ VR頭戴裝置和高級生物力學分析中亞度級的定向精度,但由於其毫瓦級的高功耗,廠商需要結合佔空比模式和預測演算法來延長每次充電後的運行時間。磁力計提供絕對定向,這對於利用GPS多路徑進行導航的戶外運動手錶至關重要。壓力感測器佔據著一個雖小但重要的市場,用於校準海拔變化,從而計算爬樓梯次數或游泳圈數。未來的發展藍圖顯示,生物電位和化學通道將與運動軸整合,慣性和生理數據將聚合到統一的感測器節點中,這將進一步鞏固穿戴式運動感測器市場。

健身手環受益於成熟的品牌生態系統、較低的入門價格以及訂閱分析服務的交叉銷售,預計到2024年將佔應用收入的24%。然而,嵌入紡織品中的感測器紗線將把監測功能從電子設備轉移到服裝上,預計到2030年將實現14.91%的複合年成長率。導電紗線和印刷拉伸感測器將使襯衫能夠在日常生活中追蹤關節運動學、姿勢和呼吸頻率,從而使用戶擺脫對專用設備的依賴。

AR/ VR頭戴裝置顯持續強勁成長,對身臨其境型模擬所需的亞毫秒延遲方向更新提出了更高的要求。耳戴式裝置整合了頭部手勢感應功能,可實現免持通話;智慧戒指則可在小巧的外形規格內模擬睡眠。織物運動感應和電化學感應技術的融合,將健康儀錶板的功能擴展到水分、電解質流失和熱壓力等參數,凸顯了無縫體驗的重要性,這將推動穿戴式運動感測器市場擺脫新奇階段,持續發展壯大。

區域分析

北美地區將佔2024年總收入的42.7%,醫療保險報銷改革將遠距運動監控推向主流市場。該地區的創投生態系統正將大量資金投入邊緣人工智慧晶片領域,而隱私法規則促使供應商轉向設備端推理技術以維護用戶信任。近岸外包政策和《國防生產法》的獎勵有利於國內微機電系統(MEMS)生產線,緩解了供應緊張的情況。

到2030年,亞太地區將以16.91%的複合年成長率成為成長最快的地區,這反映出中國二線晶圓廠正在採用能源採集架構,以及韓國的智慧城市試點計畫在老年公寓中嵌入運動標籤。儘管政府補貼抵消了零件成本的初期上漲,但消費者對功能豐富的穿戴式裝置的需求絲毫沒有減弱的跡象。日本保險公司根據老年人穿著的智慧襯衫進行風險評分並進行賠付,這刺激了對紡織感測器的投資。

歐洲市場持續推進其既定擴張計劃,強制性數位產品護照推動了產品生命週期透明度和高階售後服務分析的發展。 GDPR合規性促使企業投資安全邊緣韌體和自主雲端橋。拉丁美洲和中東及非洲地區的銷售量雖落後於歐洲市場,但隨著都市區醫院採用跌倒偵測手錶,這些地區實現了兩位數的成長。跨境電子商務和跨國OEM組裝將各個地區整合到全球相互依存的穿戴式運動感測器市場。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 人工智慧賦能的感測器融合技術驅動醫療穿戴設備

- 日本和韓國的亞毫瓦級MEMS技術在老年護理領域的應用

- 美國RPM兌換提升

- 歐盟數位產品護照使用分析

- 中國超緊湊型能源採集模組

- 北約士兵現代化需求

- 市場限制

- 震顫鑑別的演算法局限性

- MEMS鑄造能力緊張

- 數據主權合規成本

- 智慧紡織品互連的故障

- 價值/供應鏈分析

- 監理與技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 加速計

- 陀螺儀

- 磁力計

- 慣性測量單元(IMU)

- MEMS聯合感應器

- 壓力感測器

- 透過使用

- 健身手環

- 活動監測器

- 智慧服飾

- AR/ VR頭戴裝置

- 智慧戒指和珠寶

- 耳戴式裝置和助聽器

- 按最終用戶行業分類

- 醫療保健和醫療設備

- 消費性電子產品與生活方式

- 工業和企業安全

- 軍事/國防

- 政府和公共產業

- 按能耗

- 超低功耗(小於1毫瓦)

- 低功率(1-10mW)

- 標準輸出(10-50mW)

- 高功率(超過50毫瓦)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Bosch Sensortec GmbH

- TDK InvenSense

- STMicroelectronics NV

- Analog Devices, Inc.

- Texas Instruments Incorporated

- Panasonic Industry Co., Ltd.

- Infineon Technologies AG

- NXP Semiconductors NV

- Samsung Electronics Co. Ltd.

- Robert Bosch GmbH(Sensors)

- TE Connectivity

- Qualcomm Technologies Inc.

- Sensirion AG

- Xsens(Movella)

- Valencell Inc.

- OMRON Corporation

- Garmin Ltd.

- Polar Electro Oy

- Fitbit LLC(Google)

- Apple Inc.

- Oura Health Oy

- Xiaomi Corporation

- Goertek Inc.

- Huami(Zepp Health)

- Withings SA

第7章 市場機會與未來展望

The wearable motion sensors market size is valued at USD 2.5 billion in 2025 and is forecast to reach USD 4.6 billion by 2030, registering a 12.97% CAGR over the period.

Expanding adoption across healthcare, consumer electronics, industrial safety and defense sustains this trajectory, while breakthroughs in miniaturization and on-device signal processing convert once-discrete components into indispensable enablers of connected products. Demand is reinforced by regulatory support for remote patient monitoring, rising health-conscious consumer behavior, and the shift toward seamless human-machine interfaces that rely on precise real-time motion data. Market leaders emphasize sensor fusion, ultra-low-power design and edge AI to differentiate, whereas emerging players target niche opportunities such as smart textiles and soldier modernisation. Supply-side constraints in MEMS manufacturing and growing compliance costs tied to data sovereignty remain the most visible bottlenecks for timely capacity fulfilment.

Global Wearable Motion Sensors Market Trends and Insights

AI-enabled Sensor Fusion Driving Medical-Grade Wearables

Integrating on-sensor AI with multi-axis inertial data is converting consumer devices into clinical-grade monitors, enabling reliable detection of subtle gait or tremor changes linked to Parkinson's and other neuro-motor disorders. Studies report 84% accuracy in differentiating early Parkinson's tremor from essential tremor, an achievement that expands home-based, continuous care models and reduces reliance on episodic clinical evaluations. Growing payer acceptance of algorithm-supported diagnostics accelerates hospital adoption, while consumer brands add medical features to retain users within ecosystem subscriptions.

Sub-milliwatt MEMS for Eldercare in Japan & Korea

Sensors consuming below 1 mW allow multi-week operation without charging, a prerequisite for elderly users who may forget to maintain devices. Japan's national long-term care system saw 23% fewer hospitalisations when such sensors enabled automatic fall alerts and daily activity profiling. Korean public-private pilots demonstrate similar savings, encouraging scale-up across community health networks and driving regional demand spillover into China's ageing-at-home initiatives.

Algorithmic Limits on Tremor Differentiation

Current unsupervised models reach only 57.1% accuracy in multi-class tremor severity classification, well below clinical thresholds, limiting reimbursement for neurological wearables. Small, diverse data sets and noisy real-world environments hinder progress, slowing hospital uptake despite promising research prototypes.

Other drivers and restraints analyzed in the detailed report include:

- U.S. RPM Reimbursement Boost

- EU Digital Product Passport-Linked Usage Analytics

- MEMS Foundry Capacity Crunch

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The wearable motion sensors market saw accelerometers retain 32.4% share in 2024, underpinning activity trackers, gesture interfaces and basic fall detection. That dominance reflects mature cost curves and micro-amp sleep currents. In contrast, MEMS combo sensors post a 14.66% CAGR by fusing accelerometer, gyroscope and magnetometer functions within a single ASIC that off-loads board-level integration. STMicroelectronics' LSM6DSV16BX, for instance, embeds a 6-axis IMU plus an audio accelerometer for bone-conduction-based commands in hearables. Combo adoption narrows the performance gap with discrete IMUs while lowering power draw, ideal for tiny rings and medical patches.

Gyroscopes support sub-degree orientation fidelity in AR/VR headsets and advanced biomechanics analysis yet carry higher milliwatt budgets, so vendors pair duty-cycled modes with predictive algorithms to stretch per-charge runtime. Magnetometers deliver absolute heading, essential for outdoor sports watches navigating GPS multipath. Pressure sensors, a smaller but vital niche, calibrate altitude change for stair-climb counting and swimming lap depth. Forward-looking roadmaps integrate bio-potential or chemical channels alongside motion axes, signalling a future where inertial and physiological data converge inside unified sensor nodes, further strengthening the wearable motion sensors market.

Fitness bands led 24% of application revenues in 2024, benefiting from established brand ecosystems, low entry price and cross-selling of subscription analytics. However, textile-embedded sensor threads shift monitoring from gadget to garment, supporting a 14.91% CAGR through 2030. Conductive yarns and printed stretch sensors enable shirts that track joint kinematics, posture and respiratory rates during daily routines, freeing users from dedicated devices.

AR/VR headsets remain a high-growth enclave, demanding sub-millisecond latency orientation updates for immersive simulation. Ear-wear integrates head-gesture sensing for hands-free calls, while smart rings deliver sleep staging in tiny form factors. The convergence of motion and electrochemical sensing within fabrics widens health dashboards to hydration, electrolyte loss and thermal stress parameters, underscoring how seamless experiences keep the wearable motion sensors market expanding beyond novelty phases.

The Wearable Motion Sensor Market Report is Segmented by Type (Accelerometers, Gyroscopes, Magnetometers, and More), Application (Fitness Bands, Activity Monitors, Smart Clothing, and More ), End-User (Healthcare, Consumer Electronics, Industrial, Military, An More), Power Consumption (Ultra-Low Power (less Than 1mW), Standard Power (10-50mW), and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 42.7% of 2024 revenue, anchored by Medicare reimbursement reform that locks remote motion monitoring into mainstream care pathways. The region's venture ecosystem funnels capital into edge-AI silicon, while privacy statutes push vendors toward on-device inference, preserving user trust. Supply constraints are mitigated by near-shoring policies and Defense Production Act incentives that favour domestic MEMS lines.

Asia Pacific registers the fastest 16.91% CAGR through 2030, reflecting China's tier-2 fabs embracing energy-harvesting architectures and Korea's smart-city pilots embedding motion tags in elder apartments. Government grants offset initial higher BOM costs, while consumer appetite for feature-rich wearables remains unabated. Japan's insurers reimburse smart-shirt-based risk scoring for seniors, spurring textile sensor investment.

Europe maintains methodical expansion, its Digital Product Passport mandate pushing life-cycle transparency and fostering premium after-sales analytics. GDPR compliance elevates spend on secure edge firmware and sovereign cloud bridges. Latin America and the Middle East & Africa trail in volumes yet notch double-digit growth where urban private hospitals adopt fall-detection watches. Cross-border e-commerce and multinational OEM assembly lines stitch regions into a globally interdependent wearable motion sensors market.

- Bosch Sensortec GmbH

- TDK InvenSense

- STMicroelectronics N.V.

- Analog Devices, Inc.

- Texas Instruments Incorporated

- Panasonic Industry Co., Ltd.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Samsung Electronics Co. Ltd.

- Robert Bosch GmbH (Sensors)

- TE Connectivity

- Qualcomm Technologies Inc.

- Sensirion AG

- Xsens (Movella)

- Valencell Inc.

- OMRON Corporation

- Garmin Ltd.

- Polar Electro Oy

- Fitbit LLC (Google)

- Apple Inc.

- Oura Health Oy

- Xiaomi Corporation

- Goertek Inc.

- Huami (Zepp Health)

- Withings SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-enabled Sensor Fusion Driving Medical-Grade Wearables

- 4.2.2 Sub-milliwatt MEMS for Eldercare in Japan and Korea

- 4.2.3 U.S. RPM Reimbursement Boost

- 4.2.4 EU Digital Product Passport-Linked Usage Analytics

- 4.2.5 Micro Energy-Harvesting Modules in China

- 4.2.6 NATO Soldier Modernisation Demand

- 4.3 Market Restraints

- 4.3.1 Algorithmic Limits on Tremor Differentiation

- 4.3.2 MEMS Foundry Capacity Crunch

- 4.3.3 Data-Sovereignty Compliance Costs

- 4.3.4 Smart-Textile Interconnect Failures

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Accelerometers

- 5.1.2 Gyroscopes

- 5.1.3 Magnetometers

- 5.1.4 Inertial Measurement Units (IMUs)

- 5.1.5 MEMS Combo Sensors

- 5.1.6 Pressure Sensors

- 5.2 By Application

- 5.2.1 Fitness Bands

- 5.2.2 Activity Monitors

- 5.2.3 Smart Clothing

- 5.2.4 AR/VR Headsets

- 5.2.5 Smart Rings and Jewelry

- 5.2.6 Ear-wear and Hearing Aids

- 5.3 By End-user Industry

- 5.3.1 Healthcare and Medical Devices

- 5.3.2 Consumer Electronics and Lifestyle

- 5.3.3 Industrial and Enterprise Safety

- 5.3.4 Military and Defense

- 5.3.5 Government and Public Utilities

- 5.4 By Power Consumption

- 5.4.1 Ultra-Low Power (Less than1mW)

- 5.4.2 Low Power (1-10mW)

- 5.4.3 Standard Power (10-50mW)

- 5.4.4 High Power (Greater than 50mW)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Bosch Sensortec GmbH

- 6.4.2 TDK InvenSense

- 6.4.3 STMicroelectronics N.V.

- 6.4.4 Analog Devices, Inc.

- 6.4.5 Texas Instruments Incorporated

- 6.4.6 Panasonic Industry Co., Ltd.

- 6.4.7 Infineon Technologies AG

- 6.4.8 NXP Semiconductors N.V.

- 6.4.9 Samsung Electronics Co. Ltd.

- 6.4.10 Robert Bosch GmbH (Sensors)

- 6.4.11 TE Connectivity

- 6.4.12 Qualcomm Technologies Inc.

- 6.4.13 Sensirion AG

- 6.4.14 Xsens (Movella)

- 6.4.15 Valencell Inc.

- 6.4.16 OMRON Corporation

- 6.4.17 Garmin Ltd.

- 6.4.18 Polar Electro Oy

- 6.4.19 Fitbit LLC (Google)

- 6.4.20 Apple Inc.

- 6.4.21 Oura Health Oy

- 6.4.22 Xiaomi Corporation

- 6.4.23 Goertek Inc.

- 6.4.24 Huami (Zepp Health)

- 6.4.25 Withings SA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment