|

市場調查報告書

商品編碼

1851343

4K顯示解析度:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030年)4K Display Resolution - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

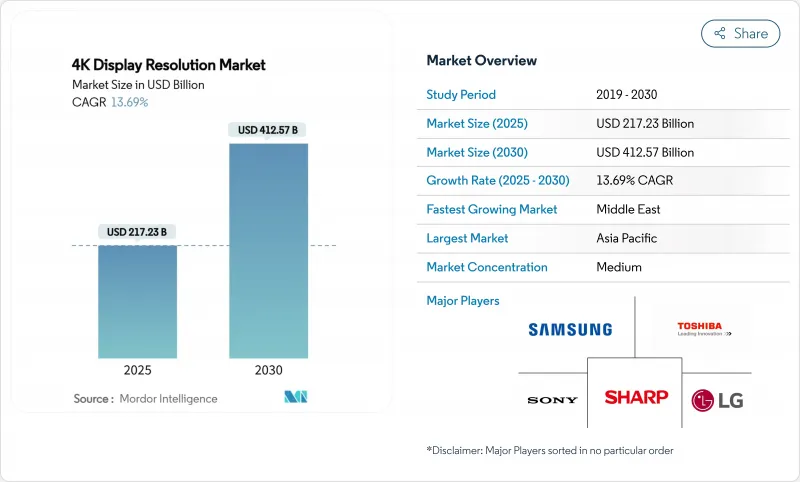

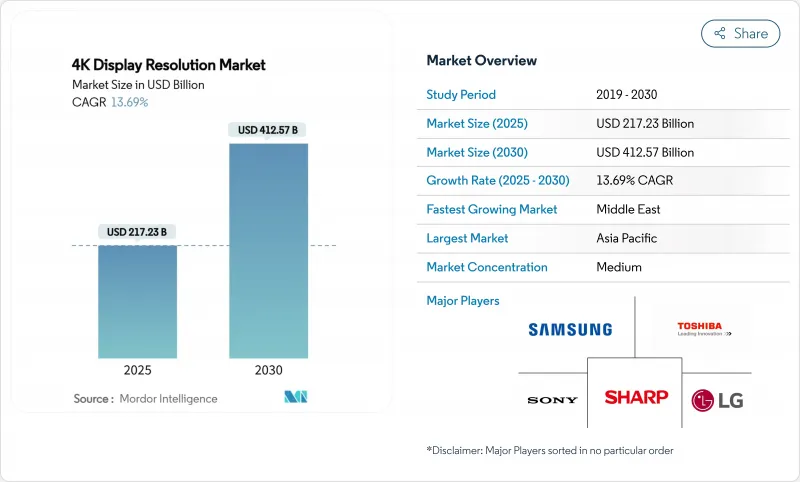

預計到 2025 年,4K 顯示解析度市場價值將達到 2,172.3 億美元,到 2030 年將達到 4,125.7 億美元,年複合成長率為 13.69%。

面板成本的快速下降、原生4K串流內容的豐富供應以及不斷擴展的企業應用場景,正推動這項技術從高階定位走向大眾普及。亞太地區的製造能力維持了平均售價的低位,而該地區的消費者也明顯偏好大螢幕。混合辦公模式和身臨其境型遊戲的需求推動了產品更新換代的加速,促使各大品牌推出更多專業化型號。同時,晶片組供應鏈風險以及歐洲不斷變化的能源效率法規,迫使供應商實現組件採購多元化,並加快低功耗背光技術的研發。

全球4K顯示解析度市場趨勢與洞察

北美地區OTT主導的4K串流媒體迅速普及

到2024年,串流媒體平台將以4K解析度提供超過60%的新內容,這將大大推動家庭升級,促使更多用戶選擇相容4K的螢幕。 Wi-Fi 7提供的更高頻寬(支援高達46 Gbps的資料速率)消除了先前限制4K普及的瓶頸。日本正在推廣毫米波頻譜,目標是在2027年前建成5萬個基地台,這將進一步提升網路容量,惠及跨國內容供應商。因此,電視和顯示器的更換週期正在加快,串流媒體服務商也正圍繞HDR效能和廣色域來製定其功能藍圖。那些將面板發布與熱門大片首映同步的品牌,在關鍵的銷售季度到來之前,吸引了許多早期用戶的注意。

中國和韓國的面板補貼和產能擴張

政府激勵措施降低了新建液晶顯示器(LCD)和量子點發光二極體(QD-OLED)生產線的資本成本,使得京東方科技(BOE Technology)和三星顯示器(Samsung Display)等公司能夠以高產運作運作其工廠。三星顯示器計劃在2025年將其QD-OLED顯示器面板的出貨量提高50%,達到143萬片,這為其OEM合作夥伴更新高階產品線提供了空間。這些投資帶來的規模經濟將支持在50-65英寸主流尺寸市場中保持價格競爭力,而mini-LED背光產量比率的降低將推動其在中階機型中的應用。補貼主導的產量激增已經滲透到全球供應鏈,降低了下游組裝商的材料成本。

HDMI 2.1晶片組短缺(2024-2025年)

主要晶圓代工廠晶圓出貨量的限制導致HDMI 2.1重定時器和開關IC的供應不足,從而延緩了旗艦級遊戲顯示器和高階電視的大規模出貨。海邁科技(Himax Technologies)報告稱,其2024年82.9%的收入將來自顯示器驅動IC,這表明該公司對單一元件市場的依賴性較高。供應商已將稀缺晶片組轉移到利潤較高的型號上,導致中端SKU出現暫時性缺貨。這種短缺也加速了DisplayPort 2.1的普及,例如微星(MSI)的新款QD-OLED顯示器就採用了該介面,這表明即使供應恢復正常,介面多樣化仍具有長期發展潛力。

細分市場分析

預計在4K顯示器解析度市場中,遊戲顯示器將以最快的速度成長,2025年至2030年的複合年成長率(CAGR)將達到14.1%。三星在2024年保持了21.0%的全球市場佔有率,並在OLED細分市場佔據了34.6%的佔有率,憑藉QD-OLED技術的興起獲得了先發優勢。該細分市場蓬勃發展得益於高規格的電競贊助、頻繁的產品更新以及NVIDIA GeForce RTX 4090等高性能GPU的協同效應,這些GPU能夠實現穩定的4K/144Hz遊戲體驗。顯示器品牌正在透過更高的峰值亮度、雙層OLED面板和DisplayPort 2.1介面等方式升級規格,以區分高階產品。由於發燒友更注重反應時間、HDR對比和色彩還原,因此遊戲顯示器的盈利仍然高於主流電視。

智慧型電視將繼續保持領先地位,預計到2024年將佔據68%的市場佔有率,這主要得益於豐富的4K串流內容庫和不斷下降的物料清單成本。隨著混合辦公模式對廣視角和高像素密度的需求日益成長,企業電視牆和數位指示牌螢幕的重要性也隨之提升。醫療顯示器開闢了一片利潤豐厚的市場,例如SONY的LMD-32M1MD等4K手術顯示器已達到VESA HDR1000標準,可用於手術室。原生4K解析度的智慧型手機和平板電腦由於功耗抵消了其行動優勢,因此其應用範圍僅限於創意類應用。總體而言,消費者對更豐富的娛樂體驗和更有效率的辦公室協作的需求正在推動4K顯示解析度市場各個細分領域的成長。

OLED面板預計將以16.7%的複合年成長率成長,成為4K顯示解析度市場中成長最快的產品。三星顯示器計畫在2025年出貨143萬塊QD-OLED顯示器面板,顯示產能擴張正在推動OLED應用範圍的拓展,使其超越旗艦電視的範疇。卓越的對比度、像素級調光和雙OLED堆疊技術的引入,如今已應用於遊戲顯示器,從而推高了平均售價。 LG將於2025年推出的G5電視,配備165Hz原生更新率和微透鏡陣列光學系統,凸顯了OLED研發的持續推進。

由於模具數量龐大、供應鏈成熟以及在中階產品中具有成本競爭力,LCD技術預計在2024年仍將維持71%的市場佔有率。 Mini-LED背光技術增加了局部調光和高亮度功能,以更低的成本縮小了與OLED的性能差距。SONY的HDR1000手術監視器展示了Mini-LED在專業垂直市場的影響力。正如海信的136吋顯示器所證明的那樣,在製造產量比率提高之前,Micro-LED的應用將僅限於超大尺寸規格。多種面板類型的共存將使遊戲、指示牌和醫療保健等各種應用能夠在不斷成長的4K顯示解析度市場中實現成本、亮度和使用壽命的最佳平衡。

區域分析

亞太地區鞏固了其作為全球最大4K顯示解析度市場的地位,預計2024年將佔全球收入的46%。中國的補貼政策促進了產能的快速擴張,而韓國在OLED領域的領先地位則為全球提供了高利潤面板。日本設定了2027年安裝5萬個毫米波基地台的目標,旨在加強該地區的網路骨幹,以支援4K串流媒體的廣泛應用。隨著平均售價下降和可支配收入增加,印度和東南亞進入了4K應用的新階段,釋放了尚未開發的市場潛力。

預計中東地區2025年至2030年的複合年成長率將達到13.6%,位居全球之首。海灣合作理事會(GCC)企業正在部署4K電視牆以增強混合協作,從而推動了對小像素間距LED組件的需求。SONY中東和非洲公司報告稱,其銷售額顯著成長,並計劃在2025年底前推出INZONE M9 4K顯示器。目前,該地區20%的電視銷售額已來自線上通路,迫使各大品牌最佳化其電商物流。

北美成熟的4K裝置量持續成長,這主要得益於OTT內容的快速普及和遊戲顯示器強勁的升級換代週期。醫療機構擴大了4K診斷套件的應用,拓展了一個利潤豐厚且受價格競爭影響較小的市場區隔。在歐洲,注重科技的消費者開始青睞更大尺寸的OLED電視,而更嚴格的環保設計標準則提高了65吋以上面板的合規成本,促使供應商轉向節能的Mini-LED設計。拉丁美洲和非洲仍是新興市場。儘管寬頻普及率的提高預示著未來成長潛力,但撒哈拉以南非洲部分地區有限的4K廣播頻譜限制了其發展。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 北美地區OTT主導的4K串流媒體迅速普及

- 中國和韓國的面板補貼和產能擴張

- 歐洲電競市場對4K/144Hz遊戲顯示器的需求

- 美國和日本對4K手術和診斷顯示器的應用

- 混合工作LED電視牆引領波灣合作理事會國家企業採用

- 台灣製造的迷你LED燈可產生50-65英吋的產量比率

- 市場限制

- 2024-2025年HDMI 2.1晶片組短缺

- 歐盟生態設計規則提高了65吋電視的合規成本

- 撒哈拉以南非洲地區4K廣播頻譜有限

- 日本和韓國的高階8K影片蠶食現象

- 生態系分析

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 智慧型電視

- 監視器

- 智慧型手機

- 藥片

- 筆記型電腦

- 數位電子看板/電視牆

- 投影螢幕

- 頭戴式顯示器(HMD)

- 醫療顯示器

- 其他

- 透過面板技術

- LCD顯示幕(IPS/VA/TN)

- 有機發光二極體

- 迷你LED

- 微型LED

- 其他

- 按螢幕尺寸

- 32英吋或更小

- 32-49 英寸

- 50-65英寸

- 66-84英寸

- 84吋或以上

- 按最終用戶行業分類

- 家用電器(家用)

- 遊戲和電競場館

- 商業與教育

- 零售和廣告

- 媒體與娛樂製作

- 衛生保健

- 航太/國防

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家(丹麥、瑞典、挪威、芬蘭)

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 東南亞

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措與發展

- 市佔率分析

- 公司簡介

- Samsung Electronics Co. Ltd

- LG Display Co. Ltd

- BOE Technology Group Co. Ltd

- TCL Technology(CSOT)

- Sony Group Corporation

- Toshiba Corporation

- Panasonic Holdings Corporation

- Sharp Corporation

- Hisense Group

- Koninklijke Philips NV

- Innolux Corporation

- AU Optronics Corp.

- Dell Technologies Inc.

- ASUSTeK Computer Inc.

- Acer Inc.

- Vizio Inc.

- Skyworth Group Ltd

- Barco NV

- Eizo Corporation

- ViewSonic Corporation

- BenQ Corporation

第7章 市場機會與未來展望

The 4K display resolution market size is estimated at USD 217.23 billion in 2025 and is forecast to reach USD 412.57 billion by 2030, advancing at a 13.69% CAGR.

Fast-declining panel costs, a richer supply of native 4K streaming content, and expanding corporate use cases are allowing the technology to move from premium positioning into mass adoption. Asia Pacific's manufacturing scale keeps average selling prices low while the region's consumers display a marked preference for larger screens. Hybrid-work demand and immersive gaming are further tightening refresh cycles, encouraging brands to launch increasingly specialized models. At the same time, supply chain risks around chipsets and evolving energy-efficiency rules in Europe urge vendors to diversify component sourcing and accelerate R&D in low-power backlighting.

Global 4K Display Resolution Market Trends and Insights

Rapid OTT-led Uptake of 4K Streaming in North America

Streaming platforms delivered more than 60% of their new content in 4K during 2024, setting a stronger pull for compatible screens in household upgrades. Bandwidth gains from Wi-Fi 7, which supports data rates up to 46 Gbit/s, remove the previous bottlenecks that limited mainstream 4K adoption. Millimeter-wave rollouts, with Japan targeting 50,000 base stations by 2027, add further capacity that benefits cross-border content providers. The result is a steeper replacement cycle for television sets and monitors, with streaming services shaping feature roadmaps around HDR performance and wider color gamuts. Brands that synchronize panel launches with blockbuster content premieres are capturing early-adopter interest ahead of key sales quarters.

Panel Subsidies and Capacity Expansion in China and South Korea

Government incentives trimmed capital costs for new LCD and QD-OLED lines, enabling firms such as BOE Technology and Samsung Display to run plants at high utilization. Samsung Display plans to raise QD-OLED monitor panel shipments by 50% to 1.43 million units in 2025, giving OEM partners more scope to refresh premium catalogs. Economies of scale flowing from these investments support competitive pricing in the 50-65" mainstream sweet spot, while yield-driven cost erosion in Mini-LED backlights widens adoption in mid-tier models. The subsidy-induced volume surge is already filtering through global supply chains, lowering bill-of-materials outlays for downstream assemblers.

HDMI 2.1 Chipset Shortages 2024-25

Constrained wafer starts at leading foundries have a limited supply of HDMI 2.1 retimer and switch ICs, delaying volume shipments of flagship gaming monitors and high-end TVs. Himax Technologies reported that 82.9% of 2024 revenue came from display driver ICs, underscoring dependence on a narrow component pool. Vendors redirected scarce chipsets to models with higher gross margins, creating temporary stockouts in mid-tier SKUs. The scarcity also accelerated DisplayPort 2.1 adoption, as seen in MSI's new QD-OLED monitor, signaling possible long-term interface diversification even after supply normalizes.

Other drivers and restraints analyzed in the detailed report include:

- Esports Demand for 4K/144 Hz Gaming Monitors in Europe

- Adoption of 4K Surgical and Diagnostic Displays in U.S. and Japan

- EU Eco-design Rules Raising Compliance Costs for >65" TVs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gaming monitors accounted for a 14.1% CAGR forecast between 2025 and 2030, the fastest trajectory within the 4K display resolution market. Samsung upheld a 21.0% global share in 2024, while its 34.6% slice of the OLED sub-segment confirmed a first-mover advantage in emerging QD-OLED stacks. The segment thrives on esports sponsorship visibility, frequent model refreshes, and the synergy with powerful GPUs such as NVIDIA GeForce RTX 4090 that unlocked stable 4K/144 Hz gameplay. Monitor brands elevate specifications with higher peak brightness, tandem OLED layers, and DisplayPort 2.1 input to differentiate premium SKUs. Profitability remains thicker than mainstream TVs because enthusiast buyers value response time, HDR contrast, and color coverage.

Smart TVs preserved leadership with a 68% revenue share in 2024, supported by wide 4K streaming content libraries and falling BOM costs. Corporate video walls and digital signage screens gained importance as hybrid-work hubs required wide viewing angles and high pixel density. Medical displays formed a high-margin niche, with 4K surgical monitors like Sony's LMD-32M1MD achieving VESA HDR1000 compliance for operating theaters. Smartphones and tablets with native 4K remain limited to creator-focused uses because energy draw offsets mobile benefits. Overall, consumer appetite for richer entertainment and workplace collaboration sustains multi-segment momentum within the 4K display resolution market.

OLED panels are projected to expand at a 16.7% CAGR, the swiftest run in the 4K display resolution market. Samsung Display's plan to ship 1.43 million QD-OLED monitor panels in 2025 exemplifies the capacity scaling that propels wider use beyond flagship TVs. Superior contrast, pixel-level dimming, and the introduction of tandem OLED stacks now reach gaming monitors, encouraging ASP premiums. LG's 2025 G5 TV, with a 165 Hz native refresh and Micro Lens Array optics, underscores the continued pace of OLED R&D.

LCD technology retained 71% share in 2024 because of vast installed tooling, mature supply chains, and cost competitiveness for mid-range sets. Mini-LED backlighting adds local dimming and higher luminance, bridging performance gaps with OLED at a lower cost. Sony's HDR1000-rated surgical monitor demonstrates Mini-LED influence in specialty verticals. Micro-LED remains confined to ultra-large formats, evidenced by Hisense's 136-inch showpiece, until manufacturing yields improve. The coexistence of multiple panel types ensures that each application - gaming, signage, healthcare - receives an optimal balance of cost, brightness, and longevity within the expanding 4K display resolution market.

The 4K Display Resolution Market Report is Segmented by Product Type (Smart TV, Monitor, Smartphone, Tablet, and More), Panel Technology (LCD, OLED, Mini-LED, and Micro-LED), Screen Size (Sub 32 Inch, 32-49 Inch, 50-65 Inch, 66-84 Inch, and Above 85 Inch), End-User Vertical (Consumer Electronics, Gaming and Esports Venues, Business and Education, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific generated 46% of 2024 revenue, cementing its position as the largest territory in the 4K display resolution market. China's subsidies enabled swift capacity ramps, while South Korea's OLED leadership supplied high-margin panels globally. Japan's goal of installing 50,000 millimeter-wave bases by 2027 reinforces the regional network backbone supporting 4K streaming uptake. India and Southeast Asia entered a new adoption phase as falling ASPs aligned with rising discretionary income, unlocking large untapped volumes.

The Middle East is forecast to post the highest CAGR at 13.6% between 2025 and 2030. GCC corporations rolled out 4K video walls to enhance hybrid collaboration, boosting demand for fine-pixel-pitch LED assemblies. Sony Middle East and Africa reported notable sales gains and aims to release the INZONE M9 4K monitor within 2025, reflecting the region's appetite for premium displays. Online channels have already captured 20% of regional TV sales, prompting brands to fine-tune e-commerce logistics.

North America's mature installed base still grew on the back of fast OTT content adoption and a robust gaming monitor upgrade cycle. Healthcare institutions expanded to 4K diagnostic suites, widening a lucrative sub-segment less exposed to price wars. Europe faced a dual narrative: tech-savvy consumers embraced larger OLED sets while stricter Eco-design norms raised compliance costs for panels over 65", nudging suppliers toward energy-efficient Mini-LED designs. Latin America and Africa remained emergent frontiers; limited 4K broadcast spectrum in parts of Sub-Saharan Africa tempered growth, though rising broadband coverage signals future upside.

- Samsung Electronics Co. Ltd

- LG Display Co. Ltd

- BOE Technology Group Co. Ltd

- TCL Technology (CSOT)

- Sony Group Corporation

- Toshiba Corporation

- Panasonic Holdings Corporation

- Sharp Corporation

- Hisense Group

- Koninklijke Philips N.V.

- Innolux Corporation

- AU Optronics Corp.

- Dell Technologies Inc.

- ASUSTeK Computer Inc.

- Acer Inc.

- Vizio Inc.

- Skyworth Group Ltd

- Barco NV

- Eizo Corporation

- ViewSonic Corporation

- BenQ Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid OTT?led Uptake of 4K Streaming in North America

- 4.2.2 Panel Subsidies and capacity Expansion in China and South Korea

- 4.2.3 Esports Demand for 4K/144 Hz Gaming Monitors in Europe

- 4.2.4 Adoption of 4K Surgical and Diagnostic Displays in United States and Japan

- 4.2.5 Hybrid-Work LED Videowalls Driving Gulf Cooperation Council Countries Corporate Installations

- 4.2.6 Mini-LED Yield-Driven Price Erosion in Taiwan-made 50-65? Panels

- 4.3 Market Restraints

- 4.3.1 HDMI 2.1 Chipset Shortages 2024-25

- 4.3.2 EU Ecodesign Rules Raising Compliance Costs for Above 65? TVs

- 4.3.3 Limited 4K Broadcast Spectrum in Sub-Saharan Africa

- 4.3.4 Premium 8K Cannibalisation in Japan and South Korea

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product Type

- 5.1.1 Smart TV

- 5.1.2 Monitor

- 5.1.3 Smartphone

- 5.1.4 Tablet

- 5.1.5 Laptop

- 5.1.6 Digital Signage/Videowall

- 5.1.7 Projection Screen

- 5.1.8 Head-Mounted Display (HMD)

- 5.1.9 Medical Display

- 5.1.10 Others

- 5.2 By Panel Technology

- 5.2.1 LCD (IPS/VA/TN)

- 5.2.2 OLED

- 5.2.3 Mini-LED

- 5.2.4 Micro-LED

- 5.2.5 Others

- 5.3 By Screen Size

- 5.3.1 Below 32 inch

- 5.3.2 32-49 inch

- 5.3.3 50-65 inch

- 5.3.4 66-84 inch

- 5.3.5 Above 84 inch

- 5.4 By End-user Vertical

- 5.4.1 Consumer Electronics (Household)

- 5.4.2 Gaming and Esports Venues

- 5.4.3 Business and Education

- 5.4.4 Retail and Advertisement

- 5.4.5 Media and Entertainment Production

- 5.4.6 Healthcare

- 5.4.7 Aerospace and Defence

- 5.4.8 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Nordics (Denmark, Sweden, Norway, Finland)

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Southeast Asia

- 5.5.3.6 Australia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Gulf Cooperation Council Countries

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung Electronics Co. Ltd

- 6.4.2 LG Display Co. Ltd

- 6.4.3 BOE Technology Group Co. Ltd

- 6.4.4 TCL Technology (CSOT)

- 6.4.5 Sony Group Corporation

- 6.4.6 Toshiba Corporation

- 6.4.7 Panasonic Holdings Corporation

- 6.4.8 Sharp Corporation

- 6.4.9 Hisense Group

- 6.4.10 Koninklijke Philips N.V.

- 6.4.11 Innolux Corporation

- 6.4.12 AU Optronics Corp.

- 6.4.13 Dell Technologies Inc.

- 6.4.14 ASUSTeK Computer Inc.

- 6.4.15 Acer Inc.

- 6.4.16 Vizio Inc.

- 6.4.17 Skyworth Group Ltd

- 6.4.18 Barco NV

- 6.4.19 Eizo Corporation

- 6.4.20 ViewSonic Corporation

- 6.4.21 BenQ Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment