|

市場調查報告書

商品編碼

1639450

化妝品包裝器材:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Cosmetic Packaging Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

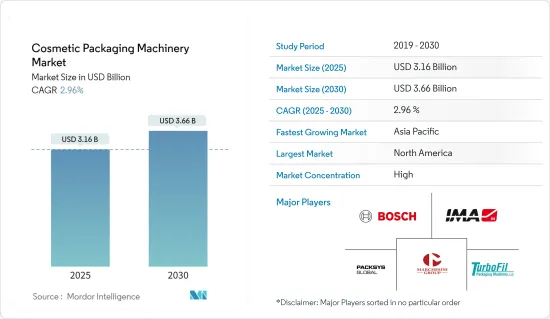

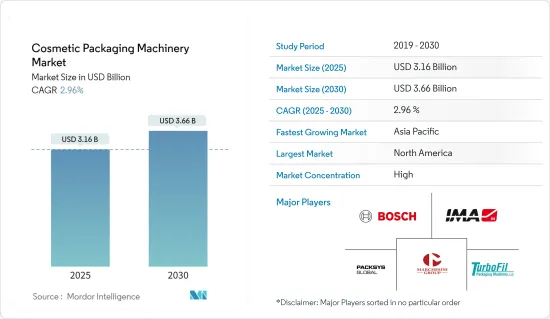

化妝品包裝器材市場規模預計到 2025 年為 31.6 億美元,預計到 2030 年將達到 36.6 億美元,預測期內(2025-2030 年)複合年成長率為 2.96%。

化妝品包裝機是用於各種化妝品的專用設備,從乳霜、乳液到香水和口紅。它在包裝和處理作業中發揮著至關重要的作用,包括填充、密封、貼標和封蓋。這確保了化妝品的有效包裝並保持高衛生標準。消費者對整裝儀容和美容產品的認知不斷提高,推動了對高效包裝解決方案的需求。歐萊雅預計,2023年全球化妝品市場與前一年同期比較增8%。

主要亮點

- 千禧世代人口的增加、都市化進程的加速和消費者收入的增加等因素對化妝品產業的成長做出了重大貢獻。都市化透過增加可支配收入並讓人們意識到各種化妝品的可用性,為市場參與企業創造了許多機會,從而大大刺激了對化妝品和包裝的需求。根據人口研究實驗室的數據,2023年全球都市化率為57%。北美、拉丁美洲和加勒比地區領先,80%以上的人口居住在都市區。

- 高所得消費者更有可能花錢購買奢侈品和有機化妝品。 Z 世代消費者越來越常被化妝品品牌的行銷努力所打動,導致消費者信心激增。例如,在英國,消費者在個人保健產品上的支出將從 2022 年的 79.92 億英鎊(99.402 億美元)躍升至 2023 年第二季的 89.76 億英鎊(111.641 億美元)。歐洲消費者支出的成長證實了該地區對多樣化包裝解決方案的需求不斷成長。

- 自動化和物聯網整合等包裝技術創新正在提高包裝器材的效率和能力。例如,2054 年 5 月,歐萊雅在「美麗為每個人,由美容科技提供動力」的旗幟下宣布了各種創新。這些創新包括先進的皮膚和頭髮診斷、由GenAI 驅動的個人美容助理、名為CREAITECH 的GenAI 美容內容實驗室(旨在提高創造力)以及由紅外光技術驅動的突破性接髮技術,其中包括吹風機、用於增強效果的微表面表面置換設備。

- 隨著對永續性的重視,化妝品製造商擴大尋找天然環保的成分和乳化劑。向「綠色」美的轉變不僅僅是一種短暫的趨勢。研究強調了傳統化妝品的毒性,並支持對天然化妝品需求的快速永續成長。消費者越來越意識到他們的選擇對環境和健康的影響,對符合他們價值觀的產品的需求不斷增加。隨著天然成分的創新和永續實踐進一步增加綠色美容產品的吸引力,這一趨勢預計將持續下去,從而在所研究的市場中創造更多機會。

- 此外,化妝品包裝器材產業也面臨初始資本要求高的主要限制。對於中小型化妝品生產商來說,這種資金障礙極為困難,阻礙了他們投資先進的包裝設備。這限制了新的行業進入,減少了競爭,並抑制了創新。

- 環境和安全法規的變化可能要求公司升級包裝器材以滿足新標準,這可能會產生額外成本。在經濟困難時期,這尤其具有挑戰性。此外,衝突擾亂供應鏈並導致原料價格波動,從而影響包裝生態系統。

化妝品包裝器材市場趨勢

貼標機檢查大成長

- 貼標機將標籤貼到各種產品、包裝或容器上。這些標籤包含消費者和企業有效識別和管理產品的基本訊息,包括產品名稱、成分和條碼定價。貼標機有多種類型和尺寸,適用於多個行業,包括化妝品。它可以處理多種標籤格式,包括收縮套管、不乾膠標籤和感壓標籤,使其成為包裝過程中的多功能工具。

- 技術的進步導致了更先進和自動化的貼標機的開發,這些貼標機可以處理大量生產並確保準確性。例如,2023年9月,通用汽車推出了豪華標籤裝飾的高度自動化的DC350Flex+葡萄酒生產線。該系列旨在為奢侈品市場(尤其是葡萄酒、化妝品和美容領域)的數位標籤提供最大的附加價值,具有獨特的可燙箔和壓花效果,以其令人印象深刻的數位清漆效果產生了巨大的影響。

- 有關產品資訊、安全性和可追溯性的嚴格規定需要準確可靠的標籤。監管機構通常需要有關化妝品的詳細資訊,例如成分、使用說明和有效期限。 2023年12月,歐洲議會和歐洲理事會就化學品分類、標示和包裝法規(CLP法規)達成臨時協議。該協議預計將對市場產生積極影響,公司將擴大採用數位標籤和永續實踐來滿足更新的監管標準。

- 此外,高品質的標籤對於吸引消費者和區分商店上的產品至關重要。先進的貼標機允許製造商使用各種材料、顏色和設計來增強品牌吸引力。隨著標籤技術的進步,為消費者提供額外資訊和互動體驗的創新(例如 RFID 和智慧標籤)變得越來越普遍。個人化和客製化化妝品的趨勢需要靈活的標籤解決方案。最新的貼標機可以處理帶有獨特標籤的小批量生產,滿足客製化包裝的需求。

- 新興市場的快速都市化和經濟成長將導致對化妝品的需求增加,進而對包裝解決方案(包括先進的貼標機)的需求增加。根據世界銀行預測,到 2023 年,印度總人口的約三分之一將居住在都市區。這一趨勢表明,過去十年,都市化增加了4%以上,這意味著人們從農村轉移到城市尋找工作和謀生。此外,歐萊雅預計,到2023年,護膚品將佔全球化妝品市場的40%。從地區來看,北亞和北美佔據了化妝品市場壓倒性的60%。

北美佔據主要市場佔有率

- 北美化妝品市場強勁,對美容和個人保健產品的需求持續成長。這種高需求需要高效率、高產能的包裝器材。美國人口普查局的資料顯示,2023年美國醫療個人照護商店銷售額達到約4,350億美元,高於前一年的4,000億美元。

- 美國也是化妝品中心,以其創新和高品質的產品而聞名。美國消費者想要滿足他們需求和偏好的產品。許多跨國公司在美國設有業務,包括露華濃 (Revlon)、MAC Cosmetics、雅芳 (Avon) 和歐萊雅 (L'Oréal)。美國是抗衰老和抗皺護膚品的最大市場之一。

- 例如,2024 年 5 月,LBB Specialties 同意成為 Ingredion 在美國和加拿大的個人保健產品的獨家分銷合作夥伴,包括 Farmal 生物基聚合物和 Nativacare 天然聚合物。 Ingredion 的美容和個人保健產品組合包括吸水和吸油澱粉,可減少護膚產品的光澤和水分。

- 該地區專注於包裝器材創新,包括自動化和智慧包裝解決方案,正在提高效率並滿足化妝品行業不斷變化的需求。中國向工業 4.0 的轉變正在推動自動化、人工智慧和物聯網等技術在製造業的採用,從而推動市場成長。北美電子商務的興起增加了對高效可靠的包裝解決方案的需求,以確保產品在運輸過程中的安全並改善消費者的拆箱體驗。

- 此外,加拿大強勁的經濟復甦將使美國公司能夠進入不斷擴大的加拿大市場。加拿大經濟蓬勃發展,是尋求建立和擴大在化妝品領域業務的美國化妝品公司的重要支柱。該細分市場包括許多產品,從肥皂和化妝品到指甲黏合劑、紋身墨水和染髮劑。加拿大廣播公司 2023 年 11 月的一份報告強調,化妝品已成為藥局和藥局零售商的重要收益來源。尤其是加拿大零售巨頭 Loblaw 將其強勁的收益歸因於食品通膨和銷售額的顯著成長,特別是在化妝品等高利潤領域。

- 根據 StatCan 的數據,2023 年第三季化妝品和香水銷售額達到約 18.6 億加元(13.8 億美元)。加拿大化妝品和香水的持續銷售將推動北美化妝品包裝的創新,從而推動所研究的市場。

化妝品包裝器材產業概況

化妝品包裝器材市場細分,許多領先公司提供解決方案,例如博世包裝技術公司、IMA Industria Macchine Automatiche SpA、Marchesini Group SpA、Packys Global Ltd、Promach Inc.、Turbofil Packaging Machines 等。公司正在創新新產品、進行收購和合作以擴大市場佔有率。

- 2024 年 4 月,GEKA 推出了用於化妝品包裝的兼容再生聚丙烯 (PCR PP)。這種 PCR PP 專為瓶子和棒材設計,保持與原始材料相同的質量,代表了材料永續性的顯著進步。最重要的是,製造商可以無縫地融入這種材料,而無需對模具或加工設備進行任何調整,並且價格分佈。

- 2023年9月,Albea Tubes與法國著名化妝品品牌歐舒丹合作,重新設計了Albea 30ml護手霜的包裝。新設計採用全塑膠層壓板,其中包括塑膠回收再利用協會認證的 Greenleaf 管中的多層 HDPE 套管。這項創新確保了該管材可以在法國、歐洲和美國現有的 PE 回收流程中回收。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 主要宏觀經濟趨勢對市場的影響

- 市場促進因素

- 個人保健產品需求不斷成長

- 工業自動化程度提高

- 市場問題

- 初始資本要求高

第5章市場區隔

- 按機器類型

- 成型/填充/密封機械

- 貼標機械

- 旋蓋機

- 包裝機

- 其他機器類型

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- Bosch Packaging Technology Inc.(Robert Bosch GmbH)

- IMA Industria Macchine Automatiche SpA

- Marchesini Group SpA

- Packsys Global Ltd

- Prosy's Innovative Packaging Equipment

- Turbofil Packaging Machine LLC

- Vetraco Group

- Zhejiang Rigao Machinery Corporation Ltd

- Wimco Ltd

- ProMach Inc.

- Liquid Packaging Solutions Inc.

- APACKS

第7章 投資分析

第8章市場的未來

The Cosmetic Packaging Machinery Market size is estimated at USD 3.16 billion in 2025, and is expected to reach USD 3.66 billion by 2030, at a CAGR of 2.96% during the forecast period (2025-2030).

Cosmetics packaging machines are specialized equipment for various cosmetic items, from creams and lotions to perfumes and lipsticks. They play a pivotal role in packaging and handling tasks like filling, sealing, labeling, and capping. This guarantees that cosmetic products are packaged efficiently and maintain high hygiene standards. The rising consumer consciousness regarding personal grooming and beauty products fuels the demand for efficient packaging solutions. According to L'Oreal, the global cosmetics market grew 8% in 2023 compared to the previous year.

Key Highlights

- Factors such as the growing millennial population, increasing urbanization, and rising incomes of consumers are the major contributors to the growth of the cosmetic industry. Urbanization has created several opportunities for the players in the market by raising disposable income and creating awareness about the availability of various cosmetics, thereby significantly spurring the demand for cosmetic products and packaging. According to the Population Reference Bureau, global urbanization stood at 57% in 2023. North America, Latin America, and the Caribbean led the charge, with over 80% of their populations living in urban centers.

- High-income consumers are highly inclined to spend on luxury and organic cosmetics. Gen Z consumers are increasingly swayed by cosmetic brand marketing efforts, leading to a surge in spending intentions. For instance, in the United Kingdom, consumer spending on personal care products surged from GBP 7,992 million (USD 9940.2 million) in 2022 to GBP 8,976 million (USD 11,164.1 million) in Q2 2023. This uptick in European consumer spending underscores the region's rising demand for diverse packaging solutions.

- Innovations in packaging technology, such as automation and the integration of IoT, enhance the efficiency and capabilities of packaging machines. For instance, in May 2054, L'Oreal introduced a range of innovations under the banner 'Beauty for Each, Powered by Beauty Tech.' These innovations encompass advanced skin and hair diagnostics, a personal beauty assistant powered by GenAI, a GenAI Beauty Content Lab named CREAITECH to boost creativity, a groundbreaking hair dryer utilizing infrared light technology, a micro-resurfacing device enhancing skincare, and an advanced technology platform mimicking human skin for scientific research and product testing.

- Amid a rising emphasis on sustainability, cosmetics manufacturers increasingly seek natural and eco-friendly ingredients and emulsifiers. The shift toward 'green' beauty is not just a passing trend. Research highlights the toxicity of conventional cosmetics, propelling the rapid and sustainable growth of the demand for natural cosmetics. Consumers are becoming more aware of their choice's environmental and health impacts, driving demand for products that align with their values. This trend is expected to continue, with innovations in natural ingredients and sustainable practices further enhancing the appeal of green beauty products, thereby creating more opportunities in the market studied.

- Moreover, the cosmetics packaging machinery sector faces significant limitations in terms of high initial capital demands. This financial barrier can be incredibly daunting for small and medium-sized cosmetic manufacturers, hindering them from investing in advanced packaging equipment. Therefore, the industry sees limited new entrants, reducing competition and stifling innovation.

- Changes in environmental and safety regulations can require companies to upgrade their packaging machinery to meet new standards, leading to additional costs. This can be particularly challenging during times of economic stress. In addition, the conflict has affected the packaging ecosystem by disrupting supply chains and causing fluctuations in raw material prices.

Cosmetic Packaging Machinery Market Trends

Labeling Machine to Witness Significant Growth

- Labeling machines spread labels to different products, packages, or containers. These labels deliver essential information such as product names, ingredients, barcode pricing, and other details that help consumers and businesses identify and manage items efficiently. Labeling machines come in different types and sizes and are suitable for multiple industries, including cosmetics. They can handle a range of label formats, including shrink sleeves, adhesive labels, and pressure-sensitive labels, making them versatile tools in the packaging process.

- Technological improvements have led to the development of more sophisticated and automated labeling machines, which can handle high volumes and ensure precision. For instance, in September 2023, GM highlighted its highly automated DC350Flex+ wine line for premium label embellishment. Designed to add maximum value to digital labels for luxury markets, especially wine, cosmetics, and beauty, it is influential for its unique foiling and embossing abilities and striking digital varnish effects.

- Stringent regulations regarding product information, safety, and traceability are driving the need for precise and reliable labeling. Regulatory bodies often require detailed information on cosmetic products, including ingredients, usage instructions, and expiry dates. In December 2023, the European Parliament and the Council reached a provisional agreement on chemical classification, labeling, and packaging regulation (CLP regulation). This agreement is expected to positively impact the market, with companies increasingly adopting digital labeling and sustainable practices to meet the updated regulatory standards.

- Furthermore, high-quality labels are essential for attracting consumers and differentiating products on store shelves. Advanced labeling machines enable manufacturers to use various materials, colors, and designs to enhance brand appeal. Innovations such as RFID and smart labels that provide additional information and interactive experiences for consumers are becoming more prevalent, driven by advances in labeling technology. The trend toward personalized and customized cosmetic products requires flexible labeling solutions. Modern labeling machines can handle small batch runs with unique labels, catering to the demand for customized packaging.

- Rapid urbanization and economic growth in emerging markets lead to increased demand for cosmetic products and, consequently, packaging solutions, including advanced labeling machines. According to the World Bank, in 2023, approximately a third of the total population in India lived in cities. The trend shows an increase in urbanization by more than 4% in the last decade, meaning people have moved away from rural areas to find work and make a living in the cities. Furthermore, according to L'Oreal, in 2023, skincare products made up 40% of the global cosmetic market. Geographically, North Asia and North America dominated, accounting for about 60% of the cosmetics market combined.

North America to Hold Significant Market Share

- North America has a robust cosmetics market with continuous demand for beauty and personal care products. This high demand necessitates efficient and high-capacity packaging machinery. Data from the US Census Bureau shows that in 2023, sales in health and personal care stores in the United States reached approximately USD 435 billion, marking an increase from the previous year's USD 400 billion.

- In addition, the United States is a hub for cosmetic products and is known for its innovative and quality products. Consumers in the United States seek products geared toward their specific needs and preferences. The country has the footprint of many multinational companies, such as Revlon, MAC Cosmetics, Avon, and L'Oreal. The United States is one of the big markets for skin care products, including anti-aging and anti-wrinkle effects.

- For instance, in May 2024, LBB Specialties agreed to become Ingredion's exclusive distribution partner in the United States and Canada for its personal care product portfolio, including Farmal bio-based polymers and Nativacare natural polymers. Ingredion's beauty and personal care portfolio includes water and oil-absorbent starches that reduce shine and moisture in skin care products.

- The region's focus on technological innovation in packaging machinery, including automation and smart packaging solutions, enhances efficiency and meets the cosmetics industry's evolving needs. The country's shift toward Industry 4.0 is driving the adoption of technologies such as automation, AI, and IoT in the manufacturing sector, driving the market's growth. The rise of e-commerce in North America has led to an increased need for efficient and reliable packaging solutions to ensure product safety during transportation and enhance consumers' unboxing experience.

- Moreover, Canada's robust economic rebound allows US firms to tap into its expanding market. With a booming economy, Canada presents a significant platform for American cosmetic companies looking to establish and expand their presence in the cosmetics sector. This sector encompasses many products, from soaps and makeup to nail adhesives, tattoo inks, and hair dyes. A November 2023 report by the Canadian Broadcasting Corporation highlighted how cosmetics have emerged as a critical revenue stream for pharmacy and drugstore retailers. Notably, Loblaw, a major Canadian retailer, attributed its robust earnings to food inflation and a notable uptick in sales, particularly in high-margin segments like cosmetics.

- According to StatCan, the sales of cosmetics and fragrances amounted to approximately CAD 1.86 billion (USD 1.38 billion) in the third quarter of 2023. The continued sales of cosmetics and perfumes in Canada drive innovation in North American cosmetic packaging, thereby boosting the market studied.

Cosmetic Packaging Machinery Industry Overview

The cosmetic packaging machinery market is fragmented, with many big players offering solutions, such as Bosch Packaging Technology Inc., IMA Industria Macchine Automatiche SpA, Marchesini Group SpA, Packys Global Ltd, Promach Inc., and Turbofil Packaging Machines. Players are engaged in new product innovation, acquisitions, collaborations, etc., to increase their market share.

- April 2024: GEKA introduced a formulation-compliant recycled polypropylene (PCR PP) tailored for cosmetics packaging. This PCR PP, designed for bottles and rods, maintains the same quality as virgin material, offering a notable advancement in material sustainability. Notably, manufacturers can seamlessly integrate this material without the need for adjustments to their tooling or processing equipment, all while being offered at a competitive price point.

- September 2023: Albea Tubes collaborated with the renowned French cosmetics brand L'Occitane to revamp Albea's 30 ml hand cream packaging. The new design features an all-plastic laminate, including an Association of Plastic Recyclers-certified Greenleaf tube with a multilayer HDPE sleeve. This innovation ensures the tube is recyclable in existing PE recycling streams across France, Europe, and the United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of Key Macroeconomic Trends on the Market

- 4.5 Market Drivers

- 4.5.1 Growing Demand for Personal Care Products

- 4.5.2 Increasing Industrial Automation

- 4.6 Market Challenges

- 4.6.1 High Intitial Capital Requirement

5 MARKET SEGMENTATION

- 5.1 By Machine Type

- 5.1.1 Form/Fill/Seal Machinery

- 5.1.2 Labelling Machinery

- 5.1.3 Capping Machinery

- 5.1.4 Wrapping Machinery

- 5.1.5 Other Machine Types

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Bosch Packaging Technology Inc. (Robert Bosch GmbH)

- 6.1.2 IMA Industria Macchine Automatiche SpA

- 6.1.3 Marchesini Group SpA

- 6.1.4 Packsys Global Ltd

- 6.1.5 Prosy's Innovative Packaging Equipment

- 6.1.6 Turbofil Packaging Machine LLC

- 6.1.7 Vetraco Group

- 6.1.8 Zhejiang Rigao Machinery Corporation Ltd

- 6.1.9 Wimco Ltd

- 6.1.10 ProMach Inc.

- 6.1.11 Liquid Packaging Solutions Inc.

- 6.1.12 APACKS