|

市場調查報告書

商品編碼

1639454

物聯網測試 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)IoT Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

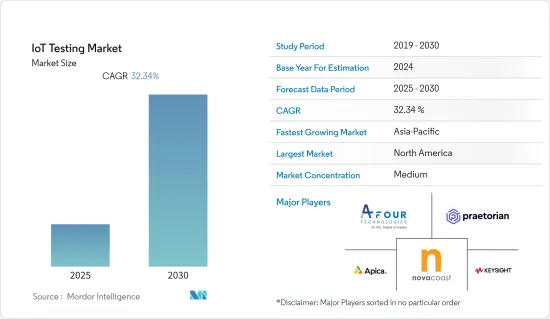

物聯網測試市場預計在預測期內複合年成長率為 32.34%

主要亮點

- 近年來,由於智慧型手機和行動裝置的日益普及以及網路普及率的不斷提高,物聯網的發展經歷了顯著的成長。預計未來同樣的因素將持續推動物聯網解決方案的需求。這些設備的增加將導致產生的資料量增加。

- 物聯網測試工具廣泛用於監控開放原始碼應用程式以及發送者和接收者之間的流量。因此,物聯網測試工具以及物聯網解決方案很可能成為推動市場需求的關鍵因素。

- 此外,物聯網測試服務在測試智慧元件和物聯網應用方面發揮重要作用,以便為最終用戶提供優質的體驗和服務。物聯網測試涉及即時智慧和通訊,以確保網際網路上的硬體和軟體完美協調。

- 微服務部署的增加主要推動了物聯網測試市場。此外,對 DevOps 的需求不斷成長,與傳統軟體開發相比,DevOps 提高了組織高速交付應用程式和服務的能力,也加速了市場擴張。

- 此外,擴大使用IP(入口保護)測試來改進IoT 設備,物聯網測試提供的許多好處(例如網路安全性、連接設備的易用性、連接性和整體系統性能)的消耗正在提高。

- 然而,隨著物聯網生態系統的擴展,它可能在測試過程中面臨擴展問題。物聯網中微服務的測試自動化預計將降低測試大型架構的複雜性,因為每個微服務都可以作為單獨的進程進行測試。使用微服務進行物聯網測試還具有測試物聯網系統的可擴展性、可擴展性和整合性的優勢。

- 疫情期間對物聯網的需求不斷成長,增加了物聯網測試市場的成長機會。 COVID-19 的爆發擾亂了全球供應鏈和多種產品的需求。到 2020年終,物聯網的採用將受到重大影響。隨後階段,物聯網技術在疫情醫療中的應用,更好的資訊協調和即時病患監測,大大促進了物聯網檢測產業的復甦。

物聯網測試市場趨勢

物聯網設備數量的增加可能會推動市場成長

- 對物聯網設備不斷成長的需求增加了對有效測試服務的需求。在將產品投放市場之前對其品質進行評估至關重要。因為即使是很小的缺陷也會對消費者和企業產生很大的影響。

- 例如,愛立信的一份報告指出,到2022年,物聯網連接總數將約為132億。這些技術預計將在 2021 年大幅增加連網設備的數量,到 2022年終將達到約 5 億台設備。網路容量的增加將透過在FDD頻寬中實現大規模物聯網與4G和5G之間的頻譜共用來加速大規模物聯網技術的發展。

- 託管物聯網測試服務供應商將新興技術視為未來幾年的重要商機。在託管物聯網測試服務中,安全測試預計將比其他測試服務佔據更大的市場佔有率。

- 智慧城市計畫的日益普及正在釋放物聯網在能源和公共產業、廢棄物管理和基礎設施方面的巨大潛力。對支援物聯網的基礎設施的投資預計將推動對這些資產的安全測試服務的需求,這可能會進一步推動這些領域對託管服務的需求。

- 此外,零售業的智慧設備和物聯網正在幫助企業改善客戶體驗並提高轉換率,改變日常商店營運並增加該行業的託管服務。

- 這導致許多製造、醫療保健和政府部門的公司訂購保全服務,而不是額外投資購買建立安全系統所需的硬體和軟體。

北美佔最大市場佔有率

- 按地區分類,北美地區預計將佔據較大佔有率並主導物聯網測試市場。該地區實際上主導著永續發展的經濟,使其有能力積極投資於研發活動。因此,我們正在為物聯網、巨量資料、DevOps 和行動性等新技術的發展做出貢獻。

- 隨著美國越來越多的消費者擁抱智慧家庭環境,物聯網正在北美地區進一步擴張。史丹佛大學研究人員的一項研究顯示,大約 66% 的北美家庭擁有至少一個物聯網設備,這一比例超過全球平均 40% 的四分之一。雖然這些技術越來越吸引駭客,但它們也提高了智慧家庭的安全水準。物聯網的日益普及極大地影響了測試服務市場的成長。

- 此外,組織熱衷於將物聯網技術納入其流程中,預計將顯著促進物聯網測試市場的成長。例如,2022年10月,拜登政府創建了一份關於改善和保護美國網路安全措施的資訊表,包括為物聯網設備制定網路安全標準標籤。

- 此外,由於物聯網系統、測試技術和智慧連網型設備的應用不斷擴大,該地區的市場正在擴大。該地區的重大技術進步以及所有業務部門對 5G 物聯網的需求推動了對物聯網測試解決方案的需求。

- 可靠的網路存取的可用性以及製造業中互連設備的快速採用也促進了市場的成長。目前正在投入大量研發支出來增強必要的網路連接基礎設施和物聯網測試技術服務,從而支援該地區的市場佔有率。

- 此外,提供相容性測試、前導測試測試、監管測試和升級測試等各種託管和專業服務的物聯網測試服務供應商正在全部區域的市場上興起。

物聯網測試產業概述

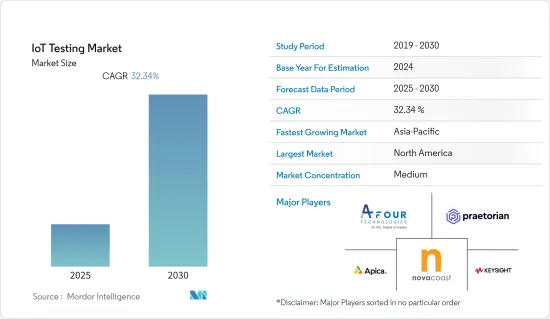

物聯網測試市場競爭適中,由幾個重要的參與企業組成。目前在市場佔有率方面佔據主導地位的一些參與企業包括 Novacoast, Inc.、Keysight Technologies, Inc.、Praetorian Security, Inc.、AFour Technologies Pvt. (ACL Digital) 和 Apica Systems。然而,物聯網測試解決方案供應商正致力於將自己與競爭對手區分開來,以便在全球市場上保持競爭力。一些參與企業正在透過研發支出支援的新產品開發投資來擴大其產品範圍。

2023 年 1 月,Happiest Minds Technologies Limited總合11.1 億印度盧比(1,350 萬美元)的預付款和遞延股票對價收購了總部位於印度馬杜賴的著名IT 服務公司SMI 的100% 股權,並宣布簽署正式協議。 SMI 擁有 400 多名海外員工,年銷售額約 900 萬美元。

2022 年 12 月,以設計主導的工程服務、解決方案和數位轉型參與企業ACL Digital 宣布收購 AFour Technologies。透過收購 AFour Technologies,ACL Digitala 的產品工程和數位解決方案得到了加強,使客戶能夠加速數位轉型之旅。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 物聯網設備的安全問題日益嚴重

- 物聯網設備數量增加

- 市場限制因素

- 物聯網設備的複雜性不斷增加

- 缺乏互通性和互連的統一標準

- 各種物聯網測試討論(資料完整性測試、功能測試、安全測試、效能測試、可用性測試、可靠性和可擴展性測試)

第6章 市場細分

- 按服務類型

- 專業的

- 管理的

- 按測試類型

- 功能測試

- 性能測試

- 網路測試

- 相容性測試

- 可用性測試

- 安全測試

- 最終用戶產業

- 零售業

- 製造業

- 醫療保健

- 能源/公共產業

- 資訊科技/電訊

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Apica Systems

- AFour Technologies Pvt. Ltd.(ACL Digital)

- Happiest Minds Technologies Pvt. Ltd

- Qualitest Group

- Praetorian Security, Inc.

- Saksoft Limited

- Keysight Technologies, Inc.

- Novacoast, Inc.

- Trustwave Holdings Inc.(Singtel)

- HCL Technologies Limited

第8章投資分析

第9章 市場機會及未來趨勢

The IoT Testing Market is expected to register a CAGR of 32.34% during the forecast period.

Key Highlights

- Due to the increasing adoption of smartphones and mobile devices, coupled with the growing internet penetration, the evolution of IoT has witnessed immense growth in recent years. The same factor is expected to continue driving the demand for IoT solutions in the future as well. The rise in these devices leads to increased data being generated.

- IoT testing tools are widely used for open-source applications and to help monitor the traffic between the sender and the receiver. Hence, IoT testing tools, along with IoT solutions, are likely to become a significant factor in driving the market demand.

- Moreover, IoT testing services play a vital role in testing smart components and IoT applications to offer end users superior quality experiences and services. IoT testing involves real-time intelligence and communication to ensure perfect harmony between hardware and software throughout the connected network.

- The increased deployment of microservices is primarily driving the market for IoT testing. The growing need for DevOps to improve an organization's capacity to provide apps and services at a high velocity compared to conventional software development is also accelerating the market's expansion.

- In addition, the increasing use of ingress protection (IP) testing for improved IoT devices and the growing consumer awareness of the many advantages offered by IoT testing, such as network security, the usability of connected devices, connectivity, system performance overall, etc., are significant growth-inducing factors.

- However, as the IoT ecosystem expands, it will likely face problems scaling the testing process. With microservices test automation in IoT, the complexity of testing a massive architecture is expected to reduce, as each microservice can be tested as a separate process. Utilizing microservices for IoT testing also offers the benefits of testing the IoT system's extensibility, scalability, and integrations.

- The growing demand for IoT during the pandemic increased the opportunities for the growth of the IoT testing market. Owing to the outbreak of COVID-19, the global supply chain and demand for multiple products have experienced disruption. The IoT adoption was significantly affected until the end of 2020. In later stages, the implementation of IoT technologies in healthcare during the epidemic for better information coordination and real-time patient monitoring significantly boosted the recovery of the IoT testing industry.

IoT Testing Market Trends

The Growing Number of IoT Devices may Drive the Market Growth

- The growing demand for IoT devices has boosted the requirement for effective testing services. Before a product is released onto the market, it is essential to assess its quality since even a small defect might significantly impact both the consumers and the company.

- For example, according to Ericsson's report, in 2022, the total IoT connections were reported to be valued at around 13.2 billion. These technologies enabled a significant increase in the number of connected devices in 2021, projected to reach about 500 million by the end of 2022. Increased network capabilities promote the development of Massive IoT technologies by enabling spectrum sharing between Massive IoT and 4G and 5G in FDD bands.

- Managed IoT testing service providers see emerging technology as a significant business opportunity for the next few years. Among managed IoT testing services, security testing will have a more substantial market share than other testing services.

- The increasing adoption of smart city concepts has evolved the great potential of IoT in energy and utilities, waste management, and infrastructure. The investment in IoT-enabled infrastructure is expected to accentuate the demand for security testing services for those assets, which may further foster the demand for managed services in these sectors.

- Moreover, smart devices and IoT in the retail sector help companies enhance the customer experience to drive more conversions, altering the day-to-day store operations and increasing the managed services in this sector.

- This encourages many companies operating in the manufacturing, healthcare, or government sectors to subscribe to security services instead of additionally investing in acquiring the hardware and software required to establish a security system.

North America Occupies the Largest Market Share

- By geography, the North American region is anticipated to hold a significant share, thereby dominating the IoT testing market. The region has substantial dominance over sustainable and well-established economies, empowering them to actively invest in R&D activities. Thus, it contributes to developing new technologies, such as IoT, Big Data, DevOps, and mobility.

- With rising consumers embracing the smart home environment in the United States, IoT is further expanding across the North American region. According to a study by Stanford University researchers, around 66% of North American households possess at least one IoT device, more than a quarter of the global average of 40%. Although these technologies are increasingly on the radar of hackers, the level of security of these smart homes has also been amplified. The increased adoption of IoT impacted the growth of the testing services market extensively.

- Moreover, organizations are keen to incorporate IoT technologies into their processes, which is expected to boost the IoT testing market's growth significantly. For instance, in October 2022, the Biden administration produced an information sheet on measures to improve and protect United States cybersecurity, including developing a cybersecurity standards label for IoT devices.

- Further, the market is growing in the region due to expanding IoT systems, testing technologies, and applications for smart, connected devices. The need for IoT testing solutions is driven by the region's significant technological advancements and demand for 5G IoT across all business sectors.

- The availability of highly reliable Internet access and the quick adoption of interconnected devices in manufacturing industries also contribute to the market's growth. Significant R&D expenditures are being made to enhance the necessary network connectivity infrastructure and IoT testing technologies & services, which support the region's market shares.

- Further, several IoT testing service providers across the region have emerged in the market, providing various managed or professional services, such as compatibility testing, pilot testing, regulatory testing, and upgrade testing.

IoT Testing Industry Overview

The IoT testing market is moderately competitive and consists of several significant players. Some players currently dominating the market in terms of market share include Novacoast, Inc., Keysight Technologies, Inc., Praetorian Security, Inc., AFour Technologies Pvt. Ltd. (ACL Digital), and Apica Systems. However, the IoT testing solution providers are focusing on creating a point of difference among their competitors to sustain the global market's competitive landscape. Several players are expanding their offerings through investments in new product development backed by research and development spending.

In January 2023, Happiest Minds Technologies Limited announced the signing of formal agreements to purchase 100% of SMI, a prominent IT services firm with headquarters in Madurai, India, for a total consideration of upfront and deferred equity consideration of INR 111 crores (USD 13.5 million). SMI has 400+ offshore workers and an annual sales run rate of about USD 9 Million.

In December 2022, ACL Digital, a player in design-driven engineering services, solutions, and digital transformation, declared the acquisition of AFour Technologies. ACL Digitala 's product engineering and digital solutions are strengthened by this purchase of the AFour Technologies company, and it will be able to speed up its clients' journeys toward digital transformation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Security Concerns in IOT Devices

- 5.1.2 The Growing Number of IOT Devices

- 5.2 Market Restraints

- 5.2.1 Rising Complexity of IOT Devices

- 5.2.2 Shortage of Uniform Standards for Interoperability and Interconnection

- 5.3 Discussion on Various Types of IOT Testing (Data Integrity Testing, Functional Testing, Security Testing, Performance Testing, Usability Testing, Reliability & Scalability Testing)

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Professional

- 6.1.2 Managed

- 6.2 By Testing Type

- 6.2.1 Functional Testing

- 6.2.2 Performance Testing

- 6.2.3 Network Testing

- 6.2.4 Compatibility Testing

- 6.2.5 Usability Testing

- 6.2.6 Security Testing

- 6.3 End-user Industry

- 6.3.1 Retail

- 6.3.2 Manufacturing

- 6.3.3 Healthcare

- 6.3.4 Energy and Utilities

- 6.3.5 IT & Telecom

- 6.3.6 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Apica Systems

- 7.1.3 AFour Technologies Pvt. Ltd. (ACL Digital)

- 7.1.4 Happiest Minds Technologies Pvt. Ltd

- 7.1.5 Qualitest Group

- 7.1.6 Praetorian Security, Inc.

- 7.1.7 Saksoft Limited

- 7.1.8 Keysight Technologies, Inc.

- 7.1.9 Novacoast, Inc.

- 7.1.10 Trustwave Holdings Inc. (Singtel)

- 7.1.11 HCL Technologies Limited