|

市場調查報告書

商品編碼

1639481

氧化鋁:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Aluminum Oxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

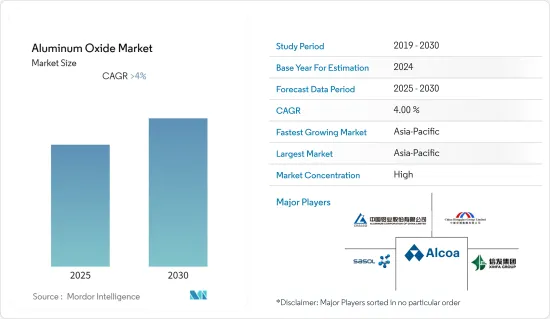

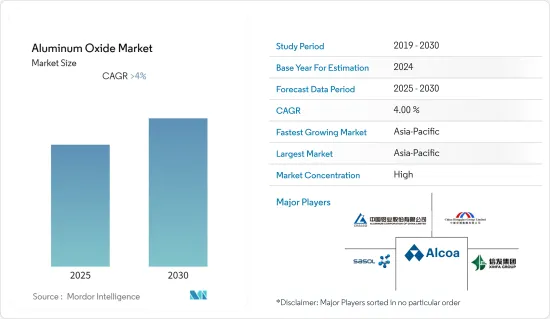

預計預測期內氧化鋁市場將以超過 4% 的複合年成長率成長。

2020 年,COVID-19 對氧化鋁市場產生了顯著的負面影響。 COVID-19 擾亂了全球供應鏈,從而損害了行業成長。然而,汽車產業的光明前景創造了更多的鋁需求,從而推動了對氧化鋁的需求。

主要亮點

- 由於製藥和工業製造業的需求不斷增加以及多孔陶瓷產量的上升,市場正在擴大。

- 然而,氧化鋁帶來的健康危害日益嚴重,成為市場關注的一大議題。

- 在預測期內,由於生醫材料在醫療產業的巨大潛力,市場可能會迎來機會。

- 由於醫療保健、工業製造和電子行業的需求不斷成長,亞太地區在全球市場佔據主導地位。

氧化鋁市場趨勢

鋁冶煉環節主導市場需求

- 氧化鋁主要用於鋁冶煉製程。事實上,幾乎 90% 的氧化鋁都用於鋁冶煉行業。氧化鋁以2:1的比例生產鋁原金屬(2噸氧化鋁生產1噸鋁)。

- 鋁是世界上使用最廣泛的第二大金屬。由於其強度高、重量輕和可回收性,在運輸、建築、電氣工程、包裝等行業中廣受歡迎。

- 兩家鋁業公司成立了一家名為 Elysis 的合資企業,以改進該技術,以便大規模使用和向公眾銷售。兩家公司計劃從 2024 年開始出售該技術包。

- 蘋果已與這兩家鋁業公司以及加拿大和魁北克政府合作,投資 1.44 億美元用於未來的研發。

- 2021年,美國原生鋁產量佔全球比重不到2%,為第九大生產國。 2021 年,美國原生鋁冶煉廠的運作為產業額定產能的 55%,而加拿大為 95%,全球為 88%。此外,2021 年,超過 75% 的國內供應來自二次冶煉廠。

- 此外,2021年中國原生鋁產量為3,850萬噸,較2020年成長3.8%。由於持續的電力短缺,中國的鋁冶煉廠和提煉難以完成工作。

- 鑑於上述情況,預測期內細分的需求可能會增加。

亞太地區佔市場主導地位

- 由於醫療和製藥、電子和工業製造等終端用戶行業的投資和產量不斷增加,亞太地區佔據全球氧化鋁市場的最大佔有率。

- 中國是世界上成長最快的經濟體之一,人口不斷成長、生活水準不斷提高、人均收入不斷上升,推動了幾乎所有終端用戶產業的成長。然而,由於國際貿易中斷和不利的地緣政治因素,預測期前幾年的成長可能會放緩。然而,預計預測期末期條件和關係將會改善,成長將會加速。

- 中國是世界最大的氧化鋁生產國。由於友好的政策和原料的便利,中國西南部的貴州省正日益成為最大的生產省份。貴州擁有豐富的礬土資源,在發展鋁生產方面具有優勢,因為礬土是許多工業製程用於生產鋁產品的原料。

- 2021年,中國是最大的原生鋁,產量約3,900萬噸。這個數字比其他國家都要多。 2022年7月中國原鋁產量年增5.6%至343萬噸,創歷史新高。

- 此外,根據世界金屬統計局的預測,2021年日本再生鋁產量約78.66萬噸,較上年增加約9.64萬噸。

- 因此,這些應該會在未來幾年推動該地區研究市場的需求。

氧化鋁產業概況

全球氧化鋁市場格局趨於整合,前五大公司佔據全球市場的大部分佔有率。市場的主要企業包括中國鋁業股份有限公司(CHALCO)、信發集團、中國宏橋Group Limited、薩索爾、美國鋁業公司等(不分先後順序)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 製藥和工業製造製程的高需求

- 陶瓷產業對多孔陶瓷生產的需求不斷增加

- 限制因素

- 接觸氧化鋁會增加健康風險

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原料分析

- 技術簡介

- 政府法規和政策

- 貿易分析

- 價格指數

第5章 市場區隔(按數量分類的市場規模)

- 依結構類型

- 奈米粒子

- 粉末

- 顆粒

- 錠劑

- 濺鍍靶材

- 按應用

- 鋁冶煉

- 磨料

- 鋁化學品

- 陶瓷

- 耐火材料

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Alcoa Corporation

- Aluminum Corporation of China Limited(CHALCO)

- China Hongqiao Group Limited

- East Hope Group(Oriental Hope)

- Emirates Global Aluminum PJSC

- Hangzhou Jinjiang Group Co. Ltd.

- Hindalco Industries Limited(Aditya Birla Group)

- NALCO India

- Norsk Hydro ASA

- Rio Tinto

- RUSAL

- Sasol

- South32

- Xinfa Group Co. Ltd.

第7章 市場機會與未來趨勢

- 作為醫療產業生物材料的巨大潛力

The Aluminum Oxide Market is expected to register a CAGR of greater than 4% during the forecast period.

The COVID-19 had a significant negative impact on the aluminum oxide market in 2020. It hurt industry growth because it messed up the supply chain around the world.But the bright future of the auto industry has made more people want aluminum, which has pushed up the demand for aluminum oxide.

Key Highlights

- The market that was looked at is growing because there is more demand from the pharmaceutical and industrial manufacturing sectors and more porous ceramics are being made.

- But one of the biggest worries about the market that was looked at is that the health risks from aluminum oxide are getting worse.

- During the forecast period, the market that was looked at is likely to have opportunities due to the huge potential of biomaterials in the medical industry.

- Due to rising demand from the medical, industrial manufacturing, and electronics industries, Asia-Pacific ruled the world market.

Aluminum Oxide Market Trends

Aluminum Smelting Segment to Dominate the Market Demand

- Aluminum oxide is mostly used in the smelting process to make aluminum. In fact, almost 90% of all aluminum oxide made is used in the aluminum smelting industry.The aluminum oxide is used to produce the primary aluminum metal at a ratio of 2:1 (2 metric tons of alumina produce 1 metric ton of aluminum).

- Aluminum is the second most used metal in the world. It is mostly used in transportation, building and construction, electrical engineering, container packaging, and other industries because it is strong, lightweight, and can be recycled.

- Together, the two aluminum companies set up a joint venture called Elysis to improve this technology so that it can be used on a larger scale and sold to the public. They plan to sell a package of this technology starting in 2024.

- Apple joined forces with these two aluminum companies and the governments of Canada and Quebec to invest USD 144 million in research and development for the future.

- In 2021, the United States produced less than 2% of the world's primary aluminum and was the ninth largest producer of primary aluminum. In 2021, the primary aluminum smelters in the United States ran at 55% of the industry's rated production capacity, compared to 95% in Canada and 88% around the world.Moreover, in 2021, more than 75% of domestic supply came from secondary smelters.

- Also, China made 38.5 million tons of primary aluminum in 2021, which was 3.8% more than in 2020. Due to the ongoing power shortages, China's aluminum smelters and refineries have had trouble getting their work done.

- Based on the above, it seems likely that the need for segmentation will grow during the forecast period.

Asia-Pacific Region to Dominate the Market

- Due to more investments and production in end-user industries like medicine and pharmaceuticals, electronics, industrial manufacturing, etc., the Asia-Pacific region had the largest share of the global aluminum oxide market.

- China has one of the fastest-growing economies in the world, and almost all end-user industries have been growing because of the country's growing population, higher living standards, and higher income per person. But because of turbulence in international trade and bad geopolitical events, the growth rate is likely to slow down in the first few years of the forecast period. But the growth is expected to speed up toward the end of the forecast period, when conditions and relationships are expected to improve.

- China is the world's top producer of aluminum oxide. Southwest China's Guizhou province is increasingly becoming the largest producer, due to friendly policies and the easy availability of raw materials. Guizhou's abundant bauxite resources have given it an edge in developing aluminum production, as bauxite is the raw material used to produce aluminum products in many industrial processes.

- In 2021, China was the biggest producer of primary aluminum, making about 39 million metric tons. This was a lot more than any other country. In July 2022, China's primary aluminum production rose 5.6% to a record monthly high of 3.43 million metric tons from a year earlier, with smelters ramping up production as power restrictions were eased.

- Also, the World Bureau of Metal Statistics says that in 2021, Japan made about 786.6 thousand metric tons of secondary aluminum, which is about 96.4 thousand tons more than the year before.

- Therefore, all of these things should drive the demand for the studied market in the region over the next few years.

Aluminum Oxide Industry Overview

The global aluminum oxide market is consolidated, with the top five players accounting for a significant share of the global market. Some of the major players in the market include Aluminum Corporation of China Limited (CHALCO), Xinfa Group Co. Ltd., China Hongqiao Group Limited, Sasol, and Alcoa Corporation, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand from Pharmaceutical and Industrial Manufacturing Processes

- 4.1.2 Increasing Demand from Ceramic Industries for Producing Porous Ceramics

- 4.2 Restraints

- 4.2.1 Increasing Health Risks due to Exposure to Aluminum Oxide

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

- 4.6 Technological Snapshot

- 4.7 Government Regulations and Policies

- 4.8 Trade Analysis

- 4.9 Price Index

5 MARKET SEGMENTATION ( Market Size in Volume)

- 5.1 Structural Form Type

- 5.1.1 Nanoparticles

- 5.1.2 Powder

- 5.1.3 Pellets

- 5.1.4 Tablets

- 5.1.5 Sputtering Targets

- 5.2 Application

- 5.2.1 Aluminum Smelting

- 5.2.2 Abrasive

- 5.2.3 Aluminum Chemicals

- 5.2.4 Engineered Ceramics

- 5.2.5 Refractories

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alcoa Corporation

- 6.4.2 Aluminum Corporation of China Limited (CHALCO)

- 6.4.3 China Hongqiao Group Limited

- 6.4.4 East Hope Group (Oriental Hope)

- 6.4.5 Emirates Global Aluminum PJSC

- 6.4.6 Hangzhou Jinjiang Group Co. Ltd.

- 6.4.7 Hindalco Industries Limited (Aditya Birla Group)

- 6.4.8 NALCO India

- 6.4.9 Norsk Hydro ASA

- 6.4.10 Rio Tinto

- 6.4.11 RUSAL

- 6.4.12 Sasol

- 6.4.13 South32

- 6.4.14 Xinfa Group Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Huge Potential as Biomaterial in Medical Industry