|

市場調查報告書

商品編碼

1639485

歐洲包裝檢測:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Package Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

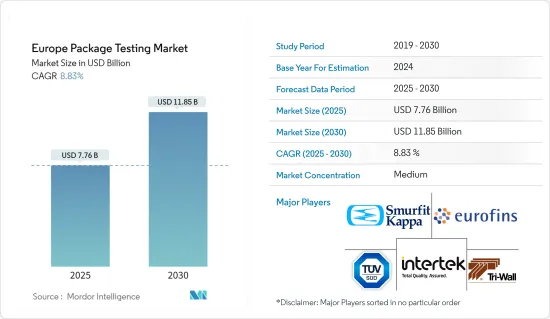

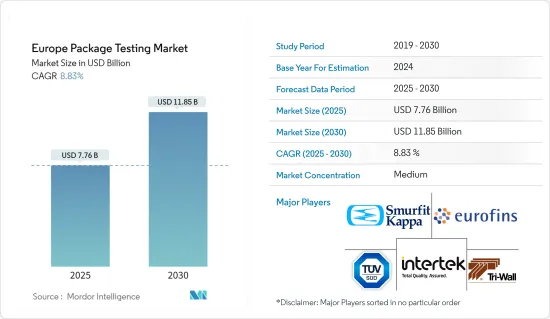

歐洲包裝檢測市場規模預計在 2025 年為 77.6 億美元,預計到 2030 年將達到 118.5 億美元,預測期內(2025-2030 年)的複合年成長率為 8.83%。

主要亮點

- 歐洲包裝檢測市場由於幾個關鍵因素而不斷成長。包裝食品、食品和飲料以及加工食品的消費量增加是主要促進因素。為確保包裝商品的安全和質量,嚴格的法規和標準進一步推動了這一趨勢。網路零售的快速擴張,尤其是食品和其他消費品的擴張,增加了對堅固包裝的需求,以確保透過複雜的分銷網路安全交付。此外,由於對能夠承受運輸過程中各種環境條件的創新包裝解決方案的需求,市場也在不斷成長。

- 包裝檢驗對於評估產品品質和確保歐洲客戶滿意度至關重要。它涵蓋了產品安全、法規遵循、改善客戶體驗、加強品牌、降低成本和產品開發創新等重要方面。有效的包裝檢驗可確保產品符合安全標準、遵守法規並提供積極的客戶體驗。它還可以幫助您的品牌在競爭激烈的市場中脫穎而出,透過包裝最佳化降低成本,並協助開發新產品和改進產品。

- 產品安全評估包裝在運輸和儲存過程中保護內容物免受損壞、污染和篡改的能力。這包括評估材料強度、密封完整性、對濕度和溫度變化等環境因素的抵抗力等等。法規合規性測試確保包裝符合法律要求,例如標籤標準、材料限制和歐洲特定國家的環境法規。

- 改善客戶經驗包括測試包裝的易用性、說明的清晰度和整體美觀。這包括評估拆包體驗、文字的可讀性和可重新密封的封口等包裝功能。透過包裝測試進行品牌提升著重於保持整個產品線的包裝品質的一致性,並確保包裝有效地傳達品牌價值和訊息。

- 包裝測試節省成本的方面包括最佳化材料使用、提高生產效率和減少廢棄物。這包括測試替代材料和設計,以在降低整體包裝成本的同時保持產品保護。包裝檢測還透過評估新的包裝概念、材料或技術來支援產品開發的創新。透過引入滿足新消費者需求和環境問題的包裝解決方案,此流程可幫助公司保持競爭力。

- 包裝材料要經過各種測試,以評估其在不同條件下的性能。這些測試包括壓力負荷、衝擊、振動、敲擊、濕度、溫度變化等。已經開發出各種測試方法來評估包裝質量,包括跌落測試、壓縮測試和環境調節測試。包裝對於在運輸和儲存過程中保持產品的品質和真實性至關重要。保護您的產品免受物理損壞、污染和環境因素的影響。隨著消費者期望的不斷提高,包裝必須經受長時間的磨損,以確保產品以最佳狀態到達消費者手中。

- 包裝食品、食品和飲料以及加工食品的消費量不斷增加,推動了歐洲包裝測試市場的發展。為確保包裝商品的安全和品質而製定的嚴格法規和標準進一步推動了這一成長。此外,網路零售(尤其是食品零售)的興起,增加了精密包裝的需求,以確保透過複雜的分銷網路安全交付。對於能夠承受運輸過程中各種環境條件的創新包裝解決方案的需求也促進了市場擴張。

- 隨著基本客群的不斷擴大,歐洲的包裹檢查範圍也不斷擴大。這種擴張的推動因素包括日益嚴格的監管要求、消費者對更安全和更永續包裝的需求以及公司在運輸和儲存過程中確保產品完整性的需求。 ASTM(美國材料與試驗協會)、ISTA(國際安全運輸協會)等權威機構會進行跌落測試、振動測試、衝擊測試等標準測試。

- 這些測試模擬了包裹在運輸和處理過程中可能遇到的真實環境。所有歐洲包裝行業都遵守這些標準,以確保產品的安全和品質。在製藥業,包裝違規行為會受到美國FDA 等機構的嚴格審查和嚴厲處罰。這些措施對於維持藥品的有效性和病人安全至關重要。包裝材料包括玻璃、塑膠、紙/紙板和金屬,每種材料都是根據特定的產品要求和環境考慮而選擇的。

- 包裹檢查費用昂貴,是市場拓展的一大限制因素。這些成本包括許多方面,例如專門的設備、訓練有素的人員和耗時的程序。小型企業,尤其是在新興市場營運的企業,可能需要協助分配資源進行全面的包裝檢查。這種經濟障礙可能會抑制創新並減緩新包裝解決方案的市場引入。因此,高昂的包裝檢查成本不僅影響個別企業,也影響整個包裝產業的成長軌跡。

歐洲包裹檢測市場趨勢

食品和飲料預計將推動市場成長

- 預計食品和飲料行業將成為整個歐洲包裝檢測成長的主要動力。隨著消費者對食品安全和品質的要求不斷提高,製造商擴大投資於包裝材料的嚴格測試程序。歐盟關於食品接觸材料和包裝完整性的嚴格規定進一步推動了這一趨勢。

- 包裝測試在食品和飲料行業的重要性日益增加,其背後有幾個因素:法規合規性:歐洲食品安全法規要求對包裝材料進行測試,以確保它們不會污染食品。廣泛的測試消費者安全:包裝檢查有助於防止與包裝故障和材料遷移相關的潛在健康危害。品質保證:嚴格的測試確保我們的包裝保持產品的新鮮度並延長其保存期限。品牌保護:經過測試檢驗的有效包裝有助於維護您的品牌聲譽和消費者信任。

- 此外,主動包裝和智慧包裝等創新包裝解決方案的興起需要更先進的測試方法來確保合規性和有效性。這些先進的包裝技術通常包含去氧劑、濕度控制系統和溫度指示器等功能,這些功能需要專門的測試通訊協定。

- 食品和飲料行業對永續性和環保包裝的日益重視也導致了歐洲對包裝測試服務的需求增加。隨著製造商轉向生物分解性、可堆肥和可回收材料,需要新的測試方法來檢驗這些替代包裝解決方案的性能和安全性。

- 食品和飲料行業電子商務的擴張給包裝帶來了新的挑戰,並導致對測試服務的需求增加。這些服務確保產品能夠承受運輸和處理的嚴格要求,同時保持其品質。包裝測試變得至關重要,因為電子商務平台需要強大的包裝解決方案來防止運輸過程中的損壞並保持產品的完整性。

- 在英國,消費者在食品和非酒精飲料上的總支出正在增加。 2023年第三季度,消費者在食品和非酒精飲料上的支出將達到約435.1億美元,高於2022年第四季的404.17億美元。食品和飲料消費的成長趨勢直接影響包裝產業,推動了對更複雜和可靠的包裝檢測方法的需求。

- 消費者偏好和監管要求的變化也推動了包裝檢測服務需求的不斷成長。隨著消費者的環保意識增強,他們越來越關注永續的包裝解決方案,這需要嚴格的測試以確保它們既符合性能又符合環保標準。此外,嚴格的食品安全法規要求進行全面的測試,以確保包裝材料不會污染食品並在整個供應鏈中保持新鮮度。

英國佔市場主導地位

- 各行各業對包裝的應用日益廣泛,推動了英國對包裝測試的需求。推動這一趨勢的是食品和飲料、製藥和電子商務行業的成長,每個行業都需要專門的包裝解決方案。隨著公司努力確保產品安全、品質和法規遵循性,對全面包裝檢驗服務的需求顯而易見。這些測試評估耐用性、阻隔性和環境影響,幫助公司最佳化包裝設計並滿足消費者的期望。

- 歐洲軟性飲料、烈酒、葡萄酒和啤酒消費量的增加推動了飲料包裝的成長,並促進了該地區包裝檢測市場的擴大。這一趨勢在德國、法國、義大利等飲料產業蓬勃發展的國家尤其明顯。隨著消費者偏好的演變和新包裝技術的出現,製造商擴大投資於嚴格的測試程序,以確保其產品安全、高品質並符合監管標準。這包括測試材料完整性、密封強度和阻隔性性能,這對於保持飲料的新鮮度和安全性至關重要。此外,歐洲市場越來越重視永續包裝解決方案,推動對測試服務的需求,以檢驗新包裝材料和設計的環境要求。

- 近年來,歐洲包裝檢測市場發生了重大變化,主要受零售商及其產品線擴張的推動。這種成長推動了對包裝檢測服務的需求,以確保產品安全、品質和法規遵循。零售公司透過更深層的垂直整合受益於更有效率的分銷和物流,從而推動了對全面包裝檢測解決方案的需求。這些發展促進了歐洲包裝行業的整體成長。

- 在歐洲市場處於主要企業的英國,「包裝活動」產業的收益呈現明顯的成長趨勢。產業資料顯示,預計2023年收益將達到約55.05億美元,較2021年的53.2億美元大幅成長。這種成長反映了包裝檢測在零售和消費品領域日益成長的重要性,以及需要嚴格測試通訊協定的包裝材料和技術的不斷創新。

歐洲包裝檢測產業概況

歐洲包裝檢測市場是半靜態的,由全球和地區參與者組成。主要企業包括 Intertek Group plc、TUV SUD AG、Smurfit Kappa 和 Tri-Wall UK Limited。該行業的特點是產品差異化程度低,產品擴散度高,市場參與企業之間的競爭激烈。

測試設備的技術進步、對永續包裝的日益關注以及對電子商務解決方案的不斷成長的需求進一步影響了競爭格局。該市場中的公司不斷投資於研發,以增強其測試能力並保持領先地位,滿足不斷變化的行業需求。

隨著市場的成長,公司正在透過策略聯盟和收購來擴大其地理影響力和服務範圍。這一趨勢可能會加劇競爭,並在未來幾年導致市場進一步整合。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 嚴格的管理規定和管理/資格要求

- 各種條件下對產品長期儲存的需求

- 市場限制

- 包裹檢查限制市場相關高成本

- 技術簡介

- 包裝完整性測試

- 包裝強度測試

- 包裝有效期限測試

- 包裹驗證

第6章 產業政策

- ASTM 標準

- ISO 標準

- ISTA 標準

第7章 市場區隔

- 按主要材料

- 玻璃

- 紙

- 塑膠

- 金屬

- 按測試類型

- 體能表現測試

- 化學測試

- 環境檢查

- 按最終用戶產業

- 飲食

- 衛生保健

- 工業產品

- 個人及居家產品

- 其他最終用戶產業

- 按國家

- 法國

- 德國

- 義大利

- 西班牙

第8章 競爭格局

- 公司簡介

- Intertek Group plc

- TUV SUD AG

- Smurfit Kappa

- Tri-Wall UK Limited

- Eurofins Scientific(Ireland)Limited

- Stora Enso Oyj

- Bureau Veritas

第9章投資分析

第10章:市場的未來

The Europe Package Testing Market size is estimated at USD 7.76 billion in 2025, and is expected to reach USD 11.85 billion by 2030, at a CAGR of 8.83% during the forecast period (2025-2030).

Key Highlights

- The European Packaging Testing market is experiencing growth due to several key factors. The increasing consumption of packaged food, beverages, and processed food is a primary driver. Stringent regulations and standards further support this trend to ensure the safety and quality of packaged goods. The rapid expansion of online retail, particularly for food and other consumer items, has intensified the need for robust packaging to guarantee safe delivery through complex distribution networks. Additionally, the market is expanding due to the demand for innovative packaging solutions capable of withstanding various environmental conditions during transit.

- Package testing is crucial in assessing product quality and ensuring European customer satisfaction. It encompasses critical aspects such as product safety, regulatory compliance, customer experience enhancement, brand strengthening, cost reduction, and product development innovation. Effective package testing ensures products meet safety standards, comply with regulations, and deliver a positive customer experience. It also helps differentiate brands in competitive markets, reduces costs through optimised packaging, and supports the development of new and improved products.

- Regarding product safety, package testing evaluates the ability of packaging to protect contents from damage, contamination, or tampering during transportation and storage. This includes assessing the strength of materials, seal integrity, and resistance to environmental factors like moisture or temperature changes. Regulatory compliance testing ensures that packaging meets legal requirements, such as labelling standards, material restrictions, and environmental regulations specific to different European countries.

- Customer experience enhancement involves testing packaging for ease of use, clarity of instructions, and overall aesthetic appeal. This may include evaluating the unboxing experience, text readability, and packaging features' functionality, like resealable closures. Brand strengthening through package testing focuses on maintaining consistency in packaging quality across product lines and ensuring that packaging effectively communicates brand values and messaging.

- Package testing's cost-reduction aspects involve optimising material usage, improving production efficiency, and minimising waste. This may include testing alternative materials or designs that maintain product protection while reducing overall packaging costs. Package testing also supports innovation in product development by evaluating new packaging concepts, materials, or technologies. This process helps companies stay competitive by introducing packaging solutions that address emerging consumer needs or environmental concerns.

- Packaging materials undergo various tests to evaluate their performance under different conditions. These tests include pressure loads, shock, vibration, knocking, humidity, and temperature variations. Various testing methods, such as drop, compression, and environmental conditioning tests, have been developed to assess packaging quality. Packaging is crucial in maintaining product quality and reliability during transportation and storage. It protects products from physical damage, contamination, and environmental factors. Packaging must withstand extended wear and tear as consumer expectations increase to ensure products reach consumers in optimal condition.

- Increasing consumption of packaged food, beverages, and processed food propels the European Packaging Testing market. Stringent regulations and standards further support this growth to ensure the safety and quality of packaged goods. Furthermore, the rise of online retail, especially for food and other items, amplifies the need for precise packaging to ensure safe delivery through complex distribution networks. The demand for innovative packaging solutions that withstand various environmental conditions during transit also contributes to market expansion.

- Package testing in Europe is expanding alongside the growing customer base. This expansion is driven by increasing regulatory requirements, consumer demand for safer and more sustainable packaging, and the need for companies to ensure product integrity during transportation and storage. Authoritative bodies such as ASTM (American Society for Testing and Materials) and ISTA (International Safe Transit Association) conduct standard examinations, including drop, vibration, and shock testing.

- These tests simulate real-world conditions that packages may encounter during shipping and handling. All European packaging industries adhere to these standards to ensure product safety and quality. In the pharmaceutical industry, packaging violations are subject to high-level investigations by authorities such as the US FDA, resulting in stringent measures. These measures are crucial to maintaining drug efficacy and patient safety. Packaging materials include glass, plastic, paper and paperboard, metal, and others, each chosen based on specific product requirements and environmental considerations.

- The substantial expenses associated with package testing significantly constrain market expansion. These costs encompass various aspects, including specialised equipment, trained personnel, and time-intensive procedures. Companies, especially smaller ones or those operating in emerging markets, may need help to allocate resources for comprehensive package testing. This financial barrier could hinder innovation and slow down the introduction of new packaging solutions to the market. As a result, the high costs of package testing impact individual businesses and influence the overall growth trajectory of the packaging industry.

Europe Package Testing Market Trends

Food and Beverage Expected to Drive the Growth of the Market

- The food and beverage industry is expected to be a key driver of growth in package testing across Europe. As consumer demands for food safety and quality increase, manufacturers invest more in rigorous testing procedures for their packaging materials. This trend is further fueled by stringent regulations on food contact materials and packaging integrity in the European Union.

- Several factors contribute to the growing importance of package testing in the food and beverage sector: Regulatory compliance: European food safety regulations require extensive testing of packaging materials to ensure they do not contaminate food products. Consumer safety: Package testing helps prevent potential health hazards associated with packaging failures or material migrations. Quality assurance: Rigorous testing ensures that packaging maintains product freshness and extends shelf life. Brand protection: Effective packaging verified through testing helps maintain brand reputation and consumer trust.

- Additionally, the rise of innovative packaging solutions, such as active and intelligent packaging, requires more sophisticated testing methods to ensure compliance and effectiveness. These advanced packaging technologies often incorporate features like oxygen scavengers, moisture control systems, and temperature indicators, necessitating specialized testing protocols.

- The growing emphasis on sustainability and eco-friendly packaging in the food and beverage sector also contributes to the increased demand for package testing services in Europe. As manufacturers shift towards biodegradable, compostable, or recycled materials, new testing methodologies are required to verify the performance and safety of these alternative packaging solutions.

- The expansion of e-commerce in the food and beverage industry has created new challenges for packaging, leading to increased demand for testing services. These services ensure products can withstand the rigours of shipping and handling while maintaining quality. Package testing has become crucial as e-commerce platforms require robust packaging solutions to prevent damage during transit and maintain product integrity.

- In the United Kingdom (UK), total consumer spending on food and non-alcoholic beverages has gr. In the third quarter of 2023, consumer spending for food and non-alcoholic drinks reached approximately USD 43,501 million, an increase from USD 40,417 million in Q4 2022. This upward trend in food and beverage consumption directly impacts the packaging industry, driving the need for more sophisticated and reliable package testing methods.

- The growing demand for package testing services is also influenced by changing consumer preferences and regulatory requirements. As consumers become more environmentally conscious, there is an increased focus on sustainable packaging solutions, which require rigorous testing to ensure they meet both performance and eco-friendly standards. Additionally, stringent food safety regulations necessitate comprehensive testing to verify that packaging materials do not contaminate food products and maintain their freshness throughout the supply chain.

United Kingdom Occupies a Majority Share in the Market

- The increasing adoption of packaging across various industries drives the demand for package testing in the United Kingdom. This trend is fueled by the growth of food and beverage, pharmaceuticals, and e-commerce sectors, each requiring specialized packaging solutions. As companies strive to ensure product safety, quality, and regulation compliance, the need for comprehensive package testing services has become more pronounced. These tests evaluate durability, barrier properties, and environmental impact, helping businesses optimize their packaging designs and meet consumer expectations.

- The rising consumption of soft drinks, spirits, wine, and beer in Europe is driving growth in beverage packaging, contributing to expanding the package testing market in the region. This trend is particularly evident in countries with beverage industries, like Germany, France, and Italy. As consumer preferences evolve and new packaging technologies emerge, manufacturers increasingly invest in rigorous testing procedures to ensure product safety, quality, and compliance with regulatory standards. This includes tests for material integrity, seal strength, and barrier properties, which are crucial for maintaining the freshness and safety of beverages. Additionally, the growing emphasis on sustainable packaging solutions in the European market has increased demand for testing services to validate the environmental claims of new packaging materials and designs.

- The European package testing market has undergone significant changes in recent years, primarily driven by the expansion of retail companies and their product lines. This growth has increased demand for package testing services to ensure product safety, quality, and regulation compliance. Retailers have benefited from more efficient distribution and logistics through broader vertical integration, fueling the need for comprehensive package testing solutions. These developments have contributed to the overall growth of the packaging industry in Europe.

- In the United Kingdom, a key player in the European market, the revenue of the "packaging activities" industry has shown a notable upward trend. According to industry data, the revenue is expected to reach approximately USD 5.505 billion in 2023, a significant increase from USD 5.320 billion in 2021. This growth reflects the increasing importance of packaging and package testing in the retail and consumer goods sectors and the ongoing innovations in packaging materials and technologies that require rigorous testing protocols.

Europe Package Testing Industry Overview

The Europe package testing market is semi-consolidated, featuring a mix of global and regional players. Key companies such as Intertek Group plc, TUV SUD AG, Smurfit Kappa, and Tri-Wall UK Limited compete. The industry is characterized by low product differentiation, increasing product penetration, and intense competition among market participants.

The competitive landscape is further shaped by technological advancements in testing equipment, increasing emphasis on sustainable packaging, and growing demand for e-commerce solutions. Companies in this market continuously invest in research and development to enhance their testing capabilities and stay ahead of evolving industry requirements.

As the market grows, companies are expanding their geographical presence and service offerings through strategic partnerships and acquisitions. This trend will likely intensify competition and lead to further market consolidation in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rigorous Control Regulations and Administration and Qualification Demands

- 5.1.2 Demand for Longer Shelf Life of the Products Under Varying Conditions

- 5.2 Market Restraints

- 5.2.1 High Costs Associated with Package Testing Limits the Market

- 5.3 Technology Snapshot

- 5.3.1 Package Integrity Testing

- 5.3.2 Package Strength Testing

- 5.3.3 Package Shelf-life Studies

- 5.3.4 Package Validation

6 INDUSTRY POLICIES

- 6.1 ASTM Standards

- 6.2 ISO Standards

- 6.3 ISTA Standards

7 MARKET SEGMENTATION

- 7.1 By Primary Material

- 7.1.1 Glass

- 7.1.2 Paper

- 7.1.3 Plastic

- 7.1.4 Metal

- 7.2 By Type of Testing

- 7.2.1 Physical Performance Testing

- 7.2.2 Chemical Testing

- 7.2.3 Environmental Testing

- 7.3 By End-user Vertical

- 7.3.1 Food and Beverage

- 7.3.2 Healthcare

- 7.3.3 Industrial

- 7.3.4 Personal and Household Products

- 7.3.5 Other End-user Verticals

- 7.4 By Country

- 7.4.1 France

- 7.4.2 Germany

- 7.4.3 Italy

- 7.4.4 Spain

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Intertek Group plc

- 8.1.2 TUV SUD AG

- 8.1.3 Smurfit Kappa

- 8.1.4 Tri-Wall UK Limited

- 8.1.5 Eurofins Scientific (Ireland) Limited

- 8.1.6 Stora Enso Oyj

- 8.1.7 Bureau Veritas