|

市場調查報告書

商品編碼

1639517

線圈塗布:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Coil Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

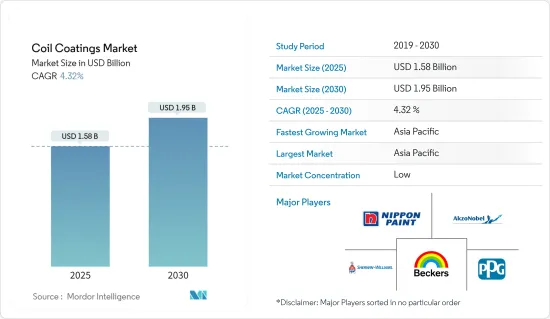

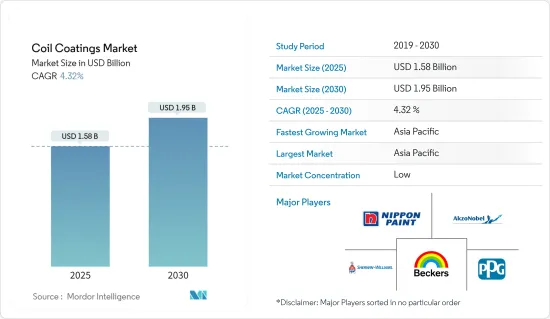

預計 2025 年線圈塗布市場規模為 15.8 億美元,到 2030 年將達到 19.5 億美元,預測期內(2025-2030 年)的複合年成長率為 4.32%。

新冠肺炎疫情為市場帶來了負面影響。疫情以各種方式使世界各地的建築施工和工程計劃面臨風險,許多計劃被關閉或取消,導致疫情危機期間線圈塗布市場成長放緩。但2021年,產業復甦,市場需求回歸。

主要亮點

- 短期內,建設產業的需求不斷增加、環境影響日益加劇、技術進步是推動市場發展的關鍵因素。

- 相反,汽車業對輕量材料的需求不斷增加預計會阻礙市場成長。

- 然而,建築應用對氟聚合物塗料的需求不斷增加可能是一個機會。

- 由於成品鋼產量高以及最終用戶產品製造量大,預塗金屬板的產量和出口量不斷增加,亞太地區在消費量方面佔據市場主導地位。

線圈塗布市場趨勢

建築和建設產業的需求增加

- 建設產業是卷材漆的最大消費者。建築中常用的主要樹脂有聚酯樹脂、有機矽改質聚酯、聚二氟亞乙烯(PVDF)、氟樹脂等。隨著越來越多的建築規範提倡節能建築,住宅和消費者逐漸轉向能夠實現長期性能和節能的建築策略。

- 建設產業的需求不斷成長是推動線圈塗布市場發展的關鍵因素。全球正在進行的大型計劃包括德克薩斯州的價值 10 億美元的混合用途計劃,該項目計劃於 2025 年第一季完工。東京南小岩六丁目區第一類都市重建計劃也預計2026年完工。因此,預計在此類計劃中,捲材產品將用於屋頂、鋼門、鋁板、橡膠、金屬層壓板黏合、維修工程等。

- 此外,線圈塗布因其可塑性而被廣泛應用於室內和室外建築應用。住宅和消費者擴大轉向能夠提供高性能和長期節能的建築技術。這就是我們專注於開發節能結構的原因。

- 線圈塗布提供紅外線反射顏料技術,有助於降低建築物的室內溫度。該技術降低了冷卻所消耗的能量,使線圈塗布成為建築應用中首選的節能捲材產品。它也用於防水排水溝和落水管。

- 由於商業房地產領域的改善以及聯邦和州政府對公共和機構建築的投資增加,北美建設產業正在穩步成長。北美主要的計劃包括耗資25億美元的酵母綜合用途開發計劃。該計劃旨在為德克薩斯州提供更好的住宅和辦公設施,預計於2040年完工。因此,預計建設產業投資增加將對線圈塗布產生正面影響。

- 法國、德國、英國和義大利等西歐主要國家正積極推動線圈塗布市場的發展。隨著該地區建設活動的活性化,對線圈塗布的需求也大幅增加。例如,根據 Trading Economics 的數據,2022 年 12 月法國建築業產量與 2022 年 7 月相比成長了 3.1%。

- 此外,由於其美觀度和持久價值,捲材漆也用於建設產業的天花板格柵、門、屋頂、牆板、窗戶等。正在進行的計劃包括美國。預計 2024 年完工。另一個正在進行的計劃是位於東京、耗資 31.7 億美元的濱松町芝浦一丁目重建計劃。

- 該計劃將由兩棟建築組成,預計於 2030 年完工。耗資 8.41 億美元的澳洲伊麗莎白碼頭地段計劃計劃2025 年完工。預計這些計劃將在未來幾年增加住宅和商業建築對預塗金屬的需求。

- 由於這些因素,預計預測期內建設產業的線圈塗布市場將穩定成長。

亞太地區佔市場主導地位

- 亞太地區佔據全球市場佔有率的主導地位。由於其美觀度和持久價值,捲材漆被用於建設產業的天花板格柵、門、屋頂、牆板和窗戶。

- 預計預測期內亞太線圈塗布市場將大幅成長,其中中國將因建築擴張和工業快速發展而引領市場。該地區的建築施工和維修活動正在增加,預計將推動線圈塗布消費量的激增。

- 例如,亞太地區正在進行的建築工程計劃包括日本東京價值 31.7 億美元的濱松町芝浦一丁目重建計劃,預計於 2030 年完工。另一個例子是計劃在中國武漢建設的武漢佛山外灘中心T1計劃。因此,預計該地區建築施工計劃數量的增加將推動線圈塗布的成長。

- 此外,對運輸車輛的需求不斷增加,推動了線圈塗布市場的發展。由於需求強勁且消費者更喜歡私家車而非公共交通,預計印度汽車產業將在 2023 年成為亞太地區最強勁的產業。例如,根據OICA的數據,2022年該國的汽車產量將達到5,456,857輛,比2020年增加24%。因此,由於汽車整體產量的增加,該地區的線圈塗布產業可能會擴大。

- 由於這些因素,該地區對線圈塗布的需求預計會增加。

線圈塗布產業概況

線圈塗布市場比較分散。該市場的主要企業(不分先後順序)包括阿克蘇諾貝爾公司、貝克斯集團、PPG工業公司、宣威威廉斯公司和日本塗料控股公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 建築和建設產業的需求不斷增加

- 日益增加的環境影響和技術進步

- 其他促進因素

- 限制因素

- 汽車產業對輕量材料的需求不斷增加

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 依樹脂類型

- 聚酯纖維

- 聚二氟亞乙烯(PVDF)

- 聚氨酯 (PU)

- 塑性溶膠

- 其他樹脂類型

- 按最終用戶產業

- 建築和施工

- 工業和消費性電器產品

- 運輸

- 家具

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率分析(%)**/排名分析

- 主要企業策略

- 公司簡介

- 捲材塗佈機

- ArcelorMittal

- Arconic

- BDM Coil Coaters

- CENTRIA

- Chemcoaters

- Dura Coat Products

- Goldin Metals Inc.

- Jupiter Aluminum Corporation

- Norsk Hydro ASA

- Novelis

- Ralco Steels

- Rautaruukki Corporation

- Salzgitter Flachstahl GmbH

- Tata Steel

- Tekno Kroma

- thyssenkrupp AG

- UNICOIL

- United States Steel Corporation

- 油漆供應商

- Akzo Nobel NV

- Axalta Coatings System LLC

- Beckers Group

- Brillux GmbH & Co. KG

- Hempel A/S

- Kansai Paint Co.,Ltd.

- Nippon Paint Holdings Co., Ltd

- NOROO Coil Coatings Co., Ltd.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Yung Chi Paint & Varnish Mfg Co. Ltd

- 預處理、樹脂、顏料、設備

- Arkema

- Bayer AG

- Covestro AG

- Evonik Industries AG

- Henkel AG & Co. KgaA

- Solvay

- Wacker Chemie AG

- 捲材塗佈機

第7章 市場機會與未來趨勢

- 建築用氟樹脂塗料需求不斷增加

- 其他機會

The Coil Coatings Market size is estimated at USD 1.58 billion in 2025, and is expected to reach USD 1.95 billion by 2030, at a CAGR of 4.32% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market. The pandemic jeopardized building construction and engineering projects worldwide in numerous ways, and many projects were closed or halted, decelerating the growth of the coil coatings market during the pandemic crisis. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, rising demand from the building and construction industry and growing environmental influences, and advancing technology are the major factors driving the market studied.

- Conversely, increasing demand for lightweight materials in the automobile industry is expected to hinder the studied market's growth.

- However, increasing demand for fluoropolymer coatings for architectural applications will likely act as an opportunity.

- Asia-Pacific dominated the market in terms of consumption due to the rise in the production and export of pre-coated metal sheets in the region due to the high production of finished steel and the high manufacturing of end-user products.

Coil Coatings Market Trends

Rising Demand from the Building and Construction Industry

- The building and construction industry is by far the largest consumer of coil coatings. The main resins used extensively in construction are polyester resin, silicone-modified polyester, polyvinylidene fluorides (PVDF), or fluoropolymer. With the rising number of building codes that promote energy-efficient structures, home builders and consumers are gradually moving toward building strategies that deliver performance and energy savings in the long run.

- The rising demand from the construction industry is a key factor driving the coil coatings market. Some of the large ongoing building construction projects worldwide include the Magnolia Mixed-Use Complex project worth USD 1 billion in Texas, which is expected to be completed in Q1 2025. The Minamikoiwa 6-Chome District Type One Urban Redevelopment project in Tokyo, Japan, is another project expected to be completed in 2026. Thus, such construction projects are estimated to use coil products for roofing, steel doors, aluminum panels, rubber, metal lamination bonding, renovation work, and others.

- Furthermore, coil coatings are also widely used for interior and exterior construction applications due to their malleability. Home builders and consumers increasingly shift towards building techniques that impart performance and long-term energy savings. Hence, they are focusing on developing energy-efficient structures.

- Coil coatings provide infrared reflective pigment technology that helps in lowering the indoor temperature of the building. This technique reduces the energy consumed for cooling, making coil coatings energy efficient and the preferred choice for coil products used in building and construction work. It is also utilized to construct gutters and downspouts for waterproof installations.

- The construction industry in North America is growing steadily due to the improving commercial real estate sector and increased federal and state investment in public construction and institutional buildings. Some of North America's major building construction projects include the East River Mixed-Use Development project worth USD 2.5 billion. The project aims to provide better residential and office facilities in Texas, which is expected to be completed in 2040. Therefore, increasing building and construction industry investments are expected to create an upside for coil coatings.

- The major Western European countries, including France, Germany, the United Kingdom, and Italy, are actively contributing to the coil coatings market. With growing building construction activities in the region, the demand for coil coatings increased significantly. For instance, according to Trading Economics, construction output in France increased by 3.1% in December 2022 compared to July 2022.

- Moreover, due to its high-end aesthetics and long-lasting value, coil coatings are used in the building and construction industry in ceiling grids, doors, roofing and siding, windows, etc. Some of the ongoing construction projects include the Eight Office Tower project worth USD 476 million, which involves the construction of a 25-story office tower in Bellevue, Washington, United States. It is expected to be completed in 2024. The Hamamatsucho Shibaura 1 Chome Redevelopment Project, worth USD 3.17 billion in Tokyo, Japan, is another ongoing project.

- The project involves the construction of two buildings and is expected to be finished by 2030. The Elizabeth Quay Lot V and Lot VI Mixed-Use Complex construction project worth USD 841 million in Australia is yet another project likely to be completed in 2025. These projects are expected to increase the demand for pre-coated metals in the construction of residential and commercial buildings in the coming years.

- Due to all such factors, the building and construction industry's coil coatings market is expected to grow steadily during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. Due to their high-end aesthetics and long-lasting value, coil coatings are used in the building and construction industry in ceiling grids, doors, roofing and siding, windows, etc.

- The Asia-Pacific coil coatings market is anticipated to grow significantly during the forecast period, with China leading the market owing to expanding construction and rapid industrial development. The growing building construction and renovation activities in the region are expected to surge the consumption of coil coatings.

- For instance, some of the ongoing building construction projects in the Asia-Pacific include the Hamamatsucho Shibaura 1 Chome Redevelopment project worth USD 3.17 billion, expected to be completed in 2030 in Tokyo, Japan. Another such project is the Wuhan Fosun Bund Center T1 project, which involves the construction of the Fosun Bund Center T1 in Wuhan, China. Therefore, increasing building construction projects are expected to drive the growth of coil coatings in the region.

- Furthermore, the growing demand for transport vehicles is driving the coil coatings market. In 2023, India's automotive sector is predicted to be the strongest in the Asia-Pacific region, owing to strong demand and consumers' preference for personal vehicles over public transportation. For instance, according to OICA, in 2022, automobile production in the country amounted to 5,456,857 units, which showed an increase of 24% compared to 2020. Therefore, the region's coil coatings industry will likely expand due to the rise in overall automobile manufacturing.

- All such factors are expected to increase the demand for coil coatings in the region.

Coil Coatings Industry Overview

The coil coatings market is fragmented in nature. The major players in this market (not in a particular order) include Akzo Nobel N.V., Beckers Group, PPG Industries, Inc., The Sherwin-Williams Company, and Nippon Paint Holdings Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Building and Construction Industry

- 4.1.2 Growing Environmental Influences and Advancing Technology

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Demand for Lightweight Materials in Automotive Industry

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Polyester

- 5.1.2 Polyvinylidene Fluorides (PVDF)

- 5.1.3 Polyurethane(PU)

- 5.1.4 Plastisols

- 5.1.5 Other Resin Types

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Industrial and Domestic Appliances

- 5.2.3 Transportation

- 5.2.4 Furniture

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Coil Coaters

- 6.4.1.1 ArcelorMittal

- 6.4.1.2 Arconic

- 6.4.1.3 BDM Coil Coaters

- 6.4.1.4 CENTRIA

- 6.4.1.5 Chemcoaters

- 6.4.1.6 Dura Coat Products

- 6.4.1.7 Goldin Metals Inc.

- 6.4.1.8 Jupiter Aluminum Corporation

- 6.4.1.9 Norsk Hydro ASA

- 6.4.1.10 Novelis

- 6.4.1.11 Ralco Steels

- 6.4.1.12 Rautaruukki Corporation

- 6.4.1.13 Salzgitter Flachstahl GmbH

- 6.4.1.14 Tata Steel

- 6.4.1.15 Tekno Kroma

- 6.4.1.16 thyssenkrupp AG

- 6.4.1.17 UNICOIL

- 6.4.1.18 United States Steel Corporation

- 6.4.2 Paint Suppliers

- 6.4.2.1 Akzo Nobel N.V.

- 6.4.2.2 Axalta Coatings System LLC

- 6.4.2.3 Beckers Group

- 6.4.2.4 Brillux GmbH & Co. KG

- 6.4.2.5 Hempel A/S

- 6.4.2.6 Kansai Paint Co.,Ltd.

- 6.4.2.7 Nippon Paint Holdings Co., Ltd

- 6.4.2.8 NOROO Coil Coatings Co., Ltd.

- 6.4.2.9 PPG Industries, Inc.

- 6.4.2.10 The Sherwin-Williams Company

- 6.4.2.11 Yung Chi Paint & Varnish Mfg Co. Ltd

- 6.4.3 Pretreatment, Resins, Pigments, Equipment

- 6.4.3.1 Arkema

- 6.4.3.2 Bayer AG

- 6.4.3.3 Covestro AG

- 6.4.3.4 Evonik Industries AG

- 6.4.3.5 Henkel AG & Co. KgaA

- 6.4.3.6 Solvay

- 6.4.3.7 Wacker Chemie AG

- 6.4.1 Coil Coaters

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Fluoropolymer Coatings for Architectural Applications

- 7.2 Other Opportunities