|

市場調查報告書

商品編碼

1639522

法國紙包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)France Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

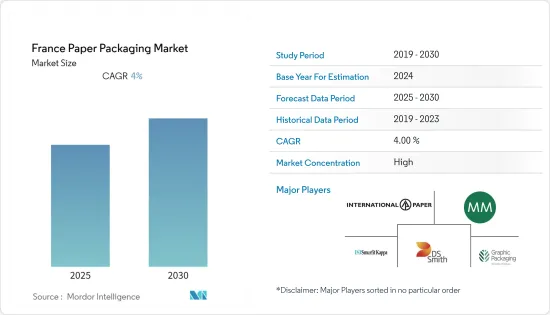

預計預測期內法國紙包裝市場的複合年成長率將達到 4%。

主要亮點

- 消費者越來越意識到與包裝相關的環境危害,並將購買習慣轉向更環保的選擇。消費者、政府和媒體正在向製造商施壓,要求他們製造的產品、包裝和生產流程更加環保。這些趨勢預計將推動國內紙包裝市場的需求。

- 此外,由於國內電子商務銷售額的成長,對紙包裝的需求不斷成長,也推動了全球紙質包裝市場的發展。然而,由於對紙漿木材的需求不斷增加,人們對森林砍伐的擔憂日益加劇,可能會阻礙市場成長。

- 此外,2021年10月,法國政府通過了一項法律,公佈了食品貿易中從2022年1月1日起將不再能用塑膠包裝的水果和蔬菜品種清單。預計該國的此類舉措將成為增加紙質包裝需求的關鍵成長要素。

- 隨著消費者對一次性塑膠和不永續的商業慣例對環境的影響的認知不斷提高,他們要求對生態系統產生積極影響的產品有更高標準。例如,歐盟於2021年10月宣布新規定,禁止向印度出口廢紙,因為廢紙屬於綠色清單廢棄物的一部分。透過這些措施,歐盟旨在推動循環造紙經濟,從而回收和再利用95%以上的廢棄物。

- 隨著電子商務的發展,並專注於提供符合法規要求的環保解決方案,環保方法也正在成為新設計的主要驅動力,同時消費者對廢棄物的意識也不斷增強。終端用戶產業相關人員正在遠離過度包裝和浪費空間,電子商務領域也出現了類似的趨勢。根據 Ascential's Edge 的數據,2021 年法國零售電商銷售額將達到 725 億歐元(773 億美元)。

- 在新冠肺炎疫情爆發期間,該國實施了封鎖措施,擾亂了供應鏈流程並關閉了生產工廠,導致市場面臨緩慢成長。從需求面來看,疫情過後紙質包裝的前景看好。

法國紙包裝市場趨勢

電子商務銷售額增加

- 在法國,疫情和疫情後電子商務的興起增加了對紙質包裝的需求,尤其是在食品和飲料行業。此外,全通路零售正在從單純的網路零售商擴展到 B2C、D2C、具有線上市場的社交媒體網站、快速商務等。

- 包括 Z 世代在內的消費者要求品牌更環保、更符合道德。這意味著考慮我們的產品對環境的影響並支持當地企業。他們面臨的最大挑戰是更明智地購買,注重實用性和再生性。據 Fevad 稱,53% 的消費者在網路購物時會考慮環境、責任和道德因素。

- 2021年11月,亞馬遜法國宣布將在年終前停止使用一次性塑膠包裝產品。顧客將在軟性紙套或紙板信封中收到物品,這樣更容易透過廢棄物收集和處理服務進行回收。這項變更將影響從亞馬遜法國履約中心出貨的所有小件商品,無論是亞馬遜直銷還是由第三方賣家使用亞馬遜物流網路銷售。

- 隨著越來越多的瓦楞紙箱從商店送到家門口,該部門希望更多的人能夠繼續進行回收。因此,紙包裝正在成為法國紙包裝市場的一個巨大且高成長的機會。

- 2021 年 7 月,快速成長和成熟品牌的開放式 SaaS 電子商務平台 BigCommerce 宣布已將其歐洲業務從英國擴展到法國、荷蘭和義大利。透過 BigCommerce,法國商家現在可以使用專為本地和全球銷售而打造的靈活的企業級電子商務平台。此次擴張將在法國創造新的職位,直接與當地經銷商合作,最終增加對紙包裝的需求。

食品工業占主要佔有率

- 市場成長受到人口變化、都市化和就業率等因素的推動,這些因素透過消費者消費能力、網路購買和網路食品配送影響食品零售。由於這些變化,便利包裝、超值包裝、多件裝和較小的單份包裝等新包裝類型越來越受歡迎。由於這些原因,法國對紙質包裝的需求龐大。

- 此外,為了在2025年實現塑膠100%回收,政府將向產業企業提供補貼,以實現基礎設施的現代化並改善廢棄物管理。例如,2021年8月,紙質包裝解決方案提供商Saika為法國兩家箱板紙廠獲得了投資資金。

- 根據有機貿易協會預測,2021年法國有機包裝食品將成長8.3%,市值達47億美元。有機乳製品佔據了26%的市場佔有率,2021年成長了8.6%。乳製品正在推動該國有機包裝食品的成長。

- 在該國營運的公司因其在業務擴展中注重創新而受到認可。例如,2022年1月,環境服務供應商CITEO認證了Koehler Paper的一系列軟包裝紙。具體來說,CITEO 已對 Koehler 的 NexPlus Seal Pure、NexPlus Seal Pure MOB 和 NexPlus Advanced 進行了認證,確保它們全部可回收。因此,在法國銷售品牌商品的公司可以透過使用CITEO認證的科勒紙張享受額外的好處,即可以享受大幅降低的授權費用。

- 為了給該國紙張市場的成長提供理想的環境,該地區的多家公司正在投資建立新設施並開發創新解決方案,以進一步鞏固其市場地位。例如,2021 年 6 月,紙包裝公司 Smurfit Kappa 宣布投資 2,400 萬歐元(2,474 萬美元),擴建其位於法國東北部雷塞爾的瓦楞紙廠。透過這項投資,該公司計劃整合其法國工廠現有的兩處設施,並安裝一台新的瓦楞機和轉換設施。

法國紙包裝產業概況

法國紙包裝市場較為分散,有多家國內外企業,包括國際紙業、Smurfit Kappa Group Plc、MM Packaging GmbH、Graphic Packaging 和 DS Smith Plc。市場參與者正致力於透過併購、夥伴關係、產能擴張和產品創新等策略措施擴大其地理範圍。

- 2022 年 6 月 - 該公司收購了 Essentra Packaging,擴大了其針對醫藥和醫療保健市場的折疊式盒、包裝插頁和標籤的包裝產品,並為進一步成長創造了一個有吸引力的平台。收購 Essentra Packaging 體現了 MM Packaging 的策略,即在二級藥品包裝等盈利、彈性大的領域中實現成長。此次收購增強了公司在歐洲醫藥折疊盒和宣傳單市場的地位。

- 2022 年 5 月-國際紙業在法國一家瓦楞紙廠投資 2,300 萬歐元(2,371 萬美元),為不斷成長的電子商務產業提供產能,並為客戶提供更永續的包裝解決方案。這項投資將用於安裝新設備,包括一條新的轉換生產線,將使生產能力分別提高60%和50%以上。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 對法國紙包裝產業的影響

第5章 市場動態

- 市場促進因素

- 對環保包裝解決方案的需求不斷增加

- 電子商務產業的成長

- 市場限制

- 嚴厲打擊森林砍伐

第6章 市場細分

- 按產品

- 瓦楞紙箱

- 折疊式紙盒

- 牛皮紙

- 最終用戶產業

- 食物

- 飲料

- 家庭和個人護理

- 衛生保健

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- International Paper

- MM PACKAGING GmbH

- Smurfit Kappa Group plc

- DS Smith Packaging France

- Graphic Packaging International

- LGR Packaging

- LACAUX Freres

- Autajon Group

- Tecnografica Spa

- Gascogne Papier

- gKRAFT Paper

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 50966

The France Paper Packaging Market is expected to register a CAGR of 4% during the forecast period.

Key Highlights

- Consumers are becoming more conscious of the environmental hazards linked with packaging and are moving their purchasing habits to more environmentally friendly options. Consumers, the government, and the media are putting pressure on manufacturers to make their products, packaging, and processes more environmentally friendly. These trends are expected to propel the demand for the paper packaging market in the country.

- The growing demand for paper packaging due to the rise in e-commerce sales in the country is another factor driving the global paper packaging market. However, the growing concern about deforestation owing to increased demand for wood for pulp is likely to hinder the market's growth.

- Moreover, in October 2021, the government of France passed a law and published a list of fruits and vegetable varieties in the food trade that may no longer be packaged with plastic from 1 January 2022. Such initiatives in the country are expected to act as a critical growth factor adding demand for paper packaging.

- The increasing awareness about the environmental effect of single-use plastic and unsustainable business practices empowered consumers to demand a higher standard of product with a positive ecological impact. For instance, in October 2021, the European Union announced a new regulation to ban the export of recovered paper to India as they are a part of the green-listed waste. Owing to such measures, the EU intends to recycle and recover more than 95% of its paper waste by encouraging the circular economy of paper.

- With the e-commerce evolution and focus on offering an eco-friendly solution to meet the regulatory bindings, the eco-friendly approach also emerged as a significant factor for new design with the consumer becoming waste-conscious. End-user industry players are steering away from over-packaging and wasting space, and similar trends have been observed in the e-commerce sector. According to Edge by Ascential, retail e-commerce sales in France reached EUR 72.5 billion (USD 77.3 billion) in 2021.

- During the COVID-19 outbreak, the market studied faced slow growth due to lockdowns imposed in the country that disrupted the supply chain process and the production plant closures. The post-COVID future for paper packaging looks promising in terms of demand.

France Paper Packaging Market Trends

Increasing Growth of E-commerce Sales

- The demand for paper packaging was propelled in the country due to increased e-commerce growth during the pandemic and post-pandemic, especially in the food and beverage industries. Furthermore, omnichannel retail is moving beyond web-based retailers to include B2C and D2C, social media sites with online marketplaces, quick commerce, and more.

- Consumers, including Gen Z, want brands to help them become greener and more ethical. It means considering the products' environmental impact and supporting local businesses. Their biggest challenge is buying wisely with a focus on practicality and reusability. According to Fevad, 53% of consumers consider environmental, responsibility, or ethical factors when shopping online.

- In November 2021, Amazon in France announced it would stop packaging items in single-use plastic by the end of the year. Customers would now receive their items in flexible paper sleeves or cardboard envelopes, recycled more easily by waste collection and treatment services. The change involves all small items shipped from Amazon fulfillment centers in France, whether sold directly by Amazon or by third-party sellers who use its logistics network.

- As more corrugated boxes are arriving on doorsteps rather than in stores, the sector is counting on more people to keep up with recycling. Thus, paper packaging is becoming a substantial and high-growth opportunity for the paper packaging market in France.

- In July 2021, BigCommerce, an Open SaaS e-commerce platform for fast-growing and established brands, announced that it had extended its European presence from the UK into France, Netherlands, and Italy. With BigCommerce, merchants in France now have access to a flexible, enterprise-grade e-commerce platform built to sell on a local and global scale. This expansion will create new roles in France to work directly with regional merchants, ultimately increasing the demand for paper packaging.

Food Industry to Hold Major Share

- The market's growth is driven by changing demographics and factors such as urbanization and employment rates, influencing retail food sales through consumer spending power, online purchasing, and online food deliveries. As a result of these changes, new package types such as convenience packaging, value-for-money packaging, multi-packs, and more miniature single-serve packs are becoming more popular. As a result of these reasons, there will be a tremendous demand for paper packaging in France.

- Furthermore, to achieve 100% recycling of plastics by 2025, the government in the country is offering subsidies to companies in the industry to modernize their infrastructure and improve waste management. For instance, in August 2021, Saica, a provider of paper-based packaging solutions, secured funds for investments at two French containerboard mills.

- According to the Organic Trade Association, organic packaged food in France increased by 8.3% in 2021, with a market value of USD 4.7 billion. Organic dairy accounts for 26% of the market and recorded 8.6% growth in 2021. It is driving growth in organic packaged food in the country.

- Companies operating in the country are focused on innovations as part of their business expansion and are being recognized for them. For instance, in January 2022, environmental service provider CITEO certified various Koehler Paper flexible packaging paper offerings. More specifically, CITEO identified Koehler's NexPlus Seal Pure, NexPlus Seal Pure MOB, and NexPlus Advanced, with the certification ensuring they all are highly recyclable. Accordingly, companies selling branded goods in France can further benefit from significantly lowering the license fees by using Koehler paper certified by CITEO.

- For the ideal environment for the paper market growth in the country, several companies operating in the region are investing in setting up new facilities and developing innovative solutions to strengthen their market position further. For instance, in June 2021, paper-based packaging firm Smurfit Kappa announced an investment of EUR 24 million (USD 24.74 million) to expand its corrugated plant in Rethel, North-East France. The company plans to use the latest investment to consolidate two existing facilities at the French plant and install a new corrugator and conversion equipment.

France Paper Packaging Industry Overview

The France Paper Packaging market is fragmented, with international and domestic players present in the market, including International Paper, Smurfit Kappa Group Plc, MM Packaging GmbH, Graphic Packaging, DS Smith Plc, etc. The players in the market are concentrating on expanding their reach with strategic initiatives such as mergers and acquisitions, partnerships, capacity expansion, and product innovation.

- June 2022 - The company acquired Essentra Packaging, which extends the company's packaging range of folding boxes, package inserts, and labels for the pharmaceutical and healthcare market and creates an engaging platform for further growth. The acquisition of Essentra Packaging implements MM Packaging's strategy to grow in profitable and resilient segments such as secondary pharma packaging. It strengthens its position in the European pharma folding boxes and leaflets market.

- May 2022 - International Paper announced invest of EUR 23 million (USD 23.71 million ) in a corrugated board mill in France to adapt its production capacity to the growth of the e-commerce sector and offer even more sustainable packaging solutions to customers. This investment will fund the installation of new equipment, including new converting lines, to increase production capacity by more than 60% and 50%, respectively.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Paper Packaging Industry in France

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Eco-friendly Packaging Solutions

- 5.1.2 Growing E-commerce Industry

- 5.2 Market Restraints

- 5.2.1 Strict Environmental Regulation Regarding Deforestation

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Corrugated Box

- 6.1.2 Folding Carton

- 6.1.3 Kraft Paper

- 6.2 End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Home and Personal Care

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Paper

- 7.1.2 MM PACKAGING GmbH

- 7.1.3 Smurfit Kappa Group plc

- 7.1.4 DS Smith Packaging France

- 7.1.5 Graphic Packaging International

- 7.1.6 LGR Packaging

- 7.1.7 LACAUX Freres

- 7.1.8 Autajon Group

- 7.1.9 Tecnografica S.p.a

- 7.1.10 Gascogne Papier

- 7.1.11 gKRAFT Paper

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219