|

市場調查報告書

商品編碼

1639536

硬焊焊合金 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Braze Alloys - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

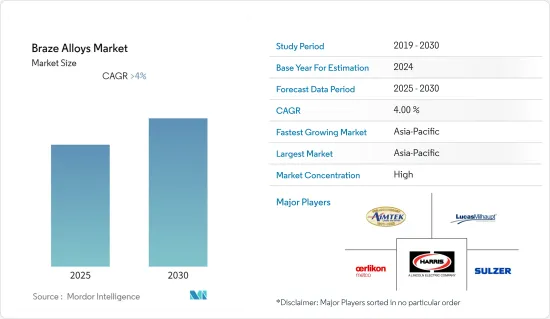

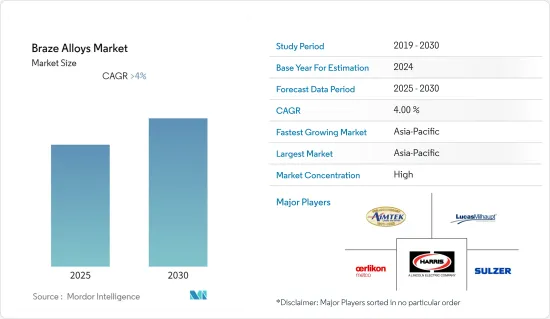

預計硬焊焊合金市場在預測期內複合年成長率將超過 4%。

COVID-19 大流行對市場產生了負面影響。不過,目前估計已達到疫情前的水平,預計將繼續穩定成長。

主要亮點

- 與焊接和錫焊等製程相比,硬焊製程的採用率不斷提高,汽車業對鋁硬焊合金的需求不斷增加,預計將推動市場的發展。

- 另一方面,基底金屬價格波動可能會減緩市場成長。

- 未來幾年,真空硬焊技術的成長預計將為市場提供成長機會。

- 預計亞太地區將佔據最大佔有率,並且在未來五年內複合年成長率最高。

硬焊焊合金市場趨勢

汽車領域預計將主導市場

- 硬焊合金用於汽車領域的各種連接目的。不同種金屬零件使用填充金屬或硬焊合金連接,其熔點低於被連接零件或基體金屬的熔點。

- 二極體雷射硬焊、熔爐/真空硬焊和金屬惰性氣體 (MIG)硬焊通常用於汽車連接應用。

- 釬焊合金在汽車製造的主要應用包括ABC柱與車頂的連接、C柱的雷射光束或等離子釬焊、行李箱蓋的雷射光束釬焊、燃料箱的MIG釬焊以及車身結構中的鋁可電鍍。

- 根據國際汽車製造商組織(OICA)的數據,2022年OICA成員國新車銷售或註冊數量接近6,900萬輛。

- 根據歐洲汽車工業協會(ACEA)預計,2022年全球乘用車產量將超過6,800萬輛,與前一年同期比較成長7.9%。此外,2022年北美地區汽車產量成長10.3%,達到1,040萬輛,主要由於美國的高需求。

- 此外,汽車製造商和貿易業者協會估計,2022 年英國將生產超過 775,000 輛汽車。另外,2023 年 1 月英國生產了約 68,600 輛汽車。

- 大眾汽車是美國最受歡迎的汽車品牌。 2021年,福斯市場佔有率最高,接近9%,其次是奧迪(7.16%)和寶馬(7.08%)。

- 由於上述因素,預計汽車領域將在預測期內主導市場。

亞太地區主導市場

- 中國、印度和日本等亞太國家生產市場上最多的硬焊料。這是因為中國、印度和日本的汽車、電子電氣、建築和航太工業都在成長。

- 中國已成為各類汽車產銷售量最大、最具主導地位的國家。根據中國工業協會預計,2022年中國汽車產量與前一年同期比較%。產量預計將從2021年的約2,608萬台增至2022年的約2,700萬台。

- 印度汽車工業協會也表示,22會計年度印度製造的汽車總數將接近2,300萬輛。摩托車佔據大部分市場佔有率,約佔總產量的74%。

- 根據日本汽車經銷商協會(JADA)預測,2022年豐田將以約125萬輛的銷量領先日本國內銷量。豐田汽車的銷量是第二名的兩倍多。位居第二的鈴木 2022 年銷量略高於 60 萬輛。

- 市場可能會受益於商業建築領域的逐步成長,特別是辦公空間的建設。此外,由於住宅銷售和現有住宅翻新的增加,亞太地區的住宅需求也在增加。

- 根據中國國家統計局的數據,2022年第四季中國建築產值約2,760億元人民幣(400億美元)。這比上一季(276 億美元)成長了 50%。

- 此外,根據日本國土交通省的數據,2022年整個建築業的投資預計與前一年同期比較成長約0.6%,達到約66.99兆日圓(5,081.6億美元)。

- 此外,根據印度工商聯合會 (FICCI) 的數據,到 2022 年,印度大都會圈將根據 PMAY 計劃建造或批准約 550 萬套和 1,140 萬套住宅。

- 反過來,這些將在未來幾年推動該地區的硬焊焊合金市場。

硬焊合金產業概況

硬焊合金市場因其性質而部分整合。在該市場營運的主要公司包括(排名不分先後)Aimtek Inc.、The Harris Products Group、Lucas-Milhaupt Inc.、Oerlikon Metco 和 Sulzer Ltd.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 與焊接和釬焊等製程相比,硬焊製程的採用率有所提高

- 汽車產業對鋁硬焊料的需求不斷增加

- 抑制因素

- 基底金屬價格波動

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(金額/數量))

- 基底金屬

- 銅

- 金子

- 銀

- 鋁

- 其他基底金屬

- 最終用戶產業

- 車

- 航太/國防

- 電力/電子

- 建造

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)分析**/市場排名分析

- 主要企業策略

- 公司簡介

- Aimtek Inc.

- Prince Izant Company(Bellman-Melcor)

- Cupro Alloys Corporation

- Indian Solder and Brazing Alloys

- Johnson Matthey

- Lucas-Milhaupt Inc.

- Morgan Advanced Materials

- OC Oerlikon Management AG(Oerlikon Metco)

- Saru Silver Alloy Private Limited

- Sulzer Ltd.

- The Harris Products Group

- VBC Group

第7章 市場機會及未來趨勢

- 真空釬焊技術的發展

The Braze Alloys Market is expected to register a CAGR of greater than 4% during the forecast period.

The COVID-19 pandemic had a negative impact on the market. However, it has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- The increasing adoption rate of the brazing process over processes like welding and soldering and the increasing demand for aluminum brazing alloys from the automotive industry are expected to drive the market.

- On the other hand, the changing prices of base metals are likely to slow the market's growth.

- In the years to come, the growth of vacuum brazing technology is likely to give the market a chance to grow.

- The Asia-Pacific region is expected to have the biggest share of the market and the highest CAGR over the next five years.

Braze Alloys Market Trends

The Automotive Segment is Expected to Dominate the Market

- Braze alloys are utilized in the automobile sector for a variety of joining purposes. Different metallic pieces are connected using a metallic filler, i.e., braze alloys, having a lower melting temperature than the linked parts' or base metal's melting point.

- Also, the filler metal might be used as a wire, a thin plate, or a paste, depending on how it will be used by the end user.Diode laser brazing, furnace/vacuum brazing, and metal inert gas (MIG) brazing are commonly used for automotive joining applications.

- Some of the key applications of braze alloys in automotive manufacturing include joining the ABC pillars to the roof, laser beam or plasma brazing on the C-pillar, laser beam brazing on the trunk cover, MIG brazing of the fuel tank tube, aluminum-plated or non-coated steel sheets in the structure area of the automotive body, and others.

- According to the Organization Internationale des Constructeurs d'Automobiles (OICA), the total number of new automobile sales or registrations in the OICA member countries was close to 69 million units in 2022.

- Also, the European Automobile Manufacturers' Association (ACEA) said that more than 68 million passenger cars were made worldwide in 2022, which was 7.9% more than the year before.Furthermore, car manufacturing in the North American region increased by 10.3% in 2022 to 10.4 million units, mostly due to high demand in the United States.

- Additionally, the Society of Motor Manufacturers and Traders estimated that over 775,000 cars would be made in the United Kingdom in 2022. Aside from that, around 68,600 cars were manufactured in the United Kingdom in January 2023.

- The report by the SMMT also stated that Volkswagen was the most popular car brand among people in the United Kingdom. In 2021, Volkswagen had the highest market share of close to 9%, followed by Audi (7.16%) and BMW (7.08%).

- Due to the aforementioned factors, the automotive segment is expected to dominate the market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific countries, such as China, India, and Japan, had the most braze alloys on the market. This was because China, India, and Japan's automotive, electrical and electronics, construction, and aerospace industries were all growing.

- China has been the largest and most dominant nation in terms of vehicle production and sales of all types. The Chinese Association of Automobile Manufacturers says that China made 3.4% more cars in 2022 than it did the year before. About 27 million cars were expected to be made in 2022, up from about 26.08 million in 2021.

- Also, the Society of Indian Automobile Manufacturers said that the total number of cars made in India in FY 2022 would be close to 23 million. Two-wheelers, which made up about 74% of the total production, held the majority of the market share.

- According to the Japan Automobile Dealers Association (JADA), Toyota was the leading car manufacturer in Japan, selling around 1.25 million vehicles domestically in 2022. Toyota reported more than twice as many unit sales as the runner-up. Suzuki, which came in second, sold slightly over 600,000 vehicles in 2022.

- The market in question is likely to benefit from the gradual growth of the commercial construction sector, especially when it comes to building office space. Also, the demand for residential buildings in the Asia-Pacific region is growing because of the rise in home sales and the renovation of existing homes.

- According to the National Bureau of Statistics of China, the value of China's construction output in the fourth quarter of 2022 was around CNY 276 billion (USD 40 billion). This was a 50% increase from the previous quarter (USD 27.6 billion).

- Also, the overall investment in the construction sector was predicted to be around JPY 66,990 billion (USD 508,16 billion) in 2022, up roughly 0.6% from the previous year, according to the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) of Japan.

- Also, the Federation of Indian Chambers of Commerce and Industry (FICCI) said that around 5.5 million and 11.4 million homes were built and approved under the PMAY plan in India's metropolitan areas in 2022.

- In turn, all of these things should drive the market for braze alloys in the region over the next few years.

Braze Alloys Industry Overview

The brazing alloys market is partially consolidated in nature. Some of the major players operating in the market (in no particular order) include Aimtek Inc., The Harris Products Group, Lucas-Milhaupt Inc., Oerlikon Metco, and Sulzer Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Adoption Rate of Brazing Process Over Processes like Welding and Soldering

- 4.1.2 Increasing Demand for Aluminum Brazing Alloys from the Automotive Industry

- 4.2 Restraints

- 4.2.1 Fluctuating Prices of Base Metals

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value and Volume)

- 5.1 Base Metal

- 5.1.1 Copper

- 5.1.2 Gold

- 5.1.3 Silver

- 5.1.4 Aluminum

- 5.1.5 Other Base Metals

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Aerospace and Defense

- 5.2.3 Electrical and Electronics

- 5.2.4 Construction

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aimtek Inc.

- 6.4.2 Prince Izant Company (Bellman-Melcor)

- 6.4.3 Cupro Alloys Corporation

- 6.4.4 Indian Solder and Brazing Alloys

- 6.4.5 Johnson Matthey

- 6.4.6 Lucas-Milhaupt Inc.

- 6.4.7 Morgan Advanced Materials

- 6.4.8 OC Oerlikon Management AG (Oerlikon Metco)

- 6.4.9 Saru Silver Alloy Private Limited

- 6.4.10 Sulzer Ltd.

- 6.4.11 The Harris Products Group

- 6.4.12 VBC Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Vacuum Brazing Technology

![釬焊合金市場 [賤金屬:初級和次級;製程:銅、金、鋁、銀、鎳和其他(鈷、青銅、鐵和鈣)] - 全球產業分析、規模、佔有率、成長、趨勢和預測,2023-2031 年](/sample/img/cover/42/1420856.png)