|

市場調查報告書

商品編碼

1640322

丙酸 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Propionic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

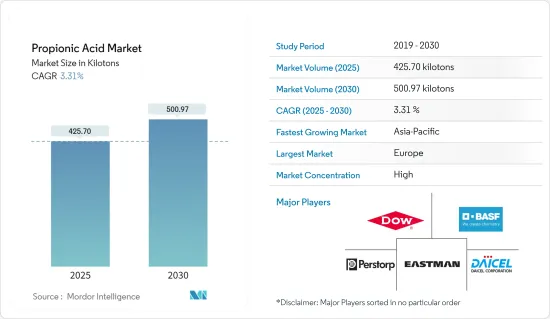

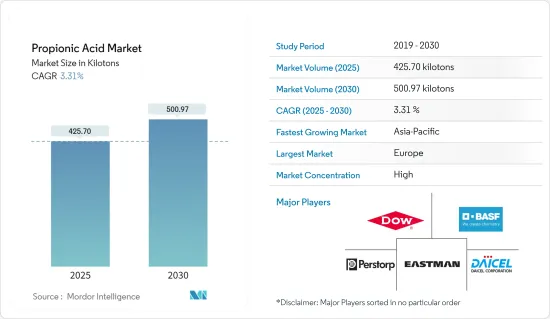

預計2025年丙酸市場規模為425.70千噸,預計2030年將達500.97千噸,預測期間(2025-2030年)複合年成長率為3.31%。

。

COVID-19 的爆發對丙酸產業造成了沉重打擊。全球封鎖和嚴格的政府法規迫使大多數生產基地關閉,給它們帶來了毀滅性的打擊。儘管如此,業務自 2021 年以來已經復甦,預計未來幾年將大幅成長。

主要亮點

- 短期內,對穀物防腐劑和安全牲畜飼料的需求不斷增加,以及新興國家採用率的大幅增加是推動市場的關鍵因素。

- 另一方面,丙酸對人體的負面影響以及除草劑的環境問題是阻礙市場成長的因素。

- 此外,丙酸生產新製程的開發可能很快就會提供市場成長機會。

- 全球丙酸市場以歐洲為主,預計亞太地區在預測期內成長率最高。

丙酸市場趨勢

農業領域的需求不斷增加

- 丙酸在農業中用作牲畜飼料和穀物的防腐劑。它也用於對儲存青貯飼料和穀物的表面進行消毒。

- 此外,丙酸也用作牲畜飲用的水中的抗菌劑。此外,有時將其噴灑在家禽糞便上以殺死真菌和細菌。

- 印度是世界第二大稻米、小麥和其他穀物生產國。國際市場對糧食的大量需求為印度糧食產品出口創造了良好的環境。印度農業部2021-22年第四次提前預測顯示,水稻、玉米和巴吉拉等主要穀物產量分別為1.3029億噸、3362萬噸和962萬噸。

- 印度是世界上最大的糧食生產國和出口國。根據農業和加工食品出口發展局(APEDA)的數據,2021-22 年印度穀物出口額為 128.0826 億美元。在印度同期糧食出口總額中,米(包括巴斯馬蒂和非巴斯馬蒂)佔很大佔有率,達 75%(以金額為準)。另一方面,包括小麥在內的其他穀類僅占同期印度穀類出口總額的25%。

- 美國糧食及農業組織公佈的資料顯示,到2050年,糧食產量需要增加70%左右才能養活全球91億人口。到 2050 年,新興國家的糧食產量可能會增加一倍。

- 這些積極的成長要素預計將推動全球農業部門的發展,並預計將增加預測期內農業部門的丙酸消費量。

歐洲主導市場

- 德國是歐洲領先的食品工業和農業市場。在食品業持續投資的支持下,歐洲丙酸市場可能會出現積極成長。

- 在政府預算、投資流入和食品消費增加的推動下,該地區的食品和飲料行業多年來經歷了顯著成長。根據FoodDrink Europe統計,2022年第一季,歐洲食品和飲料產量較2021年第一季成長3%。

- 丙酸透過牛奶的細菌發酵自然產生,是瑞士起司風味的來源。例如,根據歐盟統計局的數據,2022年歐盟起司產量為1,043萬噸,較2021年下降0.5%。

- 在化妝品應用中,丙酸可防止細菌生長,從而防止產品變質,並有助於控制化妝品中的 pH 值。因此,它在個人護理行業中被廣泛採用。

- 據歐洲化妝品協會稱,2022 年歐洲化妝品和個人護理市場規模將達到 880 億歐元(927.344 億美元)。它是世界上最大的化妝品市場。因此,該地區化妝品和個人護理行業的成長將進一步拉動丙酸的需求。

- 此外,化妝品歐洲預計,到 2022 年,歐洲最大的化妝品和個人保健產品國內市場將是德國,規模為 143 億歐元(150.6 億美元),法國為 129 億歐元(135.9 億美元),英國為 105 億歐元。萬110.6億歐元(110.6億美元)、義大利115億歐元(121.1億美元)、西班牙93億歐元(98億美元)和波蘭45億歐元(47.4億美元)。此外,在歐洲化妝品市場中,德國將在2022年消費最多的化妝品,約143億歐元(150.6億美元)。因此,歐洲化妝品市場的擴張可能會增加該地區對丙酸的需求。

- 因此,歐洲食品飲料以及化妝品和個人護理領域的快速發展預計將在預測期內提振丙酸市場需求。

丙酸產業概況

丙酸市場本質上是高度一體化的。市場的主要主要企業(排名不分先後)包括BASF、陶氏化學、大賽璐公司、伊士曼化學公司和柏斯托公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對穀物防腐劑和安全動物飼料的需求增加

- 新興經濟體招募人數顯著增加

- 其他司機

- 抑制因素

- 丙酸對人體的不良影響

- 關於除草劑使用的環境問題

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 目的

- 動物飼料及食品防腐劑

- 鈣鹽、銨鹽、鈉鹽

- 醋酸丙酸纖維素

- 除草劑

- 塑化劑

- 其他

- 最終用戶產業

- 農業

- 飲食

- 個人護理

- 藥品

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- Celanese Corporation

- Daicel Corporation

- Dow

- Eastman Chemical Company

- Hawkins

- Merck KGaA

- OQ Chemicals GmbH

- Perstorp

- Shanghai Jianbei Organic Chemical Co., Ltd

- Yancheng Hongtai Bioengineering Co., Ltd

- Yancheng Huade(Dancheng)Biological Engineering Co.,Ltd.

第7章 市場機會及未來趨勢

- 丙酸生產新製程的開發

- 其他機會

The Propionic Acid Market size is estimated at 425.70 kilotons in 2025, and is expected to reach 500.97 kilotons by 2030, at a CAGR of 3.31% during the forecast period (2025-2030).

.

The COVID-19 epidemic harmed the propionic acid sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business is recovering since 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, increasing demand for grain preservatives and safe animal feed and a significant increase in adoption in emerging economies are major factors driving the market studied.

- On the flip side, the detrimental effects of propionic acids on human health and environmental concerns regarding herbicides are some factors hindering the growth of the market studied.

- Moreover, novel process development for propionic acid production may provide opportunities for market growth shortly.

- Europe dominated the global propionic acid market, and Asia-Pacific will likely witness the highest growth rate during the forecast period.

Propionic Acid Market Trends

Growing Demand from the Agriculture Industry

- Propionic acid is used as a preservative in animal feed and grain in the agriculture industry. It is also used to sanitize the surfaces where silage and grain are stored.

- In addition, propionic acid is used as an anti-bacterial agent in water, which is used for drinking purposes by livestock. They are even sprayed into poultry litter to kill fungi and bacteria.

- India is the world's second-largest producer of rice, wheat, and other cereals. The massive demand for cereals in the global market is creating an excellent environment for exporting Indian cereal products. According to the fourth advance estimates for 2021-22 by the Ministry of Agriculture of India, the production of major cereals like rice, maize, and bajra stood at 130.29 million tons, 33.62 million tons, and 9.62 million tons, respectively.

- India is the largest producer and exporter of cereal products in the world. According to the Agricultural and Processed Food Products Export Development Authority (APEDA), India's export of cereals stood at USD 12,808.26 million from 2021-22. Rice (including Basmati and Non-Basmati) occupy the major share in India's total cereals export at 75% (in value terms) during the same period. Whereas other cereals, including wheat, represent only a 25% share of total cereals exported from India during this period.

- According to the published data by the Food and Agriculture Organization of the United States, feeding a world population of 9.1 billion people in 2050 would require raising food production by around 70%. In developing countries, food production is likely to get double by 2050.

- Such positive growth factors are expected to drive the agriculture sector worldwide, which is expected to augment the consumption of propionic acid in the agriculture sector through the forecast period.

Europe to Dominate the Market

- Germany is the major European region's food industry and agriculture sector market. Supported by the ongoing investments in the food industry, the market for propionic acid is likely to grow positively in Europe.

- The food and beverage sector in the region witnessed significant growth over the years, resulting from an increase in government budgets, investment inflows, and food consumption. According to FoodDrink Europe, in Q1 of 2022, food and drink production increased by 3% in Europe in comparison to Q1 of 2021.

- Propanoic acid occurs naturally due to the bacterial fermentation of milk and is partly responsible for the flavor of Swiss cheese. For instance, according to Eurostat, in 2022, cheese production in the EU stood at 10.43 million tons, showing a decrease of 0.5% compared to 2021.

- In cosmetics applications, propionic acid protects products from spoilage by preventing bacterial growth and also facilitates pH control of the cosmetics products. Thus, it is widely adopted in the personal care industry.

- According to Cosmetics Europe, the European cosmetics and personal care market amounted to EUR 88 billion (USD 92.7344 billion) in 2022. It is the largest market for cosmetic products in the world. Thus, growth in this region's cosmetics and personal care industry further boosts the demand for propionic acid.

- Further, Cosmetics Europe stated that, in 2022, the largest national markets for cosmetics and personal care products within Europe are Germany with EUR 14.3 billion (USD 15.06 billion), France with EUR 12.9 billion ( USD 13.59 billion), the United Kingdom with EUR 10.5 billion (USD 11.06 billion), Italy with EUR 11.5 billion (USD 12.11 billion), Spain with EUR 9.3 billion (USD 9.80 billion), and Poland with EUR 4.5 billion(USD 4.74 billion). Moreover, within the European cosmetics market, Germany consumed the largest amount of cosmetics in 2022, valued at approximately EUR 14.3 billion (USD 15.06 billion). Thus the increased market for cosmetics in Europe will likely boost the demand for propionic acid in the region.

- Therefore, such rapid development in the food and beverage and cosmetic and personal care sector in Europe is expected to boost the demand for the propionic acid market during the forecast period.

Propionic Acid Industry Overview

The propionic acid market is highly consolidated in nature. Some of the major key players in the market (in no particular order) include BASF SE, Dow, Daicel Corporation, Eastman Chemical Company, and Perstorp, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Grain Preservatives and Safe Animal Feed

- 4.1.2 Significant Increase in Adoption in Emergeing Economies

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Detrimental Effects of Propionic Acid on Human Health

- 4.2.2 Environmental Concerns Regarding Use of Herbicides

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Animal Feed and Food Preservatives

- 5.1.2 Calcium, Ammonium, and Sodium Salts

- 5.1.3 Cellulose Acetate Propionate

- 5.1.4 Herbicides

- 5.1.5 Plasticizers

- 5.1.6 Other Applications

- 5.2 End-user Industry

- 5.2.1 Agriculture

- 5.2.2 Food and Beverage

- 5.2.3 Personal Care

- 5.2.4 Pharmaceutical

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Argentina

- 5.3.4.2 Brazil

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Celanese Corporation

- 6.4.3 Daicel Corporation

- 6.4.4 Dow

- 6.4.5 Eastman Chemical Company

- 6.4.6 Hawkins

- 6.4.7 Merck KGaA

- 6.4.8 OQ Chemicals GmbH

- 6.4.9 Perstorp

- 6.4.10 Shanghai Jianbei Organic Chemical Co., Ltd

- 6.4.11 Yancheng Hongtai Bioengineering Co., Ltd

- 6.4.12 Yancheng Huade (Dancheng) Biological Engineering Co.,Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Novel Process Development for the Production of Propionic Acid

- 7.2 Other Opportunities