|

市場調查報告書

商品編碼

1640325

北美建築資訊模型:市場佔有率分析、產業趨勢與成長預測(2025-2030)NA Building Information Modelling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

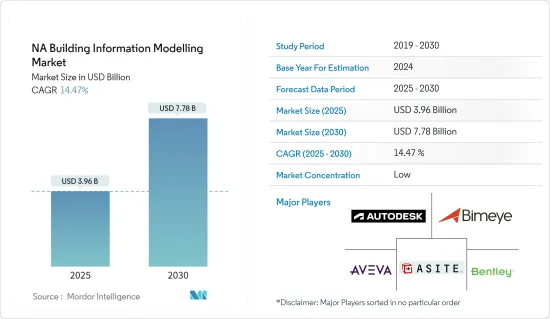

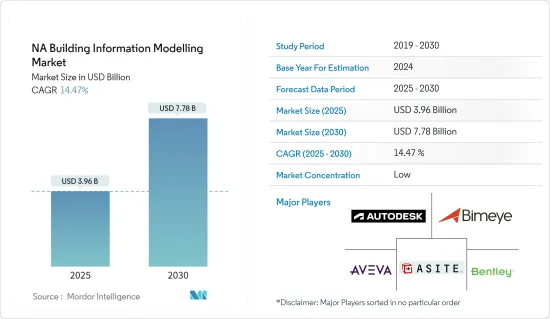

北美建築資訊模型(BIM)市場規模預計到2025年為39.6億美元,到2030年將成長到77.8億美元,預計在預測期內(2025-2030年)複合年成長率將達到14.47%。

對 BIM 解決方案的需求部分取決於該地區的建設活動。在美國,建設業在景氣衰退後顯著反彈,成為經濟的主導部門之一。美國是 BIM 解決方案的早期採用者之一,美國總務管理局已採取多項積極措施來推廣 BIM 解決方案的使用。

主要亮點

- 由於 BIM 技術具有眾多優勢,其使用在 AEC 行業已變得司空見慣。由於交貨方式分散、施工問題和相關人員眾多,現代 AEC 業務非常複雜,這使得 BIM 得以廣泛採用。這主要是由於關於在 AEC 行業採用 BIM 的政府立法的不斷成長,以及建築領域對自動化模型以提高業務效率的需求不斷成長。

- 建築資訊模型 (BIM) 因其相對於現有工具(例如紙本設計和建模以及 CAD 系統)的優勢而得到越來越多的採用。 BIM 主要促進創建精確的幾何虛擬模型,其中包括建築物中涉及的所有組件和結構。

- 隨著許多政府法規鼓勵在各個區域市場使用 BIM 解決方案,BIM 技術預計將會成長。此外,其高效的建模系統正在推動許多地區的私人組織向 BIM 過渡,從而推動市場成長。

- 然而,軟體高成本、訓練有素的專業人員有限以及實施問題可能會阻礙市場成長。

- 由於美國和加拿大等國家長期封鎖,新冠肺炎 (COVID-19) 疫情導致正在進行的建設計劃暫停。人們被迫在家工作,以遵守政府制定的安全法規。這為 BIM 在建築領域的應用創造了新的機會。提高人們對建築計劃中使用 BIM 的功能和優勢的認知,預計將推動 BIM 在建築市場的成長。

北美建築資訊模型 (BIM) 市場趨勢

商業應用領域佔據主要市場佔有率

- 北美的 BIM 商業用戶(例如承包商)在使用 BIM 解決方案方面比世界其他地區的相同細分市場的用戶要先進得多。商業領域的投資主要旨在增加 BIM 使用的深度。軟體所有者和最終設計所針對的最終用戶之間的協作可以實現改進的過程結果並減少錯誤和遺漏。

- 在北美,BIM 特別用於機構和政府建築計劃。在加拿大,BIM的使用更多的是在基礎設施計劃。

- 商業開發商透過在施工前提供建築物的詳細表示,在其銷售業務中受益於 BIM 的 3D 視覺化功能。

- 這對於客戶和商業房地產來說都是雙贏的,因為消費者可以在施工前直覺地看到已完成的建築模型。商業房地產可以在整個過程完成之前很久就找到買家。

- 北美地區正在經歷快速的進步和技術發展。因此,許多人開始搬到大城市。都市區商業性和個人需求增強基礎設施的需求激增,預計將推動未來幾年 BIM 市場的成長。

美國預計將佔據主要市場佔有率

- 專注於最新技術進步的公司預計將從關鍵市場特徵中獲益匪淺,例如城市人口的快速成長和美國各地政府投資的增加。

- 在過去的幾年裡,BIM已成為美國工程和建築領域的重要工具。這是由於私人建設計劃投資增加以及美國政府推動基礎設施發展的努力。專門開發資訊模型的開發人員需要與空間資訊科學相關的基於智慧 3D 模型的程式。

- 隨著 3D 建模的轉變,GIS 產業正日益受到顛覆。這一發展標誌著 GIS 和 BIM 整合到一個整體環境中,標誌著設計和施工行業從 2D 轉向 3D BIM 的轉變。

- 該地區有重要的 BIM 供應商,且 BIM 經常與地理資訊系統等其他趨勢整合。總部位於加州的新興企業Katerra 建立了一個整合平台,將 BIM 工具和運算設計直接整合到 ERP 全球供應鏈基礎設施中,使訂購、製造、追蹤和運輸貨物變得更加容易。

- 根據美國人口普查局的數據,去年美國私人建築支出持續成長,幾乎是公共部門建築支出的四倍。從美國50 個州的建築支出來看,德克薩斯州和加州名列前茅。預測美國建築支出將持續成長。

北美建築資訊模型 (BIM) 產業概覽

北美的建築資訊模型市場較為分散,主要參與者包括 Autodesk, Inc.、Asite Solutions Ltd.、Aveva Group PLC、Bentley Systems Inc. 和 Bimeye Inc.。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 5 月,開發工作場所管理軟體的美國工作技術公司 Eptura 宣布對其整合工作場所管理系統 Archibus 進行了新的更新。這項增強功能為 Archibus 的 BIM(建築資訊模型)檢視器工具提供了新功能,使施工後團隊能夠有效率地管理建築物。這使得該解決方案對於從施工現場到施工後操作員的順利資料傳輸極為重要。 Archibus BIM 檢視器的最新改進簡化了資料流,並使設施經理能夠更好地控制他們喜歡的建築模型。

- 2023 年 1 月,Snaptrude 是新興企業,宣布以更實惠的成本為客戶提供一系列現代且廣泛的功能。這家總部位於紐約的公司已經獲得了數千名客戶,目前正在籌集種子資金。 Snaptrude 提供 3D 建築設計協作,並產生即時資料,告知建築規模變化對成本、氣候和能源利用的影響。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 價值鏈/供應鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 政府要求在主要國際市場推廣 BIM 的使用

- 提升計劃績效和生產力

- 市場限制因素

- 成本和實施問題

- 市場機會

- 智慧城市和綠色城市的採用率不斷提高

第6章 市場細分

- 按類型

- 軟體

- 服務

- 依部署類型

- 本地

- 雲

- 按用途

- 商業的

- 住宅

- 產業

- 按國家/地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Autodesk, Inc.

- Asite Solutions Ltd

- Aveva Group PLC

- Bentley Systems Inc.

- Bimeye Inc.

- Clearedge3D Inc.

- Dassault Systems SA

- Hexagon AB

- Nemetschek SE

- Rib Software AG

- Topcon Positioning Systems Inc.

- Trimble Inc.

第8章投資分析

第9章 市場的未來

The NA Building Information Modelling Market size is estimated at USD 3.96 billion in 2025, and is expected to reach USD 7.78 billion by 2030, at a CAGR of 14.47% during the forecast period (2025-2030).

The demand for BIM solutions partly depends on the construction activity witnessed in a region. In the US, it has recovered significantly after the economic recession to emerge as one of the major sectors of the economy. The US has been one of the early adopters of BIM solutions, with the general services administration taking several proactive measures to promote the usage of BIM solutions.

Key Highlights

- The usage of BIM has become more common in the AEC industry due to the numerous benefits connected with this technology. Because of the fragmented delivery methods, building problems, and various parties involved, the contemporary AEC business is complicated, allowing for the widespread use of BIM. This is mostly due to a growth in government laws about BIM adoption in the AEC industry and the growing need for automated models in the construction arena to improve operational efficiencies.

- Building information modeling (BIM) has witnessed an increased adoption owing to its advantages over the existing tools, such as paper-based design and modeling and CAD systems. BIM primarily facilitates the users to create an accurate, precise, geometric virtual model with all the components and structures involved in the building.

- BIM technology is expected to grow as many government regulations promote using BIM solutions in various regional markets. Moreover, many regional private organizations are increasingly moving toward BIM, owing to its efficient modeling systems, thus driving market growth.

- However, high-cost software, limited trained professionals, and implementation issues might hamper the market's growth.

- The COVID-19 pandemic had shut down ongoing construction projects owing to the prolonged lockdown in countries including the United States and Canada. People were forced to work from home to maintain safety rules posed by the government. This opened new opportunities for the use of BIM in construction. Increasing awareness regarding the features and benefits of using BIM in construction projects was expected to boost the growth of BIM in the construction market.

North America Building Information Modelling (BIM) Market Trends

Commercial Application Segment Holds Significant Market Share

- Commercial users of BIM in North America, such as contractors, are far more advanced in using BIM solutions than users in other parts of the world in the same segment. Investments in the commercial segment are majorly directed toward increasing the depth of use of BIM. Collaborations between software owners and the intended end users of the finalized design can achieve improved process outcomes and reduce errors and omissions.

- In North America, BIM is used in projects, especially institutional and government building projects. In Canada, the use of BIM is more in infrastructure projects.

- Commercial developers have enjoyed the benefits of the 3D visualization feature of BIM in their sales efforts by offering a detailed representation of the building before construction.

- This can be mutually advantageous to both customers and commercial establishments, as consumers can visualize the finished model of the building before construction. The commercial establishment can find takers much before the completion of the entire process.

- The North American region is experiencing rapid improvements and technological developments. Hence, many people have started shifting to metropolitan cities. The surging demand for enhanced infrastructure for commercial and personal requirements in urban areas would propel the BIM market growth in the upcoming years.

United States is Expected to Hold Major Market Share

- Businesses concentrating on the most recent technological advancements are expected to gain significantly from important market features such as a rapidly rising urban population and increased government investment across the United States.

- During the past several years, BIM has become an important tool in the engineering and construction sectors in the United States. It results from increased private investment in construction projects and the U.S. government's attempts to boost infrastructure development. Businesses specializing in developing information models require intelligent 3D model-based procedures linked with spatial information sciences.

- The GIS industry is increasingly being disrupted as it transitions to 3D modeling. The progression, which demonstrates the integration of GIS and BIM into a single holistic environment, demonstrates the shift the design and construction industry is going through as it moves from 2D to 3D BIM.

- Significant BIM vendors are located in this area, and BIM is frequently integrated with other trends, such as geographic information systems. Katerra, a California-based startup, has built an integrated platform that directly integrates BIM tools and computational design to its ERP global supply chain infrastructure to make ordering, manufacturing, tracking, and delivery of goods easier.

- According to U.S. Census Bureau, United States spending on private construction continued to grow last year and was nearly four times larger than construction spending in the public sector. Texas and California were at the top of the ranking when observing construction spending within the 50 U.S. states. According to a forecast, the value of United States construction put in place is expected to keep growing during the following years.

North America Building Information Modelling (BIM) Industry Overview

North America Building Information Modeling Market is fragmented with the presence of major players like Autodesk, Inc., Asite Solutions Ltd, Aveva Group PLC, Bentley Systems Inc., and Bimeye Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2023: Eptura, a United States based work technology company that develops software to manage workplaces introduced new updates to its integrated workplace management system, Archibus. The enhancements provide new capabilities in Archibus's BIM (Building Information Modeling) viewer tool, to enable the post-construction teams to manage their buildings efficiently. This makes the solution crucial for data to transfer smoothly from construction to post-building operators. The recent improvements to Archibus's BIM Viewer streamline the data flow and offers facility managers more control over their preferred building models.

- January 2023: Snaptrude, a startup, attempting to disrupt Autodesk in the building design space, announced its modern and broader sets of features for customers at a more affordable cost. The New York City-headquartered firm has gained thousands of customers and now, a seed funding. Snaptrude offers collaboration for designing buildings in 3D and it also generates real-time data to inform about the impact of changing construction size on cost, climate and energy utilization.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Mandates Promoting the Usage of BIM in Key International Markets

- 5.1.2 Increased Project Performance and Productivity

- 5.2 Market Restraints

- 5.2.1 Cost and Implementation Issues

- 5.3 Market Opportunities

- 5.3.1 Increasing Adoption of Smart and Green Cities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment Type

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Application

- 6.3.1 Commercial

- 6.3.2 Residential

- 6.3.3 Industrial

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Autodesk, Inc.

- 7.1.2 Asite Solutions Ltd

- 7.1.3 Aveva Group PLC

- 7.1.4 Bentley Systems Inc.

- 7.1.5 Bimeye Inc.

- 7.1.6 Clearedge3D Inc.

- 7.1.7 Dassault Systems SA

- 7.1.8 Hexagon AB

- 7.1.9 Nemetschek SE

- 7.1.10 Rib Software AG

- 7.1.11 Topcon Positioning Systems Inc.

- 7.1.12 Trimble Inc.