|

市場調查報告書

商品編碼

1640329

歐洲阻燃化學品:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Flame Retardant Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

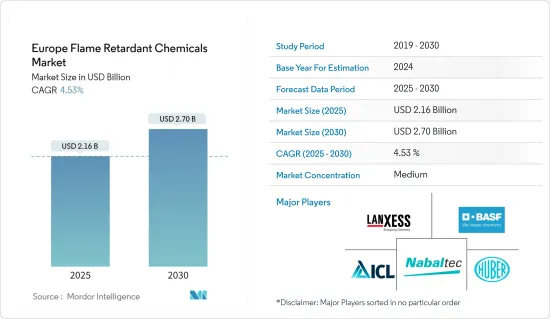

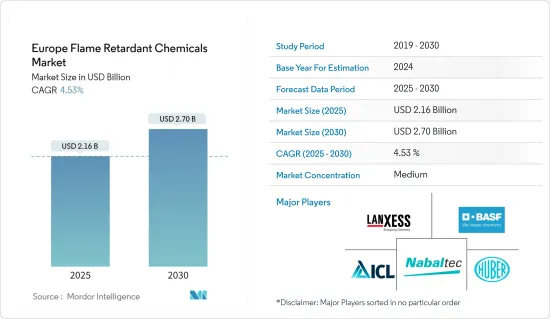

預計2025年歐洲阻燃化學品市場規模為21.6億美元,預計2030年將達27億美元,預測期間(2025-2030年)的複合年成長率為4.53%。

2020 年,歐洲阻燃化學品市場受到了 COVID-19 的負面影響。然而,在新冠疫情之後,建設產業正在迅速復甦,預計未來幾年將會成長,從而刺激阻燃化學品市場的需求。

主要亮點

- 預計消費電氣和電子產品製造業的增加、建築安全標準的提高以及東歐國家生活水準的提高將推動對阻燃化學品的需求。

- 相反,有關溴化阻燃化學品的環境和健康問題預計會阻礙市場成長。

- 然而,人們對環保阻燃化學品的認知不斷提高以及對非鹵化阻燃化學品的積極研究和開發預計將為所調查的市場提供有利的成長機會。

- 德國在阻燃化學品市場佔據主導地位,並將在預測期內實現最高的複合年成長率。

歐洲阻燃化學品市場趨勢

建築業主導市場成長

- 在歐洲建設產業中,阻燃化學品主要用於結構隔熱材料。住宅和其他建築物中使用隔熱材料來保持舒適的溫度並節省能源。

- 阻燃化學品在建築暖通空調應用(如隔音和管道絕緣)中使用的聚烯發泡體中也被廣泛應用。

- 在歐洲,所有建築和建築材料(包括硬質聚氨酯泡沫)必須符合 EN13501 的防火要求。該法規正在推動歐洲建設產業對阻燃化學品的需求。

- 據歐洲建築業聯合會稱,歐盟27國建築業的總投資正在大幅成長,推動對阻燃化學品的需求。

- 在歐洲,德國是建設產業最大的市場之一。例如,根據德國聯邦統計局(Destatis)的數據,2023 年 3 月,德國獲準建造約 24,500 套住宅。與2022年3月相比,建築許可數量減少了約10,300份(約29.6%)。

- 近年來,英國建設產業經歷了顯著成長。例如,根據Trading Economics的數據,2023年3月英國建築業產量與去年同期相比成長了近4.1%。新建築成長 2.8%,而維修和保養活動成長 6.1%。

- 預計上述因素將在預測期內增加歐洲建設產業對阻燃化學品的需求。

德國佔據市場主導地位

- 德國經濟是歐洲最大、世界第五大經濟體。工業成長、政府支出增加和建築業繁榮支撐了 2022 年的成長。

- 德國領先歐洲汽車市場,其41個組裝和引擎生產廠佔歐洲汽車總產量的三分之一。德國是汽車工業的主要製造地之一,擁有眾多領域的製造商。其中包括設備製造商、材料和零件供應商、引擎製造商和系統整合商。

- 根據國際汽車工業組織 (OICA) 的數據,2022 年德國輕型商用車和轎車總產量將達到 3,677,820 輛,較 2021 年的 3,038,692 輛成長約 11%。

- 德國是歐洲最大的建築業國家,正在經歷強勁成長,主要原因是住宅建設活動的增加。

- 根據德國聯邦統計局(Statistisches Bundesamt:Destatis)的數據,2023年前三個月共頒發了68,700份住宅建築許可證,較2022年同期下降25.7%。這主要是因為建材價格飛漲所致。

- 德國的電子產業規模位居歐洲第一、世界第五。電氣和電子產業佔德國工業總產值的 10% 以上,佔國內生產總值(GDP) 的 3% 左右。

- 德國是歐洲最大的家具市場,消費者購買力強,為製造商創造了進一步的創新機會。德國家具產業的主要企業包括Huls AG &Co.KG、Topstar GmbH和Rauch GmbH &Co.KG。 2022 年 5 月,Woody Trading 報告稱,2022 年第一季德國家具產業銷售額成長 16.1%,達到約 48 億歐元(51 億美元)。

- 因此,預計預測期內此類產業趨勢將推動該國阻燃化學品的消費。

歐洲阻燃化學品產業概況

歐洲阻燃化學品市場本質上是部分整合的。該市場的主要企業包括(不分先後順序)ICL、LANXESS、 BASF SE、JM Huber Corporation和Nabaltec AG。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 消費性電子電氣製造業成長

- 提高建築施工安全標準

- 東歐生活水準不斷提高

- 限制因素

- 溴化阻燃劑對環境與健康的危害

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 依產品類型

- 非鹵化

- 無機

- 氫氧化鋁

- 氫氧化鎂

- 硼化合物

- 磷光

- 氮化合物

- 其他類型

- 鹵化

- 溴化合物

- 氯基化合物

- 非鹵化

- 按最終用戶產業

- 電氣和電子

- 建築和施工

- 運輸

- 紡織品和家具

- 按地區

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 其他歐洲國家

第6章 競爭格局

- 併購、合資、合作與協議

- 市場排名分析**/排名分析

- 主要企業策略

- 公司簡介

- Albemarle Corporation

- BASF SE

- CLARIANT

- DIC Corporation

- Dow

- Eti Maden

- ICL

- Italmatch Chemicals SpA

- JM Huber Corporation

- LANXESS

- MPI Chemie BV

- Nabaltec AG

- RTP Company

- THOR

- TOR Minerals

第7章 市場機會與未來趨勢

- 人們對環保阻燃化學品的認知不斷提高

- 積極研發無鹵阻燃化學品

The Europe Flame Retardant Chemicals Market size is estimated at USD 2.16 billion in 2025, and is expected to reach USD 2.70 billion by 2030, at a CAGR of 4.53% during the forecast period (2025-2030).

The European flame retardant chemical market was negatively impacted by COVID-19 in 2020. However, post-COVID-19 pandemic, the construction industry is recovering fast and is estimated to rise in the coming years, stimulating the demand for the flame retardant chemical market.

Key Highlights

- Rising consumer electrical and electronic goods manufacturing, rising safety standards in building construction, and rising living standards in Eastern European countries will likely drive the demand for flame-retardant chemicals.

- Conversely, environmental and health concerns regarding brominated flame retardants are expected to hinder the market's growth.

- Nevertheless, the rising awareness of environment-friendly flame retardants and active R&D of non-halogenated flame retardants are projected to create lucrative growth opportunities for the studied market.

- Germany dominates the flame retardant chemicals market and will also witness the highest CAGR during the forecast period.

Europe Flame Retardant Chemicals Market Trends

Buildings and Construction Segment to Dominate the Market Growth

- In the European building and construction industry, flame retardants are primarily used in structural insulation. Insulation is used in homes and other buildings to keep the temperature comfortable and to save energy.

- Flame retardants also find major applications in polyolefin foams used in buildings in HVAC applications, such as sound insulation, thermal insulation for pipes, etc.

- In Europe, all materials for building and construction (including rigid PU foams) must meet the fire requirements, according to EN 13501. This regulation is driving the demand for flame retardants in the European building and construction industry.

- According to the European Construction Industry Federation, the total investments in the construction industry of EU-27 countries are increasing significantly, thereby driving the demand for flame retardants.

- In Europe, Germany is one of the largest markets for the building and construction industry. For instance, according to Statistisches Bundesamt (Destatis), the construction of around 24,500 dwellings was permitted in March 2023 for Germany. It was reduced by around 10,300 building permits (nearly 29.6%) compared to March 2022.

- The construction industry witnessed significant growth in the United Kingdom over the past few years. For instance, according to Trading Economics, in March 2023, the construction output in the UK increased by nearly 4.1% year-on-year. The new construction work showed a growth of 2.8%, and 6.1% growth was seen in repair and maintenance activities.

- The factors above are expected to create demand for flame retardants in the European construction industry during the forecast period.

Germany to Dominate the Market

- The German economy is the largest in Europe and the fifth-largest globally. Increased industrial growth, higher state spending, and booming construction helped support growth in 2022.

- Germany leads the European automotive market, with 41 assembly and engine production plants contributing to one-third of Europe's total automobile production. Germany, one of the leading manufacturing bases of the automotive industry, is home to manufacturers from different segments. It includes equipment manufacturers, material and component suppliers, engine producers, and system integrators.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2022 Germany's total LCV and car production accounted for 3,677,820 units, an increase of around 11% compared to 2021, which stood at 3,308,692 units.

- Germany's largest construction industry in Europe is growing significantly and is primarily driven by the increasing number of residential construction activities.

- According to Statistisches Bundesamt (Destatis), 68,700 building permits for dwellings were issued from January to March 2023, which decreased by 25.7% compared to the same period in 2022. It is mainly due to the surge in the coat of building materials.

- The German electronic industry is the largest in Europe and the fifth-largest worldwide. The electrical and electronics industry accounted for more than 10% of the total German industrial production and about 3% of the country's gross domestic product (GDP).

- Germany is the largest market for furniture in Europe, and the high consumer purchasing power further creates an opportunity for manufacturers to innovate. Some key players in the German furniture industry include Huls AG & Co. KG, Topstar GmbH, and Rauch GmbH & Co. KG. In May 2022, Woody Trading stated that in the first quarter of 2022, the furniture industry sales in Germany increased by 16.1% to around EUR 4.8 billion (USD 5.1 billion).

- Hence, such industrial trends are projected to drive the consumption of flame-retardant chemicals in the country during the forecast period.

Europe Flame Retardant Chemicals Industry Overview

The Europe flame retardant chemical market is partially consolidated in nature. Some of the major players in the market include ICL, LANXESS, BASF SE, J.M. Huber Corporation, and Nabaltec AG, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Consumer Electrical and Electronic Goods Manufacturing

- 4.1.2 Rise in Safety Standards in Building and Construction

- 4.1.3 Rise in Standard of Living in the Eastern European Countries

- 4.2 Restraints

- 4.2.1 Environmental and Health Concerns Regarding Brominated Flame Retardants

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 Market Segmentation

- 5.1 Product Type

- 5.1.1 Non-halogenated

- 5.1.1.1 Inorganic

- 5.1.1.1.1 Aluminum Hydroxide

- 5.1.1.1.2 Magnesium Hydroxide

- 5.1.1.1.3 Boron Compounds

- 5.1.1.2 Phosphorus

- 5.1.1.3 Nitrogen

- 5.1.1.4 Other Types

- 5.1.2 Halogenated

- 5.1.2.1 Brominated Compounds

- 5.1.2.2 Chlorinated Compounds

- 5.1.1 Non-halogenated

- 5.2 End-user Industry

- 5.2.1 Electrical and Electronics

- 5.2.2 Buildings and Construction

- 5.2.3 Transportation

- 5.2.4 Textiles and Furniture

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Albemarle Corporation

- 6.4.2 BASF SE

- 6.4.3 CLARIANT

- 6.4.4 DIC Corporation

- 6.4.5 Dow

- 6.4.6 Eti Maden

- 6.4.7 ICL

- 6.4.8 Italmatch Chemicals S.p.A

- 6.4.9 J.M. Huber Corporation

- 6.4.10 LANXESS

- 6.4.11 MPI Chemie BV

- 6.4.12 Nabaltec AG

- 6.4.13 RTP Company

- 6.4.14 THOR

- 6.4.15 TOR Minerals

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Awareness on Environment-friendly Flame Retardants

- 7.2 Active R&D of Non-Halogenated Flame Retardants