|

市場調查報告書

商品編碼

1640359

歐洲生質塑膠市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Bioplastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

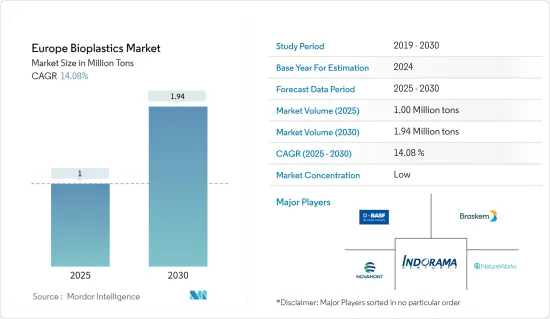

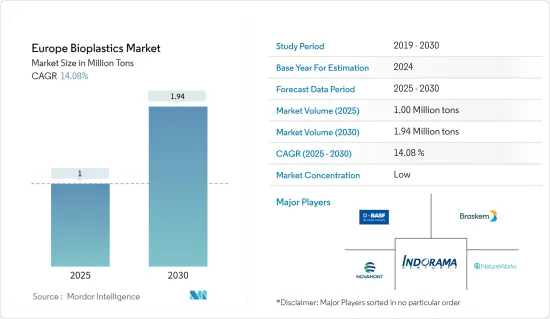

預計2025年歐洲生質塑膠市場規模為100萬噸,2030年將達194萬噸,預測期(2025-2030年)複合年成長率為14.08%。

由於 COVID-19 大流行,2020 年市場受到重大影響。然而,目前估計已達到大流行前的水平。

主要亮點

- 從短期來看,推動模式轉移的環境因素以及軟包裝中生質塑膠需求不斷成長是推動市場的關鍵因素。

- 然而,更便宜的替代品的出現預計將阻礙市場的成長。

- 預計在預測期內,軟包裝應用將在數量上主導市場。

- 擴大在電子產業的使用可能會提供未來的市場機會。

歐洲生質塑膠市場趨勢

軟包裝可望主導市場

- 生質塑膠用於軟包裝,因為它們不會危害自然世界,而且有些很容易分解。

- 生質塑膠用於非食品產品,如食品、藥品、飲料瓶、包裝薄膜、餐巾紙和紙巾、廁所用衛生紙、紙板、食品包裝用塗佈紙以及用於製造杯子和盤子的塗佈紙板。此外,它還用於軟包裝和鬆散填充包裝。

- 亞洲、東歐和中東等地區人口的成長、消費能力的增強、快速的都市化以及零售業的發展是推動包裝產業成長的因素。

- 此外,聚乳酸(PLA)用於食品包裝,生物聚對苯二甲酸乙二醇酯(PET)、生物聚乙烯和生物聚丙烯主要用作包裝薄膜。

- 此外,到 2022 年,歐洲食品和飲料行業僱用了 460 萬人。銷售額11590億美元,增加價值2423.7億美元,是歐洲最大的製造業之一。因此,該地區的食品和飲料行業有所增加,對食品包裝的需求以及市場研究也有所增加。

- 由於生質塑膠對環境友好,消費量不斷增加。有機廢棄物收集袋用於醫院、旅館和餐廳、商業設施和零售店以及住宅。世界各地的地方政府也已開始使用它。

- 生質塑膠的使用量在包裝領域最高,由於人們對全球環境問題的認知不斷增強,生物塑膠的使用量也不斷增加。

- 由於上述因素,預計市場在預測期內將顯著成長。

德國主導市場

- 德國是歐洲領先國家之一,生質塑膠消費市場成長速度為該國最快。

- 德國包裝產業是歐洲生質塑膠的主要消費者之一,政府監管推動了市場的發展。德國是最早提供 DIN CERTCO生物分解性塑膠認證的國家之一。

- 德國引領歐洲汽車市場,擁有 41 個組裝和引擎生產廠,佔歐洲汽車總產量的三分之一。作為汽車行業的主要製造地之一,德國是各個領域製造商的所在地,包括設備製造商、材料和零件供應商、引擎製造商和系統整合商。

- 根據OICA統計,2022年1月至9月德國汽車產量較2021年同期成長14%。 2022年汽車產量達368萬輛,高於2021年的331萬輛。

- 德國的紡織業是歐洲最大的,擁有約6,000家註冊公司。該國是主要的紡織原料進口國和紡織成品出口國。該產業已發展到龐大規模,約佔歐洲紡織品市場的 18% 和全球對德國產業用紡織品需求的 45%。

- 所有上述因素預計將對未來幾年的市場成長產生重大影響。

歐洲生質塑膠產業概況

歐洲生質塑膠市場較為分散。該市場的主要企業包括 Braskem、Novamont SpA、NatureWorks LLC、 BASF SE 和 Indorama Ventures Public Company Limited。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 促進模式轉移的環境因素

- 軟包裝對生質塑膠的需求不斷成長

- 其他司機

- 抑制因素

- 更便宜的替代品的可用性

- 其他限制因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 產品類型

- 生物基生物分解性

- 澱粉基

- 聚乳酸(PLA)

- 聚羥基烷酯(PHA)

- 聚酯(PBS、PBAT、PCL)

- 其他生物基生物分解產品

- 生物基非生物分解

- 生物聚對苯二甲酸乙二酯

- 生物聚乙烯

- 生物聚醯胺

- 生物聚對苯二甲酸丙二醇酯

- 其他生物基非生物分解材料

- 生物基生物分解性

- 目的

- 軟包裝

- 硬質包裝

- 汽車及組裝工作

- 農業和園藝

- 建築學

- 纖維

- 電力/電子

- 其他

- 地區

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 俄羅斯

- 北歐國家

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Arkema

- BASF SE

- Braskem

- Corbion

- Dow

- Futerro

- Kaneka Corporation

- Danimer Scientific

- Mitsubishi Chemical Corporation

- Natureworks LLC

- Maccaferri Industrial Group

- Solvay

- Toray International Inc.

- Trinseo

- Novamont SpA

第7章 市場機會及未來趨勢

- 電子產業需求增加

- 其他機會

The Europe Bioplastics Market size is estimated at 1.00 million tons in 2025, and is expected to reach 1.94 million tons by 2030, at a CAGR of 14.08% during the forecast period (2025-2030).

Due to the COVID-19 pandemic, the market was significantly impacted in 2020. However, the market is now estimated to reach the pre-pandemic levels.

Key Highlights

- Over the short term, major factors driving the market studied are environmental factors encouraging a paradigm shift and growing demand for bioplastics in flexible packaging.

- However, the availability of cheaper alternatives is likely to hinder the market's growth.

- Flexible packaging applications are expected to dominate the market, in terms of volume, during the forecast period.

- Growing use in the electronics industry will likely offer future market opportunities.

Europe Bioplastics Market Trends

Flexible Packaging Expected to Dominate the Market

- Bioplastics are used in flexible packaging, as they are not harmful to nature, and a few are easily degradable.

- They are used in packaging films for food items, medicines, beverage bottles, packaging films, and packaging of non-food products, such as napkins and tissues, toilet paper, nappies, sanitary towels, cardboard, and coat paper for food wrapping paper, and coated cardboards to make cups and plates. Moreover, they are used in flexible and loose-fill packaging.

- The rising population, increased spending power, rapid urbanization, and retail sector development in regions, including Asia, Eastern Europe, and the Middle East, are factors augmenting the growth of the packaging industry.

- Moreover, polylactic acid (PLA) is used in the packaging of food items, while bio-polyethylene terephthalate (PET), bio-polyethylene, and bio-polypropylene are majorly used as packaging films.

- Furthermore, in 2022, the Europe food and beverages industry employed 4.6 million people. It generated USD 1.159 trillion in revenue and USD 242.37 billion in value-added, making it one of the largest manufacturing industries in Europe. Thereby, increasing the food and beverages industry in the region, the demand for food packaging increases, as well as the market studied.

- Bioplastic consumption is increasing in making plastic bags, as they are nature-friendly. Organic waste collection bags are used in hospitals, hotels and restaurants, commercial and retail outlets, and houses. Local governments of different countries also initiated their usage.

- The usage of bioplastics is the highest in the packaging sector, which is increasing due to growing environmental concerns worldwide.

- Owing to all the factors above, the market is projected to grow significantly during the forecast period.

Germany to Dominate the Market

- Germany is one of the major economies in Europe, and the bioplastics consumption market grew at the fastest rate in the country.

- The packaging industry in Germany is among the major consumers of bioplastics in Europe, and regulations by the government drove the market. Germany is one of the first countries to provide certification of biodegradable plastics by DIN CERTCO.

- Germany leads the European automotive market, with 41 assembly and engine production plants contributing to one-third of Europe's total automobile production. Germany, one of the leading manufacturing bases of the automotive industry, is home to manufacturers from across segments, including equipment manufacturers, material and component suppliers, engine producers, and whole system integrators.

- According to the OICA, in the first nine months of 2022, Germany's automobile production grew 14% compared to the same period in 2021. The automotive production in 2022 reached 3.68 million, increasing from 3.31 million in 2021.

- The textile industry of Germany is the largest in the European region, with around 6,000 registered companies. The country is a prominent importer of textile raw materials and an exporter of finished textile products. The industry grew to a gigantic stature, as it caters to around 18% of the textile market in Europe, and the technical textiles from Germany cater to 45% of the global demand.

- All the abovementioned factors, in turn, are projected to significantly impact the market growth over the coming years.

Europe Bioplastics Industry Overview

The European bioplastics market is fragmented in nature. Some of the key players in the market include Braskem, Novamont SpA, NatureWorks LLC, BASF SE, and Indorama Ventures Public Company Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Environmental Factors Encouraging a Paradigm Shift

- 4.1.2 Growing Demand for Bioplastics in Flexible Packaging

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Cheaper Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Bio-based Biodegradables

- 5.1.1.1 Starch-based

- 5.1.1.2 Polylactic Acid (PLA)

- 5.1.1.3 Polyhydroxyalkanoates (PHA)

- 5.1.1.4 Polyester (PBS, PBAT, and PCL)

- 5.1.1.5 Other Bio-based Biodegradables

- 5.1.2 Bio-based Non-biodegradables

- 5.1.2.1 Bio-polyethylene Terephthalate

- 5.1.2.2 Bio-polyethylene

- 5.1.2.3 Bio-polyamides

- 5.1.2.4 Bio-polytrimethylene Terephthalate

- 5.1.2.5 Other Bio-based Non-biodegradables

- 5.1.1 Bio-based Biodegradables

- 5.2 Application

- 5.2.1 Flexible Packaging

- 5.2.2 Rigid Packaging

- 5.2.3 Automotive and Assembly Operations

- 5.2.4 Agriculture and Horticulture

- 5.2.5 Construction

- 5.2.6 Textiles

- 5.2.7 Electrical and Electronics

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Russia

- 5.3.7 Nordic Countries

- 5.3.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 BASF SE

- 6.4.3 Braskem

- 6.4.4 Corbion

- 6.4.5 Dow

- 6.4.6 Futerro

- 6.4.7 Kaneka Corporation

- 6.4.8 Danimer Scientific

- 6.4.9 Mitsubishi Chemical Corporation

- 6.4.10 Natureworks LLC

- 6.4.11 Maccaferri Industrial Group

- 6.4.12 Solvay

- 6.4.13 Toray International Inc.

- 6.4.14 Trinseo

- 6.4.15 Novamont SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from Electronics Industry

- 7.2 Other Opportunities