|

市場調查報告書

商品編碼

1640364

模組化資料中心:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Modular Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

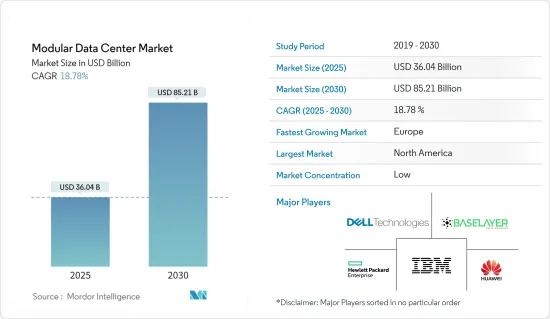

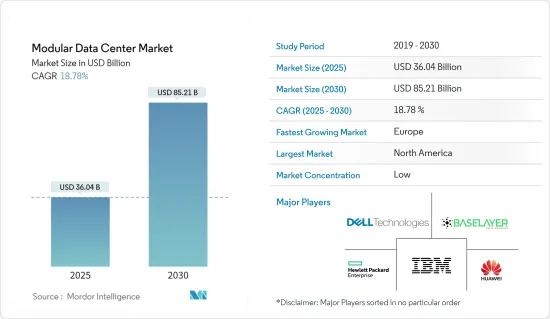

模組化資料中心市場在 2025 年的估值為 360.4 億美元,預計到 2030 年將達到 852.1 億美元,預測期內(2025-2030 年)的複合年成長率為 18.78%。

主要亮點

- 我們的分段資料中心解決方案單元讓您輕鬆建置IT基礎設施。模組化方法可以應用於資料中心級別,也可以應用於更通用的級別。

- 模組化架構可以支援多種工作負載以滿足您的業務需求,因為它繼續使用雲端基礎的分散式技術。這些可攜式資料中心滿足了雲端、行動和社交分析日益成長的需求,提供了一種有效且經濟的方式來保護電腦效能,而無需增加占地面積。

- 對綠色資料中心的高需求正在推動該市場的成長。綠色資料中心採用節能的管理實務和技術,為企業提供最佳效率,同時減少對環境的影響。由於世界各國政府對能源消費量和環境保護的要求越來越高,模組化資料中心的需求量很大。模組化資料中心最大的優勢之一是比傳統資料中心耗電量更少、能源效率更高,有助於滿足企業降低能源使用的內在需求。

- 在大容量資料中心領域,明顯且日益成長的需求是以相對密集的配置快速部署基礎設施,並且注重能源和熱效率。預計這一領域將出現比傳統方法更多的模組化成長。

- 在安裝速度和低資本支出方面,模組化資料中心對傳統的實體資料中心構成了挑戰。然而,傳統資料中心在未來一段時間內可能仍會存在,並且模組化資料中心可能非常適合某些應用。

- 全球最大的投資者正將注意力轉向數位基礎設施市場,該市場對資本的需求強勁,以推動資料經濟的發展。即使在新冠疫情期間,投資者的興趣仍然很高。隨著超大規模運算的成長,資料中心的投資也隨之增加。隨著對現代化、靈活和擴充性的資料中心的需求不斷增加,對資料中心的投資預計將為模組化資料中心的採用創造機會。

模組化資料中心市場趨勢

IT產業將推動主要市場成長

- 提供雲端、主機託管和網路託管服務的公司數量的增加導致 IT 公司對模組化資料中心的需求增加。推動該產業持續成長的關鍵因素是越來越多的企業持續採用雲端運算。

- 主要企業透過提供安全、合規的資料中心以及對世界頂級通訊業者的正確存取權限,幫助IT公司實現混合IT的成功我們正在這樣做。資訊和通訊技術產業正在轉向模組化和微模組化資料中心來提供許多服務,要求盡可能快的回應時間。

- 全球趨勢正在出現:企業出於安全考量紛紛採用模組化資料中心。資訊科技領域的模組化資料中心市場正受到資料儲存及其強大且有效率的處理需求不斷成長的正面影響。

- 中國IT公司的規模意味著需要私人儲存設施和大型資料中心。此外,由於軟體服務供應商的數量不斷增加,雲端儲存選項也隨著時間的推移而穩定增加,這導致供應商增加容量並產生對資料中心的需求。 SaaS、平台即即服務(PaaS)與基礎設施即服務(IaaS)並列為國內三大雲端運算之一。這推動了對更多資料中心的需求。

北美佔據主要市場佔有率

- 行動寬頻的成長、巨量資料分析和雲端運算水準的提高推動了該地區對新資料中心基礎設施的需求。北美擁有眾多資料中心,許多公司正在從硬體轉向基於軟體的服務,這使得該市場成為資料中心安裝的潛在目標。

- 為了最佳化基礎設施,組織正在尋找模組化服務,以便他們能夠在整合產品組合中選擇所需的服務。作為標準化部署的一部分,可透過線上目錄取得多種服務選項。這些選擇為企業提供了降低初始投資的潛力。 IBM 的整合託管基礎架構服務就是這種情況的一個很好的例子。

- 此外,巨量資料和物聯網在該地區的滲透將推動下一代模組化資料中心規模和範圍的重大變化。考慮到現有的競爭,組織需要開發 IT 可擴充性和容量。模組化資料中心因其靈活性而日益受到青睞,由於資料的迅速成長,再加上混合雲端和第三方資料中心外包,它們能夠在最短的時間內建立設施。

- 此外,物聯網的普及正在推動對邊緣資料中心的需求。許多公司將物聯網應用於從零售到醫療保健等廣泛的領域,產生的資料量非常龐大。

模組化資料中心產業概況

模組化資料中心市場較為分散,競爭容易加劇。目前,只有少數幾家主要參與者主導市場,這些佔據主導市場佔有率的參與者正專注於擴大海外基本客群。此外,為了應對激烈的競爭,新的參與者正在透過策略合作計畫進入市場。主要參與者包括IBM公司、華為技術有限公司等。

2023 年 2 月,Vertiv 公司推出了承包預製模組化 (PFM)資料中心解決方案 Vertiv MegaMod 和 Vertiv MegaMod Plus。高品質預製模組與 Vertiv 業界領先的電源管理系統、溫度控管解決方案、遠端監控和 IT 設備機架整合並經過測試,與傳統資料中心建置相比,可提供卓越的效能並降低成本。縮短高達40 .該解決方案目前已在歐洲、中東和非洲(EMEA)推出。

2022 年 9 月,Vertiv 在印度推出了 Vertiv 預製資料中心,提供模組化資料中心和基礎設施選項。此整合解決方案可根據您的 IT 資產部署進行客製化,並提供一種快速安裝容量的簡單方法。它還提供簡單的可擴展性,允許資料中心營運商從滿足其即時需求的解決方案開始,然後根據需要進行擴展。 Vertive 在預製模組化資料中心採用領先的電源和熱管理、監控和控制技術。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果和先決條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 模組化資料中心的敏捷性和擴充性

- 災難復原優勢

- 市場挑戰

- 資料中心面臨電力效率和永續性的挑戰。

第6章 市場細分

- 按解決方案和服務

- 功能模組解決方案(單獨功能模組、一體化功能模組)

- 服務

- 按應用

- 災難備份

- 高效能/邊緣運算

- 資料中心擴展

- 入門資料中心

- 按最終用戶

- IT

- 電信

- BFSI

- 政府

- 其他最終用戶(醫療保健、零售、國防等)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Huawei Technologies Co. Ltd.

- Dell EMC

- HPE Company

- Baselayer Technology LLC

- Vertiv Co.

- Schneider Electric SE

- Cannon Technologies Ltd

- Rittal Gmbh & Co. KG

- Instant Data Centers LLC

- Colt Group SA

- Bladeroom Group Ltd.

第8章投資分析

第9章 市場機會與未來趨勢

The Modular Data Center Market size is estimated at USD 36.04 billion in 2025, and is expected to reach USD 85.21 billion by 2030, at a CAGR of 18.78% during the forecast period (2025-2030).

Key Highlights

- Disaggregated data center solution units facilitate the building of the IT infrastructure. A modular approach can be applied at the level of data centers or a more general level.

- Modular architecture can support more than one workload to meet the needs of businesses as organizations continue to use cloud-based dispersed technologies. To meet the growing demand for cloud, mobile, and social analytics, these transportable data centers offer an effective, cost-efficient way of protecting computer performance while leaving no more floor space.

- The high demand for environmentally friendly data centers drives this market's growth. Green data centers use energy-efficient management methods and technology, providing enterprises with little environmental impact and optimum efficiency. Modular data centers are highly requested because of increased energy consumption and environmental protection requirements laid down by governments worldwide. One of the most significant advantages of modular data centers is that, compared to traditional data centers, they consume less power and are more energy-efficient, allowing them to meet companies' intrinsic requirements for lower energy usage.

- In the high-volume data center segment, there is a clear need for rapid infrastructure deployment in comparatively very dense configurations with an emphasis on energy and heat efficiency. We will likely see a much more significant module growth in this segment than conventional approaches.

- Regarding installation speeds and low capex, Modular Data Centres represent a challenge to traditional brick-and-mortar data centers. But, traditional data centers are likely to remain a reality, and some applications may be more suitable for modular data centers.

- The largest global investors are focusing on the market for digital infrastructure, with the extraordinary demand for capital to boost the data economy. The interest of investors remains high even during the COVID-19 situation. The investments in data centers increased after the growth of hyperscale computing. As the demand for modern, flexible, and scalable data centers increases, investments in data centers are expected to create opportunities to adopt modular data centers.

Modular Data Center Market Trends

IT Sector to Hold Significant Market Growth

- Due to the growing number of companies that provide cloud, colocation, and Web hosting services, demand from IT firms for modular data centers is increasing. The significant factor driving the continued growth of this segment is an ever growing number of enterprises adopting cloud computing.

- By providing secure and compliant data centers with adequate access to the world's top telecommunications operators and cloud computing services providers, studied market players help IT companies achieve hybrid IT success. The information and communications technology industry seeks the fastest possible response time and provides services for Modular and micromodular data centers with much to offer.

- A trend is emerging worldwide, such as enterprises adopting modular data centers due to security concerns. The Modular Data Centre Market in the Information Technology sector has been positively influenced by an increasing demand for data storage and its robust and efficient processing.

- Based on the size of Chinese IT companies, private storage facilities and large-scale data centers are required. Furthermore, cloud storage selection has steadily increased over time due to the growing number of Software Service Providers, enabling them to improve their capacity and create demand for data centers. SaaS platform as a service (PaaS) and infrastructure as a service (IaaS) are among China's three major cloud computing categories. This fuels the demand for more data centers.

North America accounts for the Significant Market Share

- The demand for new data center infrastructure in this region is triggered by the growth of Mobile Broadband, increased levels of Big Data Analytics, and cloud computing. Many data centers are present in North America, with many companies switching from hardware to software-based services, and it is estimated that this market will be a potential target for data center installation.

- Organizations are looking for modular services that allow them to select the desired service in an integrated portfolio to optimize infrastructure. Several service options are available from the online catalogs as part of a standardized deployment. These options offer the possibility of lowering an initial investment for companies. An excellent example of this situation is the IBM Integrated Managed Infrastructure Service.

- Moreover, the size and scope of next-generation modular data centers will significantly change due to the penetration of Big Data and the Internet of Things in this region. Given the existing competition, IT scalability and capacity need to be developed by organizations. Modular data centers are gaining momentum, given their flexibility to install a facility in the least time due to an exponential growth of data, coupled with hybrid cloud and outsourcing third-party data centers.

- Additionally, the increasing penetration of IoT is driving the demand for edge data centers. Many companies are taking advantage of IoT for applications ranging from retail to healthcare, and the amount of data generated is enormous.

Modular Data Center Industry Overview

The modular data center market is fragmented, where competition tends to increase and consists of several major players. Few of the major players currently dominate the market, and these major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. Further, new players enter this market through strategic collaborative initiatives catering to intense rivalry. Key players are IBM Corporation, Huawei Technologies Co. Ltd, etc.

In February 2023, Vertiv Co. introduced the Vertiv MegaMod and Vertiv MegaMod Plus, a turnkey prefabricated modular (PFM) data center solution, deployable in expandable units of 0.5 or 1 megawatts for IT loads up to 2 megawatts or more. The high-quality prefabricated modules are integrated and tested with industry-leading Vertiv power management systems, thermal management solutions, remote monitoring, and IT equipment racks to deliver exceptional performance and help companies reduce deployment time by up to 40% compared to a traditional data center build. The solutions are now available across Europe, the Middle East and Africa (EMEA).

In September 2022, Vertiv offered modular data centers and infrastructure options by introducing Vertiv Prefab Data Centres in India. Integrated solutions can be adapted to IT asset deployment and provide a simple way to install capacity quickly. Simple scalability is also offered, enabling the data center operator to start with a solution that meets Immediate needs and then scale up as needed. Vertiv uses its prefabricated modular data centers' key power and temperature management capabilities and monitoring and control technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables & Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Mobility and Scalability of Modular Data Centers

- 5.1.2 Disaster Recovery Advantages

- 5.2 Market Challenges

- 5.2.1 Data Centers Facing Power Efficiency and Sustainability Issues along with Power and cooling

6 MARKET SEGMENTATION

- 6.1 Solution and Services

- 6.1.1 Function Module Solution (Individual Function Module and All-in-One Function Module)

- 6.1.2 Services

- 6.2 Application

- 6.2.1 Disaster Backup

- 6.2.2 High Performance/ Edge Computing

- 6.2.3 Data Center Expansion

- 6.2.4 Starter Data Centers

- 6.3 End User

- 6.3.1 IT

- 6.3.2 Telecom

- 6.3.3 BFSI

- 6.3.4 Government

- 6.3.5 Other End Users (Healthcare, Retail, Defense, etc.)

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Huawei Technologies Co. Ltd.

- 7.1.3 Dell EMC

- 7.1.4 HPE Company

- 7.1.5 Baselayer Technology LLC

- 7.1.6 Vertiv Co.

- 7.1.7 Schneider Electric SE

- 7.1.8 Cannon Technologies Ltd

- 7.1.9 Rittal Gmbh & Co. KG

- 7.1.10 Instant Data Centers LLC

- 7.1.11 Colt Group SA

- 7.1.12 Bladeroom Group Ltd.