|

市場調查報告書

商品編碼

1640385

北美綠色資料中心:市場佔有率分析、產業趨勢與成長預測(2025-2030)North America Green Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

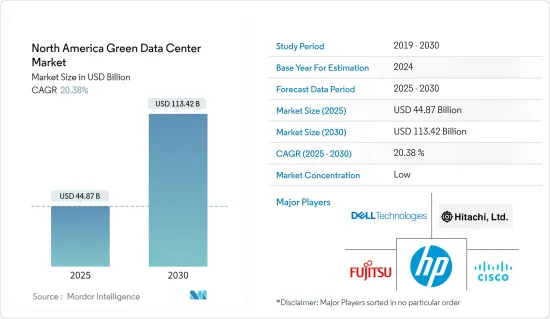

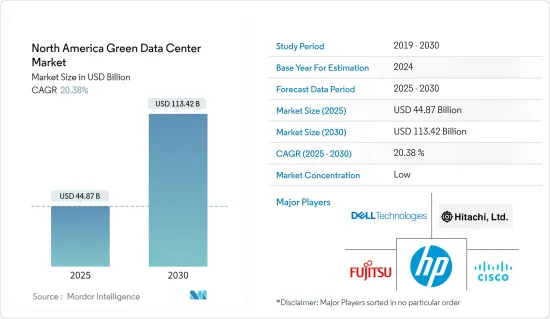

北美綠色資料中心市場規模預估至2025年為448.7億美元,預估至2030年將達1,134.2億美元,預測期間內(2025-2030年)複合年成長率為20.38%。

主要亮點

- 行動寬頻的擴展、巨量資料分析和雲端運算的成長也有望補充北美綠色資料中心市場的成長。

- 對高效能虛擬交換器和虛擬機器、下一代虛擬的需求不斷成長,推動了該市場的發展,並使企業能夠實施面向軟體的虛擬應用傳輸控制。該地區的資料中心行業正在經歷快速成長,重點關注效率和最大限度地延長運作。

- Facebook (Meta)、Google、AWS 和 Microsoft 等超大規模公司,以及 Equinix、Digital Realty、Compass Datacenters 和資料等託管公司,正在努力提高其資料中心的永續。環保人士和公眾對政府解決綠色永續性的壓力越來越大。

- 綠色資料中心的好處是減少空間需求、減少碳排放和長期營運成本,以及減少用水量和廢棄物排放。此外,我們還在技術方面進行投資,以追蹤碳排放並提高設施效率和用水量。

- 推動綠色資料中心發展的是擴大採用再生能源來源。此外,由於資料生產的快速成長,資料能力的現代化和建設預計將產生對資料中心供電和冷卻的能源來源的巨大需求,從而補充市場的成長。

- 高初始投資抑制了市場成長。建造或維修資料中心以滿足綠色標準的成本很高。這包括節能伺服器、冷卻系統、備用電源和其他基礎設施組件的成本。

- 在新冠肺炎 (COVID-19) 大流行期間,數位化迅速發展,永續性受到關注。組織需要確保關鍵任務系統正常運作,有足夠的電力來支援它們,並且有明顯的冗餘。為了克服所有這些挑戰,資料中心公司開發了資料結構基礎設施管理(DCIM)軟體來遠端系統管理和檢查資料中心基礎設施。

北美綠色資料中心市場趨勢

資料儲存需求的增加推動市場成長

- 在美國,由於雲端運算、物聯網 (IoT) 和巨量資料分析的擴展,對資料儲存和處理服務的需求持續成長。據思科系統公司稱,到 2022 年,北美將擁有最多使用穿戴式裝置的 5G 連線。北美地區的 4.39 億連線數比 2017 年 4G 網路連線數多了 2.22 億。在北美和亞太地區,到2022年,穿戴式裝置預計將佔全球整體5G連線的約70%。這種成長增加了對資料中心(包括綠色資料中心)的需求。

- 對資料儲存和處理的需求不斷成長,導致資料中心設施的建造和擴展。許多公司和服務供應商正在建造新的資料中心設施。許多公司和服務供應商正在建造新的資料中心或擴展現有的資料中心,以處理不斷增加的資料負載。

- 綠色資料中心的主要目標是提高能源效率並最大限度地減少對環境的影響。環保或永續的資料中心是一個儲存、管理和傳輸資料的地方,所有系統(機械和電氣)都可以節省能源。它還具有較低的碳排放,降低成本並提高效率。

- 此外,這些綠色資料中心使現代企業能夠節省電力並減少碳排放。在美國,大型和小型企業的使用正在擴大。此類資料中心可以成功地服務各種企業資料用途,從收集到處理、審查和分發。

- 美國的綠色資料中心可以申請認證。 LEED(能源與環境設計領先)評級系統是使用最廣泛的綠色建築評級系統(LEED)。它由美國綠色建築委員會創建,可在多個類別中存取。資料中心可以根據其評級獲得銀牌、金牌或白金認證。白金認證授予最環保和資源高效的資料中心。

- 能源之星的國家資料中心能源效率資訊計畫是美國環保署和美國能源局計劃的一部分,也可能對資料中心進行認證。該計劃檢驗建築物和消費品的能源效率。能源之星認證僅授予能源效率排名前 25% 的資料資料。由於人們對環境永續性、能源效率以及減少資料中心產業碳排放的需求的認知不斷增強,市場正在不斷成長和轉型。美國的綠色資料中心旨在最大限度地減少對環境的影響,同時保持高資料處理和儲存能力。

電源解決方案部門預計將佔據主要市場佔有率

- 綠色資料中心的建立是為了最大限度地提高能源效率並減少對環境的影響。資料中心電力消耗和冷卻問題是該地區企業面臨和大量投資的兩個最重要問題,這使得提高能源效率成為關鍵需求。控制這些營運成本對於改善業務營運和維持市場競爭力至關重要。

- 冷卻是資料中心電力消耗的主要來源。綠色資料中心採用冷熱通道封閉、自然冷卻和液冷等高效冷卻技術來減少熱管理的能源支出。

- 北美的許多綠色中心正在投資再生能源來源來為其營運提供動力。這通常包括清潔和永續能源的電力協議(PPAS)。

- 綠色資料中心致力於減少與發電相關的碳排放。這包括碳抵消計劃和對碳中和能源的投資。確保穩定、優質的電力供應對於資料運作至關重要。電力部門制定維持電能品質和可靠性的策略。

- 為了確保永續性並最大程度地減少這種成長對環境的影響,資料中心營運商正在關注能源效率、可再生能源的採用和先進的電源管理技術,以減少資料處理需求,從而有效平衡電力消耗和負責任的電力消耗。根據 Cloudscene 的數據,截至 2023 年 9 月,美國擁有 5,375 個資料中心,比世界上任何其他國家都多。

北美綠色資料中心產業概況

隨著富士通、思科、惠普、戴爾易安信和日立等主要企業的進入,北美綠色資料中心市場變得越來越分散。這些公司正在實施各種策略,包括聯盟和收購,以增強產品系列確保永續競爭。

2023 年 1 月,CleanArc 資料中心宣布了雄心勃勃的計劃,將建造超大型資料中心,同時整合清潔能源合約。該公司的首要目標是建造資料中心園區,大幅減少碳排放,最終實現零排放。 CleanArc 的設計最初將針對北美地區的超大規模部署進行客製化。

2022 年 7 月,全球著名的超大規模資料中心園區供應商 Vantage Data Centers 因其位於維吉尼亞北部的 VA13資料中心內建的永續設計功能而獲得了 3 億美元的巨額獎項,並獲得了綠色貸款。 VA13資料中心因其眾多的永續特徵而脫穎而出。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 對市場的影響

- 行業法規政策

第5章市場動態

- 市場促進因素

- 資料儲存需求增加

- 重視能源效率

- 市場限制因素

- 增加初始投資

第6章 市場細分

- 按服務

- 系統整合

- 監控服務

- 專業服務

- 其他服務

- 按解決方案

- 電源

- 伺服器

- 管理軟體

- 網路科技

- 冷卻

- 其他解決方案

- 按用戶

- 主機託管提供者

- 雲端服務供應商

- 公司

- 按最終用戶產業

- 醫療保健

- 金融服務

- 政府機構

- 通訊/IT

- 其他行業

第7章 競爭格局

- 公司簡介

- Fujitsu Ltd

- Cisco Technology Inc.

- HP Inc.

- Dell EMC Inc.

- Hitachi Ltd

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation

- Emerson Network Powers

- GoGrid LLC

第8章投資分析

第9章市場的未來

The North America Green Data Center Market size is estimated at USD 44.87 billion in 2025, and is expected to reach USD 113.42 billion by 2030, at a CAGR of 20.38% during the forecast period (2025-2030).

Key Highlights

- The expansion of mobile broadband, growth in big data analytics, and cloud computing are also expected to complement the growth of the North American green data center market.

- The market is fuelled by the increasing demand for high-performance virtual switches and machines and next-generation virtualization, enabling organizations to install software-oriented virtual application delivery control. The data center industry is witnessing rapid growth, focusing on efficiency and maximum uptime in the region.

- Hyperscale companies such as Facebook (Meta), Google, AWS, and Microsoft, and colocation companies such as Equinix, Digital Realty, Compass Datacenters, and DataBank are working to make their data centers sustainable. There is rising pressure on governments from environmentalists and the public to approach green sustainability.

- The advantages of green data centers are decreasing space requirements, lowering carbon emissions and long-term operating costs, and reducing water use and waste output. Moreover, investments are being made in technology to track carbon emissions and improve efficiency and the water use of facilities.

- The growth of the green data center is boosted by the increasing adoption of switching towards renewable energy sources. Moreover, the market's growth is expected to be supplemented by the modernization and construction of data features due to a surge in data production, putting a massive demand on energy sources to power and cool data centers.

- Higher Initial Investments restrain the market growth. Building or retrofitting a data center to meet green standards can be expensive. This includes the cost of energy-efficient servers, cooling systems, backup power supplies, and other infrastructure components.

- There was rapid digitalization and an increased emphasis on sustainability during the COVID-19 pandemic. Organizations had to ensure mission-critical systems were operational, had enough power to support them, and had obvious redundancy. To overcome all these challenges, Data center companies developed Data Structure Infrastructure Management (DCIM) software to remotely manage and inspect their data center infrastructure.

North America Green Data Center Market Trends

Increasing Demand for Data Storage Expected to Drive the Market Growth

- The demand for data storage and processing services continues to grow in the United States, driven by the expansion of cloud computing, the Internet of Things (IoT), and big data analytics. According to Cisco Systems, North America will have the most 5G connections made using wearable devices in 2022. The 439 million connections in North America would be 222 million more than those made to 4G networks in 2017. In North America and Asia Pacific, wearables are forecasted to account for around 70 percent of the wearable 5G connections globally in 2022. This growth has increased the need for data centers, including green data centers.

- The growing demand for data storage and processing has led to the construction and expansion of data center facilities. Many businesses and service providers are building new data center facilities. Many businesses and service providers are building new data centers or expanding existing ones to accommodate the increasing data load.

- An environmentally friendly data center's primary goals are energy efficiency and minimal environmental effect. A green or sustainable data center is a location for storing, managing, and transmitting data where all systems, including mechanical and electrical ones, conserve energy. It produces fewer carbon footprints, which reduces costs and improves efficiency.

- Further, these green data centers enable contemporary firms to conserve electricity and cut carbon emissions. Their use is expanding in the United States among large corporations and SMBs. Such data centers can successfully serve the aims of a vast array of company data, from collection to processing and review to distribution.

- Green data centers in the United States can apply to become accredited. The Leadership in Energy and Environmental Design (LEED) grading system is the most extensively utilized green building rating system (LEED). The United States Green Building Council created it, accessible in various categories. Data centers may be awarded a silver, gold, or platinum certification based on their ratings. Platinum certification is given to data centers with the greatest environmental responsibility and resource efficiency.

- Energy Star's National Data Center Energy Efficiency Information Program, part of a project by the US Environmental Protection Agency and the US Department of Energy, may also certify data centers. The program verifies the energy efficiency of buildings and consumer products. Energy Star certification is only given to data centers that perform in the top 25% of all data centers regarding energy efficiency. The market was experiencing growth and transformation due to increasing awareness of environmental sustainability, energy efficiency, and the need to reduce carbon footprints in the data center industry. Green data centers in the United States aim to minimize their environmental impact while maintaining high data processing and storage capabilities.

Power Solution Segment is Expected to Hold Significant Market Share

- Green data centers are built to maximize energy efficiency and lower environmental impact. The critical demand is greater energy efficiency because these data centers' power consumption and cooling problems are two of the most significant issues enterprises confront in the region and invest heavily in. It is vital to control these operating costs to improve business operations and maintain market competitiveness.

- Cooling is a significant contribution to data center power consumption. Green data centers employ efficient cooling techniques, such as hot or cold aisle containment, free cooling, and liquid cooling, to reduce energy expenditure on temperature control.

- Many North American green centers invest in renewable energy sources to power their operations. This often involves entering into power agreements (PPAS) to secure clean and sustainable energy.

- Green data centers focus on reducing carbon emissions associated with power generation. This may involve carbon offset initiatives or investments in carbon-neutral power sources. Ensuring a stable and high-quality power supply is critical for data operations. The power segment addresses strategies for maintaining power quality and reliability.

- To ensure sustainability and minimize the environmental impact of this growth, data center operators are focusing on energy efficiency, renewable energy adoption, and advanced power management practices to effectively balance the rising demand for data processing with responsible power consumption. According to Cloudscene, as of September 2023, there were 5,375 data centers in the United States, the most of any country globally.

North America Green Data Center Industry Overview

North America's green data center market is marked by fragmentation and the presence of key industry players, including Fujitsu Ltd, Cisco Technology Inc., HP Inc., Dell EMC Inc., and Hitachi Ltd. These companies are implementing various strategies such as partnerships and acquisitions to augment their product portfolios and secure a sustainable competitive edge.

In January 2023, CleanArc Data Centers unveiled ambitious plans to construct hyperscale data centers while integrating clean energy contracts. The company's primary objective is to establish data center campuses with clean energy contract structures that significantly reduce carbon emissions, ultimately moving towards zero emissions. CleanArc's designs are initially tailored for hyperscale deployments throughout North America.

In July 2022, Vantage Data Centers, a prominent global provider of hyper-scale data center campuses, secured a substantial USD 300 million green loan in recognition of the sustainable design features incorporated into its VA13 data center located in Northern Virginia. The VA13 data center stands out due to its numerous sustainable attributes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Industry Regulation and Policies

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Data Storage

- 5.1.2 Focus on Energy Efficiency

- 5.2 Market Restraints

- 5.2.1 Higher Initial Investments

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 System Integration

- 6.1.2 Monitoring Services

- 6.1.3 Professional Services

- 6.1.4 Other Services

- 6.2 By Solution

- 6.2.1 Power

- 6.2.2 Servers

- 6.2.3 Management Software

- 6.2.4 Networking Technologies

- 6.2.5 Cooling

- 6.2.6 Other Solutions

- 6.3 By User

- 6.3.1 Colocation Providers

- 6.3.2 Cloud Service Providers

- 6.3.3 Enterprises

- 6.4 By End-User Industry

- 6.4.1 Healthcare

- 6.4.2 Financial Services

- 6.4.3 Government

- 6.4.4 Telecom and IT

- 6.4.5 Other Industry Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Ltd

- 7.1.2 Cisco Technology Inc.

- 7.1.3 HP Inc.

- 7.1.4 Dell EMC Inc.

- 7.1.5 Hitachi Ltd

- 7.1.6 Schneider Electric SE

- 7.1.7 IBM Corporation

- 7.1.8 Eaton Corporation

- 7.1.9 Emerson Network Powers

- 7.1.10 GoGrid LLC