|

市場調查報告書

商品編碼

1640393

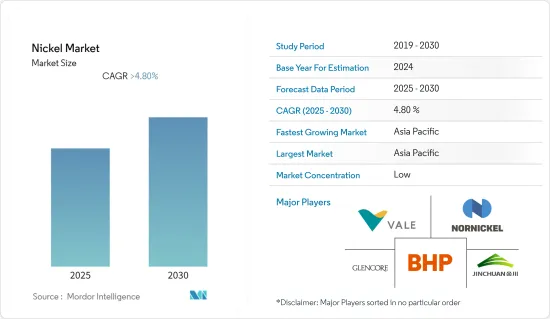

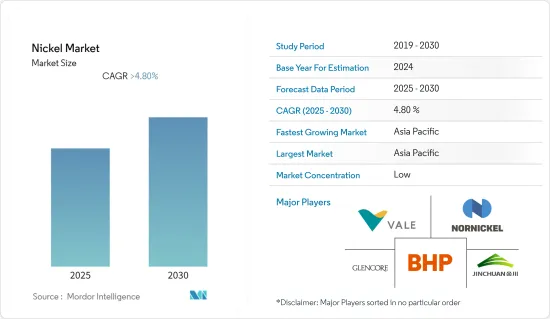

鎳 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Nickel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計鎳市場在預測期內的複合年成長率將超過 4.8%。

2021年鎳市場規模突破210萬噸。

COVID-19大流行的爆發以及由此產生的封鎖、社會疏遠規範和貿易制裁對全球供應鏈網路造成了巨大破壞,並嚴重阻礙了鎳市場的成長。主要國家的長期停工導致工業活動放緩,影響了鎳需求和價格。為了因應疫情,亞洲鎳業和全球鎳鐵控股等主要礦業公司已暫停了部分業務。然而,隨著工業部門的穩定復甦和採礦活動的恢復,預計鎳需求在預測期內將增加。

主要亮點

- 從中期來看,不銹鋼合金中鎳需求的增加預計將推動鎳市場的成長。目前,每年銷售的鎳中約有三分之二用於不銹鋼。此外,汽車電池、風力發電機能源儲存系統和太陽能電池板等應用對廉價鎳的需求不斷增加也是市場成長的主要推動力。

- 嚴格的環境法規以及鎳熔煉過程中二氧化硫排放增加帶來的潛在健康風險,鎳價的波動可能會阻礙市場成長。

- 電動車的日益普及以及鎳在醫療產業的新應用可能會成為未來的機會。

- 由於鎳消費率高以及主要不銹鋼和電池製造商的存在,預計亞太地區未來將主導鎳市場。此外,中國和印度需求的激增預計將提振金屬市場前景。

鎳市場趨勢

不銹鋼需求增加

- 鎳在不銹鋼的生產中發揮重要作用。它是用於製造不銹鋼的主要商業等級合金之一。鎳合金佔全球不銹鋼生產製程的近三分之二。一般來說,常用的不鏽鋼類型含有8%的鎳。

- 由於其耐腐蝕性、耐用性和廣泛的可用性,不銹鋼被用於食品和飲料、建築、航太、運輸、醫療和化學等各個領域。

- 根據國際不鏽鋼論壇(ISSF)統計,2021年不鏽鋼產量達5,630萬噸,與前一年同期比較增加10.6%。

- 考慮到烏克蘭戰爭、庫存膨脹和供應鏈中斷等因素導致需求減少,MEPS將2022年的產量預測下調至5,650萬噸。不過,預計2023年將恢復至6,000萬噸。

- 中國的不銹鋼工廠消耗了一半以上的原鎳。 2021年中國不鏽鋼產量與前一年同期比較增1.6%至3,060萬噸,佔全球產量的54.4%。

- 同樣,根據世界金屬統計局的數據,2021年印度不鏽鋼產量達到400萬噸左右,2020-2021與前一年同期比較增25%。

- 受上述因素影響,未來不銹鋼產業對鎳市場的需求可能會增加。

亞太地區主導市場

- 亞太地區佔據消費量。這主要是由於大型不銹鋼製造企業和電池製造商的存在。主要鎳礦集中在菲律賓、新喀裡多尼亞、澳洲、印尼和中國,使該地區成為最大的鎳生產國。

- 根據美國地質調查局(USGS)統計,印尼擁有全球最大的鎳蘊藏量,預計2021年開採量為2,100萬噸。此外,菲律賓、中國和澳洲總共擁有2,860萬噸的開採蘊藏量。

- 根據世界金屬統計局預計,2022年1月至9月中國鎳需求量預估為112萬噸,較2021年增加98.1千噸。印尼2022年1月至9月鎳產量79萬噸,年增23%。

- 此外,電動車(EV)鎳消費量的增加預計也將提振該地區的市場,因為它佔鎳需求的很大一部分。

- 2021年中國電動車銷量總合,較2020年的130萬輛成長154%。中國中央政府推廣電動車的重大措施預計將增加該國對鎳的需求。

- 同樣在 2021 年 10 月,塔塔汽車公司(印度汽車製造商)為一家新的電動車子公司獲得了 750 億印度盧比(10.1 億美元)的投資。塔塔汽車和 TPG Rise Climate 已達成一項具有約束力的協議,根據該協議,TPG Rise Climate 將與聯合投資者 ADQ 一起投資塔塔汽車新成立的子公司。

- 由於 COVID-19 的影響,許多最終用途對鎳的需求有所下降。然而,隨著各終端用戶產業的復甦,預計該地區的鎳需求在預測期內將成長。

鎳產業概況

鎳市場較為分散。主要企業包括諾裡爾斯克鎳業公司、淡水河谷公司、必和必拓公司、金川集團國際資源公司和嘉能可公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 石油和天然氣產業對耐腐蝕合金的需求增加

- 其他司機

- 抑制因素

- 供需情境不穩定

- 採礦活動中的環境考慮

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 按用途

- 防鏽的

- 合金

- 電鍍

- 鑄件

- 電池

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率**/排名分析

- 主要企業策略

- 公司簡介

- Anglo American

- BHP

- Cunico Corp.

- Eramet

- Glencore

- INDEPENDENCE GROUP NL

- Jinchuan Group International Resources Co. Ltd

- Norilsk Nickel

- Pacific Metal Company

- QUEENSLAND NICKEL SALES

- Sherritt International Corporation

- Sumitomo Metal Mining Co. Ltd

- Terrafame

- Vale

- Votorantim

第7章 市場機會及未來趨勢

- 電動車日益普及

- 醫療產業新應用

The Nickel Market is expected to register a CAGR of greater than 4.8% during the forecast period.

The nickel market was valued at more than 2.1 million tons in 2021.

The outbreak of the COVID-19 pandemic and the resultant lockdowns, social distancing norms, and trade sanctions triggered massive disruptions across the global supply chain networks, severely hampering the growth of the nickel market. The extended lockdowns across major economies resulted in a slowdown in industrial activity, thereby impacting the demand and price of nickel. Major mining companies like Nickel Asia and Global Ferronickel Holdings suspended some of their operations in response to the pandemic, with some players citing the limited ability to keep current maintenance shutdown schedules. However, with the steady recovery of the industrial sector and the resumption of mining activities, demand for nickel is anticipated to rise during the forecast period.

Key Highlights

- Over the medium term, the growth of the nickel market is likely to be driven by the increasing demand for nickel in stainless steel alloys. Currently, about two-thirds of nickel sold each year goes into stainless steel. Also, increasing demand for nickel in automobile batteries, energy storage systems in wind turbines, or solar panels at a lower cost is the major driving factor for the market growth.

- Stringent environmental regulations and possible health risks due to increasing sulfur dioxide emissions from the nickel melting process and volatility in nickel prices are likely to hinder the market's growth.

- The growing popularity of electric vehicles and the emerging application of nickel in the medical industry are likely to act as opportunities in the future.

- Asia-Pacific is expected to dominate the nickel market in the future, due to the high consumption rate of nickel and the presence of large stainless steel manufacturing companies and battery manufacturers in this region. Furthermore, burgeoning demand in China and India is expected to boost the prospects of the metal market.

Nickel Market Trends

Increasing Demand for Stainless Steel

- Nickel plays a crucial role in the manufacture of stainless steel. It is one of the major commercial grades of alloys used in stainless steel production. Nickel alloying holds for almost two-thirds of the stainless-steel production process across the world. In general, 8% of nickel is present in the commonly used grade of stainless steel.

- Owing to its corrosion resistance, durability, and abundance in availability, stainless steel is used in various sectors, including food and beverage, construction, aerospace, transport, medical, chemical, etc.

- According to International Stainless Steel Forum (ISSF), stainless steel production increased by 10.6% year-on-year to 56.3 million metric tons in 2021.

- In view of reduced demand owing to factors like the Ukraine war, inflated inventories, and supply chain disruptions, MEPS has lowered its production forecast to 56.5 million metric tons in 2022. However, the production is anticipated to rebound to 60 million metric tons in 2023.

- Chinese stainless steel mills consume more than half of the primary nickel. Stainless steel production in China witnessed a year-on-year growth of 1.6% in 2021 to a total of 30.6 million metric tons which is 54.4% of the global output.

- Similarly, according to the World Bureau of Metal Statistics, Indian production of stainless steel reached around 4 million metric tons in 2021, registering a year-on-year growth of 25% between 2020-2021.

- Owing to the above-mentioned factors, the demand in the nickel market from stainless steel industry is likely to increase in the future.

Asia-Pacific to Dominate the Market

- Asia-Pacific holds the major share in the consumption of nickel. This is primarily due to the presence of large stainless-steel manufacturing companies and battery manufacturers. The major nickel ore concentrations in the Philippines, New Caledonia, Australia, Indonesia, and China are instrumental in making the region the largest producer of nickel.

- According to US Geological Survey (USGS), Indonesia have the world's largest nickel reserve with a mining reserve of 21 million metric tons in 2021. Furthermore, the Philippines, China, and Australia have a combined mining reserve of 28.6 million metric tons.

- According to the World Bureau of Metal Statistics, the demand for nickel in China during the first 9 months of 2022 was estimated at 1.12 million tons, an increase of 98.1 kilo tons in comparison to 2021. In Indonesia, the production of nickel between January and September 2022 was 0.79 million tons, registering a year-on-year increase of 23%.

- Furthermore, the increasing consumption level of nickel in Electric Vehicles (EVs) is also expected to boost the market in the region, as it accounts for a considerable share of nickel demand.

- China is the global leader in the electric car market, with the sales of new electric vehicles being four times higher than that of the United States.A total of 3.3 million units of Electic Vehicles (EVs) were sold in China in 2021, registering an increase of 154% compared to 1.3 million units sold in 2020. The Chinese central government's principal policies to promote electric vehicles are expected to increase the demand for nickel in the country.

- Also, In Oct, 2021, Tata Motors (Indian automaker) secured an INR 7,500 crore (USD 1.01 billion) investment for new EV subsidiary. Tata Motors and TPG Rise Climate have entered into a binding agreement whereby the latter along with co-investor ADQ, will invest in a newly incorporated subsidiary of Tata Motors.

- Due to the impact of COVID-19, the demand for nickel has reduced from many end-use applications. However, with recovery in various end user industries, the demand for nickel is expected to grow in the region during the forecast period.

Nickel Industry Overview

The nickel market is fragmented in nature. The major companies include Norilsk Nickel, Vale, BHP, Jinchuan Group International Resources Co. Ltd, Glencore, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Corrosion Resistant Alloys in the Oil and Gas Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatility in the Supply Demand Scenario

- 4.2.2 Environmental Considerations During Mining Activities

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Application

- 5.1.1 Stainless Steel

- 5.1.2 Alloys

- 5.1.3 Plating

- 5.1.4 Casting

- 5.1.5 Batteries

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anglo American

- 6.4.2 BHP

- 6.4.3 Cunico Corp.

- 6.4.4 Eramet

- 6.4.5 Glencore

- 6.4.6 INDEPENDENCE GROUP NL

- 6.4.7 Jinchuan Group International Resources Co. Ltd

- 6.4.8 Norilsk Nickel

- 6.4.9 Pacific Metal Company

- 6.4.10 QUEENSLAND NICKEL SALES

- 6.4.11 Sherritt International Corporation

- 6.4.12 Sumitomo Metal Mining Co. Ltd

- 6.4.13 Terrafame

- 6.4.14 Vale

- 6.4.15 Votorantim

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Popularity of Electric Vehicles

- 7.2 Emerging Application in the Medical Industry