|

市場調查報告書

商品編碼

1640397

風險分析:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Risk Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

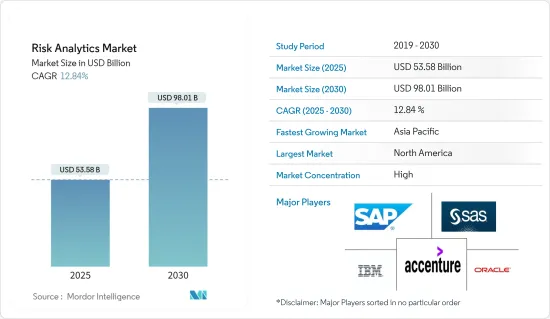

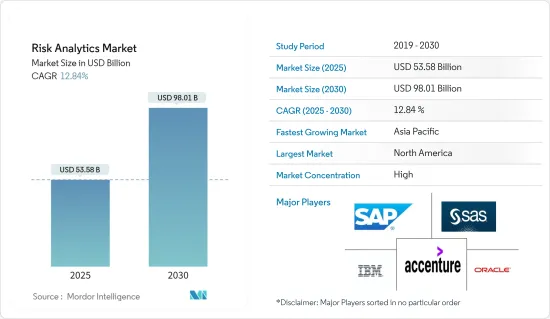

風險分析市場規模預計在 2025 年為 535.8 億美元,預計到 2030 年將達到 980.1 億美元,預測期內(2025-2030 年)的複合年成長率為 12.84%。

風險分析解決方案有助於解決和防範可能因內部因素(例如人為錯誤、系統故障(可能與軟體、硬體、網路等有關)、詐欺和網路犯罪)而引起的營運風險。

主要亮點

- 風險分析技術現在使風險管理者能夠比以前更可靠地衡量和預測風險。企業正在使用風險分析從各種安全資料來源收集支援訊息,以量化網路風險、自動化保全行動並做出情報主導的決策。此外,從網路角度來看,組織面臨越來越大的監管壓力,包括 PCI-DSS 和 NIST 網路安全框架等規定和指導。

- 各個資料產業對大量結構化和非結構化資料的使用日益增加,導致對風險分析的需求不斷增加,以管理和保護資料免受威脅。例如,根據希捷科技公司 (Seagate Technology PLC) 的數據,預計到 2020 年全球資料量將成長到 47 Zetta位元組,到 2025 年將成長到 163 Zetta位元組。

- 此外,雲端處理正在推動一場比過去 40 年中任何其他運算革命都更令人難以置信的軟體革命。隨著基於位置的風險分析的進步,使用雲端基礎的技術而不是傳統的基於伺服器的系統來建立和交付它是有意義的。目前有多個可透過雲端使用的風險評估和累積平台。基於規則的安全方法,無論應用於威脅偵測、調查或回應,都無法應對包括帳戶被盜和相關人員惡意攻擊在內的高級網路威脅。

- 由於行動銀行服務的日益普及和資料量的不斷增加,銀行、金融服務和保險 (BFSI) 領域對風險分析的需求也在成長。應用風險分析可以將資料整合成一個綜合觀點,收集重要資料並產生可操作的見解。風險分析對於全球物流公司也至關重要,以便有效應對感染疾病國際傳播帶來的業務中斷和供應鏈問題。

風險分析市場趨勢

預計 BFSI 將大量採用風險分析解決方案

- 世界各地的銀行都認知到風險分析的重要性,並認知到需要採取更簡化的方法來應對銀行和金融業日益增加的風險。

- 風險分析使銀行和金融機構能夠擺脫「孤島」式的風險管理方法,並全面審視整個企業的風險。例如,在操作風險管理(ORM)中,需要監控的交易數量呈指數級成長,對現有銀行基礎設施帶來更大壓力,並推動風險分析市場的發展。

- 金融機構在發展業務的同時,面臨著減少詐欺和滿足嚴格的監管合規要求的巨大壓力。此外,新帳戶詐騙和帳戶接管是目前金融機構面臨的兩大詐騙類型。我們的風險分析解決方案使用基於機器學習的風險分析(一種人工智慧)來防止線上和行動管道詐欺的這些和其他詐欺活動。

- 資料分析可以以多種方式幫助銀行防範風險。例如,可以使用客戶分析根據客戶的信用度進行分類,以進行信用風險管理。透過這樣做,個人可以選擇信貸產品的目標市場並降低其違約風險,因為可以預期客戶會按時付款。據全球風險管理專業人士協會稱,資本市場、銀行業和保險業預計將在風險資訊技術和服務上花費 960 億美元。

- 此外,致同會計師事務所的一項研究發現,85% 的受訪者認為銀行的資料和風險資訊管理舉措需要更有效率才能充分發揮其潛力。此外,82%的受訪者對自己銀行的風險分析與衡量也持相同的看法。因此,這些趨勢正在推動 BFSI 產業對風險分析解決方案的需求。

預計北美將佔很大佔有率

- 預計北美將佔據最高的市場佔有率,其中美國將引領市場。該地區的優勢包括終端用戶行業擴大採用風險分析解決方案、大型企業數量眾多,以及由於來自其他低成本地區公司的競爭而實現的早期成長。

- 此外,各行業對雲端處理的日益採用也推動了市場的成長。保護醫療保健資訊系統 (HIS) 免受迫在眉睫的網路安全風險的挑戰與雲端運算的採用密不可分。 HIS 的資料和資源本質上與其他系統共用,以實現遠端存取、決策、緊急情況和其他醫療保健相關的觀點。

- 此外,疫情期間美國共報告了 28 起資料外洩事件,包括電子郵件駭客事件、惡意軟體攻擊以及未授權存取EHR(資料來源:美國衛生與公眾服務部)。在醫療保健領域,雲端處理被視為直接的解決方案,因為它具有可擴展性和經濟性。

- 美國醫療保健基礎設施在預測分析領域呈現積極的趨勢。調查顯示,過去幾年,超過40%的醫療保健主管報告資料量增加了50%。隨著資料集變得越來越大且越來越難以處理,醫療系統和付款人擴大採用預測分析。

- 此外,風險分析供應商在該地區擁有強大的立足點,促進了市場的成長。其中包括 IBM Corporation、Oracle Corporation、SAS Institute Inc. 和 AxiomSL Ltd.

風險分析行業概況

風險分析市場相對集中,大型供應商佔據主導地位,尤其是在企業級部署方面。此外,大公司主導著這個市場,因為他們能夠為最終用戶提供創新和高品質的服務。 IBM 公司、SAP SE、SAS Institute Inc.、Oracle 公司、埃森哲 PLC、Adenza Group Inc.

2023 年 11 月,軟體即服務 (SaaS) 風險分析供應商 Renew Risk 與著名的可再生能源計劃保險公司 GCube Insurance 宣佈建立策略合作夥伴關係。 GCube 的離岸風力發電客戶將從此次夥伴關係中受益匪淺,增強離岸風力發電風險分析和建模能力。 GCube 將從協議中受益,利用 Renew Risk 針對其離岸風電組合量身定做的先進災難風險模型。

2023 年 9 月,企業風險解決方案、投資組合建構工具和因子風險模型的全球供應商 Axioma 宣布與 Jacobi Inc. 建立新的合作夥伴關係。 Jacobi 總部位於舊金山,其技術能夠實現動態客戶參與、最佳化投資業務並簡化多資產投資組合的建置和維護。此工作流程資料,資料跨股票和多資產類別投資組合執行基於因子的分解。

全球領先的投資銀行、證券和投資管理公司高盛集團與領先的創新風險、分析和指數解決方案提供商 Qontigo 今天宣布,雙方將於 2022 年 10 月擴大夥伴關係關係。 Qontigo 是高盛金融數據雲端的一部分,該雲端是模組化資料管理和分析解決方案的集合,也是其數位平台的一部分,為機構投資者提供市場領先的資料、分析、市場洞察和交易解決方案。 Goldman Sachs Marquee, Axioma Portfolio Optimize 和 Axioma Equity Factor Risk Models 將可用。

2022 年 9 月,Camelot Management Consultants 與著名的供應鏈洞察和風險分析提供者 Everstream Analytics 建立了合作夥伴關係。此次合作將 Everstream 領先的風險評估和人工智慧驅動分析與 Camelot 無與倫比的策略流程設計和組織知識相結合,以提供高效能、合規且有彈性的增值解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 市場定義和範圍

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 市場促進因素

- 業務流程日益複雜

- 全球監管框架與政府政策

- 市場限制

- 實施和營運成本高

- 複雜的監管合規性可能會阻礙市場成長

- COVID-19 對整體市場的影響

第5章 市場區隔

- 按組件

- 解決方案

- 按服務

- 按部署

- 本地

- 雲

- 按行業

- BFSI

- 衛生保健

- 零售

- 製造業

- 其他最終用戶(IT 和電信)

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 亞洲

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第6章 競爭格局

- 公司簡介

- IBM Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Moody's Analytics Inc.

- OneSpan Inc.

- Capgemini SE

- Accenture PLC

- Risk Edge Solutions

- Adenza Group Inc.(AxiomSL Ltd.)

- Provenir Inc.

第7章投資分析

第8章 市場機會與未來趨勢

The Risk Analytics Market size is estimated at USD 53.58 billion in 2025, and is expected to reach USD 98.01 billion by 2030, at a CAGR of 12.84% during the forecast period (2025-2030).

Risk analytics solutions help organizations deal with and protect against operational risks, which can arise due to internal factors, such as human errors, failures of systems (which can be related to software, hardware, network, etc.), and fraud cybercrime.

Key Highlights

- Currently, risk analytics techniques are enabling risk managers to measure and predict risk with more certainty than ever before. Organizations are leveraging risk analytics to gather supporting information through various security data sources to quantify their cyber risks, automate their security operations, and make intelligence-driven decisions. Additionally, organizations are witnessing increased regulatory pressure from the cyber perspective with mandates and guidance, such as the PCI-DSS and NIST Cybersecurity Framework.

- The increased usage of large amounts of structured and unstructured data in the various end-user industries boosts the demand for risk analytics to manage and save data from threats. For instance, According to Seagate Technology PLC, the global volume of data is expected to increase to 47 zettabytes and 163 zettabytes in 2020 and 2025.

- Moreover, cloud computing is driving a software revolution astonishingly as any other computing revolution of the past 40 years. As analytics for location-based risk advance, it is only sensible that they can be built and delivered using cloud-based technology rather than older server-based systems. There are several risk assessment and accumulation platforms available now through the cloud. Rules-based approaches to security, whether they are applied to threat detection, investigation, or response, can no longer keep pace with advanced cyber threats, including account compromise and malicious insiders.

- The demand for risk analytics in the banking, financial services, and insurance (BFSI) sector is also fueled by the increased use of mobile banking services and the rising volume of data. Risk analytics can be applied to combine the data into a single, comprehensive perspective, collect essential data, and produce insights that can be put to use. In addition, risk analytics are critical for logistics firms worldwide to efficiently address business disruptions and supply chain issues brought on by the spread of the coronavirus disease internationally.

Risk Analytics Market Trends

BFSI is Expected to Witness Huge Adoption of Risk Analytics Solutions

- Banks across the world are realizing that they need a more rational approach to managing a growing plethora of risks enveloping the banking and financial industries' landscape, and they have now understood the significance of risk analytics.

- Risk analytics enables banks and financial institutions to move away from the 'silo' approach to risk management and move toward the comprehensive view of enterprise-wide risks. For instance, in operational risk management (ORM), the number of transactions that need to be monitored is growing exponentially, thus implying pressure on the current banking infrastructure and enabling the market for risk analytics.

- Financial Organizations are under intense pressure to reduce fraud and meet strict regulatory compliance requirements while growing their business. Moreover, New Account Fraud and Account Takeover are the top two types of fraud challenging financial institutions today. Risk analytics solutions protect against these and other fraudulent activities across online and mobile channels, using machine learning-based risk analysis, a form of AI.

- Data analytics can be used in a variety of ways by banks to protect themselves from danger. Customer analytics, for instance, can be used to categorize customers according to their creditworthiness for credit risk management. Because one can rely on those customers to make payments on time, doing so lets individuals choose a target market for credit products and lowers exposure to default risk. According to the Global Association of Risk Professionals, it is estimated that capital markets, banking, and insurance sectors are likely to spend USD 96 billion on risk information technologies and services.

- Additionally, the Grant Thornton survey study identified that 85% of respondents believed that their bank's data and risk information management initiatives need additional efficiencies to realize their full potential. Furthermore, 82% had indicated the same for their institution's risk analytics and measurements. Hence, such trends drive the need for risk analytics solutions in the BFSI industry.

North America is Expected to Hold a Significant Share

- North America is expected to hold the highest market share, with the United States leading the market. The dominance of the region is due to its increasing adoption of risk analytics solutions among end-user industries, a significant presence of large enterprises, and drive for early technological adoption owing to competition from other businesses operating in low-cost regions.

- Moreover, adopting cloud computing across industries is driving market growth. The task of protecting Healthcare Information Systems (HIS) from immediate cyber security risks has been intertwined with cloud computing adoption. The data and resources of HISs are inherently shared with other systems for remote access, decision-making, emergency, and other healthcare-related perspectives.

- Additionally, there have been 28 data breach incidents reported during the pandemic year in the United States, including email hacking incidents, malware attacks, and unauthorized access to EHRs (source the US Department of Health & Human Services). In the medical healthcare sector, cloud computing is considered to be an immediate remedy because it is scalable as well as economical.

- The healthcare infrastructure in the United States is experiencing positive trends in the predictive analytics domain. Studies have shown that in the last few years, more than 40% of healthcare executives reported a 50% increase in data volume. As the data sets become bigger and more difficult to handle, health systems and payers increasingly adopt predictive analytics.

- Moreover, the region has a strong foothold of risk analytics vendors, which contributes to the growth of the market. Some of them include IBM Corporation, Oracle Corporation, SAS Institute Inc., and AxiomSL Ltd, among others.

Risk Analytics Industry Overview

The risk analytics market is a relatively consolidated market as the major vendors account for a significant share of the market, especially in the enterprise-level adoption. Additionally, large companies dominate this market owing to their ability to offer innovative and high-quality services to end-users on a different scale and with customization that suits their specific needs. IBM Corporation, SAP SE, SAS Institute Inc., Oracle Corporation, Accenture PLC and Adenza Group Inc. (previosuly AxiomSL Ltd.) are a few prominent players operating in the market.

In November 2023, Renew Risk, a Software-as-a-Service (SaaS) risk analytics supplier, and GCube Insurance, a prominent insurance company for renewable energy projects, announced a strategic partnership. GCube's offshore wind clients will significantly benefit from this partnership, strengthening the company's capacity for offshore wind risk analytics and modeling. GCube will benefit from this agreement by utilizing Renew Risk's advanced catastrophe risk models, which are tailored for offshore wind portfolios.

In September 2023, Axioma, a global supplier of corporate risk solutions, portfolio construction tools, and factor risk models, announced a new partnership with Jacobi Inc. The San Francisco-based company Jacobi's technology enables dynamic client engagement, optimizes investing operations, and simplifies multi-asset portfolio building and maintenance. With this single workflow-integrated solution, investment managers can readily access time series and point-in-time risk data for factor-based decomposition across equity and multi-asset class portfolios.

In October 2022, Goldman Sachs Group, Inc., a top global investment banking, securities, and investment management organization, and Qontigo, a leading innovative risk, analytics, and index solutions provider, announced an expanded partnership. Through Goldman Sachs Financial Cloud for Data, a collection of modular data management and analytics solutions, as well as Goldman Sachs Marquee, the company's digital platform that offers market-leading data, analytics, market insights, and trading solutions to institutional investors, Qontigo would now make the Axioma Portfolio Optimize and Axioma Equity Factor Risk Models available.

In September 2022, A collaborative alliance was launched between CAMELOT Management Consultants and Everstream Analytics, a prominent provider of supply chain insights and risk analytics. This partnership combines Everstream's superior risk ratings and AI-powered analytics with CAMELOT's unrivaled strategic process design and organizational knowledge to create high-performing, compliant, resilient value chains.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growing Complexities across Business Processes

- 4.4.2 Global Regulatory Frameworks and Government Policies

- 4.5 Market Restraints

- 4.5.1 High Installation and Operational Costs

- 4.5.2 Complicated Regulatory Compliance might hinder the Market Growth

- 4.6 Impact of COVID-19 on Overall Market

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By End-user Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 Retail

- 5.3.4 Manufacturing

- 5.3.5 Other End-user Verticals (IT and Telecom)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.3 Asia

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia and New Zealand

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 Argentina

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Oracle Corporation

- 6.1.3 SAP SE

- 6.1.4 SAS Institute Inc.

- 6.1.5 Moody's Analytics Inc.

- 6.1.6 OneSpan Inc.

- 6.1.7 Capgemini SE

- 6.1.8 Accenture PLC

- 6.1.9 Risk Edge Solutions

- 6.1.10 Adenza Group Inc. (AxiomSL Ltd.)

- 6.1.11 Provenir Inc.