|

市場調查報告書

商品編碼

1640401

特種聚合物:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Specialty Polymers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

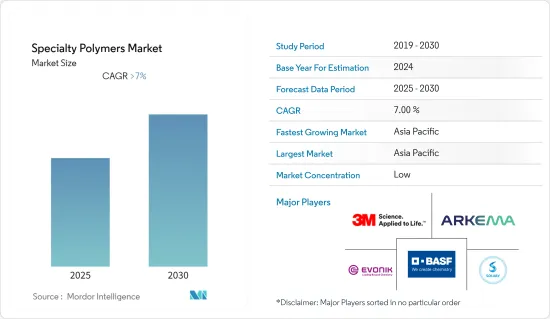

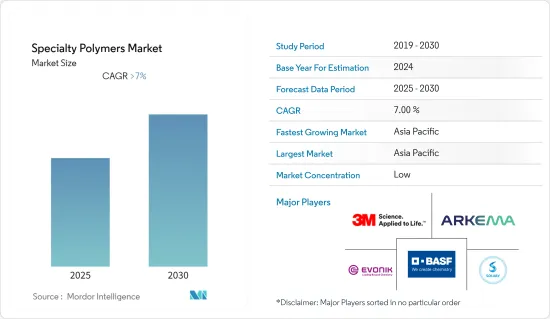

預計預測期內特種聚合物市場複合年成長率將超過 7%。

2020 年,市場受到了 COVID-19 疫情的負面影響。疫情迫使多個國家實施封鎖,導致供應鏈中斷、工作停頓和勞動力短缺。然而,自從限制解除以來,該行業已經恢復良好。住宅銷售量的增加和新計畫的推出推動了對被覆劑、密封劑和建築化學品的需求。過去兩年,醫療保健和電氣電子產業的需求不斷成長,帶動了市場復甦。

主要亮點

- 推動市場發展的主導因素包括建築和電子產業的應用不斷增加、汽車和航太應用的輕質聚合物的商業化以及天然氣和原油加工原料的供應不斷增加。

- 由於最終用戶的需求不斷變化,獲取原料的營運成本波動和技術過時預計會阻礙市場成長。

- 特種聚合物技術在各種工業應用中的興起以及工程聚合物和特種薄膜產品的積極商業化可能會在預測期內為市場研究帶來機會。

- 預計亞太地區將成為最大的市場,並預計在預測期內以最高的複合年成長率成長。亞太地區佔據主導地位的原因是中國、日本和印度等國家的需求旺盛。

特種聚合物市場趨勢

汽車和運輸業主導市場

- 特種聚合物因其優異的耐熱性、耐磨性、易於加工和設計以及耐疲勞性等優良性能,廣泛應用於汽車和運輸業。

- 這些材料具有出色的耐熱性,對於汽車而言是可靠且安全的。它還以具有競爭力的價格為您的車輛提供精緻的美感。

- 人們對更輕、更省油的汽車的需求日益成長,推動了汽車零件使用聚合物來取代重金屬以減輕重量。據估計,汽車重量每減輕 10%,燃料消耗就會減少 5-7%。

- 特種聚合物在汽車製造中發揮著至關重要的作用,隨著全球汽車銷售的不斷成長,對這些材料的需求也不斷成長。

- 汽車聚合物複合材料產業推動整個汽車供應鏈的經濟活動,並透過產業和消費者支付的工資間接推動經濟活動。輕型汽車產業是各種特種聚合物的重要客戶,面臨激烈的競爭,尤其是來自鋁和鋼鐵的競爭。

- 根據OICA的數據,2021年汽車產量為80,145,988輛,較2020年成長3%。 2021年,歐洲汽車產量為16,330,509輛,美洲汽車產量為16,151,639輛,非洲汽車產量為931,056輛。

- 根據日本汽車工業協會(JAMA)的報告,2021年乘用車和輕型車產量為7,846,955輛。

- 因此,汽車製造中使用的聚合物數量不斷增加,對輕型汽車的需求也不斷成長,因此汽車和運輸領域對特種聚合物的使用預計將成長。

亞太地區佔市場主導地位

- 預測期內,特種聚合物市場預計將在亞太地區成長最快。中國和印度的新興市場擴張和汽車和電子產業的市場發展預計將推動該地區的特殊聚合物市場的發展。此外,經濟成長和人均收入的提高是推動亞太地區特種聚合物市場成長的關鍵因素之一。

- 中國是經濟健康成長的新興國家之一。中國政府的政策符合實施經濟改革的提案目標,從而確保了該國在預測期內的健康發展。

- 中國主要致力於擴大電動車的生產和銷售。為此,政府計劃在 2020 年將電動車 (EV) 產量提高到每年 200 萬輛,到 2025 年提高到每年 700 萬輛。如果這一目標實現,到2025年電動車在中國新車總產量中的佔比預計將提升至20%。

- 根據OICA的數據,2021年印度的工業產量約為4,399,112輛,包括乘用車、商用車、三輪車、二輪車和四輪車。 「Aatma Nirbhar Bharat」和「印度製造」計畫等政府改革很可能在不久的將來推動汽車產業的發展。

- 特種聚合物提供更大的設計靈活性和創新性。這些多功能解決方案具有多種有益特性,可實現電子設備的小型化和可靠性能。

- 據日本電子情報技術產業協會(JEITA) 稱,隨著數位化的進步刺激需求並擴大出口,預計 2021 年日本電子和 IT 公司的全球產值與前一年同期比較成長8%,達到37.3 兆美元。 (~ 2853.9億美元)。預計電子業的成長將在未來幾年推動對乙苯的需求。

- 特種聚合物廣泛應用於汽車、電子和半導體產業。因此,隨著這些行業的強勁成長和政府的支持,預計在預測期內對特種聚合物的需求將以健康的速度成長。

特種聚合物產業概況

特種聚合物市場較為分散。市場的主要參與者(不分先後順序)包括 3M、阿科瑪集團、BASF公司、贏創工業集團和索爾維。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 在建築和電子產業的應用日益增多

- 輕質聚合物在汽車和航太領域的商業化應用

- 增加天然氣和原油加工原料的供應

- 限制因素

- 採購原料的營運成本波動

- 由於最終用戶需求的不斷變化導致技術過時

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 按類型

- 特殊合成橡膠

- 特殊複合材料

- 特種熱塑性塑膠

- 特殊熱固性樹脂

- 其他類型

- 按最終用戶產業

- 汽車和運輸

- 消費品

- 建築和施工

- 被覆劑、黏合劑、密封劑

- 電氣和電子

- 衛生保健

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Arkema Group

- Ashland Inc.

- Associated industries Inc.

- BASF SE

- Braskem

- Chemtura Corporation

- Covestro

- Croda International PLC

- Elantas GmbH

- Endurance Technologies Limited

- Evonik Industries AG

- Hexion Inc.

- Huntsman Corp.

- Koninklijke DSM NV

- PolyOne

- S&E Specialty Polymers LLC

- Solvay

- Speciality Polymers Pvt Ltd

第7章 市場機會與未來趨勢

- 特種聚合物技術在各種工業應用中的興起

- 積極推進工程聚合物和特殊薄膜產品的商業化

The Specialty Polymers Market is expected to register a CAGR of greater than 7% during the forecast period.

The market was negatively impacted by the COVID-19 outbreak in 2020. Owing to the pandemic scenario, several countries went into lockdown, which led to supply chain disruptions, work stoppages, and labour shortages. However, the sector is recovering well since restrictions were lifted. An increase in house sales and new project launches have led to a rise in the demand for coatings, sealants, and construction chemicals. The increasing demand for healthcare, electrical, and electronics is leading the market recovery over the last two years.

Key Highlights

- The major factors driving the market studied are the increasing applications in the construction and electronic industries, the commercialization of lightweight polymers for automotive and aerospace applications, and the growing availability of feedstock derived from natural gas and crude oil processing.

- Fluctuating operational costs to derive feedstock and technological obsolescence due to constantly changing end-user needs are expected to hinder the market's growth.

- Emerging specialty polymer technologies in various industrial applications and prolific commercialization of engineered polymer and specialty film products are likely to act as opportunities for the market studied over the forecast period.

- Asia-Pacific emerged as the largest market and is expected to witness the highest CAGR during the forecast period. This dominance of Asia-Pacific is attributed to the high demand in countries such as China, Japan, and India.

Specialty Polymers Market Trends

Automotive and Transportation Industry to Dominate the Market

- Owing to their suitable properties, such as excellent thermal resistance, wear resistance, ease of processing and designing, and fatigue endurance, speciality polymers are extensively used in the automotive and transportation industries.

- These materials are reliable and safe for vehicles due to their exceptional thermal resistance. They provide sophisticated aesthetic appeal to cars at competitive prices.

- With the rise in demand for lightweight and fuel-efficient cars, polymers use increased in automotive parts to replace heavy metals to reduce weight. It is estimated that every 10% reduction in vehicle weight results in a 5-7% reduction in fuel usage.

- As speciality polymers play a crucial role in automobile manufacturing, the demand for these materials is increasing with the rising sales of vehicles worldwide.

- The automotive polymer composite industry indirectly fosters economic activity throughout a vehicle's supply chain and through the payrolls paid by the industry and consumers. The light vehicle industry is an essential customer for various specialty polymers, and significant competition exists, especially with aluminum and steel.

- According to OICA, the total number of vehicles produced in 2021 was 80,145,988 and witnessed a growth rate of 3% compared to 2020. Europe made a total of 16,330,509 units of motor vehicles, America had 16,151,639 units, and Africa held a production number of 931,056 units in 2021.

- As per reports by the Japan Automobile Manufacturers Association (JAMA), the country produced 7,846,955 units of passenger cars and light vehicles in 2021.

- Thus, with the rise in the number of polymers used during automobile manufacturing and the increasing demand for lightweight vehicles, specialty polymers usage is expected to increase in the automotive and transportation sector.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to display the fastest growth in the specialty polymers market over the forecast period. The expanding automotive and electrical industries in China and India, combined with infrastructural development, are expected to drive the specialty polymers market in the region. Moreover, economic growth and increasing per capita income are some of the significant factors triggering the growth of the specialty polymers market in Asia-Pacific.

- China is one of the emerging economies witnessing healthy economic growth. Its government's policies have been in line with the proposed objectives to implement economic reforms, thus ensuring the healthy development of the country during the forecast period.

- China is mainly focusing on increasing the production and sales of electric vehicles in the country. For this purpose, the government planned to increase electric vehicle (EVs) production to 2 million a year by 2020 and 7 million a year by 2025. The target, if achieved, is expected to increase the share of electric vehicles to 20% of the total new car production in China by 2025.

- According to the OICA, in 2021, total industrial production in India was about 4,399,112 vehicles, including passenger, commercial, three-wheeler, two-wheeler, and quadricycles. The government's reforms, such as "Aatma Nirbhar Bharat" and "Make in India" programs, will likely boost the automotive industry in the near future.

- Specialty polymer contributes to improving design flexibility and innovation. These versatile solutions offer a range of beneficial properties to enable miniaturization and reliable performance in electronic devices.

- According to Japan Electronics and Information Technology Industries Association (JEITA), with the advance of digitalization boosting demand and expanding exports, global production by Japanese electronics and IT companies grew by 8% year on year in 2021 to JPY 37,300 billion (~USD 285.39 billion). This growth in the electronics segment will enhance the demand for the ethylbenzene market in the coming years.

- Specialty polymers are widely used in the automotive, electronics, and semiconductors industries. Hence, with robust growth in these industries, and government support, the demand for specialty polymers is projected to increase at a healthy pace during the forecast period.

Specialty Polymers Industry Overview

The speciality polymers market is fragmented in nature. Some of the major players in the market (in no particular order) include 3M, Arkema Group, BASF SE, Evonik Industries AG, and Solvay, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications in the Construction and Electronic Industries

- 4.1.2 Commercialization of Lightweight Polymers for Automotive and Aerospace Applications

- 4.1.3 Increasing Availability of Feedstock Derived from Natural Gas and Crude Oil Processing

- 4.2 Restraints

- 4.2.1 Fluctuating Operational Costs to Derive Feedstock

- 4.2.2 Technological Obsolescence due to Constantly Changing End-user Needs

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Specialty Elastomers

- 5.1.2 Specialty Composites

- 5.1.3 Specialty Thermoplastics

- 5.1.4 Specialty Thermosets

- 5.1.5 Other Types

- 5.2 End-user Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Consumer Goods

- 5.2.3 Building and Construction

- 5.2.4 Coatings, Adhesives, and Sealants

- 5.2.5 Electrical and Electronics

- 5.2.6 Healthcare

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Ashland Inc.

- 6.4.4 Associated industries Inc.

- 6.4.5 BASF SE

- 6.4.6 Braskem

- 6.4.7 Chemtura Corporation

- 6.4.8 Covestro

- 6.4.9 Croda International PLC

- 6.4.10 Elantas GmbH

- 6.4.11 Endurance Technologies Limited

- 6.4.12 Evonik Industries AG

- 6.4.13 Hexion Inc.

- 6.4.14 Huntsman Corp.

- 6.4.15 Koninklijke DSM NV

- 6.4.16 PolyOne

- 6.4.17 S&E Specialty Polymers LLC

- 6.4.18 Solvay

- 6.4.19 Speciality Polymers Pvt Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Specialty Polymer Technologies in a Myriad of Industrial Applications

- 7.2 Prolific Commercialization of Engineered Polymer and Specialty Film Products