|

市場調查報告書

商品編碼

1640409

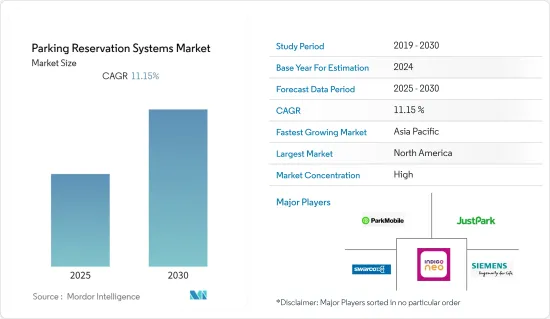

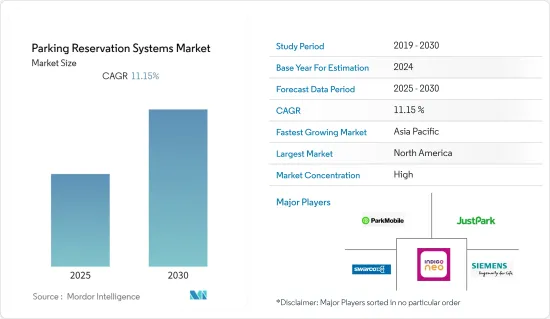

停車預訂系統:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Parking Reservation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,停車預訂系統市場預計將以 11.15% 的複合年成長率成長。

即時停車資料的需求不斷成長、新的智慧城市計劃以及車輛數量的增加是推動市場成長的一些因素。

主要亮點

- 停車預訂系統市場受到汽車領域人工智慧解決方案的進步所推動,包括向連網汽車和電動車的轉變。為了幫助電動車隊駕駛保持充電狀態,JustPark 和 FleetCharge 於 2022 年 10 月制定了一項創新舉措,為在家中安裝電動車充電站提供獎勵。 Just Park 將安裝電動車充電站、保證每月付款並支付電費。

- 停車預訂系統市場可能會受益於智慧型手機的日益普及。隨著可支配所得的增加,人們開始利用現代科技來追求舒適、無憂的生活。例如,選擇一輛連網汽車或一部具有尖端功能的高階智慧型手機。因此,消費者願意支付高價來輕鬆停放這些豪華車輛。這些基於行動的停車預訂解決方案能夠更有效地搜尋和提供停車預訂選項、搜尋當前停車位可用性和相關套餐。

- 新冠肺炎疫情對全球經濟帶來壓力,影響了製造業、生產業並擾亂了金融體系。疫情過後,各行各業紛紛恢復正常業務,受到衝擊最大的旅行及旅遊業迎來了黃金擴張機會。人們使用汽車上下班以保持社交距離,這需要複雜且可控的停車預約系統。

- 在運行基於軟體技術的系統時,成本可能是最大的挑戰,因為它需要更多的資金來維護系統。尖峰時段接入費用和軟體維護費用必須由客戶承擔。隨著報告和票務技術的引入,停車費用將會上升。

停車預約市場趨勢

行動解決方案成長強勁

- 在大多數城市,都市區的快速成長為停車系統帶來了重大問題。基於行動的停車預訂解決方案在搜尋即時停車位和相關套餐方面提供了更高的識別和提供停車預訂解決方案的效率。

- 智慧型手機不再只是用來打電話;它們還充當各種功能的中心樞紐。智慧型手機配備了 GPS 和電子錢包等功能,可用於尋找充電站或停車場等特定位置。智慧型手機電子錢包可方便地用於支付所有費用,包括停車費。

- 政府認知到停車位不足造成的問題並採取行動解決。綜合交通體係由高效率的停車管理結構支撐,促進永續交通。卡達已為司機和停車場業主推出了智慧停車服務。

- 2023 年 1 月,蘋果將與數位停車預訂服務 SpotHero 合作,為消費者提供美國和加拿大 8,000 多個地點的停車資訊。這使用戶能夠了解特定位置附近的停車選項和可用性。

北美佔有最大市場佔有率

- 汽車產業的下一個階段是連網汽車,汽車製造商正在大力投資這些新的經濟生態系統、經營模式和收益來源。通用、福特、雪佛蘭等全球頂級汽車製造商大多來自北美,這些公司都在持續為自己的車輛配備突破性的人工智慧技術。

- 北美城市的設計都假設汽車將成為主要的交通途徑。在美國,每輛車擁有8個停車位,都市區佔全國土地總面積的5%以上。隨著人工智慧技術的進步,這些停車場也必須實現機械化。

- 2022 年 10 月,北美數位停車領導者 SpotHero 慶祝自 2011 年進入該業務以來,停車預訂銷售額達到 10 億美元。作為停車行業最具活力的定價解決方案,SpotHero IQ 使營運商能夠更成功地開展業務並更好地管理其停車庫存,從而增加收益。

- 2022 年 1 月,這家總部位於安大略省滑鐵盧的公司利用其 eXactpark 應用程式的智慧停車技術簡化了擁擠城市的停車服務。

停車預約產業概況

停車預訂系統市場競爭非常激烈,因為國內和全球市場上的競爭公司提供了大量的選擇。主要企業紛紛採用產品創新、併購重組等手段,市場集中度較高。市場的主要企業包括 Conduent Incorporated、西門子股份公司、ParkMe Inc 和 JustPark Parking Ltd。

2022 年 1 月,Airtel Payments Bank 與 Park+ 合作,使用 FASTags 將印度的停車狀況數位化。 Park+ 門禁系統已在全國 1,500 多個社區、30 個購物中心和 150 個企業園區使用。此次合作將使全國各地的重要商業機構和住宅能夠使用基於 FASTag 的智慧停車場。

2022 年 2 月,沃克斯豪爾與停車服務 JustPark 簽署了新的合作夥伴關係,獲得了路邊充電站的獨家使用權。該協議還將允許更多人轉用電動車,因為他們將能夠在住所附近找到方便的充電站。

2022 年 6 月,Touch'n Go eWallet 與 ComfortDelGro 和 Alipay+ 合作,將其跨境付款功能擴展到新加坡。康福德高在新加坡營運超過 9,000 輛計程車。透過此次國際夥伴關係,客戶可以攜帶電子錢包旅行,並在國外享受輕鬆便捷的付款。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- 汽車數量增加

- 全球智慧城市計劃興起

- 市場挑戰

- 採用率緩慢

第5章 市場區隔

- 按停車位置

- 路外停車

- 路邊停車

- 按解決方案

- 基於網路

- 基於行動裝置

- 基於語音通話

- 按行業

- 政府

- 零售

- 飯店業

- 娛樂/休閒

- 運輸

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 世界其他地區

- 北美洲

第6章 競爭格局

- 公司簡介

- Conduent Incorporated

- Siemens AG

- ParkMe Inc.

- JustPark Parking Ltd

- The Kapsch Group

- Standard Parking Corporation

- APCOA Parking AG

- Streetline Inc.

- Amano Corporation

- Swarco Corporation

第7章投資分析

第8章 市場機會與未來趨勢

The Parking Reservation Systems Market is expected to register a CAGR of 11.15% during the forecast period.

The growing demand for real-time car parking data, new smart city projects, and the rising number of cars are a few factors contributing to the market's growth.

Key Highlights

- The market for parking reservation systems is being driven by the advancement of AI solutions in the automotive sector, such as linked automobiles and the migration to electric vehicles. To keep EV fleet drivers charged, JustPark and FleetCharge developed an innovative initiative to offer incentives for installing EV charging stations in homes in October 2022. JustPark will set up an EV charging station, provide a guaranteed monthly payment, and pay for any electricity costs.

- The market for parking reservation systems will benefit from the growing popularity of smartphones. Due to rising disposable incomes, people are using the newest technology for comfort and hassle-free living. Examples include selecting connected cars and high-end smartphones with cutting-edge capabilities. So, consumers are willing to pay more to park these luxury vehicles easily. These mobile-based parking reservation solutions are more effective at locating and offering parking reservation options and retrieving current parking availability and associated packages.

- The COVID-19 pandemic squeezed the world economy by affecting the manufacturing industry, production, disruption, and financial systems. Post-epidemic, the industries returned to regular operations, and travel and tourism-most adversely affected-got an excellent opportunity to expand. People used their vehicles to commute to preserve social distancing, which required advanced and managed Parking Reservation Systems.

- Cost can be the biggest challenge because more money would be needed to maintain the system when it is run using software-based technologies. Customers will have to cover peak access fees and software maintenance costs. The cost of parking will increase due to the deployment of reporting and ticketing technology.

Parking Reservation Market Trends

Mobile-based Solutions to Witness Significant Growth

- In most cities, there is a significant parking system issue due to the rapid urban population growth. The mobile-based parking reservation solutions have greater efficiency in identifying and providing parking reservation solutions in terms of retrieving real-time parking availability and related packages.

- Smartphones are being utilized for more than just making calls; they are a central hub for many different functions. They are packed with features like GPS and e-wallets that can be used to find specific locations, such as electric charging stations or parking lots. The smartphone's e-wallet will be used to conveniently pay for everything, including the parking fee.

- The Government is aware of the issues caused by a lack of parking and is acting to address them. The integrated transportation system is supported by an efficient parking management structure, promoting sustainable transportation. For drivers and owners of parking spaces in Qatar, the Smart Parking service was introduced.

- In January 2023, Apple and the digital parking reservation service SpotHero partnered to provide consumers with access to parking information for over 8,000 locations across the United States and Canada. It will inform users of the parking options and availability close to a particular location.

North America Occupies the Largest Market Share

- The next phase of the automobile industry is that of connected automobiles, and automakers are making significant investments in these new economic ecosystems, business models, and revenue streams. The majority of the world's top automakers, including General Motors, Ford, and Chevrolet, constantly creating ground-breaking AI technologies for their vehicles, have their origins in North America.

- North American cities were designed with the idea that cars would be the primary source of transportation. In the United States, there are eight parking spaces for every car, which take up more than 5% of the total urban land area. These parking places must be mechanized as AI technology advances in the nation.

- In October 2022, SpotHero, the digital parking leader in North America, celebrated the sale of USD 1 billion in parking reservations sold since it entered the business in 2011. The most dynamic pricing solution in the parking sector, SpotHero IQ, enables operators to run their companies more successfully and better manage their parking inventory, which boosts revenues.

- In January 2022, Waterloo, Ontario-based company simplified parking in crowded cities with smart parking technology using the eXactpark app.

Parking Reservation Industry Overview

The parking reservation systems market is highly competitive due to the abundance of options offered by firms competing in domestic and global markets. The key firms use tactics like product innovation and mergers and acquisitions, which suggests that the market is relatively concentrated. Some of the major players in the market are Conduent Incorporated, Siemens AG, ParkMe Inc, and JustPark Parking Ltd, among others.

In January 2022, to digitize the parking environment in India using the vehicle's FASTag, Airtel Payments Bank partnered with Park+.Park+ access control systems are used in over 1,500 societies,30 malls, and 150 corporate parks nationwide. With the help of this partnership, significant commercial and residential buildings around the country will have access to smart parking options based on FASTag.

In February 2022, Vauxhall established a new collaboration with parking service JustPark to allow exclusive access to off-street charging stations. Also, this agreement will enable more individuals to switch to electric vehicles because they can locate convenient charging stations close to their residences.

In June 2022, in collaboration with ComfortDelGro and Alipay+, Touch 'n Go eWallet increased the reach of its cross-border payment capabilities to Singapore. ComfortDelGro runs over 9,000 taxis across Singapore. This international partnership enables its customers to travel with the eWallet and take advantage of a simple and convenient payment experience outside of their native country.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Increasing Number of Vehicles

- 4.3.2 Increasing Smart City Projects Across the World

- 4.4 Market Challenges

- 4.4.1 Slow Adoption Rate

5 MARKET SEGMENTATION

- 5.1 By Parking Site

- 5.1.1 On-street Parking

- 5.1.2 Off-street Parking

- 5.2 By Solutions

- 5.2.1 Web-based

- 5.2.2 Mobile-based

- 5.2.3 Voice Call-based

- 5.3 By End-user Vertical

- 5.3.1 Government

- 5.3.2 Retail

- 5.3.3 Hospitality

- 5.3.4 Entertainment/Recreation

- 5.3.5 Transportation

- 5.3.6 Other End-user Verticals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia Pacific

- 5.4.4 Rest of the World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Conduent Incorporated

- 6.1.2 Siemens AG

- 6.1.3 ParkMe Inc.

- 6.1.4 JustPark Parking Ltd

- 6.1.5 The Kapsch Group

- 6.1.6 Standard Parking Corporation

- 6.1.7 APCOA Parking AG

- 6.1.8 Streetline Inc.

- 6.1.9 Amano Corporation

- 6.1.10 Swarco Corporation