|

市場調查報告書

商品編碼

1640419

輸油管產品:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Oil Country Tubular Goods - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

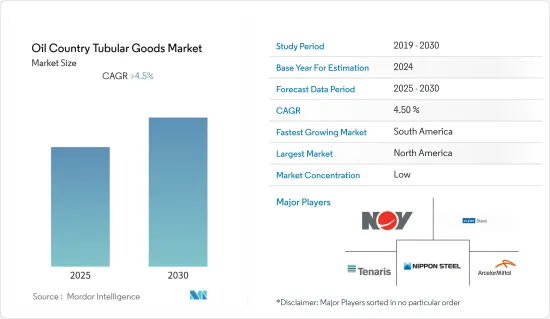

預計在預測期內,輸油管產品市場的複合年成長率將超過 4.5%。

由於地區封鎖和 2020 年油價暴跌,COVID-19 對市場產生了負面影響。目前市場處於大流行前的水平。

主要亮點

- 市場研究的主要促進因素包括探勘和生產活動增加、非石油收入增加和技術進步導致石油損益平衡價格下降、石油服務成本下降以及定向鑽井增加。

- 另一方面,美國等國家進口關稅的增加、近年來油價的波動以及對環境問題的擔憂可能會阻礙預測期內輸油管產品市場的成長。

- 世界主要國家正在開放石油和天然氣,增加外國投資,促進石油和天然氣產業的成長。預計這將在未來幾年為全球輸油管產品市場提供巨大機會。

- 北美預計將主導全球輸油管產品市場,大部分需求來自美國、墨西哥等國家。

輸油管產品(OCTG)市場趨勢

對優質品級的需求正在迅速增加

- 由於上游石油和天然氣需求的增加,優質輸油管產品市場正在擴大。進階應用擴展到氣井、水平井、高壓井(5,000 psi 以上)和高溫井(250 F 以上)。優質級輸油管產品用於需要緊密氣體密封的更複雜的應用和連接。

- 由於頁岩蘊藏量的快速增加,天然氣探勘已成為主要推動力。此外,水平定向鑽探正在推動頁岩蘊藏量的天然氣生產,從而顯著推動優質輸油管產品市場的發展。

- 在環境惡劣和偏遠地區進行深海探勘的增加增加了優質鑽井設備的使用,從而導致市場成長。中東是主要的深海蘊藏量之一,預測期內產量預計將增加。

- 2022 年 12 月,瓦盧瑞克在 2021 年與埃克森美孚圭亞那簽署的長期協議 (LTA) 框架內獲得了第三份大訂單。根據協議,瓦盧瑞克將為埃克森美孚圭亞那深水Ualu計劃交付管線管。

- 因此,由於上述因素,預計在預測期內,全球輸油管產品市場將呈現巨大的需求。

北美市場佔據主導地位

- 北美地區油氣天然氣田廣泛開發,包括陸上和海上,被認為是從事輸油管產品業務的公司的重大商機。此外,由於對輸油管產品的需求直接受到石油和天然氣活動的影響,預計該地區不斷增加的石油和天然氣探勘和生產業務將在未來幾年增加對輸油管產品的需求。

- 在美國,頁岩鑽井和水力壓裂作業擴大了水平和定向鑽井的使用,在以前僅垂直的鑽柱上增加了數千英尺的橫向鑽井。水平側向長度可超過5,000英尺,每口井使用的油管產品噸位顯著增加。

- 此外,由於美國石油和天然氣鑽探活動增加,美國的鑽機總數從2021年1月的369座激增至2022年1月的約601座,增加了63%。加拿大也出現了類似的趨勢,鑽機數量從 2021 年 1 月的 137鑽機增加到 2022 年 1 月的 190鑽機,增加了 39%。預計這種市場狀況將在預測期內持續下去,從而導致對輸油管產品的需求增加。

- 根據加拿大石油生產商協會(CAPP)統計,加拿大油氣上游資本投資從2021年的207億美元增加到2022年的227億美元,成長近10%。此外,加拿大油氣上游資本投資預計將進一步增加,到2030年將達到443億美元以上。此外,2021年至2030年,加拿大油氣上游資本投資預計將達到3,563億美元,並保持適度成長,這可能為輸油管產品市場提供充足的機會。

- 因此,基於上述因素,預計北美在預測期內將主導全球輸油管產品市場。

輸油管產品(OCTG)產業概況

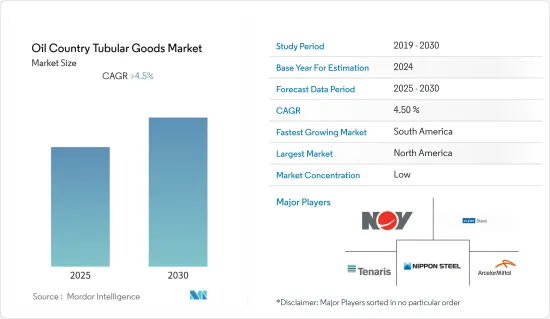

輸油管產品市場是細分的。主要企業包括 National-Oilwell Varco Inc.、ILJIN Steel Co.、Nippon Steel & Sumitomo Metal Corporation、ArcelorMittal SA 和 Tenaris SA(排名不分先後)。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 製造過程

- 無縫的

- 電阻焊接

- 年級

- 特級

- API級

- 地區

- 北美洲

- 亞太地區

- 歐洲

- 南美洲

- 中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- National-Oilwell Varco Inc.

- ILJIN Steel Co.

- Nippon Steel & Sumitomo Metal Corporation

- Tenaris SA

- TMK Ipsco Enterprises Inc.

- US Steel Tubular Products Inc.

- Vallourec SA

- ArcelorMittal SA

第7章 市場機會及未來趨勢

The Oil Country Tubular Goods Market is expected to register a CAGR of greater than 4.5% during the forecast period.

The market was negatively impacted by COVID-19 due to regional lockdowns and the 2020 crude oil price crash. Currently, the market has reached a pre-pandemic level.

Key Highlights

- Major factors driving the market study include increasing exploration and production activities, low oil breakeven prices due to rising non-oil revenues and technological advancements, reduced oil service costs, and increased directional drilling.

- On the other hand, the increased import duty in countries like the United States, the volatile nature of oil prices in recent years, and environmental concerns could hamper the growth of the OCTG market during the forecast period.

- There has been liberalization of oil and gas by major countries across the world to increase foreign investments, thereby helping the growth of the oil and gas industry. This will likely provide immense opportunities for the global OCTG market in the coming years.

- North America is expected to dominate the global OCTG market, with the majority of the demand coming from countries like the United States, Mexico, etc.

Oil Country Tubular Goods (OCTG) Market Trends

Premium Grade Segment to Witness Significant Demand

- The premium-grade OCTG market is growing because of the increasing demand from upstream oil and gas activities. Premium-grade applications are widespread in gas wells, horizontal wells, high-pressure (above 5,000 psi), and high-temperature (above 250 F) wells. The premium-grade OCTG is applied to such connections that have more complex applications and where gas-tight sealing is required.

- The exploration of natural gas is receiving huge impetus with the surge in the development of shale reserves. Moreover, horizontal directional drilling has promoted natural gas production from shale reserves, which, in turn, is a big boost for the premium-grade OCTG market.

- The increase in deepwater exploration in remote areas with harsh environments has resulted in an increase in the use of premium quality drilling equipment, which has resulted in the growth of the market. The Middle East is one of the major offshore deepwater reserves and is expected to increase production during the forecast period.

- In December 2022, Vallourec secured a third major order in the framework of the Long-Term Agreement (LTA) signed in 2021 with ExxonMobil Guyana. Under the contract, Vallourec will deliver line pipe for ExxonMobil Guyana's deep-water Uaru project.

- Therefore, based on the above-mentioned factors, the premium-grade segment is expected to witness significant demand for the global OCTG market during the forecast period.

North America to Dominate the Market

- The widespread development of oil and gas fields in the North American region, onshore and offshore, will likely provide substantial business opportunities for companies operating OCTG businesses. Further, as the demand for OCTG is directly affected by oil and gas activities, increasing oil and gas exploration and production operations in the region are expected to boost the demand for OCTG in the coming years.

- In the United States, shale drilling and hydraulic fracturing operations have expanded the use of horizontal and directional drilling, adding thousands of feet in the lateral run to what previously had been vertical-only drill strings. Horizontal laterals, which can be 5,000 feet or more in length, have significantly increased the number of tons of tubular products used per well.

- Further, the deployment of the total rig counts in the United States surged from 369 in January 2021 to around 601 in January 2022, witnessing a growth of 63% due to the country's increasing oil and gas drilling activities. A similar trend was seen in Canada, which recorded an increase of 39% in drilling rig deployment from 137 in January 2021 to 190 rigs in January 2022. Such market scenarios are expected to continue and increase OCTG demand during the forecast period.

- According to the Canadian Association of Petroleum Producers (CAPP), upstream oil and gas capex in Canada increased from USD 20.7 billion in 2021 to USD 22.7 billion in 2022, an increase of nearly 10 percent. Further, Canadian upstream oil and gas capex is expected to rise even further, reaching over USD 44.3 billion by 2030. Additionally, between 2021 and 2030, Canadian upstream oil and gas capex is expected to be USD 356.3 billion under the mid-case growth rate, which is likely to provide ample opportunities to the OCTG Market.

- Therefore, based on the above-mentioned factors, North America is expected to dominate the global oil-country tubular goods market during the forecast period.

Oil Country Tubular Goods (OCTG) Industry Overview

The oil country tubular goods market is fragmented. The key companies include (in no particular order) National-Oilwell Varco Inc., ILJIN Steel Co., Nippon Steel & Sumitomo Metal Corporation, ArcelorMittal SA, and Tenaris SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Manufacturing Process

- 5.1.1 Seamless

- 5.1.2 Electric Resistance Welded

- 5.2 Grade

- 5.2.1 Premium Grade

- 5.2.2 API Grade

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 National-Oilwell Varco Inc.

- 6.3.2 ILJIN Steel Co.

- 6.3.3 Nippon Steel & Sumitomo Metal Corporation

- 6.3.4 Tenaris SA

- 6.3.5 TMK Ipsco Enterprises Inc.

- 6.3.6 U.S. Steel Tubular Products Inc.

- 6.3.7 Vallourec SA

- 6.3.8 ArcelorMittal SA