|

市場調查報告書

商品編碼

1640421

導航系統:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Navigation System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

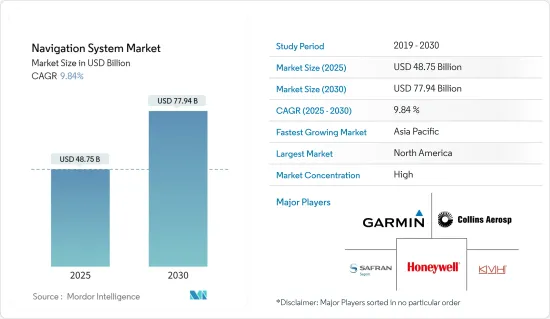

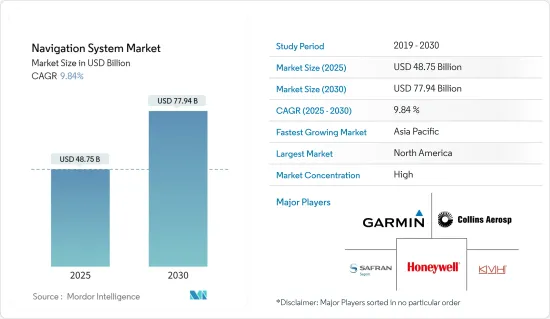

導航系統市場規模預計在 2025 年為 487.5 億美元,預計到 2030 年將達到 779.4 億美元,預測期內(2025-2030 年)的複合年成長率為 9.84%。

主要亮點

- 隨著從汽車到自主機器人等各種應用對即時資訊的需求不斷增加,導航系統在世界各地得到越來越廣泛的應用。隨著技術的進步,這些系統正在轉型以提供多種服務和導航功能,圍繞著導航技術形成龐大的服務生態系統。

- 導航系統除了確定車輛的位置和方向外,還有許多其他用途。它可以幫助您隨時了解天氣預警、追蹤小包裹和貨物、改善交通流量等。這些系統也被用於一些先進的應用中,以促進智慧空間的發展。

- 各種 GPS 系統可用於採礦、航空、測量、農業、海洋和軍事應用。近年來,全球貿易和海上運輸量的增加促進了市場的成長。此外,世界各國政府都在大力投資各工業領域的導航系統。

- 例如,印度太空研究組織(ISRO)和印度機場管理局(AAI)共同實施了 GAGAN計劃,作為衛星增強系統 (SBAS)。

- 同樣,許多汽車相關企業正致力於為導航系統帶來新的創新。例如,2023年2月,賓士與Google宣佈建立長期策略夥伴關係,致力於提升汽車創新能力,打造產業下一代數位化豪華汽車體驗。透過此次合作,賓士將成為第一家基於Google地圖平台全新車載資料和導航功能開發自有品牌導航體驗的汽車製造商。

- 近期的新冠疫情嚴重影響了全球導航系統業務。世界各地的新計畫均已停止。由於工人們待在家裡,世界各地的工廠都難以整合現代導航系統,擾亂了全球供應鏈。 COVID-19 僅對該市場產生了暫時的影響,導致生產和供應鏈停滯。隨著條件的改善,導航系統的生產、供應鏈和需求穩步擴大。

- 預計預測期內航空業的高速擴張和國防費用將推動導航系統市場的成長。然而,昂貴的安裝成本和安全法規阻礙了該行業的發展。然而,克服這些障礙需要專注於採用新的技術創新。

導航系統市場趨勢

國防推動市場成長

- 導航系統的一個重要應用是國防工業。導航系統允許使用者偵測、定位和描述干擾源。軍隊使用衛星導航進行地面導航、空中監視和海上導航。

- 導航有助於軍事任務精確定位部隊、敵軍以及敵方設施和設備的位置。準確性、可靠性、定位精度和及時測量是推動國防領域市場採用成長的一些關鍵因素。

- 許多公司提供各種各樣的產品來滿足不同最終用戶的需求。例如,柯林斯航空於 2022 年 6 月推出了 NavHub-200M,這是第一款針對國際市場且相容軍用代碼 (M-Code)接收器技術的非 ITAR 車輛導航系統。 NavHub-200M 提供保證的定位、導航和授時 (APNT) 功能,同時提高對全球定位系統 (GPS) 現有和新出現的威脅(例如欺騙和干擾)的整體抵禦能力。

- 此外,在2023年3月,賽峰集團宣布推出新產品NAVKITE,這是一款結合了GEONYXTM-M和VersaSync的綜合導航和彈性授時解決方案。這款新產品是一個全自動系統,它將 GeonyxTM-M 導航系統與 VersaSync 時間和頻率伺服器結合,可分析 GNSS*/GPS 訊號並檢驗其完整性。

- 隨著政府對安全問題的日益關注,導航系統在國防領域變得至關重要。例如,英國正在計劃推出衛星導航系統。倫敦保守黨政府最近宣布已撥出 9,200 萬英鎊(約 1.153 億美元)進行可行性測試,以設計和開發伽利略衛星系統的替代方案。

- 此外,2022 年 9 月,雷神公司獲得了一份價值 5.83 億美元的美國導航契約,用於開發更新的技術,為士兵提供戰場上關鍵的情境察覺和背景資訊。該技術將安裝在多種裝甲平台上,包括布雷德利戰車、聖騎士炮和艾布拉姆斯坦克,以及史瑞克和悍馬等輕型裝甲平台。

預計北美將佔很大佔有率

- 北美佔據全球導航系統市場的大部分佔有率。北美引領市場主要是因為該地區早期採用技術並對先進導航系統進行巨額投資。此外,預計全部區域對各種自動化技術的支出增加和智慧基礎設施建設將進一步推動市場成長。

- 推動市場發展的關鍵因素是蜂巢式網路基礎設施的日益普及以及自動車輛定位 (AVL)、追蹤系統等應用技術的整合。然而,缺乏認知、GNSS 技術高成本以及訊號連接等因素阻礙了市場成長。

- 導航系統主要用於國防領域。追蹤和定位是國防工業導航系統的主要應用。國防工業支出大部分來自北美地區,其中美國的貢獻最大。

- 2023年1月,L3Harris宣布向美國交付導航技術衛星-3號並交付太空船。 NTS-3 是一項由空軍研究實驗室資助的實驗,它將從地球靜止軌道傳輸位置、導航和定時 (PNT) 訊號。其目的是為美國軍方展示下一代PNT技術並提供GPS的替代方案。

- 與中國、沙烏地阿拉伯、印度、法國、俄羅斯、英國和德國等國家相比,美國的國防支出開支最高。

- 此外,由於自動駕駛汽車和乘用車產量的增加,北美導航系統市場預計將實現高速成長。乘用車配備有儀表板上或儀表板安裝的導航系統。這些原廠導航系統比智慧型手機導航更精確、功能更多、整合度更高。

- 此外,隨著對精度的需求不斷增加,汽車導航技術正在融入提供即時交付系統的應用程式,幫助追蹤和預測供應鏈。此外,由於汽車共享服務嚴重依賴導航技術,Ola、Uber 和 Grab 預計將推動市場成長。

導覽系統產業概況

導航系統市場的主要競爭者是 Garmin 公司、霍尼韋爾國際公司和柯林斯航空航太公司。 他們透過大量投資研發不斷創新產品的能力使他們比其他參與者更具競爭優勢。優勢。

- 2023 年 2 月,雷神公司宣布已獲得一份價值 860 萬美元的契約,為日本海上自衛隊 (JMSDF) 提供 F-35 JPALS。 JPALS 是一種基於軟體的差分全球定位系統導航和精確著陸系統。美國收到了訂單。 JPALS 與 F-35 戰鬥機整合,允許其在任何天氣條件下在海上艦艇上作戰、接近和降落。

- 2022年1月,非洲國家在非洲-馬達加斯加空中導航安全局(ASECNA)的努力下成為星基增強系統(SBAS)的一部分。 SBAS 是一種高精度且強大的全球導航衛星系統 (GNSS),它不再需要區域地面導航輔助設備和機場著陸系統。由非洲安全與航空管理局主導的非洲航空業將能夠開發自己的 SBAS 系統,以協助航空公司和航空相關人員。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 汽車產業擴大採用導航系統

- 市場限制

- 新興國家系統成本高,缺乏配套基礎設施

第6章 市場細分

- 按應用

- 防禦

- 航空

- 海上

- 車

- 其他用途

- 按類型

- 衛星導航系統

- 手術導航系統

- 慣性導航系統

- 其他類型

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Garmin Ltd

- Honeywell International Inc.

- Collins Aerospace Inc.

- Safran Electronics & Defense Inc.

- KVH Industries Inc.

- Raytheon Company Ltd

- SBG Systems SAS

- Advanced Navigation Inc.

- Trimble Navigation Ltd

- Lord Sensing Systems Inc.

- L3Harris Technologies Inc.

- Northrop Grumman Corporation

- Esterline Technologies Corporation

- Moog Inc.

第8章投資分析

第9章:市場的未來

The Navigation System Market size is estimated at USD 48.75 billion in 2025, and is expected to reach USD 77.94 billion by 2030, at a CAGR of 9.84% during the forecast period (2025-2030).

Key Highlights

- With the increasing demand for real-time information in various applications ranging from automotive to autonomous robots, navigation systems are increasingly widely adopted globally. With technological advancement, these systems have transformed and offered multiple services and navigation facilities, creating a considerable service ecosystem around navigation technologies.

- Besides determining the location or direction of vehicles, they have many different uses. They help to know the weather alerts, track parcels, and shipments, improve the traffic flow, etc. Also, these systems are used in several advanced applications to facilitate smart spaces.

- Various GPS systems find use in mining, aviation, surveying, agriculture, maritime, and military applications. Increased global trade and maritime traffic have aided the market's growth in recent years. Moreover, governments worldwide havesignificantly investeds in navigation systems across various industry verticals.

- For instance, in collaboration, the Indian Space Research Organization (ISRO) and the Airports Authority of India (AAI) implemented the GAGAN project as a Satellite-Based Augmentation System (SBAS), which is anticipated to benefit numerous stakeholders operating in Indian airspace.

- Similarly, many automotive players focus on bringing new technological innovations to navigation systems. For instance, in February 2023, Mercedes Benz and Google announced a long-term strategic partnership to improve auto innovation and create the industry's next-generation digital luxury car experiences. Through this partnership, Mercedes-Benz will be the first automaker to develop its own branded navigation experience based on the new in-vehicle data and navigation capabilities of the Google Maps platform.

- The recent COVID-19 pandemic severely impacted the global navigation system business. New projects all around the world had come to a halt. As workers stayed home, worldwide factories struggled to integrate modern navigation systems, disrupting global supply chains. COVID-19's impact on this market was only temporary because only the production and supply chain was halted. Production, supply networks, and demand for navigation systems steadily expanded as the situation improved.

- The aviation industry's high expansion and defense spending is expected to fuel the navigation system market growth during the projected period. However, expensive installation costs and safety regulations are impeding industry growth. Nonetheless, overcoming such impediments will focus on introducing new technological innovations.

Navigation Systems Market Trends

Defense is Boosting the Market Growth

- One of the significant applications of navigation systems is the defense industry. Navigation systems allow users to detect, locate, and characterize interference sources. Military forces use satellite navigation for ground navigation, aerial monitoring, and maritime navigation.

- Navigation helps military missions accurately position their units, the enemy's forces, and the locations of the enemy's facilities or installations. Accuracy, reliability, precision in positioning, and timely measurements are some of the major factors driving the growth of market adoption in the defense sector.

- Many companies provide a wide range of products to cater to the needs of various end-users. For instance, in June 2022, Collins Aerospace introduced NavHub-200M, the first non-ITAR vehicular navigation system for the international market compatible with Military Code (M-Code) receiver technology. NavHub-200M provides Assured Positioning, Navigation, and Timing (APNT) capabilities while improving overall resistance to existing and emerging threats to Global Positioning Systems (GPS), such as spoofing and jamming.

- Similarly, in March 2023, Safran announced to offer a new product, NAVKITE, an integrated navigation and resilient timing solution combining a GEONYXTM-M and a VersaSync. This new product is a fully automated system based on a combination of the GeonyxTM-M navigation system and the VersaSynctime and frequency server that analyzes GNSS*/GPS signals and verifies their integrity.

- Owing to the increasing security concerns by the government of various countries, a navigation system has become an indispensable part of the defense sector. For instance, Britain is moving toward launching its satellite navigation system. The Conservative government of London recently announced that it has set aside GBP 92 million (~USD 115.3 million) to undertake a feasibility test for designing and developing an alternative to the Galileo Satellite System.

- Moreover, in September 2022, Raytheon Company Ltd. announced that it had been awarded a USD 583 million contract for US Army navigation to develop an updated version of a technology that provides soldiers with critical situational awareness and context on the battlefield. The technology will be mounted into various armored platforms, including Bradley Fighting Vehicles, Paladin artillery, and Abrams tanks, as well as lighter options, such as Strykers and Humvees.

North America Expected to Hold Significant Share

- The North American region holds the majority share in the global navigation system market. The primary reason for North America to be the market leader can be the early adoption of technology in the region and immense investment into advanced navigation systems. Also, increased spending on various automation technologies and building a smart infrastructure throughout the region is further expected to boost market growth.

- The key factors driving the market are the increasing penetration of cellular network infrastructure and the integration of technologies for applications, such as Automatic Vehicle Location (AVL), tracking systems, etc. However, factors such as lack of awareness, high cost of GNSS technology, and signal connectivity hinder the market's growth.

- The navigation system is mostly used in the defense sector. Tracking and positioning is a navigation system's primary application area used in the defense industry. Most of the defense industry's spending comes from the North American region, with the United States contributing the most.

- In January 2023, L3Harris announced to delivery of the Navigation Technology Satellite-3 to the U.S. Air Force and the spacecraft. NTS-3 is an Air Force Research Laboratory-funded experiment that will transmit Positioning, Navigation, and Timing (PNT) signals from Earth's geostationary orbit. The goal is to demonstrate next-generation PNT technology for the U.S. military and provide an alternative to GPS.

- The United States is the largest spender on national defense compared to countries like China, Saudi Arabia, India, France, Russia, the United Kingdom, Germany, etc.

- Moreover, the navigation system market in North America will witness high growth owing to the rising production of autonomous and passenger vehicles. Passenger vehicles are equipped with dashboards or dashboard-mounted navigation systems. These factory-installed navigation systems are more accurate, have more features, and have better integration than smartphone navigation.

- Furthermore, with the growing need for accuracy, automotive navigation technology is helping supply chain tracking and forecasting by incorporating applications that provide real-time delivery systems. Moreover, Ola, Uber, and Grab are expected to drive market growth as car-sharing services rely heavily on navigation-based technology.

Navigation Systems Industry Overview

The competitive rivalry in the navigation systems market is high owing to some key players like Garmin Ltd, Honeywell International Inc., Collins Aerospace Inc., Safran Electronics & Defense Inc., and many more. Their ability to continually innovate their products through significant research and development investments has helped them achieve a competitive advantage over other players.

- In February 2023, Raytheon Company Ltd. announced that it had won USD 8.6 million contract to provide F-35 JPALS for Japan Maritime Self-Defense Force (JMSDF). JPALS is a software-based differential Global Positioning System navigation and precision landing system. The contract was awarded by U.S. Navy. JPALS is integrated with the F-35 fighter, capable of operating, approaching, and landing on naval vessels at sea in all weather conditions.

- In January 2022, African countries joined part of the satellite-based augmentation system (SBAS) because of ASECNA (Agency for Aerial Navigation Safety in Africa and Madagascar) efforts. SBAS is a precise and robust Global Navigation Satellite System (GNSS) system that eliminates the need for regional ground-based navigation aids and airport landing systems. Africa Aviation, led by ASECNA, can develop its own SBAS system to assist the airlines or aviation stakeholders.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Implementation of Navigation Systems in the Automobile Industry

- 5.2 Market Restraints

- 5.2.1 High System Cost and Lack of Supporting Infrastructure in Developing Countries

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Defense

- 6.1.2 Aviation

- 6.1.3 Maritime

- 6.1.4 Automotive

- 6.1.5 Other Applications

- 6.2 By Type

- 6.2.1 Satellite Navigation Systems

- 6.2.2 Surgical Navigation Systems

- 6.2.3 Inertial Navigation Systems

- 6.2.4 Other Types

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Garmin Ltd

- 7.1.2 Honeywell International Inc.

- 7.1.3 Collins Aerospace Inc.

- 7.1.4 Safran Electronics & Defense Inc.

- 7.1.5 KVH Industries Inc.

- 7.1.6 Raytheon Company Ltd

- 7.1.7 SBG Systems SAS

- 7.1.8 Advanced Navigation Inc.

- 7.1.9 Trimble Navigation Ltd

- 7.1.10 Lord Sensing Systems Inc.

- 7.1.11 L3Harris Technologies Inc.

- 7.1.12 Northrop Grumman Corporation

- 7.1.13 Esterline Technologies Corporation

- 7.1.14 Moog Inc.