|

市場調查報告書

商品編碼

1640431

熱塑性塑膠:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Thermoplastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

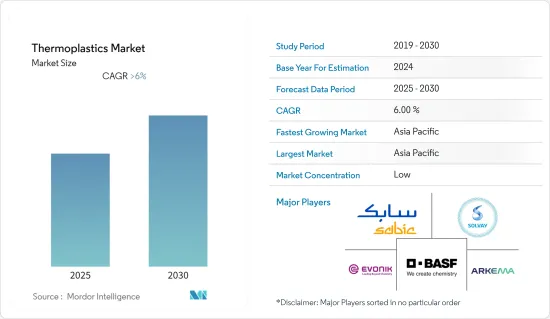

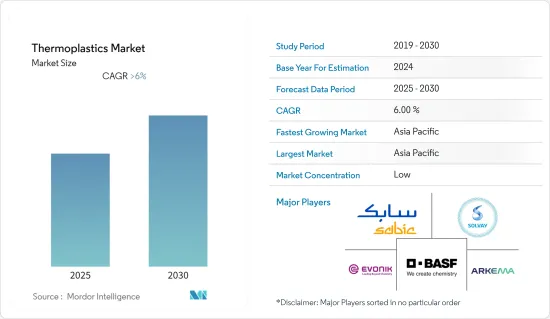

預計預測期內熱塑性塑膠市場複合年成長率將超過 6%。

新冠疫情導致全球封鎖、製造活動和供應鏈中斷以及生產停頓,所有這些都對 2020 年的市場造成了嚴重影響。然而,情況在 2021 年開始好轉,市場在整個預測期內恢復成長軌跡。

關鍵亮點

- 預計下游加工產能擴張和消費品及電子產品領域的成長將有利於該市場。

- 然而,與熱塑性塑膠相關的環境問題預計會阻礙市場成長。

- 生物基產品的日益普及預計將為市場提供機會。

- 預計亞太地區將主導市場,並在預測期內以最高的複合年成長率成長。

熱塑性塑膠市場趨勢

汽車和運輸領域的需求不斷成長

- 熱塑性塑膠廣泛應用於各種汽車和運輸應用。汽車安全氣囊、引擎蓋下應用、汽車電氣和電子設備等是工程塑膠的一些應用。

- 汽車產業對輕量材料的需求不斷增加,以提高經濟性和設計靈活性,從而推動熱塑性塑膠市場的擴張。

- 在經歷了艱難的新冠疫情時期後,汽車產業的投資和生產開始復甦,主要是在中國、印度、印尼和馬來西亞等亞太國家。

- 國際能源總署(IEA)在其《2022年全球電動車展望》中也指出,電動車銷量正呈指數級成長。 2021年電動車(EV)銷量與前一年同期比較加倍,達到660萬輛,創歷史新高。 2022年電動車銷量持續強勁成長,第一季銷量達200萬輛,較2021年同期成長75%。

- 根據中國工業協會統計,2022年中國汽車產量與前一年同期比較增3.4%左右。 2022 年汽車產量約 2,700 萬輛,而 2021 年的產量為 2,608 萬輛。

- 由於消費者越來越偏好高品質、更省油的汽車,北美對輕型車的需求強勁。因此,該地區汽車製造中工程塑膠的使用正在迅速成長。

- 此外,歐洲主要汽車企業的存在以及歐洲公司和政府對汽車研發行業的大量投資正在推動該地區熱塑性塑膠的成長。

中國主導亞太市場成長

- 預計亞太地區將主導市場。中國是成長最快的經濟體之一,已成為世界上最大的汽車、塑膠、電子產品和建築生產國之一。

- 根據中國工業協會統計,2022年新能源汽車銷量較2021年成長93.4%。 2022年終新能源車總銷量約680萬輛,而2021年全年僅約350萬輛。

- 中國建築業正在經歷強勁成長。根據中國國家統計局預測,2022年第四季(約276億美元)成長約50%。

- 根據中國國家統計局統計,2022年1-8月,中國塑膠製品總產量為5,307萬噸,去年同期為5,332萬噸。

- 中國也提案2022會計年度國防預算約1.45兆元(2,300億美元),較2021會計年度成長7.1%。而根據中國航空工業發展研究中心的報告,預計2025年,中國飛機總數將達到5,343架,調查市場規模也將進一步成長。

- 因此,預計預測期內各終端用戶產業對熱塑性塑膠的需求將會增加。

熱塑性塑膠產業概況

熱塑性塑膠市場呈現細分化,少數幾家參與企業佔據相當大的佔有率。熱塑性塑膠市場的主要企業(不分先後順序)包括BASF SE、Evonik Industries AG、Solvay、SABIC 和 Arkema。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 下游加工產能擴張激增

- 消費品和電子產業成長

- 限制因素

- 與熱塑性塑膠有關的環境問題。

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 產品類型

- 通用熱塑性塑膠

- 聚乙烯 (PE)

- 聚丙烯(PP)

- 聚氯乙烯(PVC)

- 聚苯乙烯(PS)

- 工程熱塑性塑膠

- 聚醯胺(PA)

- 聚碳酸酯(PC)

- 聚甲基丙烯酸甲酯 (PMMA)

- 聚甲醛(POM)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚丁烯對苯二甲酸酯(PBT)

- 丙烯腈丁二烯苯乙烯 (ABS)/苯乙烯丙烯腈 (SAN)

- 高性能工程熱塑性塑膠

- 聚醚醚酮 (PEEK)

- 液晶聚合物(LCP)

- 聚四氟乙烯(PTFE)

- 聚醯亞胺(PI)

- 其他產品類型(PPE、PSU、PEI、PPS、ETFE、PFA、FEP、PBI)

- 通用熱塑性塑膠

- 最終用戶產業

- 包裝

- 建築和施工

- 汽車與運輸

- 電氣和電子

- 運動休閒

- 醫療

- 其他終端用戶產業(農業、消費品)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率/排名分析

- 主要企業策略

- 公司簡介

- 3M(incl. Dyneon LLC)

- Arkema

- Asahi Kasei Corporation

- BASF SE

- Celanese Corporation

- Chevron Phillips Chemical Company

- Covestro AG

- Daicel Corporation

- DuPont

- DSM

- Eastman Chemical Company

- Evonik Industries AG

- INEOS AG

- LANXESS

- LG Chem

- LyondellBasell Industries Holdings BV(incl. A. Schulman Inc.)

- Mitsubishi Engineering-Plastics Corporation

- Polyplastics Co. Ltd

- SABIC

- Solvay

- TEIJIN LIMITED

第7章 市場機會與未來趨勢

- 生物基產品越來越受歡迎

The Thermoplastics Market is expected to register a CAGR of greater than 6% during the forecast period.

The COVID-19 outbreak caused worldwide lockdown, disruption in manufacturing activity and supply networks, and production halts, all of which harmed the market in 2020. However, conditions began to improve in 2021, resuming the market's growth trajectory throughout the projection period.

Key Highlights

- The expanding capacity additions in downstream processing and the growing consumer goods and electronic sectors are projected to benefit the market under consideration.

- However, environmental concerns related to thermoplastics are expected to hinder the market's growth.

- The growing popularity of bio-based products is expected to act as an opportunity for the market.

- The Asia-Pacific region is expected to dominate the market and will likely witness the highest CAGR during the forecast period.

Thermoplastic Market Trends

Increasing Demand from Automotive and Transportation

- Thermoplastics are widely employed in a variety of automotive and transportation applications. Automobile airbags, under-the-hood uses, and automotive electrical and electronics are some engineering plastics applications.

- The growing demand for lightweight materials in the automotive industry to improve the economy and provide design flexibility is driving the thermoplastics market's expansion.

- After a difficult COVID era, the automobile sector began to see a resurgence in investments and production, particularly in Asia-Pacific countries such as China, India, Indonesia, and Malaysia.

- The International Energy Agency, in its global EV Outlook of 2022, also stated that there had been an exponential increase in the sales of electric vehicles. The sales of electric vehicles (EVs) doubled in 2021 from the previous year to a new record of 6.6 million units. Sales of electric cars have kept rising strongly in 2022 as well, with 2 million units sold in the first quarter, up 75% from the same period in 2021.

- According to the China Association of Automobile Manufacturers, China saw an increase in automotive production in the country of around 3.4% in the year 2022 compared to the previous year. Around 27 million units of automobiles were produced in the year 2022 as compared to 26.08 million units produced in 2021.

- North America is witnessing a huge demand for lightweight automobiles, driven by the growing consumer preference for high-quality, fuel-efficient automobiles. Therefore, the region's utilization of engineering plastics for manufacturing automobiles is rapidly increasing.

- Furthermore, the presence of automotive giants in the European region and massive investments in the automotive R&D industry by European firms and governments are fueling the region's thermoplastics growth.

China to Dominate the Market Growth in Asia-Pacific

- The Asia-Pacific region is expected to dominate the market. China is one of the fastest emerging economies and became one of the world's biggest production houses for automobiles, plastics, electronics, and construction.

- According to the China Association of Automobile Manufacturers, sales of New Energy Vehicles increased by 93.4% in 2022 compared to 2021. The overall sales of new energy cars at the end of 2022 were around 6.8 million, compared to only approximately 3.5 million sales for the entire year in 2021.

- China is experiencing massive growth in its construction sector. According to the National Bureau of Statistics of China, in the fourth quarter of 2022, the construction output in China was valued at approximately CNY 276 billion (~USD 40 billion), a growth of approximately 50% compared to the previous quarter (~USD 27.6 billion).

- According to the National Bureau of Statistics of China, in the first eight months of 2022, the total plastic production in China stood at 53.07 million metric tons, compared to the previous year's 53.32 million metric tons of plastic products for the same period.

- China also proposed its FY 2022 defense budget of around CNY 1.45 trillion (USD 230 billion), a 7.1% year-on-year increase from 2021. Also, by 2025, China's total number of aircraft is expected to reach 5,343, according to the reports issued by the Aviation Industry Development Research Center of China, thus augmenting the market studied.

- Therefore, the demand for thermoplastics from various end-user industries is expected to increase during the forecast period.

Thermoplastic Industry Overview

The thermoplastics market is fragmented, with few players holding the major share in the market. Key players in the thermoplastics market (not in any particular order) include BASF SE, Evonik Industries AG, Solvay, SABIC, and Arkema.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapid Increase in Downstream Processing Capacity Additions

- 4.1.2 Growing Consumer Goods and Eelctronics Industries

- 4.2 Restraints

- 4.2.1 Environmental Concerns Related to thermoplastics

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Commodity Thermoplastics

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Polypropylene (PP)

- 5.1.1.3 Polyvinyl chloride (PVC)

- 5.1.1.4 Polystyrene (PS)

- 5.1.2 Engineering Thermoplastics

- 5.1.2.1 Polyamide (PA)

- 5.1.2.2 Polycarbonates (PC)

- 5.1.2.3 Polymethyl methacrylate (PMMA)

- 5.1.2.4 Polyoxymethylene (POM)

- 5.1.2.5 Polyethylene terephthalate (PET)

- 5.1.2.6 Polybutylene terephthalate (PBT)

- 5.1.2.7 Acrylonitrile Butadiene Styrene (ABS)/Styrene Acrylonitrile (SAN)

- 5.1.3 High-performance Engineering Thermoplastics

- 5.1.3.1 Polyether Ether Ketone (PEEK)

- 5.1.3.2 Liquid Crystal Polymer (LCP)

- 5.1.3.3 Polytetrafluoroethylene (PTFE)

- 5.1.3.4 Polyimide (PI)

- 5.1.4 Other Product Types (PPE, PSU, PEI, PPS, ETFE, PFA, FEP, PBI)

- 5.1.1 Commodity Thermoplastics

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Building and Construction

- 5.2.3 Automotive and Transportation

- 5.2.4 Electrical and Electronics

- 5.2.5 Sports and Leisure

- 5.2.6 Medical

- 5.2.7 Other End-user Industries (Agriculture, Consumer Goods)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M (incl. Dyneon LLC)

- 6.4.2 Arkema

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 BASF SE

- 6.4.5 Celanese Corporation

- 6.4.6 Chevron Phillips Chemical Company

- 6.4.7 Covestro AG

- 6.4.8 Daicel Corporation

- 6.4.9 DuPont

- 6.4.10 DSM

- 6.4.11 Eastman Chemical Company

- 6.4.12 Evonik Industries AG

- 6.4.13 INEOS AG

- 6.4.14 LANXESS

- 6.4.15 LG Chem

- 6.4.16 LyondellBasell Industries Holdings BV (incl. A. Schulman Inc.)

- 6.4.17 Mitsubishi Engineering-Plastics Corporation

- 6.4.18 Polyplastics Co. Ltd

- 6.4.19 SABIC

- 6.4.20 Solvay

- 6.4.21 TEIJIN LIMITED

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Popularity of Bio-based Products