|

市場調查報告書

商品編碼

1640446

歐洲神經型態晶片:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Neuromorphic Chip - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

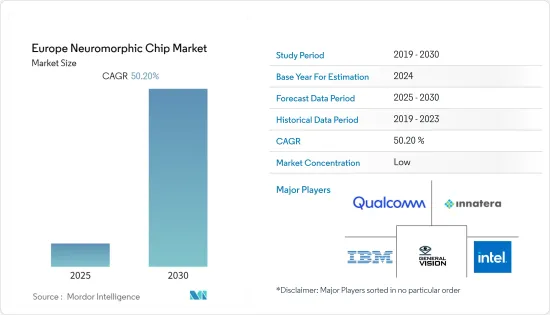

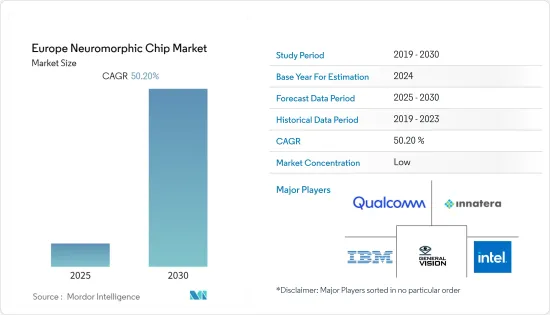

預計預測期內歐洲神經型態晶片市場複合年成長率將達到 50.2%。

主要亮點

- 隨著智慧技術的出現,智慧感測器被應用於許多終端消費產業,包括汽車、電子和醫療。儘管在研發方面投入了大量資金並且硬體設計的複雜性不斷增加,但神經型態晶片市場的成長仍然受到發展速度緩慢的阻礙。

- 神經型態晶片可部署於該地區的廣泛終端客戶,包括醫療、海軍和國防領域。目前的深度掌握策略和相關硬體面臨許多障礙,包括莫耳定律的經濟性。

- 同時,市場需要增加即時語音辨識和翻譯性能、即時視訊理解以及機器人和汽車的即時視圖。一些程式需要結合感知和計算的額外智慧。

- 此外,生物識別和語音辨識的使用日益增多也推動了智慧型手機對神經型態晶片的需求。這些晶片用於處理雲端的語音資料並將其發送回行動電話。此外,人工智慧(AI)需要更多的運算能力。不過,低能耗神經形態運算可以顯著促進目前駐留在雲端的應用程式未來直接在智慧型手機上運行,而不會顯著消耗智慧型手機的電池。

- 推動神經型態應用的一些突出特點包括低功耗、機率計算、模式識別、容錯、更快的計算和可擴展性。在晶片上模擬神經元應該可以改善流程並使商業決策更具成本效益和可靠性。

- 新冠肺炎疫情在全球爆發,造成了前所未有的局面,造成大量人員死亡,並有社區蔓延的風險。這使得採取緊急措施變得必要,即透過各種醫學上已證實的方法,如胸部電腦斷層掃描(CT)和胸部X光,儘早發現疾病,並防止病毒在全部區域傳播。開發深度學習模型來分析這些放射影像是基於電腦的醫學影像分析中的一種眾所周知的技術。此外,隨著各國解除限制、經濟恢復正常,市場也正在獲得動力。預測期內,神經型態晶片的需求預計會大幅成長。

歐洲神經型態晶片市場趨勢

基於人工智慧的晶片有望推動市場成長

- 人工智慧(AI)正在吸引各大企業的巨額投資,晶片市場的興趣和關注度日益提升。許多應用程式已經被最終用戶採用,並且預計不久的將來還會出現許多新興應用程式。

- 人工智慧加速器在超越CPU運算極限的領域中佔據領先地位。可用的 AI 加速器包括 GPU、專用積體電路 (ASIC) 和現場可程式閘陣列 (FPGA)。 GPU擁有大量平行處理核心,在處理AI訓練和推理方面具有顯著優勢。

- 神經型態晶片在並行性、能源效率和性能方面有望成為一個引人注目的選擇。這些晶片可以即時處理AI推理和訓練。此外,還可以透過神經型態晶片進行邊緣訓練。但該學習方法的準確性仍有待提升。

- 隨著感測、運算和記憶領域的追求和需求的融合,神經形態硬體正走出實驗室。已經建立了合資企業並啟動了為期10年的研究任務,其中包括歐盟的「人腦」。

- 神經形態認知和運算可以解決人工智慧目前面臨的許多問題,同時也為未來幾十年開闢新的應用。憑藉其研究和創新生態系統,歐洲有能力發展其科學文化並利用技術機會。

英國神經型態晶片將創下成長紀錄

- 由於政府計劃和供應商的投資,歐洲,特別是英國的神經型態晶片預計也將成長。幾個長期研究計劃正在邀請合作來推進神經型態技術。此外,義大利、德國、法國、葡萄牙等國家也正致力於提升神經型態晶片在各個業務領域的成長。

- 此外,由歐盟研究與創新計畫H2020資助的NeuronN研究計劃,以「節能的仿生設備加速實現類腦運算」為核心主題,匯集了歐洲知名研究和學術機構。計劃預計工期36個月(2020年1月至2022年12月)。

- 該地區的本地供應商也正致力於透過市場上各類創業投資的資金籌措來開發神經型態晶片。預計此類投資將在技術創新方面塑造市場。

- 此外,英國曼徹斯特大學的先進處理器技術小組正在研發一款名為 SpiNNaker 的低階超級電腦。它代表脈衝神經網路架構。這可以刺激所謂的皮質微電路,進而刺激人類的精神皮層並有助於識別老年失智症症等複雜疾病。

- Chip AI 和英國思克萊德大學的一項研究發現,在當今資料主導的社會中,處理大量資料的能力至關重要。模式辨識和影像分類等重要任務非常適合人工神經網路 (ANN)。它受到旨在物理實現大腦和 ANN 的神經形態計算方法的啟發。

歐洲神經型態晶片產業概況

歐洲神經型態市場較分散,主要企業包括: Brain Corporation、英特爾公司、高通、IBM Corporation、General Vision Inc.、洛克希德馬丁公司、Innatera Nanosystems BV 等。研究下列的。

- 2022 年 4 月 - BrainChipHoldings Ltd 和 nViso SA 宣布合作,以滿足機器人、移動/汽車領域對超低功耗技術高水準 AI 性能的需求。第一階段,NVISO 針對社群機器人和車載監控系統的 AI 解決方案將在 BrainChip 的 AkidaTM 處理器上實現。

- 2022 年 3 月 - Brainchip 是一家超低功耗神經形態 AI 晶片和 IP 的商業製造商,該公司正在最佳化整個歐洲的本地市場銷售,以擴大其 Akidaneuromorphic 運算平台的商業性覆蓋範圍。該公司宣布已收購SalesLink ,一家歐洲技術解決方案提供商。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

- 超級電腦處理技術簡介

第5章 市場動態

- 市場促進因素

- 人工智慧的發展

- 積體電路小型化

- 提高感測器性能

- 市場限制

- 儘管在研發上投入了大量資金,但應用開發的速度卻很慢

- 硬體設計複雜性

第6章 市場細分

- 按應用

- 影像識別

- 訊號處理

- 資料處理

- 其他

- 按最終用戶

- 航太和國防

- 汽車與運輸

- 工業自動化

- 衛生保健

- 消費品產業

- 其他

- 按國家

- 英國

- 德國

- 法國

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Intel Corporation

- Qualcomm Technologies, Inc.

- IBM Corporation

- Samsung

- HRL Laboratories

- General Vision, Inc.

- Lockheed Martin Corporation

- Innatera Nanosystems BV

- Brain Corporation

- Vicarious FPC Inc.

第8章投資分析

第9章 市場機會與未來趨勢

簡介目錄

Product Code: 53052

The Europe Neuromorphic Chip Market is expected to register a CAGR of 50.2% during the forecast period.

Key Highlights

- With the appearance of intelligent technology, smart sensors are getting used in many end-consumer industries like automotive, electronics, and medical. The increase of the neuromorphic chip marketplace is hindered because of the gradual tempo of development, notwithstanding heavy R&D investments and rising complexities of hardware design.

- Implementing neuromorphic chips throughout extensive end-customers, including medical, navy, protection, etc., is possible in this region. Current deep-mastering strategies and related hardware face numerous hurdles, including the economics of Moore's Law, which makes it appreciably hard for a start to compete withinside the AI space, restricting competition.

- Meanwhile, the market needs extra real-time speech popularity and translation performance, real-time video understanding, and real-time view for robots and cars. Several programs require additional intelligence that mixes sensing and computing.

- Moreover, the increasing use of biometrics and in-speech recognition drives the demand for neuromorphic chips in smartphones. These chips are used to process audio data in the cloud and then return it to the phone. Additionally, Artificial Intelligence (AI) requires more computing power. Still, low-energy neuromorphic computing could significantly push applications presently in the cloud to run directly in the smartphone in the future without substantially draining the phone battery.

- The prominent features driving the adoption of neuromorphic chipsets include low power consumption, stochastic operations, pattern recognition, fault tolerance, faster computation, and scalability. Emulating neurons on a chip should improve processes and make business decisions cost-effective and reliable.

- The outbreak of COVID-19 has created unprecedented circumstances resulting in many deaths and risk of community spreading throughout the world. This created a need for desperate measures to detect the disease at an early stage via various medically proven methods like chest computed tomography (CT) scan, chest X-Ray, etc., to prevent the virus from spreading across the community. Developing deep learning models for analyzing these radiological images is a well-known methodology in computer-based medical image analysis. Further, the market has gained traction as the countries are removing restrictions and things are returning to normal. The demand for neuromorphic chips is anticipated to grow significantly over the forecasted period.

Europe Neuromorphic Chip Market Trends

AI-based Chips are Expected to Drive the Market Growth

- Artificial Intelligence (AI) is witnessing significant corporate investment, and the chips market is receiving increasing interest and attention. End-users have already adopted many applications, and numerous emerging applications are expected to happen in the short term.

- AI accelerators are leading the region because of the computing limitations of CPUs. Available AI accelerators are GPUs, Application-Specific Integrated Circuits (ASICs), and Field-Programmable Gate Arrays (FPGAs). GPUs have many parallel processing cores, which gives them a significant advantage for processing AI training and inference.

- Neuromorphic chips are poised to be the prominent option concerning parallelism, energy efficiency, and performance. They can handle both AI inference and training in real time. Moreover, edge training is possible through neuromorphic chips. However, learning methodologies should improve their accuracy.

- Neuromorphic hardware is transferring out of the studies lab with a convergence of pursuits and desires from the sensing, computing, and reminiscence fields. Joint ventures are being formed, and decade-length investigation tasks, including the European Union's Human Brain, are being launched.

- Neuromorphic recognition and computation can solve many of AI's current problems while opening up new applications for decades. With an ecosystem of research and innovation, Europe is well-positioned to advance a culture of science and capitalize on technological opportunities.

United Kingdom to record growth in Neuromorphic Chips

- The European region, mainly the United Kingdom, is also expected to witness growth in neuromorphic chips due to government projects, investments from vendors, etc. Several long-term research projects are attracting collaborations for advancements in neuromorphic technology. Also, Italy, Germany, France, Portugal, and other countries are focusing on improving the growth of neuromorphic chips in various business areas.

- Also, the NeurONN research project funded by H2020's EU research and innovation program with a core subject, "Energy-efficient bio-inspired devices accelerate the route to brain-like computing," brought together some prominent European research and academic institutions. The project is planned for 36 months (January 2020 - December 2022).

- Local vendors in the region also focus on developing neuromorphic chips through funding from various venture capitalists in the market. Such investments are expected to shape the market in terms of innovation.

- Further, the United Kingdom's Advanced Processor Technologies Group at the University of Manchester runs on a low-grade supercomputer called SpiNNaker. It stands for Spiking Neural Network Architecture. It is assumed to stimulate so-called cortical microcircuits, subsequently the human mind cortex, and assist us in recognizing complicated illnesses like Alzheimer's.

- A study by Chip AI and Strathclyde University in the United Kingdom found that the ability to process large amounts of data in today's data-driven world is critical. Critical tasks such as pattern recognition and image classification are well suited for artificial neural networks (ANN). They are inspired by neuromorphic computing approaches that target the physical implementation of brains and ANNs.

Europe Neuromorphic Chip Industry Overview

The Europe neuromorphic Chip Market is moderately fragmented, with key players such as Brain Corporation, Intel Corporation, Qualcomm, IBM Corporation, General Vision Inc., Lockheed Martin Corporation, Innatera Nanosystems BV, and more. These companies are investing and innovating new products to expand the market in various applications.

- April 2022 - BrainChipHoldings Ltd and nViso SA announced a collaboration to address the need for high levels of AI performance with ultra-low power technologies in robotics and mobility/automotive. The first step will be implementing NVISO's AI solutions for Social Robots and In-cabin Monitoring Systems on BrainChip's AkidaTMprocessors.

- March 2022 - Brainchip, a company involved in the commercial production of ultra-low power neuromorphic AI chips and IP, announced that it has SalesLink, a European technology solutions provider, to optimize local market sales throughout the region to expand the commercial reach of its Akidaneuromorphic computing platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

- 4.5 Super Computer Processing Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Development of Artificial Intelligence

- 5.1.2 Miniaturization of Ics

- 5.1.3 Growth in Demand for Smarter Sensors

- 5.2 Market Restraints

- 5.2.1 Slow Pace in Development of Applications Despite Heavy investments in R&D

- 5.2.2 Commplexities in Hardware Designing

6 MARKET SEGMENTATION

- 6.1 Application

- 6.1.1 Image Recognition

- 6.1.2 Signal Processing

- 6.1.3 Data Processing

- 6.1.4 Others

- 6.2 End-User

- 6.2.1 Aerospace and Defence

- 6.2.2 Automotive and Transportation

- 6.2.3 Industrial Automation

- 6.2.4 Health Care

- 6.2.5 Consumer Industry

- 6.2.6 Others

- 6.3 Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Qualcomm Technologies, Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Samsung

- 7.1.5 HRL Laboratories

- 7.1.6 General Vision, Inc.

- 7.1.7 Lockheed Martin Corporation

- 7.1.8 Innatera Nanosystems B.V.

- 7.1.9 Brain Corporation

- 7.1.10 Vicarious FPC Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219