|

市場調查報告書

商品編碼

1640465

氯化鐵:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Ferric Chloride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

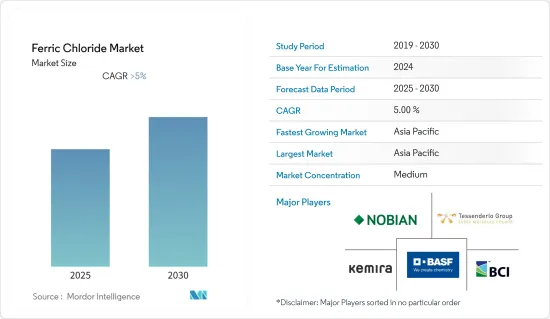

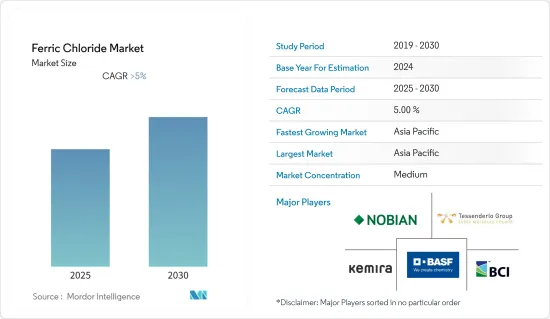

預測期內,氯化鐵市場預計將以超過 5% 的複合年成長率成長

COVID-19 對市場產生了負面影響。全球各國停工停產導致的供應鏈限制嚴重阻礙了該產業的擴張。然而,去年市場已經復甦,預計未來幾年將大幅成長。

關鍵亮點

- 短期內,污水處理廠的高需求以及為控制污染而不斷加強的污水和工業廢棄物處理法規可能會推動市場成長。

- 另一方面,對企業生產和運輸氯化鐵產品的嚴格規定以及替代產品的存在可能會阻礙市場成長。

- 尚未開發的催化應用市場預計將為市場提供機會。

- 由於中國、印度和日本等國家的供水和用水和污水處理廠數量不斷增加,亞太地區很可能在預測期內佔據市場主導地位。

氯化鐵市場趨勢

印刷基板(PCB) 的使用日益增多

- 許多電子產品都使用印刷基板(PCB)。優質的 PCB 製造技術使電子製造商能夠生產出更小、更複雜的產品。它被認為是當今充滿活力且快速發展的電子創新的關鍵。

- 三氯化鐵(FeCl3)廣泛用於印刷電路基板製造中的蝕刻製程。印刷基板用於製造電子電路。全球經濟正在經歷嚴峻的技術發展,進一步增加了對 PCB 的需求。

- 聯網汽車中 PCB 的採用也加速了 PCB 市場的發展。如今的汽車配備了有線和無線技術,可以輕鬆連接到智慧型手機。

- 目前,台灣是PCB產業領先的國家之一。根據台北印刷電路協會(TPCA)統計,台灣印刷基板產業約佔全球33.9%的市場佔有率。

- 此外,台灣的印刷電路基板(PCB)產業以金額計算是世界上最大的。根據台灣經濟部統計局統計,2021年台灣印刷基板(PCB)總產值為161.8兆新台幣(約57.666億美元),較2020年成長4.84%。

- 根據印度蜂窩與電子協會預測,2022年印度印刷基板組裝(PCBA)市場規模將達240億美元,預計2026年將達到880億美元。

- 此外,智慧型手機、個人電腦、平板電腦和其他醫療用電子設備產品等消費性電子產品的需求在全球範圍內迅速成長,這些產品都意味著使用印刷基板(PCB),其中美國、德國、英國預計印度、中國和日本仍將佔據市場領先地位。

中國主宰亞太地區

- 中國是亞太地區領先的經濟體,也是世界上工業部門最多的地區。由於供水和用水和污水處理以及印刷基板(PCB)等領域對三氯化鐵的需求龐大,預計該國將在全球三氯化鐵市場中佔據主導地位。

- 隨著我國工業領域經濟發展的擴大,污水的產生量也日益增加。全國約有10,113座水處理廠,處理95%城市和30%農村地區的污水。

- 此外,中國計劃在2021年至2025年期間新建或維修8萬公里污水收集管網,增加污水處理能力2,000萬立方公尺/日。

- 根據國際貿易局預測,2025年,中國工業污水市場規模將達194億美元。作為新興經濟體向更清潔、更永續的經濟轉型的發展策略的一部分,中國計劃向各類重污染產業投資 500 億美元,以抑制這些產業的污水產生。

- 中國政府推出了防治水、土壤污染的工作計劃,並加強了對違反標準的處罰。

- 「十三五」規劃公佈後,中國政府啟動了《水污染防治行動計畫》,主要針對造成水污染的工業,對三氯化鐵等污水處理化學品的需求巨大。

- 此外,中國是世界領先的印刷電路基板製造國。中國當地存在大量中低階單層、雙層及多層PCB產品,市場需求尚不確定。

- 根據業內估計,全球市場有超過2,500家PCB製造商,光是中國當地就佔全球PCB製造商的1,200多家。

氯化鐵行業概況

氯化鐵市場部分分割,少數參與企業佔主要佔有率。全球氯化鐵市場的主要企業包括BASF SE、Basic Chemical Industries、Tessenderlo Group、Novian、Kemira 等(不分先後順序)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 污水處理廠需求旺盛

- 為控制污染,對污水和工業廢棄物的處理標準越來越嚴格

- 限制因素

- 對企業生產和運輸氯化鐵產品時實施嚴格監管

- 存在替代產品

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 應用

- 用水和污水處理

- 印刷基板(PCB)

- 顏料製造

- 動物營養補充品

- 瀝青噴灑

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 西班牙

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- Basic Chemical Industries

- Chemifloc LTD

- CHIMI ART

- SEQUENS

- Feralco AB

- HORIZON CHEMICALS

- Kemira

- MALAY-SINO CHEMICAL INDUSTRIES SDN. BHD.

- MISR Chemical Industries

- Nobian

- PVS Technologies, Inc.

- Saf Sulphur Factory

- SIDRA WASSERCHEMIE GmbH

- Tessenderlo Group

第7章 市場機會與未來趨勢

- 尚未開發的催化應用市場

The Ferric Chloride Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 negatively impacted the market. Owing to lockdowns in various countries worldwide, supply chain constraints significantly obstructed the industry's expansion. However, the market recovered last year, and it is expected to grow at a significant rate in the coming years.

Key Highlights

- Over the short term, high demand from wastewater treatment plants and increasing stringent norms for treating sewage water and industrial waste to curtail pollution are likely to drive the market's growth.

- On the flip side, stringent regulations imposed on companies during the manufacturing and shipment of ferric chloride products and the presence of substitute products are likely to hinder the market's growth.

- Nevertheless, an untapped market for its application as a catalyst is expected to act as an opportunity for the market.

- Asia Pacific is likely to dominate the market over the forecast period owing to increasing water and wastewater treatment plants in the countries such as China, India, and Japan.

Ferric Chloride Market Trends

Increasing Applications in the Printed Circuit Board (PCB)

- Most electronics products use printed circuit boards (PCBs). High-quality PCB manufacturing technology has allowed electronics product manufacturers to produce smaller and more complex products. It is considered the key to today's dynamic and rapidly progressing electronic innovations.

- Ferric chloride (FeCl3) is widely used in manufacturing printed circuit boards for the etching process. PCBs are used for making electronic circuits. The global economy is rigorously experiencing technological developments, further increasing the demand for PCBs.

- The adoption of PCBs in connected vehicles has also accelerated the market for PCBs, as vehicles are nowadays equipped with both wire and wireless technologies, which enables vehicles to connect with smartphones easily.

- Currently, Taiwan is one of the leading countries in the PCB industry. According to Taipei Printed Circuit Association (TPCA), Taiwan's Printed Circuit Board industry accounts for around 33.9% market share in the global market,

- Moreover, Taiwan's printed circuit board (PCB) industry is the largest in the world in terms of value. As per the Department of Statistics, Ministry of Economic Affairs of Taiwan, the total production value of printed circuit boards (PCBs) in 2021 in the country amounted to TWD 161.08 trillion (~USD 5,766.60 million) observed an increase of 4.84% as compared to the year 2020.

- In India, as per India Cellular & Electronics Association, the printed circuit board assembly (PCBA) market size in India was estimated at USD 24 billion in 2022 and is expected to reach USD 88 billion by the year 2026.

- Additionally, the demand for consumer gadgets which implies the usage of printed circuit board (PCBs), such as smartphones, PCs, tablets, and other medical electronics products, is rapidly increasing across the world, with the United States, Germany, the United Kingdom, India, China, and Japan expected to remain at the top of the market.

China to Dominate the Asia-Pacific Region

- China is a major economy in the Asia-Pacific, with the highest number of industries in the world. The country is expected to dominate the global market for ferric chloride due to the major demand from applications such as water and wastewater treatment and printed circuit boards (PCB).

- With the growing economic development in the industrial sector of China, there has been an increase in wastewater generation. The country has around 10,113 water treatment plants that treat wastewater for 95% of municipalities and 30% of rural areas.

- Moreover, China plans to build or renovate 80,000 km of sewage collection pipeline networks and increase sewage treatment capacity by 20 million cubic meters/day between 2021-2025.

- As per the International Trade Administration, the industrial wastewater market in China is expected to reach USD 19.4 billion by 2025. As part of the country's development strategy to transform into a cleaner and more sustainable economy, China planned to invest USD 50 billion into various heavy-polluting industries to control the wastewater generation from these industries.

- The Chinese government introduced water and soil pollution prevention and control work plans and increased the penalties for violation of the norms.

- After the declaration of the 13th Five Year Plan, the Chinese government initiated the Water Pollution Prevention and Control action plan, which primarily focuses on preventing industries from causing water contamination and has created a significant demand for wastewater treatment chemicals such as ferric chloride in the country.

- Additionally, China is the major manufacturer of printed circuit boards in the world. There are a large number of medium and low-order, single-, double-, or multi-layer PCB products with undefined market demand in mainland China.

- According to industry estimates, there are more than 2,500 PCB manufacturers in the global market, with mainland China itself accounting for more than 1,200 PCB manufacturers in the world.

Ferric Chloride Industry Overview

The ferric chloride market is partially fragmented, with few players holding the major share in the market. The leading players in the global ferric chloride market include (not in any particular order); BASF SE, Basic Chemical Industries, Tessenderlo Group, Nobian, and Kemira among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand from Wastewater Treatment Plants

- 4.1.2 Increasing Stringent Norms for the Treatment of Sewage Water and Industrial Waste to Curtail Pollution

- 4.2 Restraints

- 4.2.1 Stringent Regulations Imposed on Companies during the Manufacturing and Shipment of Ferric Chloride Products

- 4.2.2 Presence of Substitutes Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 Application

- 5.1.1 Water and Wastewater Treatment

- 5.1.2 Printed Circuit Board (PCB)

- 5.1.3 Pigment Manufacturing

- 5.1.4 Animal Nutrient Supplements

- 5.1.5 Asphalt Blowing

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 ASEAN Countries

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Russia

- 5.2.3.6 Spain

- 5.2.3.7 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Egypt

- 5.2.5.3 South Africa

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Basic Chemical Industries

- 6.4.3 Chemifloc LTD

- 6.4.4 CHIMI ART

- 6.4.5 SEQUENS

- 6.4.6 Feralco AB

- 6.4.7 HORIZON CHEMICALS

- 6.4.8 Kemira

- 6.4.9 MALAY-SINO CHEMICAL INDUSTRIES SDN. BHD.

- 6.4.10 MISR Chemical Industries

- 6.4.11 Nobian

- 6.4.12 PVS Technologies, Inc.

- 6.4.13 Saf Sulphur Factory

- 6.4.14 SIDRA WASSERCHEMIE GmbH

- 6.4.15 Tessenderlo Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Untapped Market for Application as a Catalyst