|

市場調查報告書

商品編碼

1640471

汽車潤滑油:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

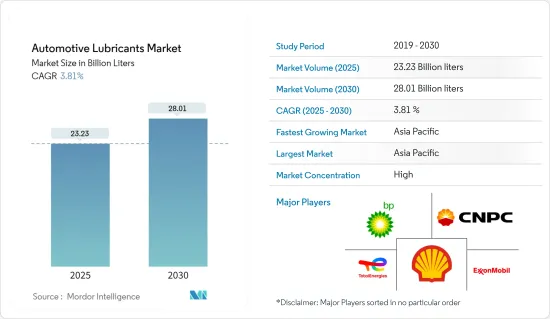

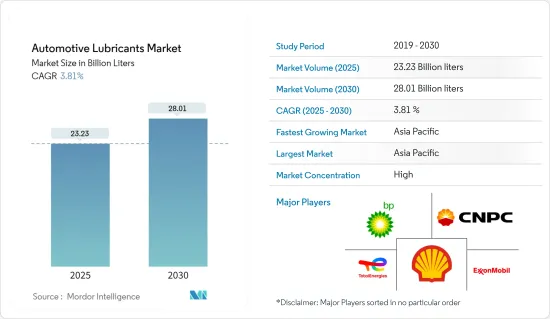

預計 2025 年汽車潤滑油市場規模將達到 232.3 億公升,預計到 2030 年將達到 280.1 億公升,預測期內(2025-2030 年)複合年成長率為 3.81%。

2020 年,COVID-19 疫情爆發導致全國範圍內實施封鎖、製造活動和供應鏈中斷以及全球生產停頓,對市場產生了負面影響。不過2021年情況有所好轉,市場恢復了成長軌跡。

關鍵亮點

- 短期內,二手車的大量流行以及汽車產量的增加是推動被調查市場需求的關鍵因素。

- 然而,電動車和假冒機油的興起預計將阻礙市場成長。

- 隨著生物潤滑油越來越受到關注,預計該市場將出現新的商機。

- 預計亞太地區將主導全球市場,大部分需求來自中國和印度。

汽車潤滑油市場趨勢

增加引擎油耗

- 機油主要由75-90%的基礎油和10-25%的添加劑組成,在內燃機的潤滑中起著重要作用。

- 這些油對於各種應用都至關重要,包括減少磨損、防止腐蝕和確保引擎部件平穩運行。

- 為了滿足日益成長的機油需求,全球領先的製造商正在透過推出針對特定消費者需求的新型機油來實現產品多樣化。

- 2024 年 4 月,潤滑油行業主要企業Saneg 透過從其義大利工廠推出合成和半合成機油,加強了其在烏茲別克斯坦的業務。具體來說,該公司推出了SEG Motol Diesel 10W-40(API CI-4/SL)機油,專為遠距曳引機、越野車和施工機械等重型柴油機械而設計。

- 2023年9月,埃克森美孚行銷(泰國)有限公司(EMMTL)致力於以創新的產品解決方案服務泰國消費者和商業部門。在汽車應用中,美孚 1 號和美孚超級旨在提供增強的引擎保護。這將對研究市場產生正面影響。

- 新興市場對輕型高性能汽車的需求不斷成長、汽車基數不斷增加以及可支配收入不斷提高是車用潤滑油需求旺盛的關鍵原因。

- 2023年,在強勁的經濟和消費者偏好變化的推動下,汽車產業將經歷顯著成長。根據國際汽車製造商組織(OICA)的資料,2020年全球汽車產量約9,354萬輛,高於2022年的8,483萬輛,成長率約10.26%。

- 德國是歐洲汽車產業的重要參與者,擁有大眾、賓士、奧迪、寶馬和保時捷等知名品牌。隨著研發的持續投入和汽車產量的活性化,中國可望引領汽車潤滑油市場的成長。

- 在歐洲,2023年新車註冊與前一年同期比較增加了18.7%。預計2023年乘用車銷售量將達到1,499萬輛,商用車銷售量將達290萬輛,而2022年分別為1,264萬輛及244萬輛。

- 鑑於這些動態,未來幾年市場將大幅成長。

亞太地區可望主導市場

- 亞太地區的快速工業化正在推動市場成長。該地區的汽車產業正在快速成長,對潤滑油的需求預計將增加。

- 此外,汽車產業越來越依賴潤滑油來實現最佳性能,預計這一趨勢將進一步加強市場。預計亞太地區將佔相當大的市場佔有率,主要受中國、馬來西亞、印度、泰國、印尼和斯里蘭卡等新興市場的消費所推動。

- 中國在潤滑油消費量和生產量方面都是全球強國。影響中國潤滑油格局的主要參與企業包括殼牌公司、中國石化、埃克森美孚公司和英國石油公司。預測期內,該產業的成長主要得益於投資活性化和擴張。

- 隨著汽車持有快速成長和技術進步的推動,中國汽車產業已成為車用潤滑油的最大消費產業。中國工業協會預計,2023年中國汽車產銷量將雙雙突破3,000萬輛,較上年實現顯著兩位數成長。

- 此外,中汽協資料顯示,2023年中國商用車將強勁復甦,銷量將成長22.1%至403萬輛,產量將成長26.8%至404萬輛。汽車銷售和產量的激增直接增加了潤滑油的需求。

- 2023年,受可支配收入增加、新型運動型多功能車蓬勃發展以及貸款利率誘人的推動,印度的乘用車銷量將首次突破400萬輛大關。根據印度汽車工業協會 (SIAM) 的數據,國內市場乘用車、轎車和多用途車銷量超過 410 萬輛,較 2022 年的 379 萬輛成長 8.2%。其中,多功能車銷量佔總銷售量的57.4%。

- 2023年,日本新乘用車註冊量將大幅增加,達到約399萬輛,較上年的345萬輛有大幅成長。日本全國新車註冊量約478萬輛,其中乘用車註冊量排名第一。

- 這些因素加上有利的政府法規,正在推動整個全部區域對汽車潤滑油的需求。

汽車潤滑油產業概況

汽車潤滑油市場部分整合。主要企業(不分先後順序)包括殼牌公司、中國石油化學集團公司、英國石油公司、埃克森美孚、道達爾能源公司等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 二手車流行導致潤滑油需求增加

- 由於汽車製造增加導致潤滑油消耗增加

- 其他促進因素

- 限制因素

- 電動車日益普及

- 假冒引擎油

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 產品類型

- 機油

- 變速箱/齒輪油

- 油壓

- 潤滑脂

- 汽車模型

- 搭乘用車

- 商用車

- 摩托車

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AMSOIL INC.

- Bharat Petroleum Corporation Limited

- BP plc

- Chevron Corporation

- China National Petroleum Corporation(CNPC)

- China Petroleum & Chemical Corporation

- ENEOS

- Exxon Mobil Corporation

- FUCHS

- Gazprom Neft PJSC

- Gulf Oil International Ltd

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Ltd

- Lukoil

- Motul

- Petrobras

- PETRONAS Lubricants International

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol

- Shell PLC

- SK Lubricants Co. Ltd

- TotalEnergies

- Valvoline Inc.

- Veedol International Limited

第7章 市場機會與未來趨勢

- 人們對生物潤滑劑的興趣日益濃厚

- 其他機會

The Automotive Lubricants Market size is estimated at 23.23 billion liters in 2025, and is expected to reach 28.01 billion liters by 2030, at a CAGR of 3.81% during the forecast period (2025-2030).

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions recovered in 2021, restoring the market's growth trajectory.

Key Highlights

- Over the short term, the vast penetration of used vehicles and increasing vehicle manufacturing are the major factors driving the demand for the market studied.

- However, the increasing adoption of electric vehicles and counterfeiting of engine oils are expected to hinder the market's growth.

- Nevertheless, the growing prominence of bio-lubricants is expected to create new opportunities for the market studied.

- The Asia-Pacific region is expected to dominate the global market, with the majority of demand coming from China and India.

Automotive Lubricants Market Trends

Increasing Usage of Engine Oils

- Engine oils, primarily composed of 75-90% base oils and 10-25% additives, play a crucial role in lubricating internal combustion engines.

- These oils are essential for various applications, including wear reduction, corrosion protection, and ensuring the smooth operation of engine components.

- In response to the rising demand for engine oils, leading global manufacturers are diversifying their offerings, introducing new engine oils tailored to specific consumer needs.

- In April 2024, Saneg, a key player in the lubricant industry, bolstered its footprint in Uzbekistan by rolling out synthetic and semi-synthetic motor oils from its Italian plant. Specifically, the company unveiled its SEG Motol Diesel 10W-40 (API CI-4/SL) oils, tailored for heavy-duty diesel machinery like long-haul tractors, off-road vehicles, and construction equipment.

- In September 2023, ExxonMobil Marketing (Thailand) Limited (EMMTL) announced its commitment to serve Thai consumers and business sectors with innovative product solutions. For automotive, Mobil 1 and Mobil Super are engineered to raise engine protection performance. This makes a positive impact on the studied market.

- Growing demand for lightweight, high-performance cars in emerging markets, increasing automotive hubs, and rising disposable income are the major reasons for the high demand for automotive lubricants.

- In 2023, buoyed by a strong economy and shifting consumer preferences, the automotive sector witnessed notable growth. Data from the Organisation Internationale des Constructeurs d'Automobiles (OICA) indicates global vehicle production reached approximately 93.54 million units, up from 84.83 million units in 2022, marking a growth rate of about 10.26%.

- Germany, a key player in Europe's automotive landscape, is home to renowned brands like Volkswagen, Mercedes-Benz, Audi, BMW, and Porsche. With ongoing investments in R&D and a boost in automotive production, the country is poised to drive the growth of the automotive lubricants market.

- In Europe, the overall registration of new motor vehicles increased by 18.7% in 2023 compared to the previous year. In 2023, passenger car and commercial vehicle sales reached 14.99 million units and 2.9 million units, respectively, compared to 12.64 million units and 2.44 million units in 2022.

- Given these dynamics, the market is set for significant growth in the coming years.

Asia-Pacific is Expected to Dominate the Market

- Rapid industrialization in the Asia-Pacific region is poised to fuel market growth. The region's burgeoning automotive industry is set to drive an uptick in lubricant demand.

- Furthermore, as the automotive sector increasingly relies on lubricants for optimal performance, this trend is expected to bolster the market further. Asia-Pacific is projected to command a significant market share, predominantly driven by consumption in developing nations like China, Malaysia, India, Thailand, Indonesia, and Sri Lanka.

- China stands out as a global powerhouse, both in lubricant consumption and production. Major players shaping China's lubricant landscape include Shell Plc, Sinopec, ExxonMobil Corporation, and BP Plc. The sector's growth was bolstered by heightened investments and expansions throughout the forecast period.

- China's automotive sector, driven by a burgeoning vehicle fleet and tech advancements, emerges as the top automotive lubricant consumer. 2023 saw both sales and production of automobiles in China hit a record 30 million units, marking a notable double-digit growth from the prior year, as highlighted by the China Association of Automobile Manufacturers (CAAM).

- Moreover, 2023 marked a significant rebound for China's commercial vehicles, with sales and production jumping 22.1% and 26.8%, respectively, reaching 4.03 million and 4.04 million units, according to CAAM data. This surge in automotive sales and production directly amplifies the demand for lubricants.

- In 2023, India's passenger vehicle sales surpassed the 4 million milestone for the first time, fueled by rising disposable incomes, a boom in new sport-utility vehicles, and attractive loan rates. The domestic market reported sales exceeding 4.1 million cars, sedans, and utility vehicles, marking an 8.2% increase from 2022's 3.79 million, as per the Society of Indian Automobile Manufacturers (SIAM). Notably, utility vehicles made up 57.4% of total sales.

- In 2023, Japan saw a notable uptick in new passenger car registrations, hitting approximately 3.99 million-a significant rise from the 3.45 million recorded in the previous year. Overall, the country registered about 4.78 million new motor vehicles, with passenger cars leading the charge.

- These factors, coupled with favorable government regulations, are driving the heightened demand for automotive lubricants across the region.

Automotive Lubricants Industry Overview

The automotive lubricants market is partially consolidated in nature. The major players (not in any particular order) include Shell PLC, China Petrochemical National Corporation, BP p.l.c., Exxon Mobil Corporation, and TotalEnergies, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Vast Penetration Of Used Vehicles Increasing Lubricant Demand

- 4.1.2 Increase in Vehicle Manufacturing Bolstering Lubricant Consumption

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Adoption of Electric Vehicles

- 4.2.2 Counterfeiting of Engine Oils

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Engine Oil

- 5.1.2 Transmission and Gear Oils

- 5.1.3 Hydraulic Fluids

- 5.1.4 Greases

- 5.2 Vehicle Type

- 5.2.1 Passenger Vehicles

- 5.2.2 Commercial Vehicles

- 5.2.3 Motorcycles

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMSOIL INC.

- 6.4.2 Bharat Petroleum Corporation Limited

- 6.4.3 BP p.l.c.

- 6.4.4 Chevron Corporation

- 6.4.5 China National Petroleum Corporation (CNPC)

- 6.4.6 China Petroleum & Chemical Corporation

- 6.4.7 ENEOS

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 FUCHS

- 6.4.10 Gazprom Neft PJSC

- 6.4.11 Gulf Oil International Ltd

- 6.4.12 Hindustan Petroleum Corporation Limited

- 6.4.13 Indian Oil Corporation Ltd

- 6.4.14 Lukoil

- 6.4.15 Motul

- 6.4.16 Petrobras

- 6.4.17 PETRONAS Lubricants International

- 6.4.18 Phillips 66 Company

- 6.4.19 PT Pertamina Lubricants

- 6.4.20 Repsol

- 6.4.21 Shell PLC

- 6.4.22 SK Lubricants Co. Ltd

- 6.4.23 TotalEnergies

- 6.4.24 Valvoline Inc.

- 6.4.25 Veedol International Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Prominence for Bio Lubricants

- 7.2 Other Opportunities