|

市場調查報告書

商品編碼

1640495

歐洲安全測試:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Security Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

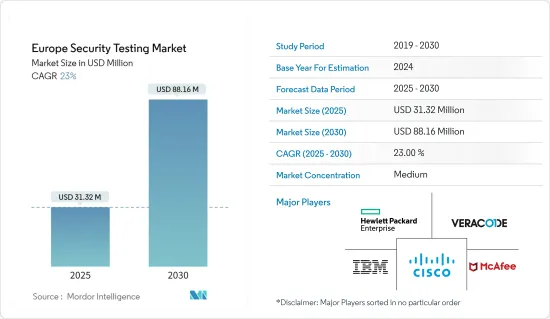

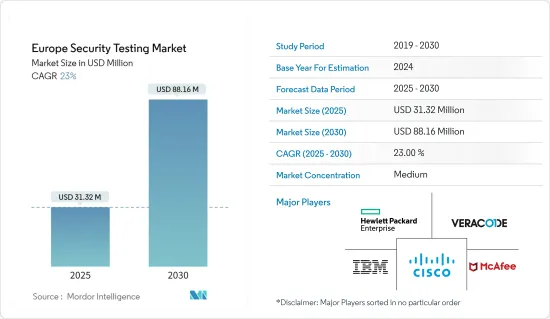

預計 2025 年歐洲安全測試市場規模為 3,132 萬美元,到 2030 年將達到 8,816 萬美元,預測期內(2025-2030 年)的複合年成長率為 23%。

主要亮點

- 針對歐洲公司和政府的大量網路攻擊將推動未來幾年市場成長。

- 販毒集團利用駭客對港口和公司網站進行網路攻擊,以進行跨國販毒。駭客找到您系統上安裝的軟體中的漏洞,並從網路中竊取機密資訊。歐洲網路和資訊安全局已針對政府部門、能源公司、電信業者、安全機構、網路服務供應商和金融機構發動了 2,000 多起網路攻擊。安全系統幫助企業和政府保護其在網路中使用的軟體。網路駭客攻擊會對公司的營運造成嚴重破壞,並導致客戶資訊外洩。

- 應用程式對敏感網路發起的網路安全攻擊和駭客攻擊日益增多,暴露出應用程式在開發和部署時並不明顯的漏洞和威脅。此類駭客攻擊可能會嚴重擾亂您的業務並洩露機密的客戶和內部資訊。為此,世界各國政府都推出了嚴格的法規,確保企業遵守準則並確保敏感資料的安全。

- 安全測試驗證網路上的系統和應用程式是否安全。動態應用程式安全測試 (DASS) 的發展已不僅限於後端 Web 應用程式安全測試,它還為安全測試市場開闢了新的途徑。我們現在有能力測試次世代應用程式。一些測試提供者提供更詳細的資訊,能夠實現靜態和動態安全測試技術的交互,以便向開發人員提供更有意義的結果,這在 QA 測試中非常有用。

歐洲安全測試市場趨勢

穿透測試測試工具部分預計將顯著成長。

- 全球範圍內發生的多起網路攻擊增加了企業和政府對網路安全的重視。這就是為什麼企業現在比以往任何時候都更需要優先考慮安全性,並採取包含穿透測試提供的多種主動策略。

- 雲端基礎的滲透測試,也稱為滲透測試即服務 (PTaaS),是網路安全產業的發展趨勢。 PTaaS 為 IT 專業人員提供執行和進行滲透測試所需的資源。這項服務涉及持續的測試和補救週期。這表明需要持續進行測試和管理計劃來應對組織不斷變化的安全立場。該服務確保持續的安全管理和頻繁的漏洞掃描。此外,該服務的自動變更追蹤功能可確保應用程式安全改進的可追溯性。

- 隨著遠距工作的概念變得越來越普及,企業發現自己比以往任何時候都更加脆弱。因此,網路攻擊者利用這個機會攻擊全球成千上萬的企業和個人。 2020 年網路犯罪率大幅上升,預計還會持續上升。

- 現在,定期進行漏洞掃描和滲透測試以避免漏洞並確保您的組織免受網路攻擊比以往任何時候都更加重要。滲透測試可能有助於加強網路防禦,同時保障企業安全。

英國可望佔據主要市場佔有率

- 英國是歐洲資料外洩的主要地點之一。據 IBM 稱,英國事故平均成本上漲 8%,達到 336 萬英鎊。同時,每張唱片的平均成本為 131 英鎊,其中服務業唱片的成本最高,為 191 英鎊。

- 資料外洩最常見的原因之一是用戶憑證被盜,而洩漏的最常見資訊是個人客戶資訊。在緩解因素方面,採用人工智慧、安全分析和加密是降低違規平均成本的三大最重要的緩解因素。

- 此外,由於新冠疫情,許多人選擇在家辦公,家庭安全措施不佳也為犯罪分子提供了新的攻擊和洩露資料的方法。 2020年11月,英國政府成立國家網路部隊(NCF),以應對日益嚴重的網路犯罪和資料外洩問題。

- 英國政府對1,419家英國企業和487家慈善機構進行的安全漏洞調查發現,44%的受訪企業表示,如果遇到網路安全事件,他們會嘗試找出事件的來源。此外,46% 的慈善機構受訪表示,當事件發生時,他們會正式記錄。

歐洲安全測試產業概況

歐洲安全測試市場競爭激烈,參與者眾多。這些公司不斷制定策略並採取各種措施來確立自己的市場地位。因此,各公司都在競爭以獲得更多客戶,從而增加其市場佔有率和收益佔有率。

- 2021 年 1 月-自動穿透測試(APT) 公司 Pcysys 宣布將透過在德國、法國、義大利、伊比利亞和北歐設立辦事處來擴展其歐洲市場。此擴展舉措旨在支援對持續安全檢驗解決方案日益成長的需求。

- 2021 年 2 月-法國網路安全機構 ANSSI 報告了一次針對法國公司 CENTREON 分銷的監控軟體 Centreon 的入侵宣傳活動。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 安全威脅下的安全需求日益增加

- 政府法規推動安全需求

- 市場挑戰

- 安全測試意識

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按配置

- 本地

- 雲

- 混合

- 按類型

- 網路安全測試

- VPN 測試

- 防火牆測試

- 其他服務類型

- 應用程式安全測試

- 應用程式類型

- 行動應用程式安全測試

- Web應用程式安全性測試

- 雲端應用安全測試

- 企業應用安全測試

- 測試類型

- SAST

- DAST

- IAST

- RASP

- 網路安全測試

- 透過測試工具

- Web 應用程式測試工具

- 程式碼審查工具

- 滲透測試工具

- 軟體測試工具

- 其他測試工具

- 按最終用戶產業

- 政府

- BFSI

- 衛生保健

- 製造業

- 資訊科技/通訊

- 零售

- 其他最終用戶產業

- 按國家

- 英國

- 德國

- 法國

- 其他歐洲國家

第6章 競爭格局

- 公司簡介

- Hewlett Packard Enterprise Development LP

- IBM

- VERACODE

- McAfee, LLC

- Cisco Systems, Inc.

- Core Security Technologies

- Offensive Security

- Accenture PLC

- Maveric Systems

- ControlCase, LLC

- Paladion Networks

- Netcraft Ltd

第7章投資分析

第 8 章:市場的未來

簡介目錄

Product Code: 53787

The Europe Security Testing Market size is estimated at USD 31.32 million in 2025, and is expected to reach USD 88.16 million by 2030, at a CAGR of 23% during the forecast period (2025-2030).

Key Highlights

- The market will grow in the coming years as a result of the massive number of cyber-attacks targeting corporations and governments of Europe.

- Drug cartels use hackers for cyber-attacks on the ports and companies' sites to traffic drugs across countries. Hackers are finding loopholes in the software that has been installed in the system to take sensitive information out of the network. European Network and Information Security Agency carry out more than 2000 cyber incidents targeting ministries, energy companies, telecom companies, security agencies, internet service providers, and financial institutions. Security systems help companies and governments secure the software used on the network. The hacks on the networks cause massive disruption in the activities of a company or compromise customer information.

- The increasing number of cyber security attacks and hacks into sensitive networks from applications is exposing the vulnerabilities and threats caused by applications that are not evident during their development and deployment. These hacks can cause severe disruptions to the business or compromise sensitive customer or internal information. This has caused governments worldwide to introduce stringent regulations to ensure companies follow guidelines and ensure the security of sensitive data.

- Security Testing will ensure that the systems and applications on a network it is secure or not. The evolution of Dynamic application security testing beyond the security testing of back-end web applications has opened up new avenues for the security testing market. They now have the capabilities to test next-generation applications. The ability of some of the testing providers to enable interaction between their static and dynamic security testing techniques provides more detailed information, which is quite useful in QA testing in order to provide more meaningful results to developers.

Europe Security Testing Market Trends

Penetration Testing Tools segment is anticipated to register significant growth

- Many cyber-attacks occurring worldwide are escalating the importance of cybersecurity among enterprises and governments. Therefore, companies must prioritize their security more than ever before with several proactive tactics, including those offered by penetration testing.

- The cybersecurity industry is witnessing a growing trend of cloud-based penetration testing, also referred to as penetration testing as a service (PTaaS). It provides IT professionals with the required resources to conduct and act upon penetration testing. This service encompasses a continuous cycle of testing and remediation. It indicates that for combating the changing security stance of an organization, there must be continuous and ongoing testing and management programs. This service ensures ongoing security management and frequent vulnerability scanning. Further, the automatic track changes feature of the service ensures traceability of improvements in the application security.

- The increasing concept of remote working has companies left more vulnerable than ever. Hence, cyber-attackers have used this opportunity to take advantage of thousands of enterprises and people worldwide. In 2020, cybercrime rates rose significantly, and it is very much anticipated that the numbers will continue to rise.

- It is then becoming more crucial than ever to undertake regular vulnerability scans and penetration testing to avoid vulnerabilities and make sure that the organizations are protected against cyberattacks. Penetration testing could help enhance the cyber defenses in place, all the while ensuring the company's safety.

The United Kingdom is expected to hold a significant share in the market

- The United Kingdom is one of the key geographies across Europe where a significant number of data breaches occur. According to IBM, the average cost of an incident in the UK rose by 8% to GBP 3.36 million. The average cost for each record was GBP 131, meanwhile, with the records in the services sector proving the most lucrative, at GBP 191 per record.

- One of the most prevalent causes of breaches is stolen user credentials, with customer personal data the most common type of information exposed. In terms of mitigation factors, the adoption of AI, security analytics, and encryption was among the three most significant mitigating factors that reduced the average cost of a breach.

- The COVID-19 pandemic also enabled the criminals to target data and breach security in new ways due to the lack of security measures at home, as many people work from home. In November 2020, the UK government launched the National Cyber Force (NCF) to counter the increasing issue of cybercrime and data breaches.

- According to a Security Breach Survey by the UK Government comprising 1,419 UK businesses and 487 charities, 44% of business respondents said that they attempt to identify the source of the incident when they experience a cyber security incident. Also, 46% of the respondents from the Charities responded that they formally log the incidents when they occur.

Europe Security Testing Industry Overview

The Europe Security Testing Market is competitive, with various players present in the market. These companies continuously strategize their operations and undertake various initiatives to establish their market presence. As such, various companies are competing to increase their presence and revenue share in the market by acquiring more customers.

- January 2021 - Pcysys, an automated penetration testing (APT) company, announced that the company is expanding in the European market, with offices in Germany, France, Italy, Iberia, and the Nordics. The expansion initiative is meant to support the growth in demand for a continuous security validation solution.

- February 2021 - ANSSI, a French cybersecurity agency, has reported an intrusion campaign targeting the monitoring software Centreon distributed by the French company CENTREON, which resulted in the breach of several French entities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Need for Safety from Security Threats

- 4.2.2 Government Regulations Driving Security Needs

- 4.3 Market Challenges

- 4.3.1 Awareness Regarding Security Testing

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 On Premise

- 5.1.2 Cloud

- 5.1.3 Hybrid

- 5.2 Type

- 5.2.1 Network Security Testing

- 5.2.1.1 VPN Testing

- 5.2.1.2 Firewall Testing

- 5.2.1.3 Other Service Types

- 5.2.2 Application Security Testing

- 5.2.2.1 Application Type

- 5.2.2.1.1 Mobile Application Security Testing

- 5.2.2.1.2 Web Application Security Testing

- 5.2.2.1.3 Cloud Application Security Testing

- 5.2.2.1.4 Enterprise Application Security Testing

- 5.2.2.2 Testing Type

- 5.2.2.2.1 SAST

- 5.2.2.2.2 DAST

- 5.2.2.2.3 IAST

- 5.2.2.2.4 RASP

- 5.2.1 Network Security Testing

- 5.3 Testing Tool

- 5.3.1 Web Application Testing Tool

- 5.3.2 Code Review Tool

- 5.3.3 Penetration Testing Tool

- 5.3.4 Software Testing Tool

- 5.3.5 Other Testing Tools

- 5.4 End-User Industry

- 5.4.1 Government

- 5.4.2 BFSI

- 5.4.3 Healthcare

- 5.4.4 Manufacturing

- 5.4.5 IT and Telecom

- 5.4.6 Retail

- 5.4.7 Other End-User Industries

- 5.5 Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Hewlett Packard Enterprise Development LP

- 6.1.2 IBM

- 6.1.3 VERACODE

- 6.1.4 McAfee, LLC

- 6.1.5 Cisco Systems, Inc.

- 6.1.6 Core Security Technologies

- 6.1.7 Offensive Security

- 6.1.8 Accenture PLC

- 6.1.9 Maveric Systems

- 6.1.10 ControlCase, LLC

- 6.1.11 Paladion Networks

- 6.1.12 Netcraft Ltd

7 Investment Analysis

8 Future of the Market

02-2729-4219

+886-2-2729-4219