|

市場調查報告書

商品編碼

1640504

3D 掃描:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)3D Scanning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

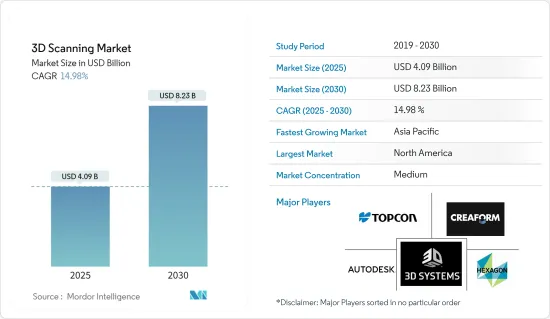

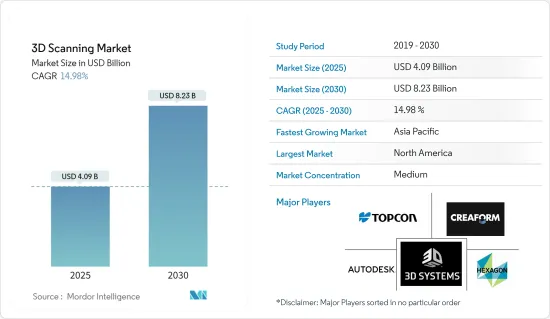

3D掃描市場在2025年的價值估計為40.9億美元,預計到2030年將達到82.3億美元,在市場估計和預測期(2025-2030年)內複合年成長率為14.98%。

雖然 3D 掃描技術尚未進入住宅或個人環境,但這些設備已廣泛應用於娛樂和媒體等行業,用於製作電玩遊戲和影片。這些設備廣泛用於其他工業應用,包括建築、航太、醫療保健和汽車,可用於現場零件生產。 3D掃描器是應用主導創新的一部分。

主要亮點

- 3D 掃描技術在商業應用中已廣泛應用。此外,該技術具有客製化靈活性,能夠滿足不同行業的專業需求,從而得到了主要終端用戶行業的廣泛採用。

- 此外,3D 掃描器也用於建設產業,以 3D 比例創建大量建築結構。在建築業,3D 掃描儀可協助博物館保存和存檔歷史建築。該技術的可客製化性和擴充性使製造商在構建和開發先進的軍事和防禦系統時可以依靠它來獲得測量的準確性和速度,3D掃描儀有助於準確測量武器和巡防艦。

- 此外,預測期內,全球建築和基礎設施活動的增加可能會推動對 3D 掃描的需求。據印度基礎設施基金會稱,政府已撥款 1,305.7 億美元用於加強印度基礎設施部門,為該產業帶來了巨大的推動作用。此外,印度計劃未來五年透過國家基礎設施管道投資1.4兆美元用於基礎建設。

- 在醫學領域,3D掃描儀用於對身體部位進行3D並製作矯正器具。它還可以促進創傷治療和護理並產生身體植入。 3D 掃描儀廣泛被醫療保健和醫療專業人員用於創建客自訂矯正器具解決方案、背部支架、人體工學義肢、人工植牙、測量等。

- 此外,老年人口的不斷成長預計將推動醫療產業對先進技術的需求。根據美國消化系統疾病負擔報告顯示,美國每年進行胃腸道內視鏡檢查超過2000萬例,而美國每年進行內視鏡檢查的人數為7500萬例。此外,根據美國癌症協會的數據,預計2023年美國將新增238,340總合肺癌和支氣管癌病例。

- 此外,各行業也越來越多採用3D列印技術也是推動3D列印機應用的主要因素之一。隨著3D列印機的普及,對3D掃描系統的需求也將同時增加,進而推動市場成長。隨著各行各業的公司開始將 3D 列印技術用於快速原型製作以外的其他用途,3D 列印很可能即將達到這個曲折點。

- 3D掃描作為一種非接觸式技術,已在COVID-19胸部掃描中發揮了作用。這次呼吸道疾病的爆發促使人們使用 3D 掃描技術作為檢測和量化 COVID-19 病毒的有用工具。

3D 掃描市場趨勢

按硬體類型分類的結構光掃描器推動市場成長

- 結構光 3D 掃描器是一種 3D 掃描設備,它使用單一光源將多條線投射到物體上,透過一個或多個攝影機進行追蹤,以測量物體的3D形狀。這與雷射掃描器形成對比,雷射掃描器會連續將各種雷射點照射到物體上。

- 物體的逆向工程以創建 CAD資料、工程部件的體積測量、擴增實境遊戲的運動和環境捕捉、時尚零售的身體測量、高速生產線的自動光學檢測、無人機的障礙物檢測結構光掃描儀正在積極部署於成像系統等應用領域。

- 手持式 3D 掃描器具有速度快、無需設定時間等特點,方便整合。因此,幾種用於 3D 列印的手持式 3D 掃描器採用了結構光技術。該技術透過將光圖案投射到被掃描的物體上來進行空間三角測量。

- 工業領域對機器人技術的日益廣泛應用可能會支持 3D 掃描市場的成長。結構光 3D 掃描器由視訊投影機和多個攝影機組成。 3D 掃描器可安裝在機械臂上並自動圍繞物體移動,從各個角度進行 3D 掃描。這些掃描儀能夠快速產生具有最精細解析度和最高精度的表面掃描,精確到幾微米的範圍。

- 然而,這種掃描器的一個顯著缺點是它對特定環境的照明條件很敏感,這在戶外工作時是一個顯著的問題。

北美占主要佔有率

- 美國是全球最重要、最具影響力的 3D 掃描市場之一,主要涉及醫療保健、航太和國防、建築和工程、3D 數位公司、研究和教育、娛樂和媒體等行業。最發達市場。

- 3D 掃描為藝術家開啟了無限的可能性,讓他們能夠將最瘋狂的想法變成現實。例如,美國媒體和娛樂 (M&E) 市場佔全球動畫 &E 行業的 33%,是美國動畫最大的 M&E 市場。 M&E 市場。在 3D 掃描出現之前,許多特技和視覺效果很難甚至不可能實現。

- 政府也正在投資幫助加拿大的創新產業在全球擴張。例如,2022年8月,聯邦政府宣布將向29家出版、電視和電玩公司投資1,120萬美元,進一步支持市場成長。

- 加拿大非常重視民眾的醫療保健,因此政府在醫療保健方面的支出佔加拿大國內生產毛額的10%以上,是已開發國家中最高的比例。同時,對整形外科、義肢和截肢的需求不斷增加,這推動了新型 3D 掃描儀和掃描技術的發展。

3D 掃描行業概況

3D掃描市場比較分散。整體來看,現有競爭對手之間的競爭非常激烈。大公司和小公司的新產品創新策略正在推動 3D 掃描市場的發展。該領域的一些主要發展包括:

- 2023 年 4 月-Shining 3D 推出新型多功能 3D 掃描器 FreeScan Combo。 FreeScanCombo 將 FreeScan 系列的計量精度、精細掃描和高精度與更輕、更緊湊的設計相結合。它配備26+7+1條藍色雷射線和紅外線掃描模式。這些掃描器用於逆向工程、計量級檢查和其他應用等掃描場景。

- 2023 年 3 月-Capture 3D 推出 ZEISS T-Scan Hawk 2。這款輕型手持式 3D 掃描儀由蔡司在德國開發和製造,具有紅色雷射標記器,可實現完美的距離控制,具有新型衛星模式、GOM Inspect 3D 檢測軟體和超尺度校準。 ZEISS T-SCAN Hawk 2 也經過了符合最高業界標準的驗收測試。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 航太和汽車產業對 3D 計量的需求龐大

- 3D 列印機在醫療保健領域重組手術的應用不斷擴大

- 市場挑戰

- 高解析度 3D 掃描器越來越貴

第6章 市場細分

- 按類型

- 硬體

- 光學掃描儀

- 結構光掃描儀

- 雷射掃描儀

- 其他硬體

- 軟體

- 硬體

- 按範圍

- 短距離

- 中型

- 遠端

- 按應用

- 逆向工程

- 快速原型製作

- 品管/檢驗

- 臉部和身體掃描

- 工業測量

- 數位建模

- 按行業

- 航太和國防

- 車

- 衛生保健

- 製造業

- 媒體與娛樂

- 建築和施工

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- 3D Systems Inc.

- CREAFORM Inc.

- GOM GmbH

- Faro Technologies Inc.

- Topcon Corporation

- Maptek Pty Ltd

- Autodesk Inc.

- Artec Inc.

- Hexagon AB

- Trimble Inc.

第8章投資分析

第9章:市場的未來

The 3D Scanning Market size is estimated at USD 4.09 billion in 2025, and is expected to reach USD 8.23 billion by 2030, at a CAGR of 14.98% during the forecast period (2025-2030).

Though 3D scanning technology has not penetrated residential and private settings, these devices are prominently used to produce video games and movies in industries such as entertainment and media. Other industrial applications where these devices are found to be of great use are architecture, construction, aerospace, healthcare, and automotive, among others, where these can be used for onsite parts production. 3D scanners have been a part of the innovations led by applications.

Key Highlights

- 3D scanning technology witnessed considerable adoption from commercial applications. Further, the flexibility of the technology to be customized to meet professional needs in various industries has made it profoundly popular across major end-user industries.

- Furthermore, 3D scanners are used in the construction industry to create a scaled 3D many-building structure. In the architectural industry, these devices help preserve and archive historical monuments from museums. Due to this technology's customizability and scalability, manufacturers rely on measurement accuracy and speed when building and developing advanced military and defense systems, using 3D scanners in making weapons and vehicles, such as frigates.

- Moreover, the growing construction or infrastructure activities across the globe will increase the demand for 3D scanning during the projected timeline. According to IBEF, the government has dramatically pushed the infrastructure sector by allocating USD 130.57 billion to enhance the infrastructure sector in India. Additionally, India plans to spend USD 1.4 trillion on infrastructure through the 'National Infrastructure Pipeline' in the following five years.

- In the medical sector, 3D scanners are used to model body parts in three dimensions, which are used to create prosthetics. It can also facilitate wound healing and care and generate body implants. 3D scanners are widely used by healthcare and medical professionals for creating custom-fit orthotic solutions, back braces, ergonomic prosthetic devices, dental implants, measurements, etc.

- Moreover, the increasing elderly population is expected to boost the demand for advanced technologies in the medical industry. According to the Burden of Digestive Diseases in the United States, it is estimated that more than 20 million GI endoscopies are performed yearly in the United States, whereas a total of 75 million endoscopies are performed in the U.S. every year. Also, as per the American Cancer Society, It is estimated that in 2023 there will be a total of 238,340 new cases of lung and bronchus cancer in the United States.

- Additionally, the rising adoption of 3D printing technology in various industries is one of the major factors thriving the adoption of 3D printers. As the adoption of 3D printers grows, the need for 3D scanning systems will increase simultaneously, driving market growth. 3D printers are experiencing this inflection point, likely because companies across multiple industries are increasingly using 3D printing technologies for more than just rapid prototyping.

- 3D scanning as a non-contact technique helped the thoracic chest scanning for COVID-19. The outbreak of this respiratory disease led to using 3D scanning technology as a useful tool to detect and quantify the COVID-19 virus.

3D Scanning Market Trends

Structured-light Scanner by Hardware Type to Drive the Market Growth

- A structured-light 3D scanner is a 3D scanning device for measuring the three-dimensional shape of an object using a single light source projecting multiple lines on the object being tracked by a camera or multiple cameras. This contrasts a laser scanner, which emits various laser dots on a single object, one after the other.

- Applications, such as reverse engineering of objects to produce CAD data, volume measurement of engineering parts, motion, and environment capture for augmented reality games, body measurements for fashion retailing, automated optical inspection in high-speed manufacturing lines, and obstacle detection systems on unmanned aircraft, have been actively deploying structured light scanners.

- By offering capabilities such as fast and no setup time, handheld 3D scanners conveniently integrate the same. Thus, multiple handheld 3D scanners for 3D printing have been deploying structured light technology. The technology uses trigonometric triangulation by projecting a light pattern onto the object to scan.

- The growing adoption of robots in the industrial sector will support the growth of the 3D scanning market. A structured light 3D scanner consists of a video projector and multiple cameras. The 3D scanner can be attached to a robotic arm, automatically moving around the object and 3D-scans it from all angles. These scanners can perform quick surface scans with the finest resolution in the range of a few microns and the highest accuracy.

- However, a significant downside of this type of scanner is sensitivity to the lighting conditions in a given environment, which poses a significant issue in working outside.

North America to Account for Major Share

- The United States is one of the most significant and consequential 3D scanning markets globally, with healthcare, aerospace and defense, architecture and engineering, 3D Digital Corporation, research and education, entertainment, and media as the significant, largest, and among some of the most advanced.

- 3D scanning opens up boundless possibilities for artists, allowing them to translate their most fantastic ideas into reality. For instance, the US media and entertainment (M&E) market, which is 33% of the global M&E industry, is the largest M&E market in the world, especially 3D animation production in the country, which houses the animation studios such as Disney and Pixar. The technology drives forward the movie industry and video games - many stunts and visual effects would have been difficult or even impossible to bring off before the advent of 3D scanning.

- Furthermore, the government invests in helping Canadian creative industries expand their global reach. For instance, in August 2022, the Federal government announced investing USD 11.2 million into 29 publishing, television, and video game companies, further supporting the market growth.

- Due to Canada's commitment to public access to healthcare, the government spending on healthcare exceeds 10% of Canada's GDP, one of the highest percentages in the developed world, equating to well over USD 5000 in healthcare spending per capita. These, coupled with the increased demand for plastic surgery, prosthetics, amputation, etc., provide new 3D scanners and scanning technologies.

3D Scanning Industry Overview

The 3D scanning market is fragmented. Overall, the competitive rivalry among the existing competitors is high. Large and small companies new product innovation strategy is giving rise to the 3D scanning market. Some of the key developments in the area are:

- April 2023 - Shining 3D introduced its new multifunctional FreeScan Combo 3D scanner. FreeScanCombo adopts metrology-grade accuracy, fine scanning, and high precision from the FreeScan series while providing an even lighter and more compact design. It features 26 + 7 + 1 blue laser lines and an infrared scanning mode. These scanners are used for scanning scenarios such as reverse engineering, metrology-grade inspection, and further applications.

- March 2023 - Capture 3D introduced a ZEISS T-Scan Hawk 2. Developed and produced in Germany by ZEISS, this lightweight handheld 3D scanner includes a red laser marker for perfect distance control, new satellite mode, GOM Inspect 3D inspection software, and hyperscale calibration. The ZEISS T-SCAN Hawk 2 also comes with acceptance testing certified to the highest industry standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Significant Demand for 3D Metrology Across the Aerospace and Automobile Secto

- 5.1.2 Growth in Deployment of 3D Printers for Reconstructive Surgeries in the Healthcare Sector

- 5.2 Market Challenges

- 5.2.1 Significant Price of High-resolution 3D Scanners

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.1.1 Optical Scanners

- 6.1.1.2 Structured Light Scanners

- 6.1.1.3 Laser Scanners

- 6.1.1.4 Other Hardware

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By Range

- 6.2.1 Short Range

- 6.2.2 Medium Range

- 6.2.3 Long Range

- 6.3 By Application

- 6.3.1 Reverse Engineering

- 6.3.2 Rapid Prototyping

- 6.3.3 Quality Control/Inspection

- 6.3.4 Face and Body Scanning

- 6.3.5 Industrial Metrology

- 6.3.6 Digital Modeling

- 6.4 By End-user Vertical

- 6.4.1 Aerospace and Defense

- 6.4.2 Automotive

- 6.4.3 Healthcare

- 6.4.4 Manufacturing

- 6.4.5 Media and Entertainment

- 6.4.6 Architecture and Construction

- 6.4.7 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 3D Systems Inc.

- 7.1.2 CREAFORM Inc.

- 7.1.3 GOM GmbH

- 7.1.4 Faro Technologies Inc.

- 7.1.5 Topcon Corporation

- 7.1.6 Maptek Pty Ltd

- 7.1.7 Autodesk Inc.

- 7.1.8 Artec Inc.

- 7.1.9 Hexagon AB

- 7.1.10 Trimble Inc.