|

市場調查報告書

商品編碼

1640512

機器對機器 (M2M) 服務 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Machine To Machine (M2M) Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

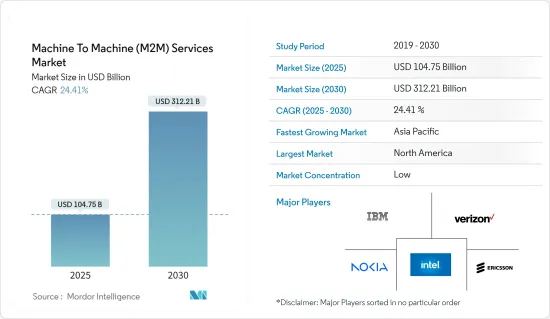

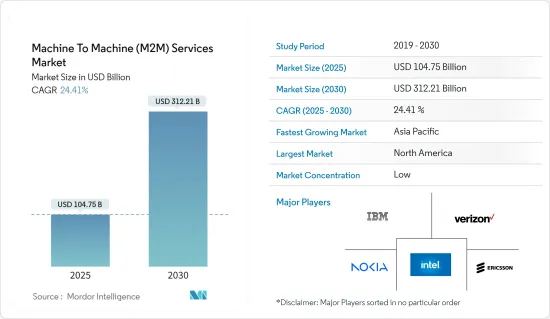

機器對機器服務市場規模在 2025 年預計為 1,047.5 億美元,預計到 2030 年將達到 3,122.1 億美元,預測期內(2025-2030 年)的複合年成長率為 24.41%。

世界正在走向工業 4.0,其中分析、人工智慧 (AI) 和物聯網 (IoT) 有望推動智慧、決策和生產力。反過來,這為機器對機器服務市場創造了巨大的機會。

關鍵亮點

- 機器對機器 (M2M)通訊,也稱為基於機器的通訊(MTC),是指一組協作的機器交換感測資料或資訊並進行決策,通常不需要人工參與。 M2M技術近年來發展迅速,使大量設備能夠透過網路互聯互通。這可能是許多領域的關鍵推動因素,特別是物聯網(IoT)和第五代(5G)網路。

- 隨後,各行業採用有線或無線連接也推動了市場的發展。此外,高速網路連線的廣泛普及以及 4G/LTE 和 5G 等新連接技術的日益普及進一步推動了 M2M 連接市場的成長。

- 除了連接性之外,為增強產品而不斷增加的軟體應用程式整合以及為提高成本效益和滿足安全法規而在產品製造中採用各種技術預計也將成為支援成長的因素。在預計預測期內,收購和合作等不斷增加的策略發展將推動市場成長率。

- 例如,2022年2月,森薩塔科技完成了對私人控股的Elastic M2M Inc.的收購,後者是重型運輸、倉儲、供應鍊和物流、工業、輕型車輛和許多其他業務部門的營運資產互聯智慧創新者。 Elastic M2M 的雲端平台和分析功能使遠端資訊處理服務供應商(「TSP」)和經銷商能夠向最終用戶提供基於感測器的營運資料。

- 此外,2022 年 5 月,M2M通訊品牌 Sensorise Digital Services 被 Rosmerta Group 收購。結合 Rosmerta 集團在 M2M 和 IoT 領域的財務實力和技術力,Sensorise 有望進入下一階段的擴張階段。

- 然而,實施和維護這項技術的高成本是限制市場成長的一個問題。

機器對機器服務市場趨勢

預計通訊產業將在其他終端用戶產業中見證顯著的成長。

- M2M 系統透過無線或有線網路在硬體、感測器和機器之間採用點對點通訊。基於蜂巢的 M2M 增加了不同 SIM 卡機器之間的連接過程,以提供透過多個無線網路的連接。許多企業正在採用蜂窩M2M附加價值服務,以確保營運效率並最大限度地減少與營運違規相關的損失。

- 由於政府採取舉措,預計基於蜂窩的 M2M 將在預測期內實現更廣泛地部署,這些舉措將推動蜂窩 M2M 在公共、智慧城市、汽車和醫療保健等關鍵領域的發展。

- 2022 年 9 月,印度理工學院德里分校 (IITD) 和該國著名的通訊研發機構新興國家遠端資訊處理發展中心 (C-DOT) 將在物聯網/M2M、人工智慧/機器學習、網路安全、 5G及其兩家公司簽署了一份合作備忘錄,將在包括上述技術在內的多個通訊相關領域開展合作。 C-DOT 已進行先進的研究和開發計劃,開發涵蓋多種技術的廣泛產品,包括光學、交換、無線、安全、網路管理和先進的通訊軟體應用。 C-DOT 與當地企業、學術界和新興企業夥伴關係,在建立該國 4G 和 5G 系統方面發揮了關鍵作用。

- 該合作備忘錄旨在創建一個互惠互利的研發和學術合作框架,以鼓勵設計和開發完整的本土通訊解決方案。該平台可望成為催化劑,加速創新概念發展成為市場化產品。

亞太地區將經歷最快成長

- 由於中國和印度等國家採用了數位技術,預測期內亞太地區將以最高速度成長。物聯網、人工智慧和雲端運算等技術進步正在促進市場成長。

- 根據2021年7月10個政府部門聯合發布的三年規劃,中國的目標是到2023年終發展5.6億5G行動客戶,並將大型企業的高速無線技術普及率提高35%。 %。到2023年終,中國預計5G在個人消費者中的普及率將達到40%,5G資料將佔所有線上流量的一半以上。

- 此外,印度採用 5G 連接將帶來許多新機遇,提高線上和 M2M(機器對機器)交易的效率和安全性。事實上,物聯網 (IoT) 的主要目標之一是使公司能夠開發使用人工智慧 (AI) 的自動化系統,從管理家用電子電器到智慧電錶和交通燈。業界還必須確定有關設備、連接、安全部署和實體安全的連接技術的安全參數。

- 此外,政府舉措,例如推動廣泛部署智慧城市、智慧電錶和蜂窩 M2M舉措的措施,將促進 M2M 服務市場的成長。

- 例如,2022 年 2 月,電訊部要求所有機器對機器服務供應商向該部註冊,以解決安全問題、與電訊公司對接等。隨著 5G 的出現以及 M2M/IoT 領域重大開發計劃的開展,這些法規可能會促進通訊領域的成長。此外,這將鼓勵企業創造更廣泛的創新應用和解決方案,造福公民。

機器對機器服務產業概覽

由於有多家領導企業,機器對機器(M2M)服務市場的競爭格局十分激烈且細分化。這個市場的參與企業俱有很強的創新能力。產品研究、高額研發支出、合作和收購是公司為維持激烈競爭而採取的主要成長策略。全球市場的主要企業包括華為科技公司、思科系統、Google、英特爾和 IBM。

2023 年 12 月:Zebra Technologies 宣布推出 Zebra 行動裝置和軟體封裝解決方案,旨在幫助 Verizon Private 5G 客戶更快開始享受網路優勢。 Zebra 堅固耐用的企業平板電腦和行動數據終端旨在簡化運輸和物流、零售、製造和其他行業第一線員工的工作流程。

2023 年 11 月:Telenor 與愛立信合作,率先利用人工智慧和機器學習研究實現永續的智慧未來。挪威電信和愛立信在此次合作下的合作凸顯了他們通用致力於以負責任的方式利用人工智慧和機器學習的潛力來釋放客戶潛力。

2022年10月,印度領先的通訊服務供應商Bharti Airtel(「Airtel」)宣佈在該國推出其「Always On」物聯網連接解決方案。作為 Airtel「始終連接」服務的一部分,雙重配置 M2M eSIM 使物聯網設備能夠在 eSIM 內維持來自多個行動通訊業者(MNO) 的行動網路連線。 Airtel 符合 GSMA 標準的技術、功能豐富的 Airtel IoT Hub 中基於 API 的靈活 eSim 生命週期管理以及對電訊部 (DoT) M2M 要求的完全符合性都有助於確保面向未來。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 科技快速進步

- 連網設備數量不斷增加

- 市場限制

- 缺乏標準化

- 龐大的運輸成本

第6章 市場細分

- 按類型

- 託管服務

- 專業服務

- 按最終用戶

- 零售

- 銀行和金融機構

- 通訊及IT業

- 醫療

- 車

- 石油和天然氣

- 運輸

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- International Business Machine Corporation

- Rogers Communications Inc.

- Cstar Technologies Inc

- Nokia Corp(Alcatel-Lucent SA)

- Comarch Inc

- Cisco System Inc

- Huawei Technologies Co. Ltd

- Intel Corporation

- Thales Group(Gemalto NV)

- Amdocs Inc

- EE Ltd

- Verizon Communications Inc

第8章投資分析

第9章 市場機會與未來趨勢

The Machine To Machine Services Market size is estimated at USD 104.75 billion in 2025, and is expected to reach USD 312.21 billion by 2030, at a CAGR of 24.41% during the forecast period (2025-2030).

The world is moving toward industry 4.0, where analytics, artificial intelligence (AI), and the internet of things (IoT) are expected to drive intelligence, decision-making, and productivity. In return, this creates a huge opportunity for the machine-to-machine services market.

Key Highlights

- Machine-to-machine (M2M) communications, also known as a machine-type communication (MTC), typically refer to the exchange of sensed data or information and decision-making by a group of collaborating machines without human involvement. M2M technology enables a sizable number of devices to be interconnected through the internet, which has resulted in recent rapid development. It can be a favorable enabling key for many fields, particularly the internet of things (IoT) and fifth-generation (5G) networks.

- Following this, the adoption of wired or wireless connectivity across different industries is also fueling the market. In addition, the penetration of high-speed internet connectivity and the growing adoption of new connectivity technologies, such as 4G/LTE and 5G, is further driving the growth of the M2M connections market.

- Apart from connectivity, increasing software application integration for product enhancements and adoption of various technologies in manufacturing products for cost-effectiveness and to meet safety regulations are the factors that are expected to support the growth. The growing strategic developments, such as acquisitions and partnerships, are analyzed to boost the market growth rate during the forecast period.

- For instance, in February 2022, Sensata Technologies announced the acquisition of Elastic M2M Inc., a privately held innovator of connected intelligence for operational assets in the heavy-duty transport, warehousing, supply chain and logistics, industrial, light-duty passenger car, and numerous other business segments. With the help of Elastic M2M's cloud platform and analytics capabilities, telematics service providers ("TSPs") and resellers can employ sensor-based operational data to inform their end users.

- Further, in May 2022, Sensorise Digital Services, an M2M communication brand, was acquired by Rosmerta Group. By integrating the financial and technological strength of Rosmerta Group in the M2M and IoT arena, Sensorise is therefore prepared for the next expansion stage.

- However, on the contrary, the high cost of installation of this technology and its maintenance are some of the challenges the market faces, restraining its growth.

Machine-to-Machine Services Market Trends

Telecom Industry to Witness Significant Growth Among Other End-user Verticals

- M2M systems employ point-to-point communications between hardware, sensors, and machines across wireless or wired networks. Cellular-based M2M is added connectivity process among different sim-enabled machines to provide connectivity over multiple wireless networks. Cellular M2M value-added services are being incorporated in many enterprises to ensure operational efficiency and minimize losses associated with operational breaches.

- The cellular-based (M2M) is expected to grow during the forecast period because of the introduction of government policies, which enable wider deployment of cellular M2M in key sectors, such as utilities, smart cities, automotive, and healthcare.

- In September 2022, The Indian Institute of Technology, Delhi (IITD) and the Centre for Development of Telematics (C-DOT), the country's prominent telecom R&D facility, signed a Memorandum of Understanding (MoU) for collaboration in several telecom-related fields, including IoT/M2M, AI/ML, cyber security, and 5G and beyond technologies. C-DOT has engaged in several advanced R&D projects that have resulted in the development of a wide range of products that encompass a variety of technologies in the areas of optical, switching, wireless, security, network management, and cutting-edge telecom software applications. In partnership with local businesses, academics, and startups, C-DOT has played a key role in creating domestic 4G & 5G systems.

- This MoU attempts to build a mutually beneficial framework for R&D and academic cooperation on encouraging the design and development of entirely indigenous telecom solutions. The platform would catalyze to accelerate the development of innovative concepts into products ready for market.

Asia-Pacific to Witness the Fastest Growth

- Asia-pacific is analyzed to grow at the highest growth rate during the forecast period owing to the adoption of digital technologies in countries such as China, India, etc. Technological advancements like IoT, AI, and Cloud contribute to market growth.

- According to a three-year plan jointly released by ten government entities in July 2021, China plans to develop 560 million 5G mobile customers by the end of 2023 and increase the penetration rate of fast wireless technology among large industrial firms to 35%. By the end of 2023, China hopes to have reached a 40 percent penetration rate of 5G among individual consumers, with 5G data making up more than half of all online traffic.

- Further, with the introduction of 5G connectivity in India, various new opportunities are developed to boost the efficiency and security of online transactions and Machine-to-Machine (M2M) transactions. Indeed, one of the primary goals of the Internet of Things (IoT) is to enable businesses to develop automated systems employing Artificial Intelligence (AI) for applications ranging from home appliance management to smart meters and traffic lights. The industry must also specify the parameters of connected technology security regarding devices, connection, secure deployment, and physical security.

- Further, government initiatives, like smart cities, smart meters, and policies, enabling a wider deployment of cellular M2M initiatives will help the M2M services market to grow.

- For instance, in February 2022, The Department of Telecom mandated all machine-to-machine service providers to register with the department to address security concerns and interface with telecom companies, among other things. With 5G on the horizon and massive development projects in the M2M/IoT sector, these rules will boost the growth of the communication sector. Additionally, this will encourage companies to create a wide range of innovative applications and solutions for the benefit of citizens.

Machine-to-Machine Services Industry Overview

The competitive landscape for the Machine to Machine (M2M) services market is highly competitive and fragmented because of the presence of many major players. The players in this market are highly innovative. Product launches, high expenses on research and development, partnerships and acquisitions, etc., are the prime growth strategies these companies adopt to sustain the intense competition. Key market players in the global market are Huawei Technologies Co. Ltd, Cisco Systems Inc., Google Inc., Intel Corporation, IBM, and other prominent players.

In Decmber 2023 : Zebra Technologies has announced the launch of Zebra mobile device and software packaged solutions designed to help Verizon Private 5G customers reap the benefits of their networks even faster. Zebra rugged enterprise tablets and mobile computers are purpose-built to simplify processes for frontline workers in transportation and logistics, retail, manufacturing, and other industries

In November 2023 : Telenor and Ericsson join forces to pioneer the usage of AI and Machine Learning Research for a Sustainable and Smarter Future, The collaboration between Telenor and Ericsson under this collobration underscores the shared commitment of both companies to harnessing the potential of AI and ML in a responsible manner to unlock the potential for the customer.

In October 2022, Bharti Airtel ("Airtel"), India's major telecommunications services provider, announced the implementation of the "Always On" IoT connectivity solution in the country. Dual profile M2M eSIM, part of Airtel's "Always On" service, enables an IOT device to maintain a mobile network connection from several Mobile Network Operators (MNOs) in the eSIM. GSMA-compliant technology from Airtel, flexible API-based eSim lifecycle management on the feature-rich Airtel IoT Hub, and full compliance with Department of Telecom (DoT) M2M requirements all contribute to the company's ability to meet future needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Technological Advancements

- 5.1.2 Increasing Number of Connected Devices

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization

- 5.2.2 Huge Delivery Cost

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Managed Service

- 6.1.2 Professional Service

- 6.2 By End User

- 6.2.1 Retail

- 6.2.2 Banking and Financial Institution

- 6.2.3 Telecom and IT Industry

- 6.2.4 Healthcare

- 6.2.5 Automotive

- 6.2.6 Oil and Gas

- 6.2.7 Transportation

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Business Machine Corporation

- 7.1.2 Rogers Communications Inc.

- 7.1.3 Cstar Technologies Inc

- 7.1.4 Nokia Corp (Alcatel-Lucent S.A.)

- 7.1.5 Comarch Inc

- 7.1.6 Cisco System Inc

- 7.1.7 Huawei Technologies Co. Ltd

- 7.1.8 Intel Corporation

- 7.1.9 Thales Group (Gemalto NV)

- 7.1.10 Amdocs Inc

- 7.1.11 EE Ltd

- 7.1.12 Verizon Communications Inc