|

市場調查報告書

商品編碼

1640541

油漆和塗料添加劑:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Paints and Coatings Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

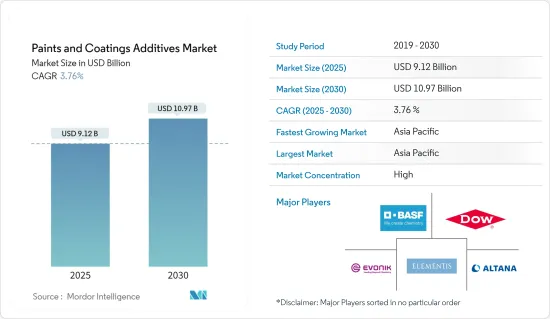

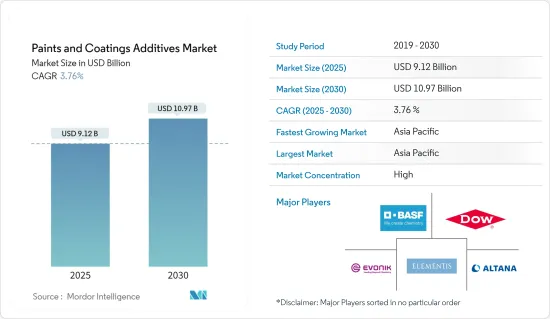

油漆和塗料添加劑市場規模預計在 2025 年為 91.2 億美元,預計到 2030 年將達到 109.7 億美元,預測期(2025-2030 年)的複合年成長率為 3.76%。

COVID-19 對 2020 年的油漆和塗料添加劑市場產生了負面影響。但隨著主要終端用戶產業復工,預計未來幾年市場將穩定成長。

主要亮點

- 建築塗料需求的增加是市場研究的主要促進因素。

- 相反,預計日益嚴格的環境法規將阻礙市場成長。

- 各行業對流變改質劑的需求不斷增加可能會提供機會。

- 亞太地區佔全球市場主導地位,其中中國和印度的消費量最大。

油漆和塗料添加劑市場趨勢

建築業佔據市場主導地位

- 建築部門包括商業塗料中使用的添加劑,例如辦公大樓、倉庫、便利商店、購物中心和住宅。

- 建築塗料中使用的主要助劑包括流變改質劑、消泡劑、分散劑和潤濕劑。

- 一般來說,建築塗料中使用的助劑有助於改善表面性能,穩定顏料,提高潤濕性、分散性、消泡性等。

- 根據美國人口普查局的數據,2022 年 12 月美國新建設產值為 17,929 億美元。 2023年3月,非住宅部門支出為9,971.4億美元,年增18.8%。

- 此外,根據美國人口普查局的數據,2022 年 6 月私人和公共建築住宅支出為 4,926.8 億美元,較 2021 年 6 月的 4,842.6 億美元成長 1.74%。因此,預計該國私人和公共非住宅建築支出的增加將推動油漆和塗料添加劑市場的需求上升。

- 除此之外,美國也規劃了各種商業建築計劃。紅牛北美公司在北卡羅來納州康科德擁有 200 萬平方英尺的加工和配送設施,價值 7.4 億美元;酪農合作社DareGold 在華盛頓州帕斯科港擁有40 萬平方英尺的加工廠,價值5 億美元。

- 沙烏地阿拉伯住宅投資的增加預計將推動油漆和塗料添加劑市場的需求。例如,在沙烏地阿拉伯,房地產開發項目數量的增加、住宅需求的不斷成長以及政府發展社會經濟基礎設施的舉措正在推動該國的油漆和塗料添加劑市場的發展。根據沙烏地阿拉伯住宅部長馬吉德·霍蓋爾介紹,沙烏地阿拉伯王國計劃在未來五年內建造 30 萬套住宅。住宅是沙烏地阿拉伯「2030願景」下的重點舉措之一。未來幾年,該國的建築業可能會對油漆和塗料添加劑市場產生需求。

- 政府的這些措施可望迅速振興建設產業。這也進一步促進了建築業的塗料和塗料添加劑的消費。

- 因此,此類住宅建設投資和計劃,以及住宅建設中使用的油漆和被覆劑的消費,正在推動這些國家的建設活動。

亞太地區佔市場主導地位

- 亞太地區正在尋求發展油漆和塗料行業。憑藉其對關鍵原料、基本分子生產和區域市場的便捷獲取,該公司預計將成為全球油漆和被覆劑供應鏈的核心。

- 亞太地區正在不懈地追求建造最高、最大、最宏偉的建築。預計未來幾年該國的油漆和塗料行業將實現穩步成長。預計未來幾年建設產業將出現強勁成長,推動對塗料添加劑的需求。

- 在油漆和塗料添加劑市場,中國佔亞太地區最大的佔有率。由於該國投資和建設活動的增加,預計整個預測期內對油漆和塗料添加劑市場的需求將會增加。中國近年來是全球基礎設施主要投資者之一,並做出了重要貢獻。例如,根據中國國家統計局的數據,2022年中國建築業產值預計將達到人民幣31.2兆元(4,758.4億美元),比2021年成長6.5%。

- 此外,根據中國住宅及城鄉建設部的數據,到2025年建設業佔GDP的比重將維持在6%。在該國,預製建築的趨勢正在成長,預計預製建築將佔新建築的 30% 以上。

- 據國家發展和改革委員會稱,中國政府已核准26 個基礎設施計劃,預計投資約 1,420 億美元,預計將於 2023 年完工。預計住宅需求的增加將刺激公共和私營部門的住宅建設。因此,預計住宅投資的增加將推動該國建設產業對油漆和塗料添加劑市場的需求。

- 預計印度仍將是亞太地區二十國集團中成長最快的經濟體。印度政府宣布,2023-2025年三年期間的基礎設施投資目標為3,765億美元。其中包括投資1,205億美元發展27個產業叢集,投資753億美元用於公路、鐵路和港口連通計劃。因此,該國的建設產業可能會為油漆和塗料添加劑帶來福音。

- 此外,據 IBEF 稱,在 2022-2023 年聯邦預算中,政府已撥款 10 兆印度盧比(1,305.7 億美元)用於加強基礎設施部門。此外,印度計劃未來五年透過其國家基礎設施管道投資 1.4 兆美元用於基礎建設。

- 民航部長進一步宣布,印度政府計畫在2032年建造100座機場。

- 由於上述因素,預計亞太地區將在預測期內佔據全球主導地位。

油漆和塗料添加劑行業概況

油漆和塗料添加劑市場因其性質而部分整合。該市場的主要企業(不分先後順序)包括陶氏化學、BASF歐洲公司、阿爾塔納集團 (BYK)、贏創工業股份公司和 Elementis PLC。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 建築塗料需求不斷成長

- 各行業對流變改質劑的需求不斷增加

- 其他促進因素

- 限制因素

- 日益嚴格的環境法規

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 按類型

- 除生物劑

- 分散劑和潤濕劑

- 消泡劑和消泡劑

- 流變改性劑

- 表面改質劑

- 穩定劑

- 流動和流平添加劑

- 其他類型

- 按應用

- 建築油漆和塗料

- 木器漆

- 交通運輸塗料

- 防護漆

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AGC Inc.

- ALTANA AG

- Arkema

- Ashland

- BASF SE

- Cabot Corporation

- DAIKIN INDUSTRIES, Ltd.

- Dow

- Dynea AS

- Eastman Chemical Company

- ELEMENTIS PLC

- Evonik Industries AG

- K-TECH(INDIA)LIMITED

- Momentive

- Nouryon

- Solvay

- The Lubrizol Corporation

第7章 市場機會與未來趨勢

- 趨勢轉向水性塗料

- 其他機會

The Paints and Coatings Additives Market size is estimated at USD 9.12 billion in 2025, and is expected to reach USD 10.97 billion by 2030, at a CAGR of 3.76% during the forecast period (2025-2030).

COVID-19 negatively impacted the market for paints and coatings additives in 2020. However, with the resumption of work in major end-user industries, the market is estimated to grow steadily in the coming years.

Key Highlights

- The increased demand for architectural coatings is the major factor driving the market studied.

- Conversely, rising environmental regulations are expected to hinder market growth.

- Increasing demand for rheology modifiers in various industries will likely be an opportunity.

- Asia-Pacific dominated the global market, with the largest consumption in China and India.

Paints and Coatings Additives Market Trends

Architectural Segment to Dominate the Market

- The architectural segment includes additives used in coatings for commercial purposes, such as office buildings, warehouses, retail convenience stores, shopping malls, and residential buildings.

- Some majorly used additives for architectural coatings include rheological modifiers, defoamers, dispersants, and wetting agents.

- Generally, the additives used for architectural coatings help to enhance surface properties, stabilizing pigment, enhancing wetting, dispersing, and defoaming properties, etc.

- According to the US Census Bureau, the value of new construction output in the United States amounted to USD 1,792.9 billion in December 2022. The non-residential sector accounted for USD 997.14 billion in March 2023, registering a growth of 18.8% compared to the same period of the previous year.

- Moreover, according to the US Census Bureau, the private and public construction non-residential spending in June 2022 was 492.68 billion, which showed an increase of 1.74% compared to June 2021, which amounted to USD 484.26 billion. Therefore, increasing spending on private and public non-residential constructions in the country is expected to create an upside demand for the paints and coatings additives market.

- Apart from that, there are various construction commercial projects scheduled in the United States Red Bull North America's USD 740 million worth 2 million sq ft processing and distribution facility in Concord, North Carolina, Dairy cooperative DairgoldUSD 500 million worth 400,000 sq ft processing facility in Port of Pasco, Washington (completion scheduled for 2023), Biotics Research Corporation USD 9 million worth 88,000 sq ft warehouse, laboratory, and office facility in Rosenberg, Texas (completion scheduled for 2023).

- Increasing investment in residential constructions in Saudi Arabia is expected to boost the demand for the paints and coatings additives market. For instance, in Saudi Arabia, the growing number of real estate developments, increasing demand for residential property, and governmental initiatives to develop socio-economic infrastructure drive the country's paints and coatings additives market. According to Majid Al-Hogail, the Saudi Housing Minister, the Kingdom of Saudi Arabia plans to construct 300,000 extra housing units over the next five years. One of Saudi Arabia's significant initiatives under Vision 2030 is housing. It will likely create demand for the paints and coatings additives market from the country's construction sector in the upcoming years.

- Such initiatives by the government are expected to rapidly boost the construction industry. It is also further boosting the consumption of coating and, in turn, coating additives in the construction sector.

- Hence, all such residential construction investments and projects are driving construction activities in these countries, along with the consumption of paints and coatings for application in residential construction.

Asia-Pacific to Dominate the Market

- Asia-Pacific is aiming for the development of its paints and coatings sector. It is on the way to becoming the center of the global paints and coatings supply chain, leveraging its easy access to key feedstock, production of basic molecules, and access to the regional market.

- Asia-Pacific includes a persistent expedition in making some of the tallest, largest, and biggest structures. The paints and coatings industry in the country is expected to register steady growth in the coming years. The construction industry is poised to witness sturdy growth in the forthcoming years, augmenting the demand for coating additives.

- China holds the largest Asia-Pacific market share for the paints and coatings additives market. The demand for the paints and coatings additives market is expected to rise throughout the forecast period due to rising investments and construction activity in the country. China is a huge contributor, as it is one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to CNY 31.2 trillion (USD 475.84 billion), an increase of 6.5% compared with 2021.

- Moreover, in China, according to the country's Ministry of Housing and Urban-Rural Development, the construction industry will maintain a 6% share of the country's GDP by 2025. There is a growing trend in the country for prefabricated buildings, which is expected to account for more than 30% of the country's new construction.

- According to the National Development and Reform Commission, the Chinese government approved 26 infrastructure projects at an estimated investment of about USD 142 billion, estimated to be completed by 2023. The growing demand for housing is expected to drive residential construction in the public and private sectors. Therefore, increasing investments in residential construction is expected to create an upside demand for the paints and coatings additives market from the country's construction industry.

- India is anticipated to remain the fastest-growing G20 economy in the Asia-Pacific region. The Indian government announced a target of USD 376.5 billion in infrastructure investment over three years (2023-2025). It includes USD 120.5 billion for developing 27 industrial clusters and USD 75.3 billion for road, railway, and port connectivity projects. Therefore, this will likely create an upside for paints and coatings additives from the country's construction industry.

- Moreover, according to IBEF, in Union Budget 2022-2023, the government allocated INR 10 trillion (USD 130.57 billion) to enhance the infrastructure sector. Moreover, India plans to spend USD 1.4 trillion on infrastructure through the 'National Infrastructure Pipeline' in the next five years.

- Furthermore, the civil aviation minister announced that the Indian government is also planning to construct 100 airports by 2032, owing to increasing demand for air commutes.

- The factors above are expected to make the Asia-Pacific the dominant globally during the forecast period.

Paints and Coatings Additives Industry Overview

The Paints and Coatings Additives Market is partially consolidated in nature. The major players in this market (not in a particular order) include Dow, BASF SE, Altana Group (BYK), Evonik Industries AG, and Elementis PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Demand for Architectural Coatings

- 4.1.2 Increasing Demand for Rheology Modifiers in Various Industries

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Rising Environmental Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Biocides

- 5.1.2 Dispersants and Wetting Agents

- 5.1.3 Defoamers and Deaerators

- 5.1.4 Rheology Modifiers

- 5.1.5 Surface Modifiers

- 5.1.6 Stabilizers

- 5.1.7 Flow and Leveling Additives

- 5.1.8 Other Types

- 5.2 Application

- 5.2.1 Architectural Paints and Coatings

- 5.2.2 Wood Paints and Coatings

- 5.2.3 Transportation Paints and Coatings

- 5.2.4 Protective Paints and Coatings

- 5.2.5 Others Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 ALTANA AG

- 6.4.3 Arkema

- 6.4.4 Ashland

- 6.4.5 BASF SE

- 6.4.6 Cabot Corporation

- 6.4.7 DAIKIN INDUSTRIES, Ltd.

- 6.4.8 Dow

- 6.4.9 Dynea AS

- 6.4.10 Eastman Chemical Company

- 6.4.11 ELEMENTIS PLC

- 6.4.12 Evonik Industries AG

- 6.4.13 K-TECH (INDIA) LIMITED

- 6.4.14 Momentive

- 6.4.15 Nouryon

- 6.4.16 Solvay

- 6.4.17 The Lubrizol Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Trends Towards Water Coatings

- 7.2 Other Opportunities