|

市場調查報告書

商品編碼

1640542

化學注入裝置:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Chemical Injection Skids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

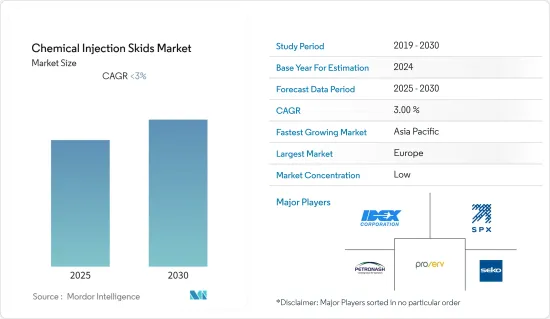

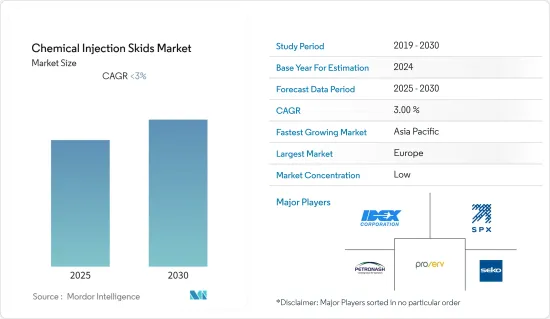

預測期內,化學注入滑橇市場預計以低於 3% 的複合年成長率成長。

2020 年,市場受到了 COVID-19 的負面影響。一些國家面臨嚴重的供應鏈中斷。不過,預計在研究期間市場將穩定成長並達到疫情前的水準。

關鍵亮點

- 短期內,化學工業的擴張和廢棄物處理應用需求的加速是推動研究市場成長的關鍵因素。

- 然而,歐洲和北美的市場飽和是預測期內抑制該產業成長的關鍵因素。

- 先進噴射系統的快速發展和技術創新預計很快就會在全球市場創造豐厚的成長機會。

- 預計歐洲將主導市場,而亞太地區預計將在預測期內見證最快的成長率。

化學品注入裝置市場趨勢

能源、電力和化學領域將主導市場

- 能源、電力和化學品是化學注入橇市場的主要終端用戶領域。紙漿和造紙業也包括在此部分。

- 2021年,中國是最大的能源消費國,能源消耗總量為157.65艾焦耳,其次是美國和印度。新興經濟體工業對能源的需求不斷成長是能源電力終端用戶產業成長的主要動力。

- 化學注入橇在化學工業中有著廣泛的應用。用於注入各種化學品,如苛性鈉(用於壓力清洗)、腐蝕抑制劑、鹽酸(用於除垢)、胺(用於去除酸性氣體)。

- 這些化學品被注入煉油廠的關鍵部件,如熱交換器、攪拌機、流動管道、管柱和塔,以確保高效加工和生產輸入的原油。

- 此外,這些滑軌也用於注入水處理化學物質來處理產生的污水,以及抑制汽油和其他燃油添加劑。也使用化學注入裝置注入凝結劑以幫助固態。

- 石化產品的使用和需求不斷增加,推動了全球精製能力的激增。

- 產能的成長也在一定程度上受到全球石油和天然氣活動增加的刺激,包括生產和消費。

- 此外,化學注入裝置也常用於發電。硫酸鐵和硫酸等化學物質需要精確測量才能將水轉化為鍋爐的超純水。因此,預計預測期內化學注入滑橇的需求將適度成長。

亞太地區成長良好

- 預計預測期內亞太地區將呈現最快的複合年成長率,這主要歸因於石化和化學工業的需求不斷增加。

- 在亞太地區,中國和日本佔據市場主導地位。不過,預計印度在預測期內將實現健康成長。

- 預計這些國家精製活動的活性化將刺激市場需求。

- 日本是全球第四大石油消費國,精製能力約350萬桶/日,佔全球精製能力的3.7%。日本目前約有21家煉油廠,但石油產品的需求量每年以1-2%的速度下降。

- 此外,印度政府正在進行錢迪霍勒戰略石油儲備建設計劃,總耗資11億美元。該計劃預計於 2028年終投入運作。

化學注入裝置產業概況

該市場由主要企業細分。主要企業包括(不分先後順序)Proserv Group Inc.、IDEX Corporation、SPX FLOW Inc.、Petronash、Seco SpA 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 化學工業快速成長

- 對水處理應用的需求不斷增加

- 限制因素

- 歐洲和北美新興經濟體市場的成熟度

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 最終用戶產業

- 石油化工

- 化學

- 能源動力

- 石油和天然氣

- 水處理

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率分析

- 主要企業策略

- 公司簡介

- AES Arabia Ltd

- Carotek Inc.

- Casainox Flow Solutions

- Degremont Technologies Ltd

- IDEX Corporation

- ITC SL

- Intech Process Automation Inc.

- Integrated Flow Solutions LLC(IFS)

- Lewa GmbH

- Milton Roy Europe

- Petrak Industries Inc.

- Petronash

- Proserv Group Inc.

- Seko SpA

- SPX FLOW Inc.

- Swelore Engineering

第7章 市場機會與未來趨勢

- 尖端化學注入系統的開發

The Chemical Injection Skids Market is expected to register a CAGR of less than 3% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Several countries faced severe supply chain disruptions. However, the market is expected to grow steadily and reach pre-pandemic levels in the studied period.

Key Highlights

- Over the short term, the expansion of the chemical industry and accelerating demand for waste treatment applications, are major factors driving the growth of the market studied.

- However, the saturation of the market in Europe and North America is a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, rapid development and innovation in the technology of advanced injection systems are likely to create lucrative growth opportunities for the global market soon

- Europe dominates the market and Asia-Pacific is expected to witness the fastest growth rate during the forecast period.

Chemical Injection Skids Market Trends

Energy, Power, and Chemicals Segment to Dominate the Market

- Energy, Power and Chemicals is one of the major end-user segments for the chemical injection skids market. The pulp and paper industry is also included in this segment.

- In 2021, China stood as the largest energy consumer with 157.65 exajoules, followed by the United States and India. The growing need for energy for industrial purposes in developing economies is the major driver for the growth of the energy and power end-user industry.

- Chemical injection skids are widely employed in the chemicals industry. They are used for the injection of various chemicals, including caustic soda (for high-pressure cleaning, corrosion inhibitor chemicals, hydrochloric acid (for descaling purposes), and amines (for removal of sour gas), among many more.

- These chemicals are injected into key components of refineries, such as heat exchangers, mixers, flow conduits, columns, and towers, to ensure efficient processing and outputs of the input crude oil.

- In addition, these skids are also used for the injection of water treatment chemicals to treat the wastewater produced and for inhibition of gasoline and other additives to fuel oils. Coagulant dosing is also done using chemical injection skids in order to aid in the coagulation of solids.

- The refinery capacities are witnessing a surge globally due to the rising usage and demand for petrochemical products.

- The increase in the capacities is also fueled to some extent by increasing oil & gas activities across the globe both in terms of production and consumption.

- Moreover, chemical injection skids also find a major use in power generation. There are chemicals, such as ferric sulphate and sulphuric acid, which are needed in precise measurements for transformation of water into ultra-pure water for the boilers. Hence, the demand for chemical injection skids is expected to rise moderately during the forecast period.

Asia-Pacific to Witness Lucrative Growth

- The Asia-Pacific region is estimated to witness the fastest CAGR during the forecast period, primarily due to the increasing demand from the petrochemicals and chemical industries.

- China and Japan dominated the market in the Asia-Pacific. However, India is expected to witness healthy growth during the forecast period.

- Increasing refining activities in these countries are, in turn, expected to boost the market demand.

- Japan is the fourth-largest oil consumer globally, with a refinery capacity of about 3,500 thousand barrels per day, constituting 3.7% of the world's refining capacity. Currently, Japan has approximately 21 oil refineries, and the demand for petroleum products is decreasing by 1-2% per year.

- Furthermore, the Government of India is developing the Chandikhol Strategic Petroleum Reserve Construction Project with a total cost of USD 1.1 billion. The project is expected to reach operational capacity by the end of year 2028.

Chemical Injection Skids Industry Overview

The market studied is fragmented among the top players. The key players include (not in any particular order) Proserv Group Inc., IDEX Corporation, SPX FLOW Inc., Petronash, and Seko SpA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapid Growth in Chemical Industry

- 4.1.2 Accelerating Demand from Water Treatment Applications

- 4.2 Restraints

- 4.2.1 Maturing Markets in Developed Economies of Europe & North America

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION ( Market Size in Value)

- 5.1 End-user Industry

- 5.1.1 Petrochemicals

- 5.1.2 Chemicals

- 5.1.3 Energy & Power

- 5.1.4 Oil & Gas

- 5.1.5 Water Treatment

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 United Kingdom

- 5.2.3.2 France

- 5.2.3.3 Germany

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 South Africa

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AES Arabia Ltd

- 6.4.2 Carotek Inc.

- 6.4.3 Casainox Flow Solutions

- 6.4.4 Degremont Technologies Ltd

- 6.4.5 IDEX Corporation

- 6.4.6 ITC SL

- 6.4.7 Intech Process Automation Inc.

- 6.4.8 Integrated Flow Solutions LLC (IFS)

- 6.4.9 Lewa GmbH

- 6.4.10 Milton Roy Europe

- 6.4.11 Petrak Industries Inc.

- 6.4.12 Petronash

- 6.4.13 Proserv Group Inc.

- 6.4.14 Seko SpA

- 6.4.15 SPX FLOW Inc.

- 6.4.16 Swelore Engineering

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Technologically Advanced Chemical Injection System