|

市場調查報告書

商品編碼

1640543

苯胺:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Aniline - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

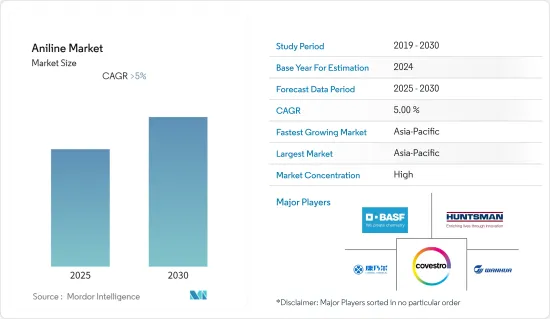

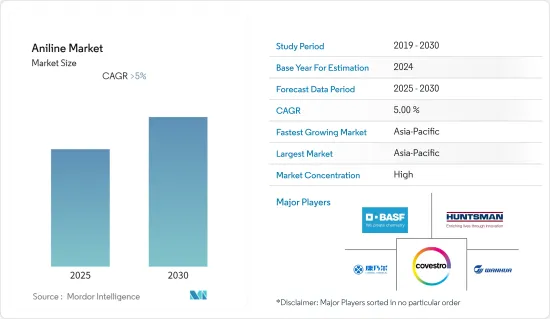

預計預測期內苯胺市場將以超過 5% 的複合年成長率成長。

2020 年,由於新冠疫情爆發以及全球封鎖導致供應中斷,市場受到了負面影響。此外,為了遏制病毒傳播,所有建築和其他活動都停止了,這也對市場產生了不利影響。不過,預計到 2023 年市場將會復甦。

關鍵亮點

- 推動市場發展的首要因素是被覆劑、黏合劑、密封劑和其他行業對 MDI 的需求不斷增加。

- 然而,高鐵血紅蛋白對健康的不利影響預計是預測期內抑制目標產業成長的主要因素。

- 生質能生產苯胺的技術創新有望在未來提供市場機會。

- 預計亞太地區將佔據約 50% 的市場佔有率,以最高的複合年成長率成長。

苯胺市場趨勢

建築和施工領域的需求不斷增加

- 苯胺基二二苯基甲烷二異氰酸酯(MDI) 對建築業至關重要。它是用於生產硬質聚氨酯隔熱材料的重要化學品。

- 硬質聚氨酯泡棉具有很高的絕緣性能,使建築商能夠建造更薄的牆壁,保持隔熱,並降低屋頂形狀。

- 根據美國人口普查局的數據,美國建築支出從 2020 年的 14,692 億美元增加到 2021 年的 15,904 億美元。

- 泰國是最大的旅遊中心之一,正在投入大量資金擴建和建造購物中心、豪華酒店等。例如,泰國最大的購物中心營運商 Central Pattana PCL 預計到 2022 年將投資 7.2297 億美元,包括店面整修。

- 根據泰國國家統計局的數據,2021 年批准了 280,720 份申請,高於 2020 年的 273.14 份。

- 中國、印度和印尼等其他亞洲經濟體的建築業成長也推動了所研究的市場。

- 預計所有上述因素都將增加建築產量,從而預計在預測期內對苯胺市場產生正面影響。

亞太地區佔市場主導地位

- 由於建築業和汽車業的成長,亞太地區在全球市場佔據主導地位。預計需求將來自中國、印度和印尼等開發中國家。

- 在亞太地區,中國是最大的聚氨酯產品生產國和消費國。根據國家統計局的數據,中國的建築支出預計將從 2020 年的 72445 億元人民幣(10360 億美元)增加到 2021 年的 80138 億元人民幣(11465 億美元)。

- 該地區也是最大的汽車製造地,並擁有最大的農業用地面積之一。因此,對橡膠輪胎、殺蟲劑、農藥和化學肥料的需求可能會推動中國、印度和日本等國家對苯胺的需求。

- 根據 OICA 的數據,2021 年印度汽車產量為 25,225,242 輛,比 2020 年成長 30%。

- 根據日本經濟產業省統計,2021年日本乘用車橡膠輪胎產量達1.0033億條,較2020年的8,902萬條成長率為12.69%。

苯胺產業概況

苯胺市場呈現盤整態勢。主要參與企業包括BASF公司、亨斯邁集團、科思創股份公司、吉林康奈爾化工有限公司和萬華化學集團。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 被覆劑、黏合劑和密封劑產業對 MDI 的需求不斷增加

- 聚氨酯產業的需求不斷成長

- 限制因素

- 高鐵血紅蛋白對健康的不良影響

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原料分析

- 生產流程

- 貿易分析

- 監理政策分析

- 價格趨勢分析

第5章 市場區隔(市場規模)

- 按應用

- 二苯基甲烷二異氰酸酯(MDI)

- 橡膠加工化學品

- 農業化學品

- 染料和顏料

- 特種纖維

- 其他

- 最終用戶產業

- 建築和施工

- 橡皮

- 消費品

- 車

- 包裝

- 農業

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- Covestro AG

- Dow

- Huntsman International LLC

- GNFC

- SNEI

- Wanhua Chemical Group Co. Ltd.

- Tosoh Corporation

- Sumitomo Chemical Co. Ltd.

- SP Chemicals Holdings Ltd.

- BONDALTI

- Jilin Connell Chemical Industry Co. Ltd.

第7章 市場機會與未來趨勢

- 生質能生產苯胺的創新

- 其他市場機會和未來趨勢

The Aniline Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by the COVID-19 outbreak in 2020 when supply was disrupted due to a worldwide lockdown. Furthermore, all construction and other activities were put on hold to curb the spreading of the virus, thus, negatively affecting the market. However, the market is expected to recover by 2023.

Key Highlights

- The major factor driving the market is the increasing demand for MDI in coatings, adhesives, sealants, and other industries.

- However, the detrimental effect of methemoglobin on health is a key factor anticipated to restrain the growth of the target industry over the forecast period.

- Innovation in producing aniline from biomass is expected to act as an opportunity for the market in the future.

- Asia-Pacific dominated the market studied with about 50% share and is expected to witness the highest CAGR.

Aniline Market Trends

Growing Demand from the Building and Construction Sector

- Aniline-based methylene diphenyl diisocyanate (MDI) is crucial for the building and construction industry. It is an important chemical used to produce rigid polyurethanes as an insulating material.

- The insulating quality of rigid polyurethane foam is high, enabling builders to make walls thinner, keeping the insulating properties intact and roof profiles lower, and creating more space for the inhabitants.

- According to the United States Census Bureau, construction spending in the United States has increased from USD 1,469.2 billion in 2020 to USD 1,590.4 billion in 2021.

- Thailand is one of the largest tourist hubs and has been witnessing huge investments in expanding and constructing malls, luxury hotels, etc. For instance, Central Pattana PCL, Thailand's largest mall operator, was likely to invest USD 722.97 million, including for store renovations, by 2022.

- According to the National Statistical Office (Thailand), a total number of 280.72 thousand were permitted in 2021 and witnessed a growth compared to 273.14 in 2020.

- The growing construction industry in other Asian economies such as China, India and Indonesia is also driving the market studied.

- All the aforementioned factors are increasing the construction output, which, in turn, is expected to have a positive impact on the aniline market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region dominates the global market due to the region's growing construction and automotive industry. The demand is expected to be generated from developing nations like China, India, and Indonesia.

- In the Asia-Pacific region, China is the largest producer and consumer of polyurethane products. According to the National Bureau of Statistics of China, construction spending in China has increased from CNY 7,244.5 billion (USD 1036 billion) in 2020 to CNY 8,013.8 billion (USD 1146.5 billion) in 2021.

- Also, the region is the largest automotive manufacturing hub and has one of the largest agricultural land areas. Hence, the requirement for rubber tires, insecticides, pesticides, and fertilizers is likely to drive the demand for aniline in the countries like China, India, and Japan.

- According to OICA, in India, the total number of vehicles produced in 2021 was 25,225,242 units and witnessed a growth rate of 30% compared to 2020.

- As per the Ministry of Economy, Trade, and Industry (METI), the production volume of rubber tires for passenger cars in Japan reached 100.33 million pieces in 2021 and witnessed a growth rate of 12.69% compared to 89.02 million pieces in 2020.

Aniline Industry Overview

The aniline market is consolidated in nature. The major players include BASF SE, Huntsman Corporation LLC, Covestro AG, Jilin Connell Chemical Industry Co. Ltd, and Wanhua Chemical Group Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for MDI in Coatings, Adhesives, and Sealants Industry

- 4.1.2 Rising Demand from the Polyurethane Industry

- 4.2 Restraints

- 4.2.1 Detrimental Effects of Methemoglobin on Health

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Feedstock Analysis

- 4.6 Production Process

- 4.7 Trade Analysis

- 4.8 Regulatory Policy Analysis

- 4.9 Price Trend Analysis

5 MARKET SEGMENTATION(Market Size in Volume)

- 5.1 Application

- 5.1.1 Methylene Diphenyl Diisocyanate (MDI)

- 5.1.2 Rubber-processing Chemicals

- 5.1.3 Agricultural Chemicals

- 5.1.4 Dyes and Pigments

- 5.1.5 Specialty Fibers

- 5.1.6 Other Applications

- 5.2 End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Rubber

- 5.2.3 Consumer Goods

- 5.2.4 Automotive

- 5.2.5 Packaging

- 5.2.6 Agriculture

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Covestro AG

- 6.4.3 Dow

- 6.4.4 Huntsman International LLC

- 6.4.5 GNFC

- 6.4.6 SNEI

- 6.4.7 Wanhua Chemical Group Co. Ltd.

- 6.4.8 Tosoh Corporation

- 6.4.9 Sumitomo Chemical Co. Ltd.

- 6.4.10 SP Chemicals Holdings Ltd.

- 6.4.11 BONDALTI

- 6.4.12 Jilin Connell Chemical Industry Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Production of Aniline from Biomass

- 7.2 Other MARKET OPPORTUNITIES AND FUTURE TRENDS